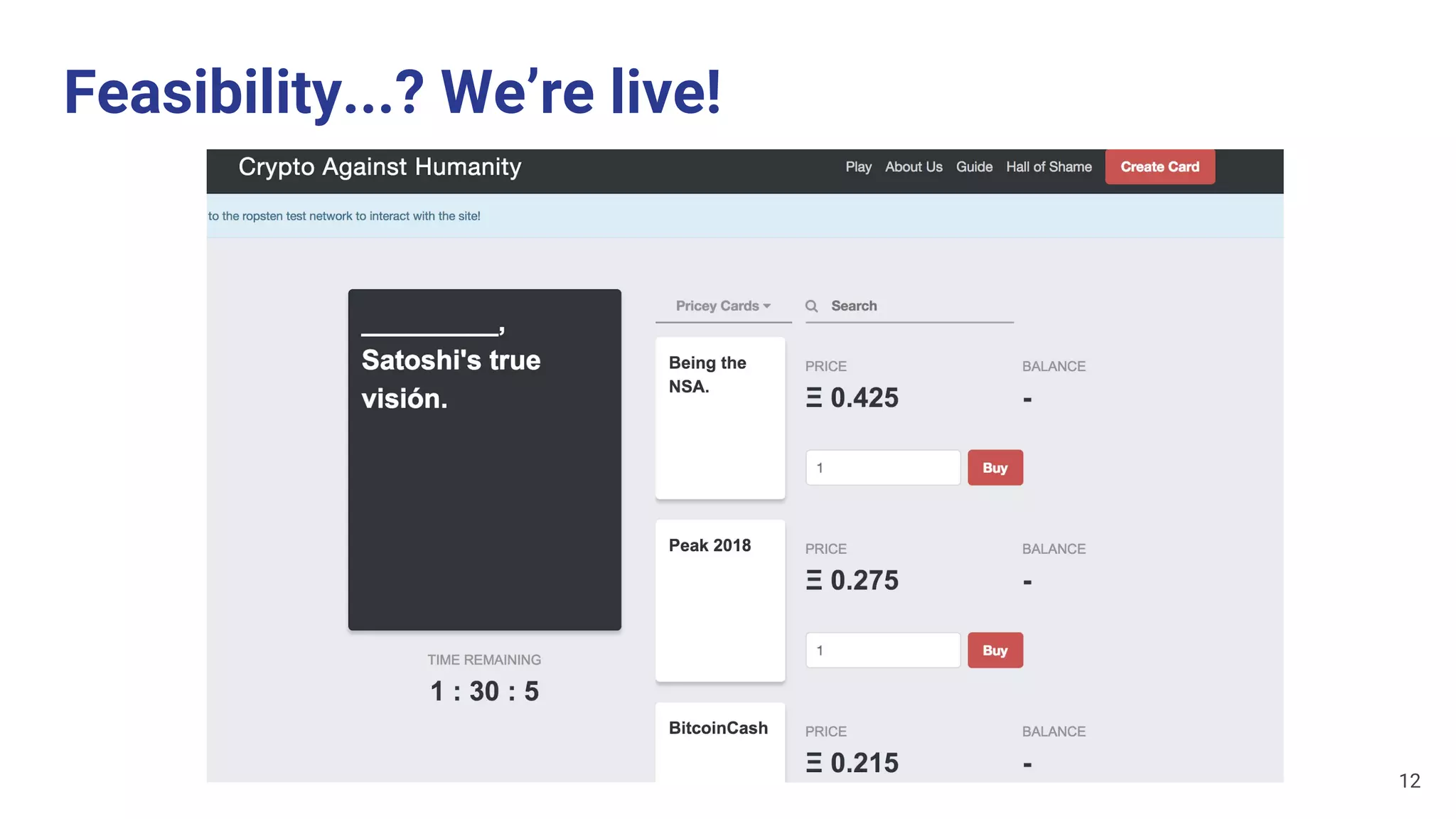

