erie insurance group 2006-first-quarter-report

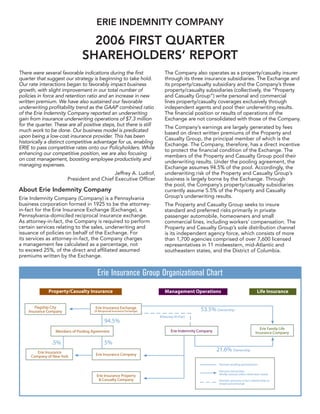

- 1. ERIE INDEMNITY COMPANY 2006 FIRST QUARTER SHAREHOLDERS’ REPORT There were several favorable indications during the first The Company also operates as a property/casualty insurer quarter that suggest our strategy is beginning to take hold. through its three insurance subsidiaries. The Exchange and Our rate interactions began to favorably impact business its property/casualty subsidiary and the Company’s three growth, with slight improvement in our total number of property/casualty subsidiaries (collectively, the “Property policies in force and retention ratio and an increase in new and Casualty Group”) write personal and commercial written premium. We have also sustained our favorable lines property/casualty coverages exclusively through underwriting profitability trend as the GAAP combined ratio independent agents and pool their underwriting results. of the Erie Indemnity Company reported an underwriting The financial position or results of operations of the gain from insurance underwriting operations of $7.3 million Exchange are not consolidated with those of the Company. for the quarter. These are all positive steps, but there is still The Company’s earnings are largely generated by fees much work to be done. Our business model is predicated based on direct written premiums of the Property and upon being a low-cost insurance provider. This has been Casualty Group, the principal member of which is the historically a distinct competitive advantage for us, enabling Exchange. The Company, therefore, has a direct incentive ERIE to pass competitive rates onto our Policyholders. While to protect the financial condition of the Exchange. The enhancing our competitive position, we are also focusing members of the Property and Casualty Group pool their on cost management, boosting employee productivity and underwriting results. Under the pooling agreement, the managing expenses. Exchange assumes 94.5% of the pool. Accordingly, the Jeffrey A. Ludrof, underwriting risk of the Property and Casualty Group’s President and Chief Executive Officer business is largely borne by the Exchange. Through the pool, the Company’s property/casualty subsidiaries About Erie Indemnity Company currently assume 5.5% of the Property and Casualty Group’s underwriting results. Erie Indemnity Company (Company) is a Pennsylvania business corporation formed in 1925 to be the attorney- The Property and Casualty Group seeks to insure in-fact for the Erie Insurance Exchange (Exchange), a standard and preferred risks primarily in private Pennsylvania-domiciled reciprocal insurance exchange. passenger automobile, homeowners and small As attorney-in-fact, the Company is required to perform commercial lines, including workers’ compensation. The certain services relating to the sales, underwriting and Property and Casualty Group’s sole distribution channel issuance of policies on behalf of the Exchange. For is its independent agency force, which consists of more its services as attorney-in-fact, the Company charges than 1,700 agencies comprised of over 7,600 licensed a management fee calculated as a percentage, not representatives in 11 midwestern, mid-Atlantic and to exceed 25%, of the direct and affiliated assumed southeastern states, and the District of Columbia. premiums written by the Exchange. Erie Insurance Group Organizational Chart

