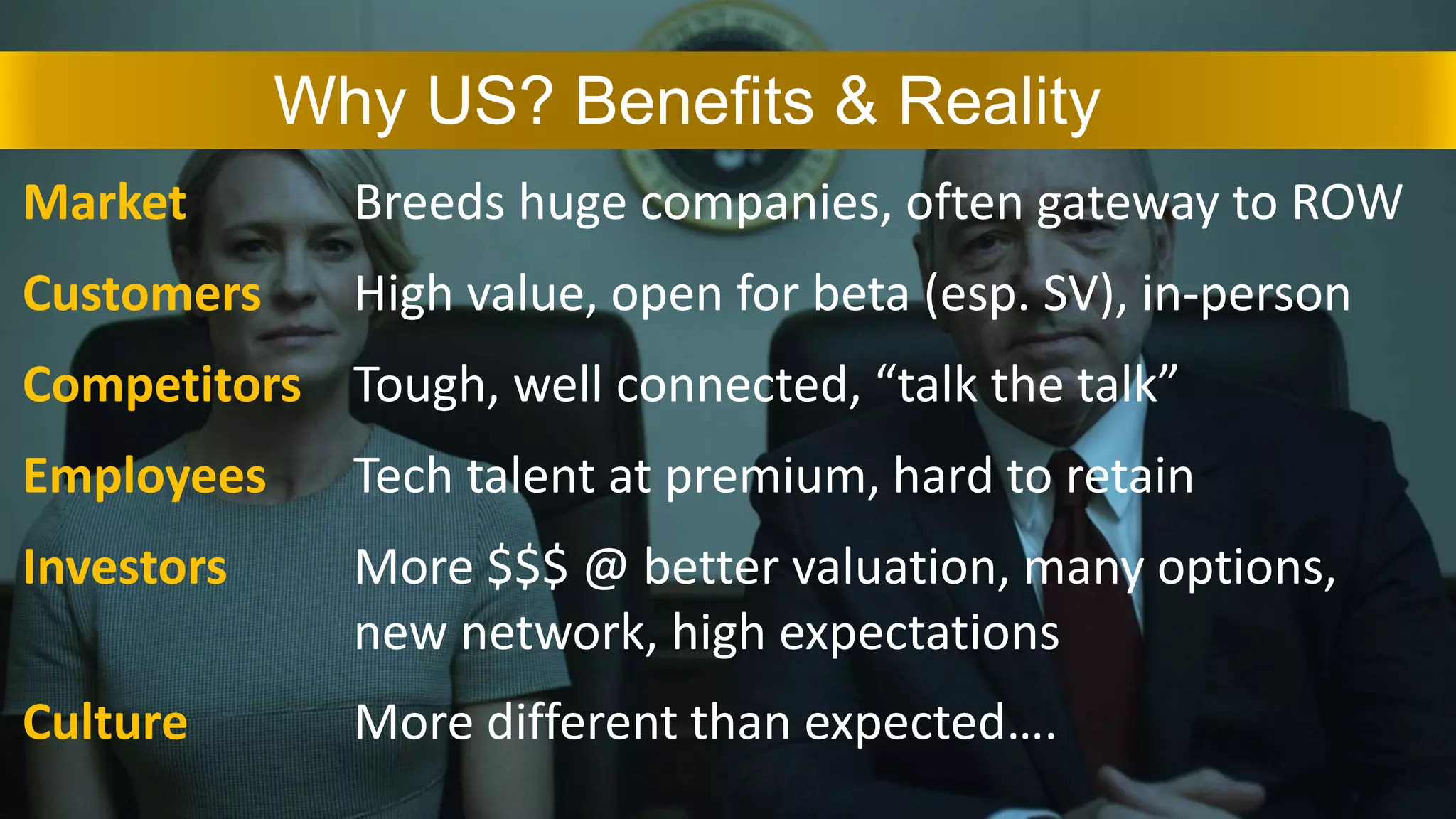

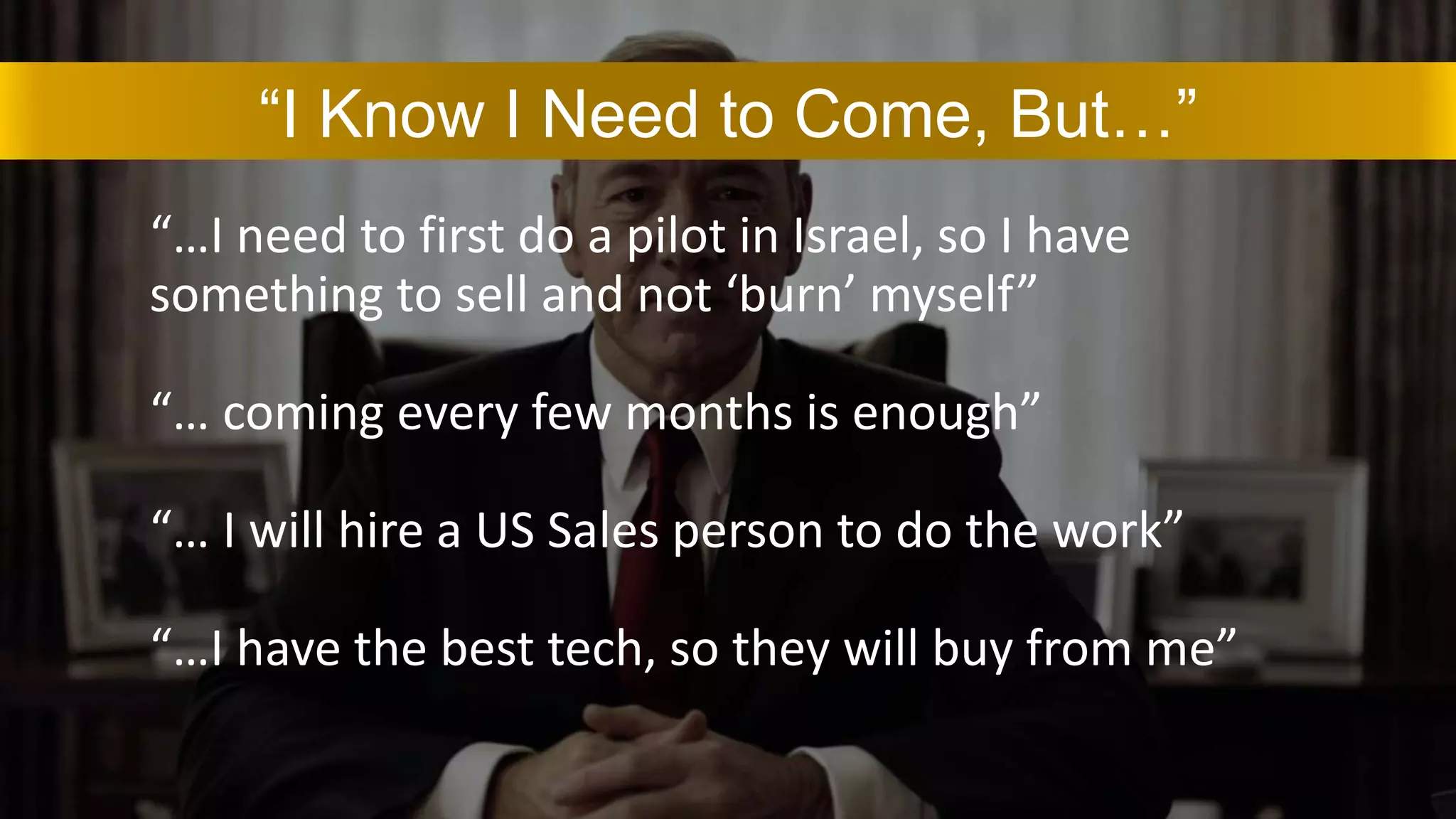

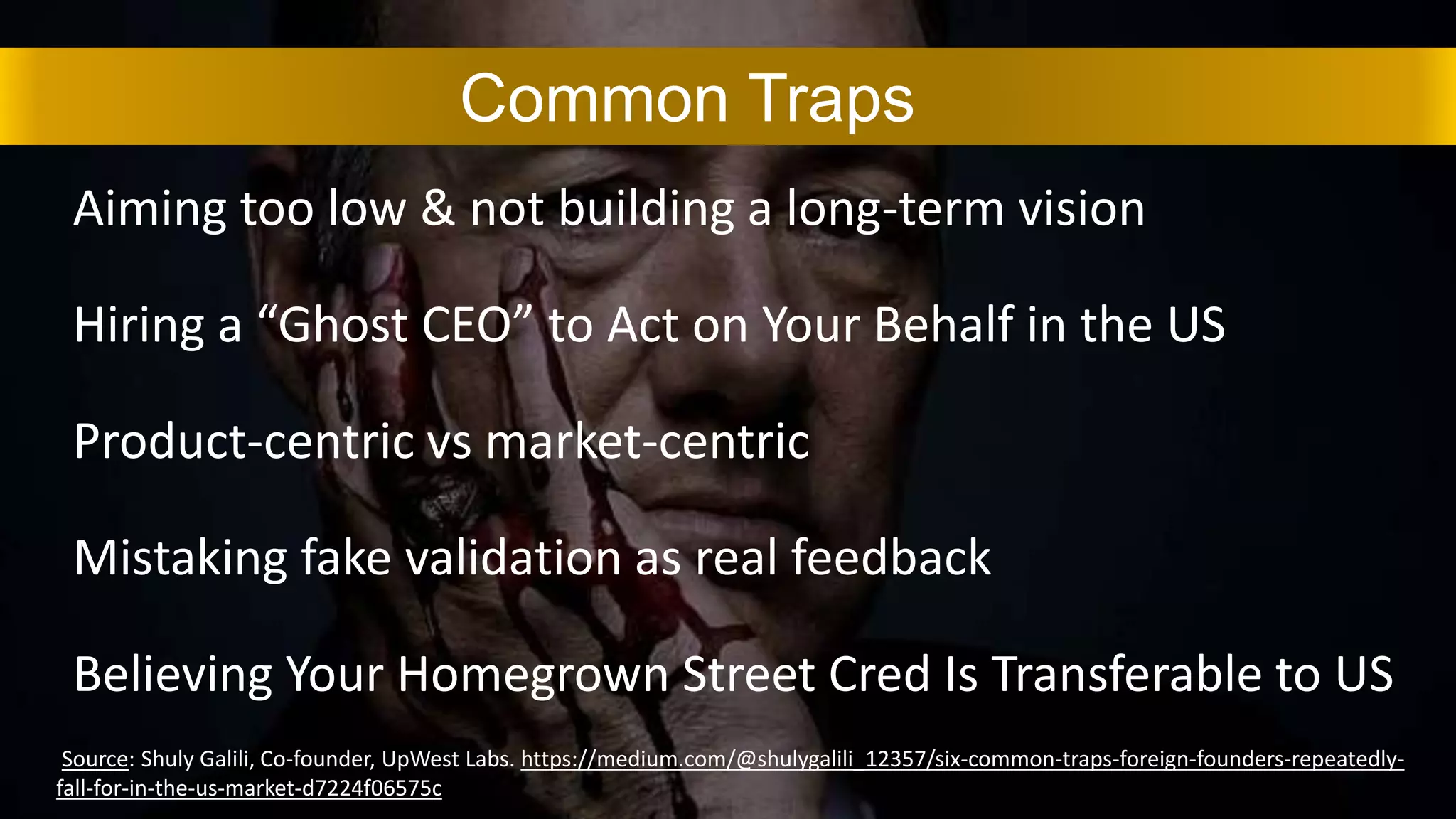

