QNBFS Daily Market Report March 14, 2019

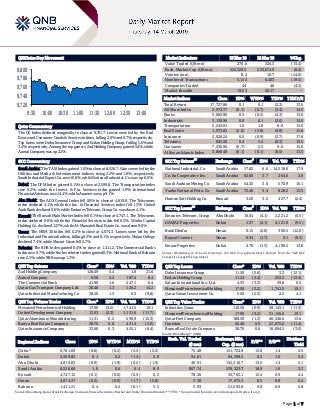

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QE Index declined marginally to close at 9,761.7. Losses were led by the Real Estate and Consumer Goods & Services indices, falling 2.0% and 0.7%, respectively. Top losers were Doha Insurance Group and Ezdan Holding Group, falling 5.6% and 3.4%, respectively. Among the top gainers, Zad Holding Company gained 5.4%, while Aamal Company was up 2.2%. GCC Commentary Saudi Arabia: The TASI Index gained 1.0% to close at 8,526.7. Gains were led by the Utilities and Media & Entertainment indices, rising 2.2% and 1.8%, respectively. Saudi Industrial Export Co. rose 10.0%, while National Industrial. Co. was up 6.6%. Dubai: The DFM Index gained 0.1% to close at 2,599.8. The Transportation index rose 5.2%, while the Invest. & Fin. Services index gained 1.9%. International Financial Advisors rose 14.4%, while Aramex was up 9.1%. Abu Dhabi: The ADX General Index fell 0.9% to close at 4,819.8. The Telecomm. index declined 4.1%, while the Inv. & Financial Services index fell 1.3%. United Arab Bank declined 9.6%, while Emirates Telecom. Group Co. was down 4.1%. Kuwait: The Kuwait Main Market Index fell 0.1% to close at 4,747.1. The Telecomm. index declined 0.6%, while the Financial Services index fell 0.5%. Warba Capital Holding Co. declined 12.7%, while Al-Massaleh Real Estate Co. was down 9.6%. Oman: The MSM 30 Index fell 0.2% to close at 4,074.3. Losses were led by the Industrial and Financial indices, falling 0.3% and 0.1%, respectively. Majan College declined 7.4%, while Muscat Gases fell 5.7%. Bahrain: The BHB Index gained 0.4% to close at 1,411.2. The Commercial Banks index rose 0.7%, while the Investment index gained 0.3%. National Bank of Bahrain rose 2.5%, while BBK was up 1.3%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Zad Holding Company 126.49 5.4 1.8 21.6 Aamal Company 9.58 2.2 187.4 8.4 The Commercial Bank 41.90 1.6 247.1 6.4 Qatar Gas Transport Company Ltd. 20.48 1.3 126.2 14.2 Qatar Industrial Manufacturing Co 38.50 1.3 0.3 (9.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 17.90 (3.2) 1,741.5 19.1 United Development Company 13.03 (2.3) 1,131.6 (11.7) Qatar Aluminium Manufacturing 11.31 0.2 590.9 (15.3) Barwa Real Estate Company 38.70 0.6 431.4 (3.0) Qatar Insurance Company 33.60 0.3 425.1 (6.4) Market Indicators 13 Mar 19 12 Mar 19 %Chg. Value Traded (QR mn) 276.0 326.3 (15.4) Exch. Market Cap. (QR mn) 552,329.5 553,674.9 (0.2) Volume (mn) 8.2 10.7 (24.0) Number of Transactions 5,154 6,403 (19.5) Companies Traded 44 46 (4.3) Market Breadth 19:23 26:17 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,727.86 0.1 0.1 (2.3) 13.6 All Share Index 2,973.77 (0.1) (0.7) (3.4) 14.5 Banks 3,665.90 0.3 (0.5) (4.3) 13.6 Industrials 3,130.96 0.0 0.1 (2.6) 15.0 Transportation 2,243.81 1.0 1.8 8.9 13.0 Real Estate 1,973.63 (2.0) (5.8) (9.8) 15.8 Insurance 2,926.24 0.0 (0.9) (2.7) 17.8 Telecoms 925.50 0.4 3.4 (6.3) 19.5 Consumer 7,336.90 (0.7) 2.5 8.6 15.0 Al Rayan Islamic Index 3,860.49 (0.1) (0.1) (0.6) 13.5 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% National Industrial. Co Saudi Arabia 17.82 6.6 14,518.6 17.9 Co. for Cooperative Ins. Saudi Arabia 62.00 3.7 264.6 2.8 Saudi Arabian Mining Co. Saudi Arabia 54.30 3.6 570.9 10.1 Yanbu National Petro. Co. Saudi Arabia 72.40 3.4 828.2 13.5 Human Soft Holding Co. Kuwait 3.20 3.2 437.7 (2.4) GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Emirates Telecom. Group Abu Dhabi 16.04 (4.1) 2,221.2 (5.5) DAMAC Properties Dubai 1.37 (2.1) 4,121.9 (9.3) Bank Dhofar Oman 0.15 (2.0) 390.5 (12.0) Raysut Cement Oman 0.34 (1.7) 9.1 (9.5) Emaar Properties Dubai 4.70 (1.3) 4,199.2 13.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Doha Insurance Group 11.50 (5.6) 3.3 (12.1) Ezdan Holding Group 11.24 (3.4) 253.2 (13.4) Salam International Inv. Ltd. 4.35 (3.3) 59.8 0.5 Mesaieed Petrochemical Holding 17.90 (3.2) 1,741.5 19.1 Qatar Oman Investment Co. 5.56 (2.5) 2.2 4.