- 2. Corporate Information Financial Information Stock Transfer Agent The Erie Indemnity Company submits a quarterly report American Stock Transfer & Trust Company to the Securities and Exchange Commission on Form 59 Maiden Lane 10-Q. Shareholders may obtain a copy of the Form 10-Q Plaza Level report without charge by writing to: Chief Financial New York, NY 10038 Officer, Erie Indemnity Company, 100 Erie Insurance (800) 937-5449 Place, Erie, PA, 16530 or by visiting the Company’s Web Corporate Headquarters site at www.erieinsurance.com. 100 Erie Insurance Place Common Stock Information Erie, PA 16530 The Erie Indemnity Company’s Class A, non-voting (814) 870-2000 common stock is traded on the NASDAQ Stock Market Internet Address under the symbol “ERIE.” Quotations are available via major financial news sources. Financial statement filings, shareholder information, press releases and general news about the Company may also be accessed at: www.erieinsurance.com. Erie Indemnity Company First Quarter 2006 Results Highlights of the first quarter 2006 results of the Erie percent resulted in $9.4 million more in management Indemnity Company (Company) are as follows: fee revenue for the quarter ended March 31, 2006, or an increase in net income of $.09 per share-diluted. * Net income decreased by 14.4 percent to $49.5 The management fee rate was 23.75 percent in the first million, from $57.8 million at March 31, 2005, due to quarter of 2005. modest growth in management fee revenue which was outpaced by the growth in the cost of management The direct written premiums of the Property and operations. Casualty Group, upon which management fee revenue is calculated, totaled $942.8 million in the first quarter 2006, * Net income per share decreased to $.73 per share, compared to $971.8 million in the first quarter 2005, a compared to $.83 per share in the comparable quarter 3.0 percent decline. New written premium increased 3.3 for 2005. percent, to $86.6 million at March 31, 2006 compared to * Management fee revenue grew by 1.1 percent to $83.8 million at March 31, 2005. Year-over-year policies in $232.9 million, up from $230.4 million for the same force increased 0.1 percent at March 31, 2006. period one year ago. The year-over-year average written premium per policy * The Property and Casualty Group’s direct written declined by 2.1 percent to $1,044 at March 31, 2006, as premium declined 3.0 percent to $942.8 million at compared to $1,066 at March 31, 2005. The decline is a March 31, 2006, from $971.8 million at March 31, result of rate reductions and several new rate interactions, 2005. New written premium in the first quarter of 2006 including segmented pricing, a safe driver discount, a increased 3.3 percent over 2005 results. new multi-policy discount associated with life insurance purchases and a new payment plan discount. Year-over- * The Property and Casualty Group’s adjusted statutory year personal lines premium decreased 4.5 percent, while combined ratio for the first quarter 2006, which commercial lines remained flat at March 31, 2006. The removes the profit portion of the management fee year-over-year policy retention rate improved to 88.8 earned by the Company, was 82.3 percent, compared percent at March 31, 2006, from 88.3 percent at March to 81.4 percent a year earlier. 31, 2005. * The Company’s reported GAAP combined ratio was Pricing actions and estimates approved, filed and 86.5 percent for the first quarter of 2006, versus 88.4 contemplated for filing during 2006, are anticipated to percent for the same quarter in 2005, yielding an reduce direct written premiums by $114.6 million, of underwriting gain of $7.3 million for the first quarter which approximately $26.8 million occurred in the first 2006, compared to an underwriting gain of $6.2 million quarter of 2006. Included in the total 2006 reduced in the first quarter of 2005. premiums is $35.3 million related to the carryover impact of pricing actions approved and effective in 2005. These Management operations pricing actions are being implemented to further enhance Management fee revenue increased by 1.1 percent to the competitive position of ERIE products. $232.9 million for the quarter ended March 31, 2006, The cost of management operations increased 9.1 compared to $230.4 million for the same period one year percent to $193.8 million in the first quarter of 2006, from ago. The higher management fee rate in 2006 of 24.75 2