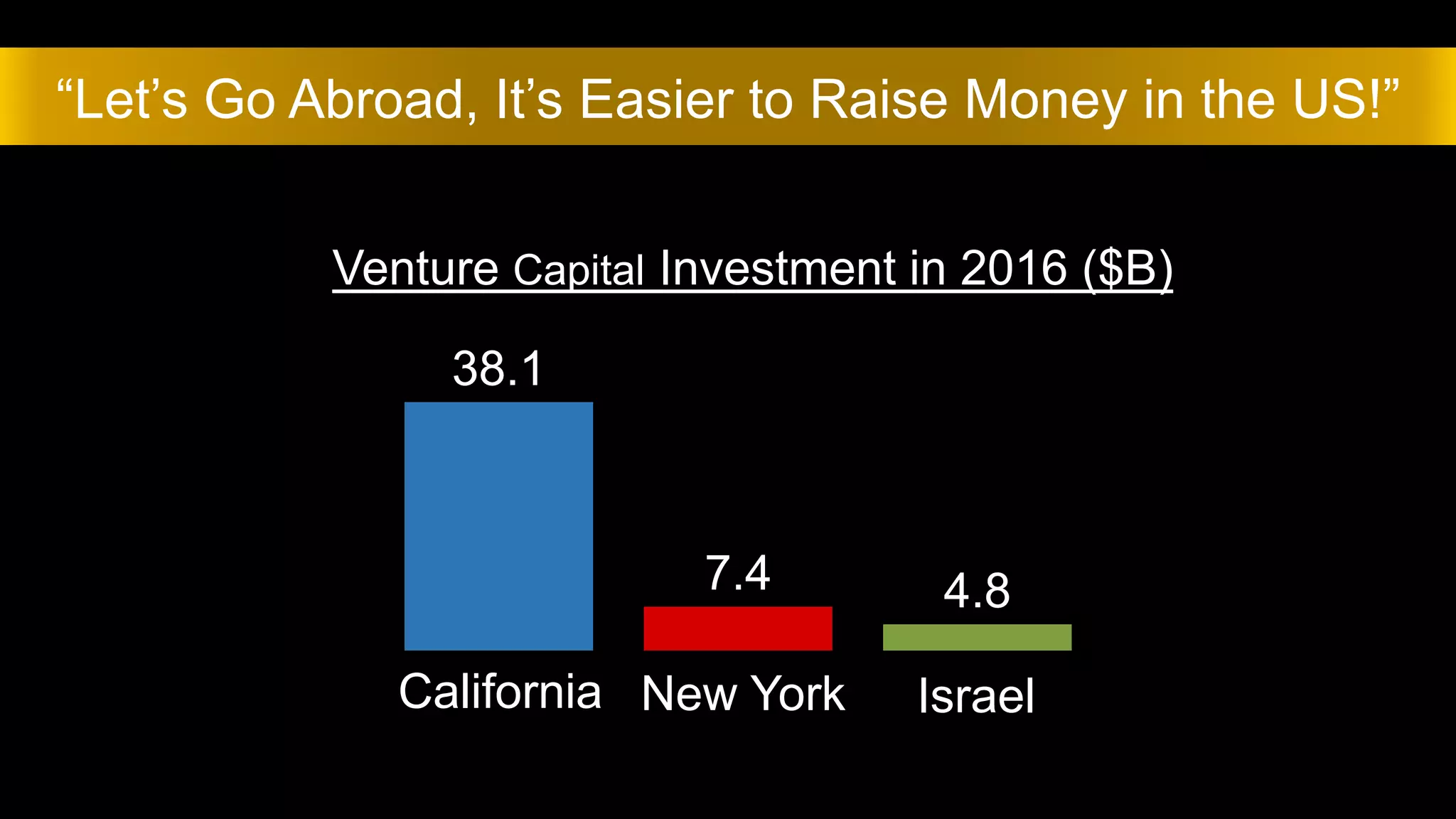

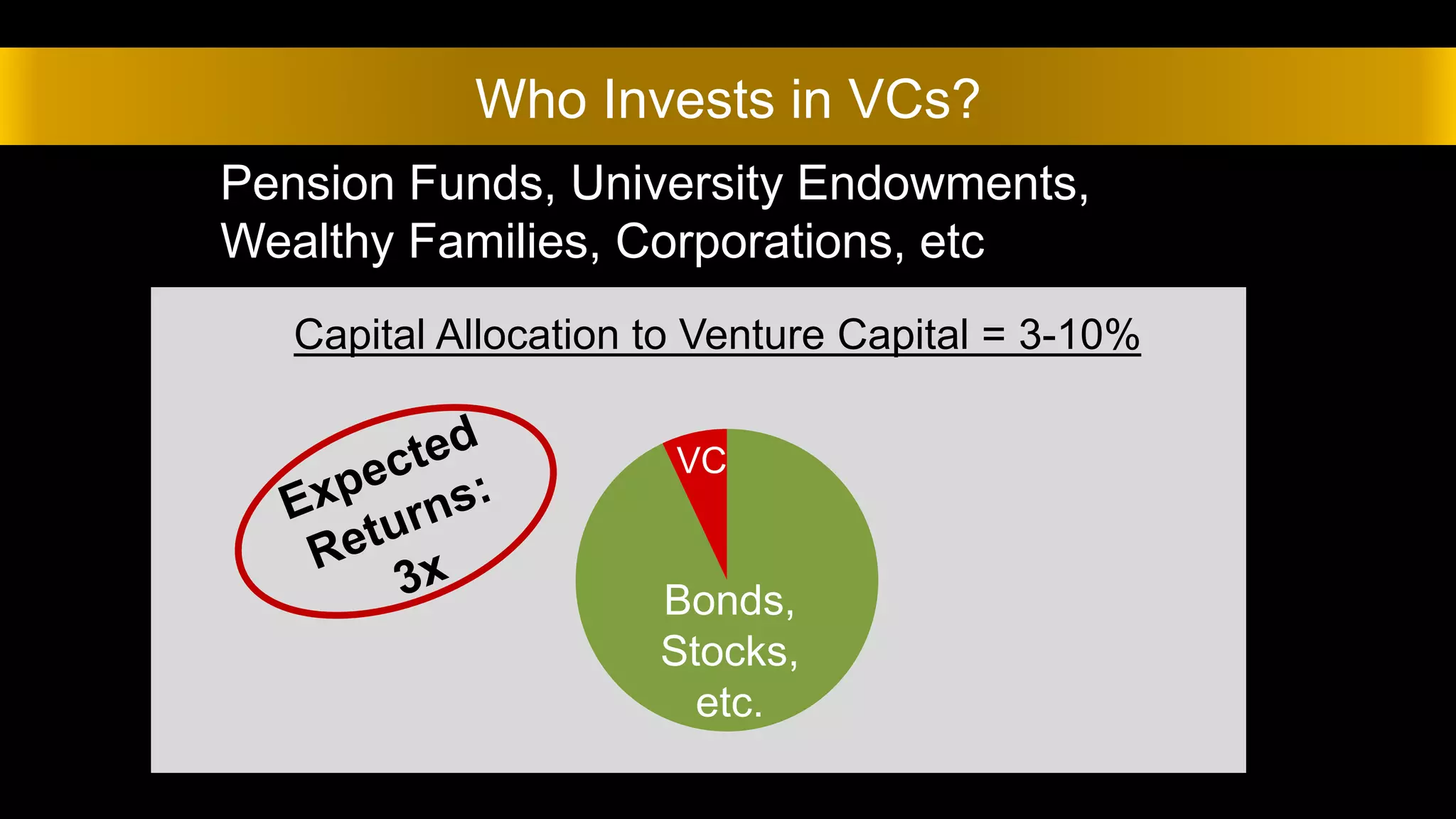