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Industries Qatar 118.50 (0.9) 50,143.1 (11.3) Mesaieed Petrochemical Holding 17.90 (3.2) 31,156.6 19.1 Qatar Fuel Company 188.50 (1.3) 26,346.6 13.6 Ooredoo 66.48 0.9 23,672.0 (11.4) Barwa Real Estate Company 38.70 0.6 16,694.5 (3.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,761.69 (0.0) (0.2) (3.5) (5.2) 75.48 151,724.9 13.6 1.4 4.5 Dubai 2,599.82 0.1 0.2 (1.4) 2.8 94.61 94,298.2 8.3 1.0 5.4 Abu Dhabi 4,819.83 (0.9) (1.9) (6.2) (1.9) 46.91 132,310.7 13.5 1.4 5.1 Saudi Arabia 8,526.68 1.0 0.6 0.4 8.9 867.74 539,323.7 18.9 1.9 3.3 Kuwait 4,747.12 (0.1) (0.6) (0.5) 0.2 78.36 32,763.1 15.5 0.9 4.4 Oman 4,074.27 (0.2) (0.9) (1.7) (5.8) 3.38 17,675.3 8.5 0.8 6.4 Bahrain 1,411.21 0.4 0.2 (0.1) 5.5 3.93 21,592.8 9.0 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,720 9,740 9,760 9,780 9,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE Index declined marginally to close at 9,761.7. The Real Estate and Consumer Goods & Services indices led the losses. The index fell on the back of selling pressure from GCC shareholders despite buying support from Qatari and non-Qatari shareholders. Doha Insurance Group and Ezdan Holding Group were the top losers, falling 5.6% and 3.4%, respectively. Among the top gainers, Zad Holding Company gained 5.4%, while Aamal Company was up 2.2%. Volume of shares traded on Wednesday fell by 24% to 8.2mn from 10.7mn on Tuesday. Further, as compared to the 30-day moving average of 8.8mn, volume for the day was 7.8% lower. Mesaieed Petrochemical Holding Company and United Development Company were the most active stocks, contributing 21.4% and 13.9% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Saudi Electricity Co.* Saudi Arabia SR 64,064.0 26.4% 6,016.0 -39.9% 1,757.0 -74.6% Saudi Public Transport Co. * Saudi Arabia SR 1,455.5 29.1% -6.9 – 22.9 -71.9% Dubai Investments* Dubai AED 3,046.4 9.4% – – 651.4 -35.0% Arkan Building Materials Co. * Abu Dhabi AED 967.6 6.5% – – 53.5 77.2% International Holdings Company* Abu Dhabi AED 570.2 35.4% – – 18.5 -37.1% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/13 US Mortgage Bankers Association MBA Mortgage Applications 8-March 2.3% 2.3% 2.3% 03/13 EU Eurostat Industrial Production SA MoM January 1.4% 1.4% 1.4% 03/13 EU Eurostat Industrial Production WDA YoY January -1.1% -1.1% -1.1% 03/13 Japan Bank of Japan PPI YoY February 0.8% 0.8% 0.8% 03/13 Japan Bank of Japan PPI MoM February 0.2% 0.2% 0.2% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status DBIS Dlala Brokerage & Investment Holding Company 17-Mar-19 3 Due ERES Ezdan Holding Group 18-Mar-19 4 Due IGRD Investment Holding Group 19-Mar-19 5 Due MRDS Mazaya Qatar Real Estate Development 20-Mar-19 6 Due AKHI Al Khaleej Takaful Insurance Company 25-Mar-19 11 Due QFBQ Qatar First Bank 27-Mar-19 13 Due QGMD Qatari German Company for Medical Devices 27-Mar-19 13 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 19.77% 26.87% (19,582,503.07) Qatari Institutions 41.78% 30.68% 30,630,144.87 Qatari 61.55% 57.55% 11,047,641.80 GCC Individuals 1.34% 0.60% 2,034,335.73 GCC Institutions 0.81% 5.84% (13,891,792.95) GCC 2.15% 6.44% (11,857,457.22) Non-Qatari Individuals 5.65% 9.74% (11,307,013.94) Non-Qatari Institutions 30.65% 26.26% 12,116,829.36 Non-Qatari 36.30% 36.00% 809,815.42

- 3. Page 3 of 7 News Qatar SIIS to hold its AGM and EGM on April 1, 2019 – Salam International Investment Limited’s (SIIS) board of directors invited its shareholders for Ordinary General Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) of the company to be held on April 1, 2019. In the event that the quorum is not met, the second meeting will be adjourned to April 8, 2019. (QSE) CBQK to hold its AGM and EGM on March 20, 2019 – The Commercial Bank’s (CBQK) board of directors invited its shareholders for AGM and EGM of the company to be held on March 20, 2019. In case the quorum of one or both of the above meetings is not met, the second meeting shall be held on March 27, 2019. (QSE) Qatar Petroleum signs agreement to enter 12 exploration blocks in Morocco – Qatar Petroleum has entered into an agreement with Eni to acquire a 30% participating interest in the Tarfaya Shallow Exploration Permit, a series of 12 neighboring offshore blocks along the Atlantic coast