- 3. $177.7 million for the same period in 2005. Commission incurred but not reported reserves related to seasonality costs increased 6.3 percent to $134.1 million, from adjustments was $2.3 million, compared to $2.7 million in $126.2 million in the first quarter 2005. An increase in the first quarter of 2005. Catastrophe losses resulted in a agent bonus expense of $9.5 million, resulting from the 0.6 point increase in the first quarter statutory combined improvements in underwriting profitability, impacted ratio of the Property and Casualty Group compared to 0.5 commission costs for the first quarter of 2006. points in catastrophe losses for the same period in 2005. These first quarter amounts are below the Property and First quarter costs of management operations within Erie Casualty Group’s historical norm for catastrophe losses. Indemnity Company, excluding commissions, increased The ten year historical average of catastrophe losses 15.9 percent to $59.7 million in 2006, from $51.5 million has contributed 3.0 percentage points to the Group’s in 2005. Personnel costs increased 15.3 percent as a statutory combined ratio on an annual basis. result of higher average pay rates and higher estimates of future payouts for management incentive plans that In April, the Company announced it would cease were influenced by the significant improvement in the development of ERIEConnection, a personal lines policy Company’s underwriting profitability over the past three administration and Web-based agency interface system. years. The cost of using insurance scoring on all new and As a result, the Company incurred a charge to net income renewal business also impacted other operating costs and of about $1.3 million or $.02 per share in the quarter totaled $1.0 million in the first quarter of 2006, compared ended March 31, 2006. The Company is now focusing to $0.5 million in the first quarter of 2005. Insurance on a strategy to surround current personal lines policy scoring was initially used for pricing purposes in March systems with component-based enhancements for policy 2005 for new business and in April 2005 for renewal management and agency interface, while continuing plans business. The first quarter of 2006 includes a full quarter’s to begin deployment of a Web-based system on a pilot expense for insurance scoring on new and renewal basis for commercial lines business in May. business. The statutory combined ratio for the Property and Maintaining a low-cost position within the industry is Casualty Group included 4 points in the first quarter of essential to enhancing ERIE’s competitiveness, remaining 2006 from writing off the ERIEConnection assets. attractive to the Company’s agency distribution system Investment operations and producing revenue growth. The Company has developed a plan to control non-commission expense Net revenue from investment operations for the first levels of the ERIE Group of companies in 2006 to a quarter of 2006 reflects a decrease of 9.9 percent to 6.0 percent increase over 2005 operating expense. $20.6 million, compared to $22.8 million for the same For the Company that translates to an increase in non- period in 2005. commission management expenses of 9.0 percent. The Net realized gains on investments of $0.8 million were Company’s cost management plan calls for a strategic recorded during the first quarter 2006, compared to net review of functional expenses and for balancing workforce realized gains of $5.5 million for the first quarter 2005. requirements with business needs. Net realized gains on investments included impairment Insurance underwriting operations charges of $.9 million on fixed maturities and $1.1 million on equity securities in the first quarter of 2006. In the first The Company’s insurance underwriting operations quarter of 2005, impairment charges of $1.4 million were recorded gains of $7.3 million in the first quarter of 2006, recorded on fixed maturities and $0.1 million on equity compared to $6.2 million in the first quarter of 2005. securities. Equity in earnings of limited partnerships The Company’s share of catastrophe losses totaled $0.3 was $4.1 million and $2.1 million for the quarters ended million for the three-month periods ended March 31, March 31, 2006, and 2005, respectively. Private equity 2006, and 2005. The GAAP combined ratio for the and mezzanine debt limited partnerships generated Company in the first quarter 2006 was 86.5, compared to earnings of $2.0 million and $1.1 million for the three 88.4 for the same period in 2005. months ended March 31, 2006, and 2005, respectively. The adjusted statutory combined ratio for the Property Real estate limited partnerships generated earnings and Casualty Group for the first quarter 2006 was 82.3, of $1.5 million and $1.0 million in the first quarters of compared to 81.4 for the first quarter 2005. Continued 2006 and 2005, respectively. Market value adjustments favorable development of losses on prior years, excluding contributed $0.6 million to the total earnings of limited salvage and subrogation recoveries, improved the partnerships in the first quarter of 2006. The Company’s Group’s combined ratio by 7.9 points in the first quarter earnings from its 21.6 percent equity ownership of Erie of 2006 and 4.9 points in the first quarter of 2005. The Family Life totaled $0.7 million for the first quarter of first quarter of the year typically has the lowest non- 2006, compared to $0.8 million in the first quarter 2005. catastrophe loss results of the year. Catastrophe losses Liquidity and capital resources incurred by the Property and Casualty Group were not significant and therefore the lower claim volume, As part of its capital management activities, the Exchange coupled with improving underwriting, resulted in has undertaken an offer to acquire the balance of Erie seasonally low losses for the quarter ended March 31, Family Life’s common stock at $32.00 per share in cash 2006. Underwriting losses are seasonally higher in the during the second quarter of 2006. The Exchange second and fourth quarters and, as a consequence, the currently owns 53.5% of the outstanding common stock Company’s property/casualty combined ratio generally of EFL. The aggregate consideration for the outstanding increases as the year progresses. In the first quarter EFL shares would be approximately $75 million. The of 2006, the Company’s share of the reduction to Exchange intends to complete the transaction as soon 3

