2014 financial innovations in wealth management services

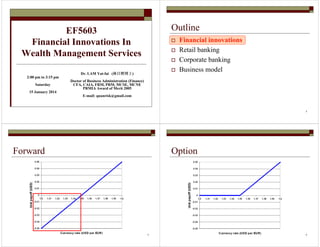

- 1. EF5603 Financial Innovations In Wealth Management Services Dr. LAM Yat-fai (林日辉博士) Doctor of Business Administration (Finance) CFA, CAIA, FRM, PRM, MCSE, MCNE PRMIA Award of Merit 2005 E-mail: quanrisk@gmail.com 2:00 pm to 3:15 pm Saturday 15 January 2014 2 Outline Financial innovations Retail banking Corporate banking Business model 3 Forward 4 Option

- 2. 5 Trading strategy 6 Evolution of financial products Spot Linear derivatives Forwards and futures Vanilla options European and American, call and put Trading strategies Bull spread, bear spread, butterfly, straddle 7 Evolution of financial products First generation exotic options Binary, Asian, Bermuda options Barrier, one-touch, no-touch options Second generation exotic options Corridors, faders, step-up, step-down options Structured products CLDs, PPNs, accumulators, TARFs 8

- 3. 9 Structured products under the SFO A financial instrument with its payoff determined by reference to one or more of the value, rate, level (or a range of value, rate, level) of any type or combination of types of currency, interest, equity, commodity, credit event or index Everything the value, rate, level (or a range of value, rate, level) of any basket of more than one type or combination of types of currency, interest, equity, commodity, credit event or index Excluding bonds, mutual funds and exchanged traded products 10 Defacto definition Simple financial instruments Without using derivatives Financial instruments with derivatives for hedging Using derivatives solely for hedging purpose Derivatives for profit making Single small or no initial cash outflow Single payoff Structured products A combination of derivatives that results sophisticated payoff structure 11 Credit linked structured products vs currency linked structured products Credit linked structured products Linked to credit events Bank’s own investments Bank earns interest income Currency linked structured products Linked to currency rate Majority made for and sold to corporate and private banking customers Bank earns service fees 12 Why currency linked structured products? Dream structured products High return and no risk No cash outflow but only cash inflow Real structured products Matching risk-return preferences Matching cash in-out flow patterns Common features Look like deposits 不劳而获 Shorter term, usually with maturity less than one year Early termination when sufficient earnings accumulated Psychological comfortable when suffering from loss, e.g. rebate

- 4. 13 Currency linked structured products Exempted from the SFO if sold by a bank under the supervision of the HKMA The largest category of structured products in terms of transaction volume To capture earning potential under the current environment of extremely low interest rate high currency rate volatility 14 Outline Financial innovations Retail banking Corporate banking Business model 15 Major currency linked structured products Retail banking Currency linked deposits Principal protected notes Corporate and private banking Accumulators Target accrual redemption forwards 16 High yield deposits

- 5. 17 Currency linked deposits At origination Customer makes a term deposit in HKD At maturity If HKD per GBP rate strike rate Customer receives HKD principal + high interest If HKD per GBP rate strike rate Customer receives GBP principal + high interest converted at strike rate Worse performer of a simple HKD deposit and a simple GBP deposit 18 Payoff diagram 19 Currency linked deposits Objective To seek high return under a low interest rate environment Psychologically comfortable to receive the foreign currency Risk To acquire foreign currency at the strike rate above the market rate at maturity Similar to investing in foreign currency Trade off Give up the potentially higher return of currency rate 20 Principal protected notes At origination Customer makes a term deposit in HKD At maturity Customer receives the principal Interim regular interest Linked to the performance of underlying currency rate