of Morocco. The agreement is subject to customary regulatory approvals by the Government of Morocco. Following such approvals, the partners holding participating interest in the Tarfaya Shallow Exploration permit will be affiliates of each of Eni (operator) with a 45% participating interest, Qatar Petroleum with a 30% participating interest, and Office National des Hydrocarbures et des Mines (ONHYM) with the remaining 25% participating interest. The Tarfaya Shallow Exploration Permit covers a total area of approximately 23,900 kilo meter square in water depths of up to 1,000 meters. The first phase of exploration ending in 2020 will include conducting geological and geophysical studies with the objective of further defining potential prospects/leads and assessing the full potential of the blocks. (Gulf-Times.com) Cabinet nod to areas where non-Qataris can own real estate – The Cabinet has given its nod to a draft resolution of the Council of Ministers that determined the areas where non- Qataris are allowed to own and use real estate. The resolution paves the way for implementation of Law No. 16 of 2018 on the regulation of non-Qatari ownership and use of real estate, the official Qatar News Agency (QNA) reported. After HE the Prime Minister Sheikh Abdullah bin Nasser bin Khalifa Al-Thani chaired the Cabinet's regular meeting, HE the Minister of Justice and Acting Minister of State for Cabinet Affairs Issa bin Saad Al-Jafali Al-Nuaimi said the Cabinet gave approvals pertaining to the following: allow the ownership of real estate for non- Qatari individuals and non-Qatari commercial companies and real estate investment funds; determine 10 areas where non- Qataris can own real estate; determine 16 areas for the use of real estate by non-Qataris for 99 years; allow non-Qatari ownership of residential villas within residential complexes; allow non-Qatari ownership of shops within commercial complexes; and grant residence to non-Qatari owners of real estate whether for the purpose of housing or investment throughout the period of ownership of real estate. In December last year, the Cabinet had approved a draft decision to form a committee to regulate non-Qatari ownership and use of real estate and determine the committee's work system and remuneration. (Gulf-Times.com) Qatar’s CPI falls 1.55% YoY and rises 0.18% MoM in February – Qatar’s CPI, the measure of inflation in the country, of February 2019 reached 107.76 points (base year is 2013), showing an increase of 0.18% when compared to the previous month. On an annual basis, it showed a decrease of 1.55%. On monthly basis, there were four main groups, where respective indices in this month have increased, namely: ‘Clothing and Footwear’ by 3.69%, followed by ‘Food and Beverages’ by 1.13%, ‘Miscellaneous Goods and Services’ by 0.45%, and ‘Housing, Water, Electricity and Gas’ by 0.28%. Compared to the same month of the previous year, the decrease was primarily due to the decreasing prices seen in the seven groups, namely: ‘Communication’ by 11.45%, followed by ‘Recreation and Culture’ by 6.49%, ‘Transport’ by 2.85%, ‘Housing, Water, Electricity and other Fuel’ by 2.66%, ‘Food and Beverages’ by 1.16%, ‘Clothing and Footwear’ by 0.66%, and ‘Restaurants and Hotels’ by 0.13%. Also, there has been an increase in price levels in five groups, namely: ‘Tobacco’ by 127.19%, ‘Education’ by 9.25%, ‘Furniture and Household Equipment’ by 1.31%, ‘Miscellaneous Goods and Services’ by 0.26%, and ‘Health’ by 0.10%. (Qatar Tribune) Real estate trading volume exceeds QR320mn in the week ended March 7 – The trading volume of registered real estates in between March 3 to March 7 at the Ministry of Justice’s real estate registration department stood at over QR320mn. The department’s weekly report stated that the trading included empty lands, residential units, residential buildings, residential tower and a multipurpose building. Most of the trading took place in Al Rayyan, Doha, Al Daayen, Umm Salal, Al Wakra, Al Shamal, Al Khor and Al Thakhira. The trading volume of registered real estates in between February 24 to February 28 was over QR323mn. (Peninsula Qatar) Al