- 4. as practicable. The Company’s 21.6% stake in EFL will be the Company and Black Interests Limited Partnership. The unaffected by this transaction. 260 shares of class B voting stock represent 9.2 percent of the outstanding Class B voting stock of the Company. Dividends paid to shareholders totaled $22.2 million in the first quarter of 2006 and $20.6 million in the first Erie Indemnity Company provides management services quarter of 2005. to the member companies of the Erie Insurance Group, which includes the Erie Insurance Exchange, Flagship During the first quarter of 2006, the Company City Insurance Company, Erie Insurance Company, Erie repurchased 772,447 shares of its outstanding Class A Insurance Property and Casualty Company, Erie Insurance common stock in conjunction with the stock repurchase Company of New York and Erie Family Life Insurance plan that was authorized in December 2003. The shares Company. were purchased at a total cost of $40.7 million. The plan allows the Company to repurchase up to $250 million of its outstanding Class A common stock through December “Safe Harbor” Statement Under the Private Securities 31, 2006. In February 2006, the Company’s Board Litigation Reform Act of 1995: Certain forward-looking approved a continuation of the current stock program, statements contained herein involve risks and uncertainties. allowing the Company to repurchase an additional These statements include certain discussions relating to $250 million of its Class A common stock through management fee revenue, cost of management operations, underwriting, premium and investment income volume, business December 31, 2009. At March 31, 2006, a total of $306 strategies, profitability and business relationships and the million repurchase authority remains. Company’s other business activities during 2006 and beyond. Additionally, subsequent to quarter end, on May 1, In some cases, you can identify forward-looking statements 2006, the Company entered into a definitive agreement by terms such as “may,” “will,” “should,” “could,” “would,” with Black Interests Limited Partnership to repurchase “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential” and similar expressions. These 1,844,604 shares of Class A non-voting common stock of forward-looking statements reflect the Company’s current the Company (which included 260 shares of Class B voting views about future events, are based on assumptions and are stock required to be converted into 624,000 non-voting subject to known and unknown risks and uncertainties that may shares) for $106,000,000 under the Company’s previously cause results to differ materially from those anticipated in those authorized share repurchase program. The shares were statements. Many of the factors that will determine future events purchased in a privately negotiated transaction between or achievements are beyond our ability to control or predict. 4

- 5. CONSOLIDATED STATEMENTS OF OPERATIONS (Dollars in thousands, except in per share data) Three months ended March 31 2006 2005 (unaudited) Operating revenue Management fee revenue—net $ 220,102 $ 217,736 Premiums earned 54,026 53,648 Service agreement revenue 7,592 4,787 Total operating revenue 281,720 276,171 Operating expenses Cost of management operations 183,154 167,940 Losses and loss adjustment expenses incurred 30,053 32,677 Policy acquisition and other underwriting expenses 14,501 11,844 Total operating expenses 227,708 212,461 Investment income—unaffiliated Investment income, net of expenses 15,000 14,468 Net realized gains on investments 784 5,497 Equity in earnings of limited partnerships 4,142 2,111 Total investment income—unaffiliated 19,926 22,076 Income before income taxes and equity in earnings of Erie Family Life Insurance Company 73,938 85,786 Provision for income taxes 25,077 28,729 Equity in earnings of Erie Family Life Insurance Company, net of tax 605 714 Net income $ 49,466 $ 57,771 Net income per share—basic $ 0.81 $ 0.91 Class A common stock $ 121.08 $ 138.84 Class B common stock Net income per share—diluted $ 0.73 $ 0.83 Weighted average shares outstanding Basic: Class A common stock 60,630,395 62,926,683 Class B common stock 2,833 2,851 Diluted shares 67,505,125 69,845,958 Dividends declared per share Class A common stock $ 0.36 $ 0.325 Class B common stock $ 54.00 $ 48.75 5

