Colliers Quarterly Mumbai Q1 2017

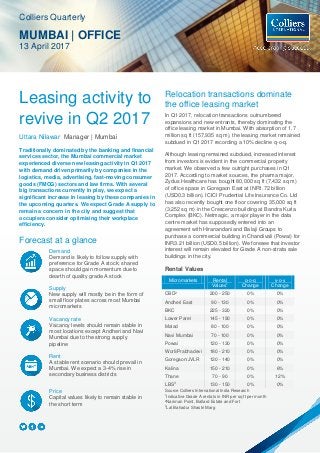

- 1. Leasing activity to revive in Q2 2017 Uttara Nilawar Manager | Mumbai Traditionally dominated by the banking and financial services sector, the Mumbai commercial market experienced diverse new leasing activity in Q1 2017 with demand driven primarily by companies in the logistics, media, advertising, fast-moving consumer goods (FMCG) sectors and law firms. With several big transactions currently in play, we expect a significant increase in leasing by these companies in the upcoming quarters. We expect Grade A supply to remain a concern in the city and suggest that occupiers consider optimising their workplace efficiency. Forecast at a glance Demand Demand is likely to follow supply with preference for Grade A stock; shared space should gain momentum due to dearth of quality grade A stock Supply New supply will mostly be in the form of small floor plates across most Mumbai micromarkets Vacancy rate Vacancy levels should remain stable in most locations except Andheri and Navi Mumbai due to the strong supply pipeline Rent A stable rent scenario should prevail in Mumbai. We expect a 3-4% rise in secondary business districts Price Capital values likely to remain stable in the short term Relocation transactions dominate the office leasing market In Q1 2017, relocation transactions outnumbered expansions and new entrants, thereby dominating the office leasing market in Mumbai. With absorption of 1.7 million sq ft (157,935 sq m), the leasing market remained subdued in Q1 2017 recording a 10% decline q-o-q. Although leasing remained subdued, increased interest from investors is evident in the commercial property market. We observed a few outright purchases in Q1 2017. According to market sources, the pharma major, Zydus Healthcare has bought 80,000 sq ft (7,432 sq m) of office space in Goregaon East at INR1.72 billion (USD0.3 billion). ICICI Prudential Life Insurance Co. Ltd has also recently bought one floor covering 35,000 sq ft (3,252 sq m) in the Crescenzo building at Bandra Kurla Complex (BKC). Netmagic, a major player in the data centre market has supposedly entered into an agreement with Hiranandani and Balaji Groups to purchase a commercial building in Chandivali (Powai) for INR3.21 billion (USD0.5 billion). We foresee that investor interest will remain elevated for Grade A non-strata sale buildings in the city. Rental Values Micromarkets Rental Values1 q-o-q Change y-o-y Change CBD2 200 - 250 0% 0% Andheri East 90 - 130 0% 0% BKC 225 - 320 0% 0% Lower Parel 145 - 190 0% 0% Malad 80 - 100 0% 0% Navi Mumbai 70 - 100 0% 0% Powai 120 - 130 0% 0% Worli/Prabhadevi 180 - 210 0% 0% Goregaon/JVLR 120 - 140 0% 0% Kalina 150 - 210 0% 6% Thane 70 - 90 0% 12% LBS3 130 - 150 0% 0% Source Colliers International India Research 1 Indicative Grade A rentals in INR per sq ft per month 2 Nariman Point, Ballard Estate and Fort 3 Lal Bahadur Shastri Marg Colliers Quarterly MUMBAI | OFFICE 13 April 2017