Khalij Cement Company, Qatar Petroleum sign agreement for oil well cement supply – Al Khalij Cement Company, a subsidiary of Qatari Investors Group, signed a three-year agreement with Qatar Petroleum for the supply of oil well cement at the launch of Qatar Petroleum’s ‘Tawteen’ initiative event held last month. Al Khalij Cement Company was awarded the prestigious American Petroleum Institute (API) certification in November 2018, allowing it to produce oil well cement Class ‘G’ at Grade (s) HSR at its Umm Bab factory. It is the first and only cement producer in Qatar able to deliver this high specification grade of cement. The certification was attained by the company’s production plant following API’s comprehensive audit. (Gulf-Times.com) QAMC’s strict business plan focuses on cost optimization – Qatar Aluminum Manufacturing Company (QAMC), which owns 50% interest in Qatalum, has put in a strict business plan with special emphasis on cost optimization as part of its efforts to enhance efficiency. The company will announce an interim dividend next month along with its 2019 first quarter results. The dividend to be declared will pertain to the six-month period from July 1, 2018 to December 31, 2018, in line with the company’s Initial Public Offering prospectus and the founder’s (Qatar Petroleum) economic rights waiver. It has obtained the necessary no objection from the Ministry of Commerce and Industry to amend the company’s Articles of Association to

- 4. Page 4 of 7 have the first financial year to end on December 31, 2019. Qatalum does not envisage any increase in production at present but its focus is now on enhancing efficiency, according to Mohamed Jaber A Al-Sulaiti, QAMC’s board member. Qatalum’s operations have been ranked among the most efficient smelters in terms of cash cost in US Dollar per metric ton. It aims to continue to improve processes throughout the organization to optimize costs. The company benchmarks ‘cash cost’ to track its progress as it implements best practices. It utilizes benchmarks to measure its performance and evaluate results. The Qatalum Improvement Programme (QIP) seeks to continuously optimize processes throughout the organization resulting in reduced business costs. (Gulf-Times.com) Barwa Bank’s AGM and EGM endorses all items on its agenda and approves cash dividend of QR1.5 per share – Barwa Bank convened its AGM and EGM. During the AGM, all items on the agenda were discussed, such as hearing and approving the board’s report for the year that ended December 31, 2018, as well as discussing and approving the group’s future business plans. This also came in line with the approval of the board’s recommendation to distribute cash dividends amounting to 15% of the nominal value of the shares at the rate of QR1.5 per share. The new board members were elected for the 2019-2021 term. They are: Sheikh Mohamed bin Hamad bin Jassim Al- Thani, Abdul Aziz Mohamed Hamad Al-Mana, Sultan Yousif Al- Sulaiti, Sheikh Jassim bin Fahd bin Jassim Al-Thani, and Nasser Ali Al-Hajri. During the assembly, the representatives of the General Authority for Retirement and Social Security were also appointed – Moza Mohamed Al-Sulaiti, Ahmed Abdul Razzaq Al-Hashimi and Ahmed Mohamed Al-Mana, in addition to the appointment of Sheikh Khalid bin Hassan bin Khalid Al-Thani as representative of Qatar Holding. The Shari’ah Supervisory Board has been appointed for the next three years (2019-2021) renewable under the chairmanship of Sheikh Walid bin Hadi; Sheikh Osama Al-Durai, executive member; and Sheikh Essam Al-Anzi, member of the board. (Gulf-Times.com) Barwa Bank’s CEO: Merger with International Bank of Qatar to be completed by April – Barwa Bank’s CEO, Khalid Al Subaie, said that Barwa Bank’s legal merging with International Bank of Qatar is expected to take place in April, following the approval of Qatar Central Bank, followed by the operational merger which is expected to be by the end of this year. Al Subaie said that there will be a new strategy for the bank as it will double its assets to nearly QR80bn, and there will be a strategy for the new joint entity legal integration under