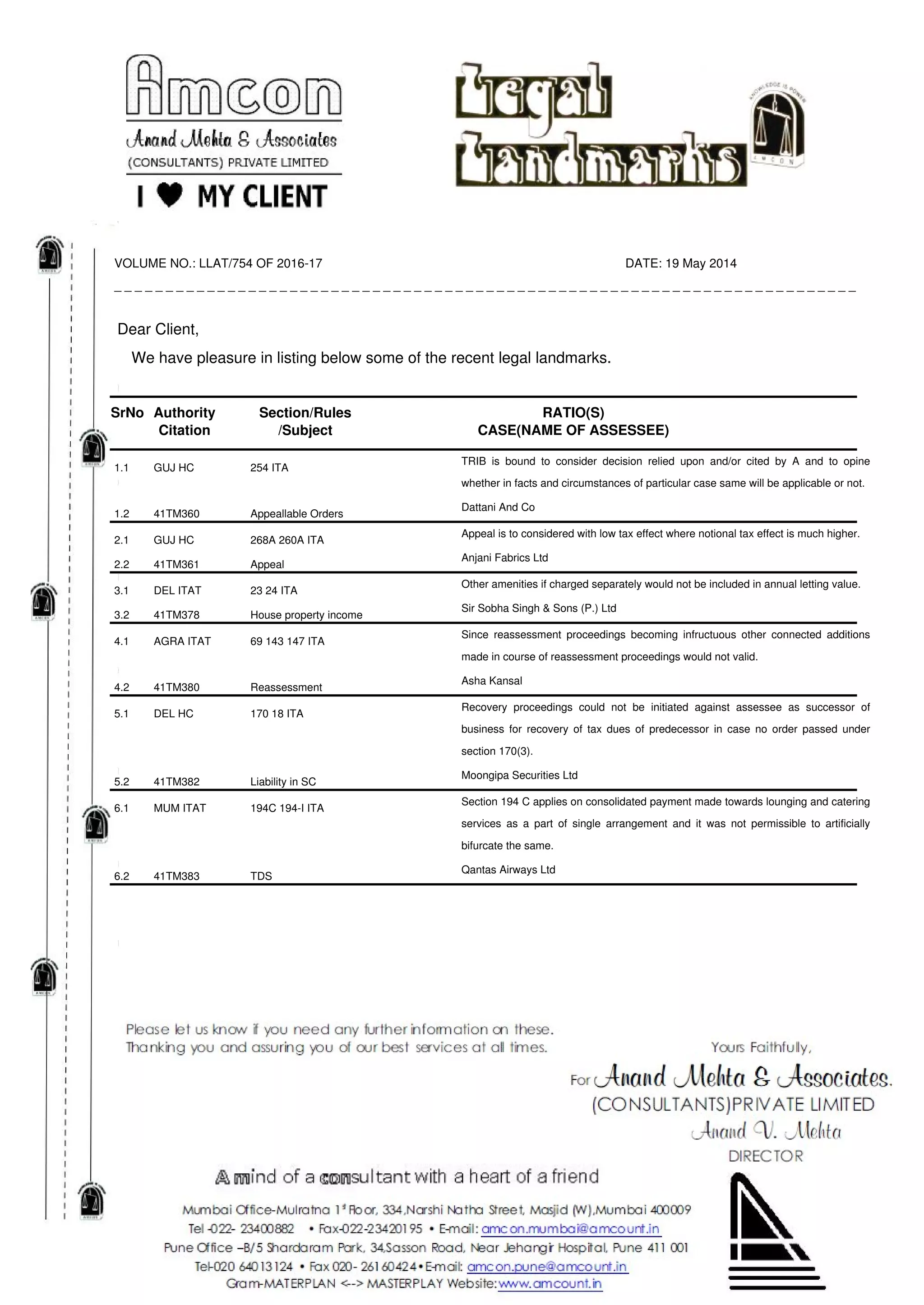

This document lists recent legal landmarks from various tax authorities in India. It includes 6 cases summarized as follows:

1. The tribunal is bound to consider precedents cited by the appellant and give its opinion on their applicability.

2. An appeal should be considered based on potential tax effect, not just actual tax effect.

3. Amenities charged separately from rent would not be included in annual letting value for housing property income.

4. If reassessment proceedings become invalid, related additions made during reassessment would also not be valid.

5. Recovery proceedings cannot be initiated against a successor business for a predecessor's tax dues without an order under section 170(3).