- 2. 2 Colliers Quarterly | 13 April 2017 | mumbai | office | Colliers International Although banking and financial services usually account for a big share in Mumbai leasing, a major shift in leasing concentration was observed in Q1 2017. Companies in logistics, media, advertising, FMCG and law firms accounted for a 35% share in total leasing volume, while other demand drivers like engineering & manufacturing, technology firms, banking and financial services (BFSI) along with healthcare & pharmaceuticals recorded a 20%, 19%, 18% and 5% share respectively of the overall leasing volume. Consulting formed only a 3% share; we are expecting several large deals to conclude in the upcoming quarters by global consulting giants, which should revive the absorption numbers. In Q1 2017, the average deal size was in the range of 16,000-18,000 sq ft (1,486-1,672 sq m), a 30% decline since Q4 2016. The Western suburbs recorded a 37% share in leasing volume with occupiers' preference concentrated in Andheri and Goregaon. Owing to the available Grade A stock, Central suburbs and Navi Mumbai recorded a 27% and 15% share of leasing; while other micromarkets like Central Mumbai, Thane, BKC and CBD accounted for 21% share in absorption. In our opinion, demand will follow supply; hence occupiers' preference should remain concentrated in the western suburbs, central suburbs and Navi Mumbai. With premium completions in Q1 2017 such as Empressa, ATL Corporate Park and Crescent Business Square totalling to 0.4 million sq ft of new office stock (37,161sq m), Andheri micromarket in the western suburbs should continue to outperform. Gross Office Absorption in million sq ft Source: Colliers International India Research New supply addition to increase vacancy in Andheri and Navi Mumbai While the supply pipeline dried up in Thane, Powai and CBD with vacancy levels averaging 4-5%; markets such as Andheri and Navi Mumbai experienced a vacancy rate of 20%. With major developments such as Kanakia Wall Street, Times Square Tower D, Skyline Icon Corporate Park and Platinum, Andheri should witness supply addition of about 3 million sq ft (278,709 sq m) in the next two years. Navi Mumbai should also be a frontrunner in quality Grade A supply infusion with almost 6 million sq ft (557,418 sq m) of new supply by 2020. The upcoming supply pipeline in both these micromarkets should put further upward pressure on vacancy levels in coming quarters. On the other hand, markets like Thane, Powai, CBD and LBS should be challenged by significant supply constraints as no major development is scheduled for completion in these micromarkets. Rental & Capital Value Trend (INR) Source: Colliers International India Research Note. The above graph represents average Grade A rents in INR per sq ft per month and average capital values on an INR per sq ft basis Rental values to remain stable Rental values were unchanged since Q4 2016 owing to a steady supply and demand in most micromarkets. The stable rent scenario is likely to continue in the future as well since occupiers are looking to optimise costs and expand to locations with available quality stock. As there is a dearth of Grade A contiguous large floor plates across Mumbai, select buildings should continue to demand a premium over market average rent depending on demand supply dynamics at the micromarket level. Although there were a few outright purchases in the city in Q1 2017, we expect capital values to remain stable in the short term. 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 2010 2011 2012 2013 2014 2015 2016 2017 Q1 Q2 Q3 Q4 0 5000 10000 15000 20000 25000 30000 0 50 100 150 200 250 300 350 Q12010 Q12011 Q12012 Q12013 Q12014 Q12015 Q12016 Q12017 Q12018F Q12019F Q12020F Rental Values Capital Values

- 3. 3 Colliers Quarterly | 13 April 2017 | mumbai | office | Colliers International We expect a significant increase in transaction volumes in coming quarters owing to a number of market transactions currently in play. Demand is likely to be led by logistics and pharmaceutical companies, consulting firms and serviced offices. Back office operations of a few banking and financial companies moved to Navi Mumbai in Q4 2016 and Q1 2017. We expect this number to increase in coming quarters as occupiers may continue to relocate at affordable locations in Navi Mumbai. Rental and capital values are set to remain stable as the tenant demand of smaller plate sizes should be met by most micromarkets for the next few months. Recently, City and Industrial Development Corporation (CIDCO) awarded the first phase of the Navi Mumbai airport to the GVK Group. In addition, work on Metro II A & B and Metro III is in full swing. These projects should improve connectivity in Mumbai significantly, thereby affecting the office market positively. The revised Mumbai Development Plan (DP) although delayed due to several corrections and alterations, is likely to be finalised soon. Builders keenly await the same to get clarity on the Development Control Rules (DCR) to be followed for ongoing and planned projects. Colliers View MAJOR TRANSACTIONS IN Q1 2017 CLIENT BUILDING NAME AREA (SQ FT) LOCATION LEASE/SALE General Mills Venture 1,85,000 Powai Lease Tata Consulting Engineers (TCE) Empire Tower 90,000 Navi Mumbai Lease FCBUlka Chibber House 80,000 Andheri Lease Bisleri Bisleri Compound 80,000 Andheri Lease FIS Global Fairmount 80,000 Powai Lease Source: Colliers International India Research KEY UNDER CONSTRUCTION PROJECTS BUILDING NAME DEVELOPER AREA (SQ FT) LOCATION POSSESSION Codename Smash Hit Neptune Developer 1,040,000 Bhandup 2017 Wall Street Kanakia 780,000 Andheri 2017 Source: Colliers International India Research Notes: 1. Office Market: The major business locations in Mumbai are the CBD (Nariman Point, Fort and Ballard Estate), Central Mumbai (Worli, Lower Parel and Parel), Bandra Kurla Complex (BKC) and Andheri Kurla stretch. Powai, Malad and Vashi are the preferred IT-ITES destinations, while Airoli at Navi Mumbai and Lal Bahadur Shastri Marg are emerging as new office and IT-ITeS submakets. 2. Rents/Capital Value: Market average of indicative asking price for Grade A office space. 3. Available Supply: Total Grade A office space being marketed for sale or lease in surveyed quarter. 4. All the figures are based on market information as on 25th March 2017 Copyright © 2017 Colliers International. The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged to consult their professional advisors prior to acting on any of the material contained in this report. For more information: Nishith Agarwal Surabhi Arora Senior Associate Director | Research Tel: +91 124 456 7500 Surabhi.arora@colliers.com Senior Associate Director | Office Services Nishith.agarwal@colliers.com Ravi Ahuja Executive Director | Office Services Ravi.ahuja@colliers.com 17th Floor, Indiabulls Finance Center, Tower 3, Elphinstone (W), Mumbai - 400013 | India