the name of Barwa Bank. He said that the procedure will double the number of branches and in terms of opening the new branches, the decision will be made in a timely manner, but for existing customers, the number of branches will double. (Peninsula Qatar) The Commercial Bank joins international blockchain collective – The Commercial Bank has become the first bank in Qatar to join enterprise software firm R3’s collaborative initiative to develop innovative applications and solutions on its ‘Corda’ blockchain platform. The bank joins R3’s global network of more than 300 of the world’s largest financial services firms, technology companies, central banks, regulators, and trade associations working together on Corda – an enterprise-grade blockchain platform that removes costly friction in business transactions. Through Corda, institutions can transact directly using smart contracts while ensuring the highest levels of privacy and security. The Commercial Bank’s membership of R3 is further evidence of its commitment to apply the latest technologies to improve services for customers and to drive operational efficiencies. It also demonstrates the bank’s readiness to collaborate with other organizations in the financial services industry to find new ways that blockchain technology can be used. (Gulf-Times.com) QLife Pharma set for US FDA approval, plans to export products soon – QLife Pharma, the first licensed pharmaceutical manufacturing company in Qatar, is set to go for the US FDA approval of its drug products in a bid to export to neighboring countries in the Middle East, Africa, and beyond. QLife Pharma’s CEO, Ahmed Hamad Almohanadi said the company which has been selling its generic medicine lines to institutes, pharmacies, hospitals, and clinics here will now also diversify to new markets outside the country. He said, “We are keen to deliver the best quality and affordable medicines with much lower prices. And we look forward to giving our medicines to international bodies and have our facility and products qualified and certified by international organizations like the FDA and other certificates around the world. Our aim is to first satisfy the needs of Qatar and gradually to diversify and export to other countries.” (Peninsula Qatar) International US core capital goods orders rebound; inflation muted – New orders for key US-made capital goods rose by the most in six months in January and shipments increased, but the trend in both measures of business spending on equipment remained soft, leaving forecasts for weak first-quarter economic growth intact. The slowing economy is helping keep inflation tame, with other data showing producer prices barely rising in February, resulting in the smallest annual increase in more than one-and-half years. This environment supports the Federal Reserve’s wait-and-see approach to further interest rate hikes this year. Orders for non-defense capital goods excluding aircraft, a closely watched proxy for business spending plans, rebounded 0.8%, the biggest gain since July. These core capital goods orders fell 0.9% in December. Economists polled by Reuters had forecasted core capital goods orders edging up 0.1% in January. Core capital goods orders increased 3.1% on a YoY basis. Core capital goods orders in January were boosted by orders for machinery, which rebounded 1.4% after dropping 0.6% in December. Orders for electrical equipment, appliances and components jumped 1.7% after falling 0.2% in the prior month. (Reuters) MBA: Average US mortgage size hits record-high in last week – The average size of mortgages US consumers were looking to obtain to buy a home or to refinance one hit a record high of $354,500 last week, suggesting resilience in the higher end of the housing market, the Mortgage Bankers Association (MBA) stated. On the other hand, the rise hints that first-time buyers face a challenge in finding their home of choice heading into spring, which is typically the busiest time of the year for home sales, the Washington-based industry group stated. The MBA’s seasonally adjusted index of loan applications to buy a home