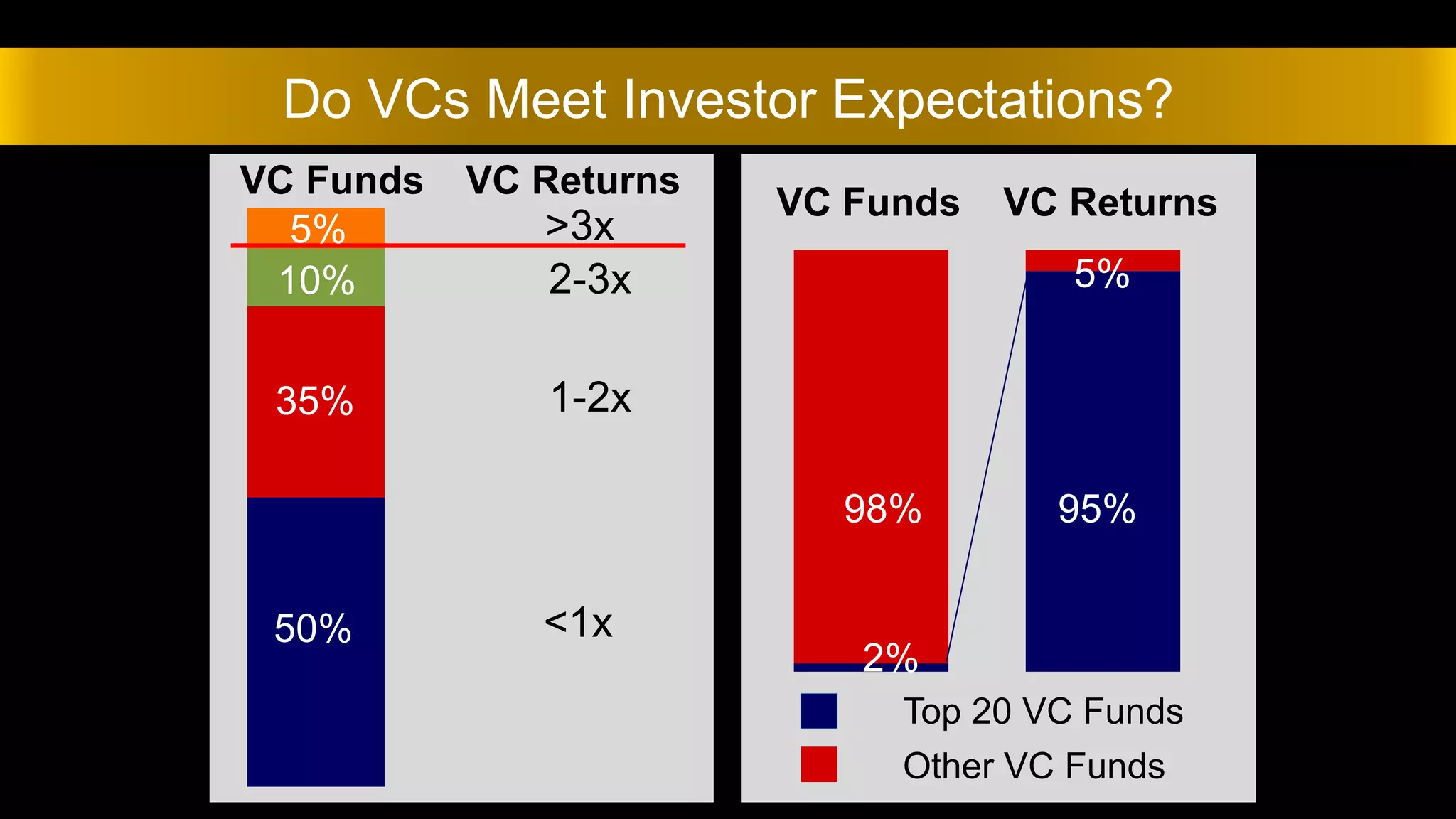

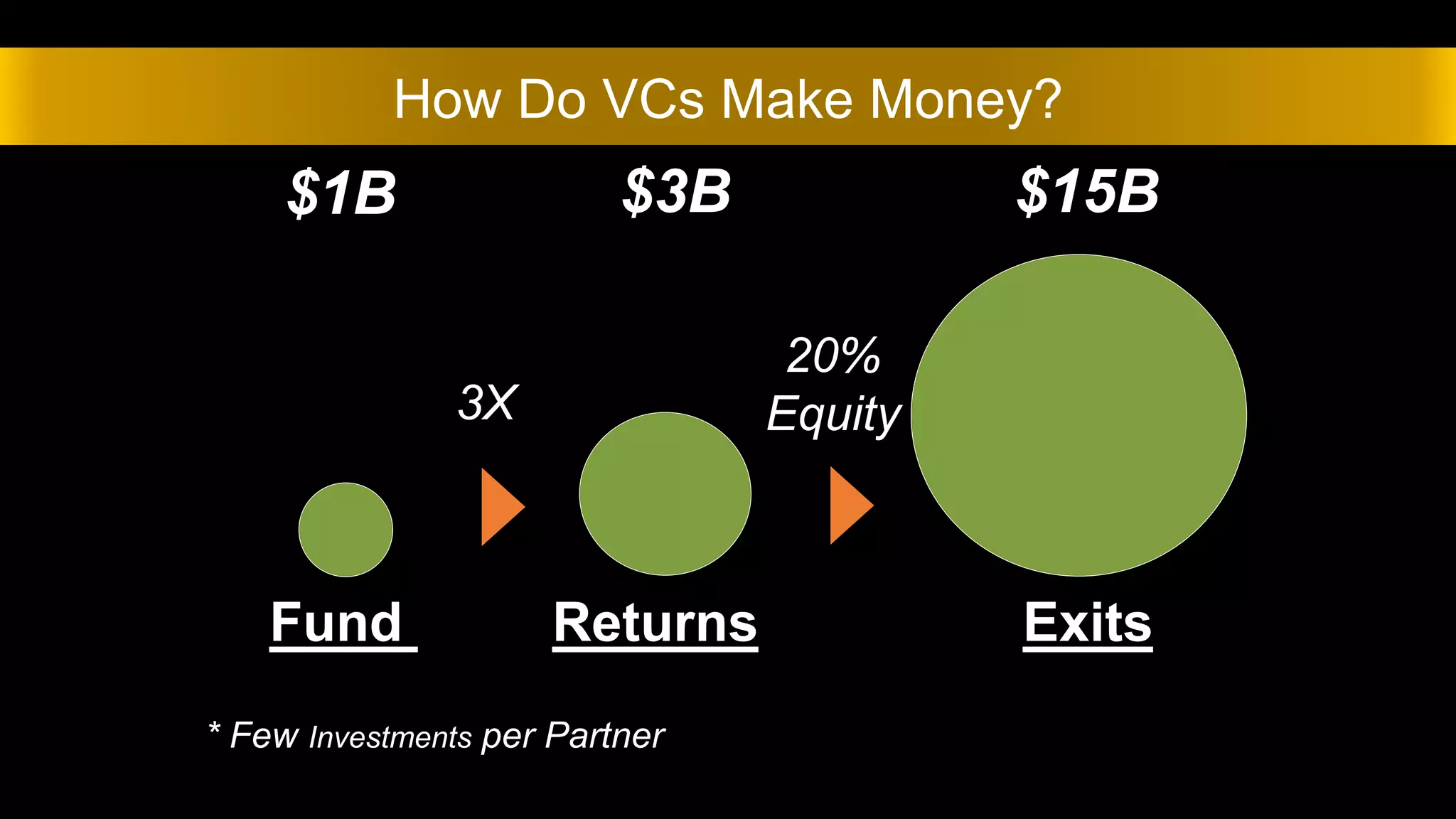

UpWest Labs, focused on investing in Israeli founders for the U.S. market, discusses the challenges and strategies for startups looking to expand into the U.S. This document outlines common misconceptions, the importance of a strong U.S. presence, and best practices for fundraising and scaling in a competitive environment. It emphasizes the need for local engagement, partnerships, and momentum to achieve product-market fit and successful exits.