- 6. 21 Risk-return alternation Fixed deposit Cash outflow: principal Interim cash inflows: fixed 0.01% monthly Principal protected Cash outflow: principal Monthly interests invested in highly leveraged options Interim cash inflows: 0% to 10% in a sudden 22 Principal protected notes Objective To reserve the investment principal With a potential to earn higher coupon rate Risk To loss the interest Hidden vulnerability Chance of getting high coupon return is very very small 23 Outline Financial innovations Retail banking Corporate banking Business model 24 Accumulator At origination Customer makes a longer term deposit in USD Every month If USD per EUR rate strike rate Customer receives USD principal + high interest If USD per EUR rate strike rate Customer receives EUR principal + high interest bought at strike rate

- 7. 25 Multiple fixings 26 Accumulator Objective To seek high return under a low interest environment Psychologically comfortable to receive the foreign currency One deposit amount for multiple fixings Risk To acquire foreign currency at the strike rate above the market rate on fixing dates Similar to investing in foreign currency Trade off Give up the potentially higher return of currency rate 27 Accumulator with knock-out If the currency rate is above a knock-out rate during the life of an accumulator, knock-out occurs and the principal is returned to the investor To reduce the hedging cost of the issuer 28 Target accrual redemption forward At origination The customer makes no cash outflow Every month If USD per EUR rate strike rate Customer receives (Spot rate – strike rate) × Notional principal If USD per EUR rate strike rate Customer pays (Strike rate - spot rate) ×Notional principal × 2 Redemption If the aggregated received cash target, the TARF ends

- 8. 29 Bull TARF 30 Multiple fixings 31 Bear TARF 32 Dual-strike TARF

- 9. 33 Survival gap TARF 34 Pivot TARF 35 36

- 10. 37 RMB as underlying currency China trade emerges RMB becomes popular in Taiwan and Hong Kong Companies using RMB as transaction currency Outlook of appreciation of RMB Controlled free trade on RMB Customer base Companies with businesses in mainland China Individuals with investments in mainland China Wealthy Chinese as an emerging sector of private banking Downside risk: forced to acquire RMB at a unknown price Offshore RMB – CNH 38 39 Outline Financial innovations Retail banking Corporate banking Business model 40 SSPA classification of structured products

- 11. 41 42 Sales and marketing Sales Private banking Corporate banking Retail banking Marketing Nice features of a structured product Strong sales channels – the dominating factor 43 44

- 12. 45 Major sales channels Commercial bank Corporate banking “Nominal” hedging Private banking Professional Investor under the SFO Corporate private banking Private banking customer in legal form of a company dedicated for investments Wealth management services Risk assessment of investing in structured products Market risk Sensitivity to underlying currency and value-at-risk Credit risk Default of structured product issuer Operational risk Very tedious settlement procedure Liquidity risk No secondary market due to high degree of customization Legal risk Lengthy contract with difficulty to understand legal terms Wealthy retail banking customers 46 47 Revenue model Financial engineering – investment bank Construct with liquid underlying currency and vanilla options at a lower cost Sell to a wholesaler at a higher price Pocket the price-cost differential Dynamic hedging through out the life of the structured product Subject to market risk and operational risk Intermediary – commercial bank Buy from an investment bank at a lower cost Sell to a customer at a higher price Pocket the price-cost differential Subject to operational risk and credit risk 48 Cost model Sales and marketing Customer services Hedging Raw material Dynamic hedge Static hedge: back-to-back Labour – traders Settlement Technology

- 13. 49 Valuation Component approach Decomposition into component options and deposits Structured product = Sum of components Monte Carlo simulation Exotic payoff which cannot be deposited into components 50 Pricing Price = Raw material + operating cost + profit Too expensive No customer Too cheap Loss on every sale Completion among banks force the convergence of price 51 Other back office functions Settlement Decompose a structured product into many fixings To be settled on individual fixing basis Very tedious due to the variable payoff Subject to high operational risk General ledger Each fixing generate one set of GL transactions A challenging topic to accountants 52 Documentation Term sheet Deal confirmation Fixing ticket Portfolio statement Online enquiry