- 5. Page 5 of 7 grew 4.3% to 250.8 in the week ended March 8. Demand for mortgages for home purchases was bolstered by a decline in most mortgage rates last week. The average interest rate on 30- year fixed-rate mortgages with conforming loan balances of $484,350 or less decreased to 4.64% from 4.67%. (Reuters) Eurozone’s industrial output stronger than expected in January – Eurozone’s industrial production was stronger than expected in January, data showed, mainly due to a strong contribution from energy and despite a drop in German output. The European Union’s statistics office Eurostat stated production in the 19 countries sharing the Euro rose 1.4% MoM in January for a 1.1% YoY fall. Economists polled by Reuters had expected a 1.0% monthly increase and a 2.1% annual decline. The January result was mainly influenced by a 2.4% monthly and 4.0% YoY jump in energy output, which helped offset or mitigate the weaker results for intermediate and capital goods production. Output went up despite a drop in Germany, the bloc’s largest economy. Eurostat estimated industrial production in Germany fell 0.9% on the month, a higher drop than the 0.8% fall estimated by the German statistics agency earlier this week. (Reuters) Japan may cut economic view as China slowdown hits growth – Japan’s government is considering a slight downgrade to its assessment of the economy in its monthly report for March as exports and factory output fell due to slowing demand from China, the Nikkei business daily reported. In February, the government stated the economy was recovering, but noted weak data on corporate sentiment, capital expenditure and exports showed the US-China trade war is hurting the outlook for the world’s third-largest economy. The government could slightly tweak the wording of its economic assessment to indicate a downgrade, the Nikkei report stated without citing sources. The government’s coincident indicator index fell for a third straight month in January, prompting the government to cut its view on the index, which showed the economy may have reached the peak of its long-term business cycle. (Reuters) China’s industrial output growth falls to 17-year low, but investment picks up – Growth in China’s industrial output fell to a 17-year low in the first two months of the year, pointing to further weakness in the world’s second-biggest economy. However investment picked up speed as the government fast- tracked more road and rail projects, offering some relief for policymakers as they work to avert a sharper slowdown, data showed. China is ramping up support for the economy this year as growth looks set to plumb 29-year lows. Premier Li Keqiang last week announced hundreds of billions of Dollars in additional tax cuts and infrastructure spending, even as officials vowed they would not resort to massive stimulus like in the past. Industrial output rose 5.3% in January-February, the National Bureau of Statistics (NBS) stated, less than expected and the slowest pace since early 2002. Factory output growth had been expected to slow to 5.5% from December’s 5.7%. An official factory survey showed manufacturing output contracted in February for the first time since January 2009, while factory-gate inflation in February hovered at multi-year lows, pointing to further pressure on industrial profits. (Reuters) China's January-February property investment accelerates despite cooling sales – China’s property investment accelerated in the first two months of the year, driven by strong demand in its hinterland, despite government curbs on speculation in bigger markets and the broader economic slowdown. Real estate investment, which mainly focuses on the residential sector but also includes commercial and office space, rose 11.6% in January-February from a year earlier, data from National Bureau of Statistics (NBS) showed. That was quicker than the 9.5% growth reported for the 2018 full year and the strongest growth figure for the January-February period since 2014, when it grew 19.3%. Howere housing transactions slowed as property sales by floor area fell 3.6% YoY in the first two months of 2019, easing from the 0.9% again in December. (Reuters) ZHCD