- 6. CONSOLIDATED STATEMENTS OF OPERATIONS—SEGMENT BASIS (Dollars in thousands, except in per share data) Three months ended March 31 2006 2005 (unaudited) Management operations Management fee revenue $ 232,935 $ 230,409 Service agreement revenue 7,592 4,787 Total revenue from management operations 240,527 235,196 Cost of management operations 193,825 177,714 Income from management operations 46,702 57,482 Insurance underwriting operations Premiums earned 54,026 53,648 Losses and loss adjustment expenses incurred 30,053 32,677 Policy acquisition and other underwriting expenses 16,663 14,742 Total losses and expenses 46,716 47,419 Underwriting gain 7,310 6,229 Investment operations Investment income, net of expenses 15,000 14,468 Net realized gains on investments 784 5,497 Equity in earnings of limited partnerships 4,142 2,111 Equity in earnings of Erie Family Life Insurance Company 651 767 Net revenue from investment operations 20,577 22,843 Income before income taxes 74,589 86,554 Provision for income taxes 25,123 28,783 Net income $ 49,466 $ 57,771 Net income per share—Class A basic $ 0.81 $ 0.91 Net income per share—Class B basic $ 121.08 $ 138.84 Net income per share—diluted $ 0.73 $ 0.83 Weighted average shares outstanding—diluted 67,505 69,846 Amounts presented on a segment basis are presented gross of intercompany/intersegment items 6

- 7. RECONCILIATION OF OPERATING INCOME TO NET INCOME Definition of Non-GAAP and Operating Measures management services, insurance underwriting and Management believes that investors’ understanding investment operations that may be obscured by of the Company’s performance is enhanced by the the net effects of realized capital gains and losses. disclosure of the following non-GAAP financial measure. Realized capital gains and losses may vary significantly The Company’s method of calculating this measure may between periods and are generally driven by business differ from those used by other companies and, therefore, decisions and economic developments such as capital comparability may be limited. market condition, the timing of which is unrelated to Operating income is net income excluding realized management services and the insurance underwriting capital gains and losses and related federal income processes of the Company. The Company believes it taxes. Equity in earnings or losses of Erie Family Life is useful for investors to evaluate these components Insurance Company and equity in earnings or losses of separately and in the aggregate when reviewing the limited partnerships are not excluded from the calculation Company’s performance. The Company is aware that the of operating income. Both of these categories include price to earnings multiple commonly used by investors the respective investment’s realized capital gains and as a forward-looking valuation technique uses operating losses, as well as unrealized gains and losses, as these income as the denominator. Operating income should investments are accounted for under the equity method. not be considered as a substitute for net income and Net income is the GAAP measure that is most directly does not reflect the overall profitability of the Company’s comparable to operating income. business. The Company uses operating income to evaluate the The following table reconciles operating income and net results of operations. It reveals trends in the Company’s income for the periods ended March 31, 2006, and 2005: Three months ended March 31 (in thousands) (unaudited) 2006 2005 Operating income $ 48,956 $ 54,199 Net realized gains on investments 784 5,497 Income tax expense on realized gains ( 274) ( 1,925) Realized gains, net of income tax expense 510 3,572 Net income $ 49,466 $ 57,771 Three months ended March 31 (per share information—diluted) (unaudited) 2006 2005 Operating income $ 0.72 $ 0.78 Net realized gains on investments 0.01 0.08 Income tax expense on realized gains 0.00 ( 0.03) Realized gains, net of income tax expense 0.01 0.05 Net income $ 0.73 $ 0.83 7

- 8. CONSOLIDATED STATEMENTS OF FINANCIAL POSITION (Amounts in thousands, except per share data) March 31 December 31 2006 2005 (unaudited) Assets Investments Fixed maturities $ 925,689 $ 972,210 Equity securities Preferred stock 137,048 170,773 Common stock 106,554 95,561 Other invested assets 180,554 158,044 Total investments 1,349,835 1,396,588 Cash and cash equivalents 7,132 31,666 Equity in Erie Family Life Insurance Company 52,434 55,843 Premiums receivable from policyholders 258,083 267,632 Receivables from affiliates 1,179,860 1,176,419 Other assets 158,871 173,113 Total assets $ 3,006,215 $ 3,101,261 Liabilities and shareholders’ equity Liabilities Unpaid losses and loss adjustment expenses $ 997,124 $ 1,019,459 Unearned premiums 443,269 454,409 Other liabilities 306,953 348,791 Total liabilities 1,747,346 1,822,659 Total shareholders’ equity 1,258,869 1,278,602 Total liabilities and shareholders’ equity $ 3,006,215 $ 3,101,261 Book value per share $ 18.74 $ 18.81 Shares outstanding 67,189 67,962 Member • Erie Insurance Group An Equal Opportunity Employer Home Office • 100 Erie Insurance Place • Erie, PA 16530 814.870.2000 • www.erieinsurance.com GF540 5/06 © 2006 Erie Indemnity Company