to hold its board meeting on March 30 – Zad Holding Company (ZHCD) announced that its board of directors will meet on March 30, 2019 to discuss the company’s FY2018 financial results and the profit distribution. (QSE) Regional Saudi Real Estate Refinance Company issues $200mn Sukuk – Government-owned Saudi Real Estate Refinance Company (SRC) stated that it has completed a $200mn Sukuk issue with multiple tenors, the first transaction by a non-sovereign issuer in Saudi Arabia in 2019. The issuance comes under a program SRC established in December that allows it to issue up to SR11bn of local currency-denominated Islamic bonds. SRC, a wholly owned subsidiary of the Kingdom’s sovereign wealth fund (PIF), aims to accelerate housing construction - a sensitive social issue and a top objective of economic reforms - by injecting liquidity into the real estate market. Its target is to eventually refinance 20% of Saudi Arabia’s primary home loans market, which authorities hope to expand to SR500bn by 2020 and SR800bn by 2028. The company has mandated HSBC Saudi Arabia as sole lead manager and bookrunner of the Sukuk program. The program may help the company become a major issuer in Saudi Arabia’s domestic bond market. (Reuters) Saudi Aramco said to seek LNG traders in Singapore over next year – Saudi Aramco is seeking to hire several people in Singapore over the next 18 months for a range of roles including LNG marketing and trading, according to sources. Aramco Trading has hired Jianyi Zheng from Pavilion for its LNG business; he has joined the company in Singapore in January, sources said. Among the planned hires, Aramco is seeking people with a Chinese background and who have traded in China, sources added. (Bloomberg) SABIC will merge two petrochemical companies to boost efficiency – Saudi Arabian Basic Industries Corporation (SABIC) will merge its wholly-owned affiliates Saudi Petrochemical Company and Arabian Petrochemical Company, it has stated. All assets, rights, liabilities and obligations of Saudi Petrochemical Company (SADAF), will be transferred to Arabian Petrochemical, also known as Petrokemya. SADAF as a company will cease to exist. Part of SABIC’s plan is to increase efficiency and competitiveness. It expects the merger to be completed during the 2H2019; SABIC does not expect to have any material impact on its financial position. The merger is subject to regulatory approvals. (Bloomberg) Moody's: UAE’s growth to increase slightly in 2019, Saudi Arabia and Oman economies to slow – The growth of the UAE is

- 6. Page 6 of 7 only expected to speed up marginally in 2019, according to ratings agency Moody's. It has forecasted a GDP growth of 2.8% this year, up from an estimated 2.6% growth in 2018. Analyst, Thaddeus Best said that headline growth will be "constrained" this year, which is partly due to the production cuts agreed by the 'OPEC-plus' group of producers, although its overall production allocation could be slightly higher than last year. Growth in the non-oil economy is predicted to be slightly more robust at 2.9% this year, up from an estimated 2.4% in 2018. "In terms of non-oil GDP, we are forecasting a modest acceleration," he said. He argued that the main driver for the economy will be the expansionary fiscal policy set, most notably in Abu Dhabi. "But at the same time, I think we see a lot of pressures particularly in some of the key industries," he added. He cited that tourism as one industry facing challenges, with Dubai reporting only marginal growth in 2018 after several years of strong improvement. Dubai's Department of Tourism & Commerce Marketing stated last month that the Emirate has received 15.92mn overnight visitors in 2018, up 0.8% on 2017's figure of 15.8mn. Senior Analyst at Moody's, Alexander Perjessy said that Kuwait is set to run the biggest deficit of around 12% (after investment income and transfers to its future generations fund). Oman is set to run a deficit of 10.9%, and Saudi Arabia a deficit of 5.6%. Both of these nations are also predicted to experience slower growth in 2019, with Moody's forecasting overall GDP growth of 1.8% for Saudi Arabia, down from 2.2% last year (although non-oil growth is set to jump to 3.6%, from 1.6% last year). Overall GDP growth in Oman is set to slow to 1.5%, from 2% last year. (Zawya) UAE’s bank chief warns of need to extend property loans amid real estate sector stress – Lenders in the UAE will need to extend the maturity of property loans, according to the Chairman of the UAE Banks Federation and CEO of Mashreqbank, Abdul Aziz alAl-Ghurair, as the real estate market shows no sign of recovery. Banks are seeing “some stress” in the property industry, he said. They need to “proactively” give clients more time to repay to protect the economy and the banking system, because the environment has softened, he said. While economic growth in the UAE is expected to accelerate to 3.1% this year, softer oil prices and job losses are putting pressure on real-estate. Property prices in Dubai, the region’s trade and tourist hub, have fallen about 22% since the end of 2014, according to data from the Bank of International Settlements. (Gulf-Times.com) UAE on EU tax blacklist because of poor communication – The European Union’s (EU) decision to include the UAE on its blacklist of tax havens was caused by “lack of communication” between the EU and the UAE government, the Head of the UAE Banks Federation, Abdul Aziz alAl-Ghurair said. European UnionU governments updated a blacklist of tax havens this week, adding the UAE and nine other jurisdictions. (Peninsula Qatar) Emirates NBD targets $1bn with perpetual bond sale – Emirates NBD, is planning to raise $1bn through the sale of bonds with a 6.125% yield, a document issued by one of the banks leading the deal showed. The deal, which has received SR3.85bn in orders, will be an Additional Tier 1 perpetual bond not callable for six years. Perpetual bonds are similar to an equity instrument in that they have no maturity. The bank has mandated BNP Paribas, Emirates NBD Capital, First Abu Dhabi Bank (FAB), HSBC, Nomura and Standard Chartered Bank to arrange the issue. (Reuters) Mashreq bank will close 50% of its branches this year as part of digital transformation – Dubai-based lender Mashreq bank will close 50% of its branches this year as part of a digital transformation, its CEO, Abdulaziz Al-Ghurair said. (Reuters) Gulf Capital hires NBK Capital Partners’ Managing Director for private debt business – Gulf Capital has appointed Sharaf F. Sharaf as Managing Director for the private debt business as the alternative asset management firm looks to boost its team after several senior people left last year. Sharaf joins Gulf Capital from NBK Capital Partners, the company stated. Gulf Capital’s CEO, Karim El Solh said that the firm is planning four new investments and four exits this year. Sharaf joins the firm following the departure of Walid Cherif and Fidaa Haddad, who were Co-Heads of the private debt business. Fidaa Haddad left to become head of private debt at NBK Capital Partners. (Bloomberg)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 QSE Index S&P Pan Arab S&P GCC 1.0% (0.0%) (0.1%) 0.4% (0.2%) (0.9%) 0.1% (1.2%) (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,309.20 0.6 0.8 2.1 MSCI World Index 2,095.67 0.6 2.2 11.2 Silver/Ounce 15.45 0.1 0.7 (0.3) DJ Industrial 25,702.89 0.6 1.0 10.2 Crude Oil (Brent)/Barrel (FM Future) 67.55 1.3 2.8 25.6 S&P 500 2,810.92 0.7 2.5 12.1 Crude Oil (WTI)/Barrel (FM Future) 58.26 2.4 3.9 28.3 NASDAQ 100 7,643.41 0.7 3.2 15.2 Natural Gas (Henry Hub)/MMBtu 2.87 1.4 (9.7) (11.7) STOXX 600 375.60 0.7 1.9 9.8 LPG Propane (Arab Gulf)/Ton 69.00 0.4 0.7 7.8 DAX 11,572.41 0.5 1.6 8.3 LPG Butane (Arab Gulf)/Ton 70.25 0.5 0.0 1.1 FTSE 100 7,159.19 1.1 2.3 10.2 Euro 1.13 0.3 0.8 (1.2) CAC 40 5,306.38 0.8 2.0 10.7 Yen 111.17 (0.2) 0.0 1.3 Nikkei 21,290.24 (0.9) 1.1 5.6 GBP 1.33 2.0 2.5 4.6 MSCI EM 1,050.46 (0.1) 2.0 8.8 CHF 1.00 0.4 0.4 (2.2) SHANGHAI SE Composite 3,026.95 (1.1) 2.1 24.5 AUD 0.71 0.2 0.7 0.6 HANG SENG 28,807.45 (0.4) 2.0 11.2 USD Index 96.55 (0.4) (0.8) 0.4 BSE SENSEX 37,752.17 0.6 3.6 4.9 RUB 65.40 (0.3) (1.3) (6.2) Bovespa 98,903.88 0.8 5.0 14.0 BRL 0.26 (0.1) 1.4 1.7 RTS 1,189.14 0.5 0.8 11.3 97.2 91.6 80.9