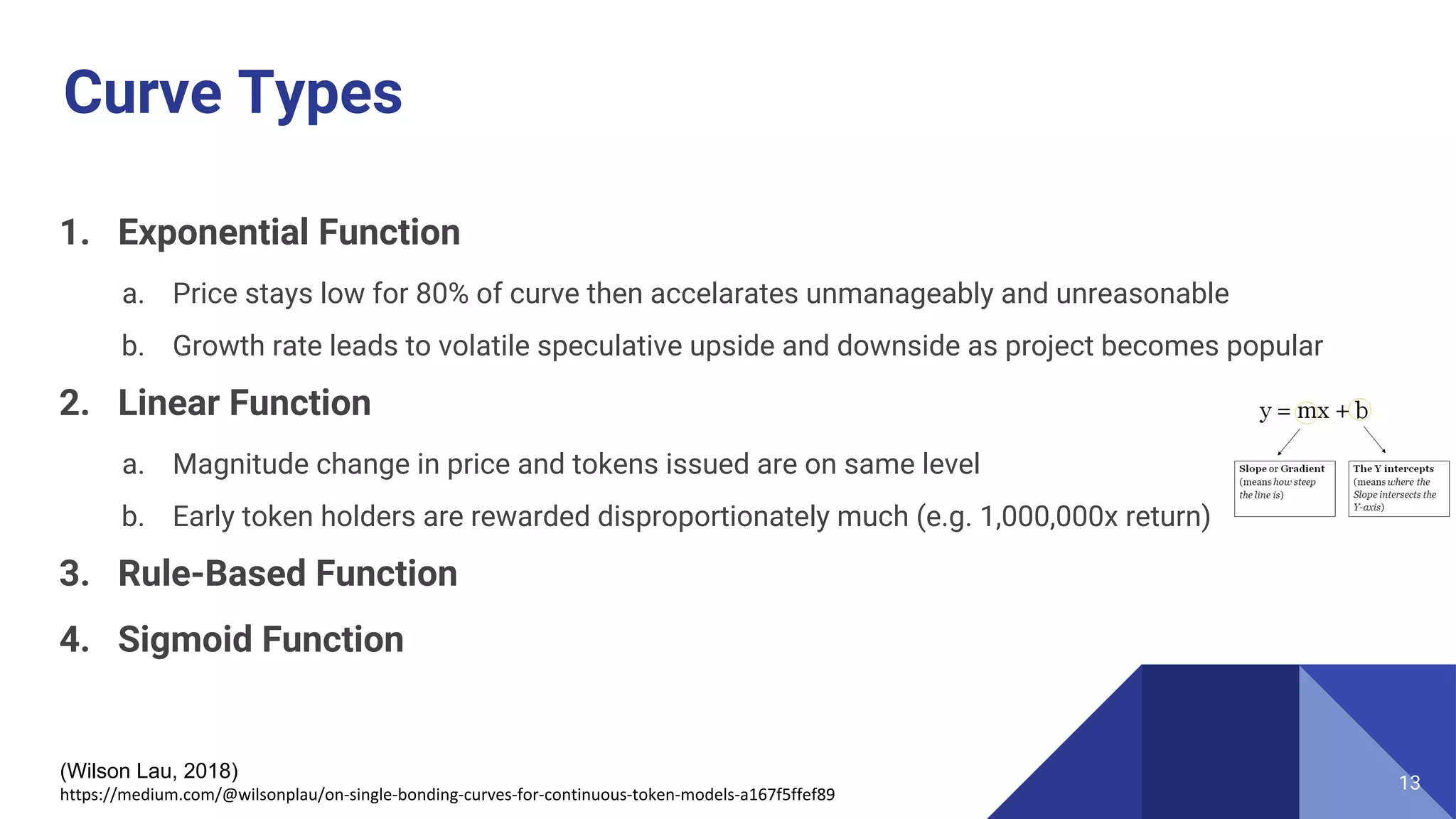

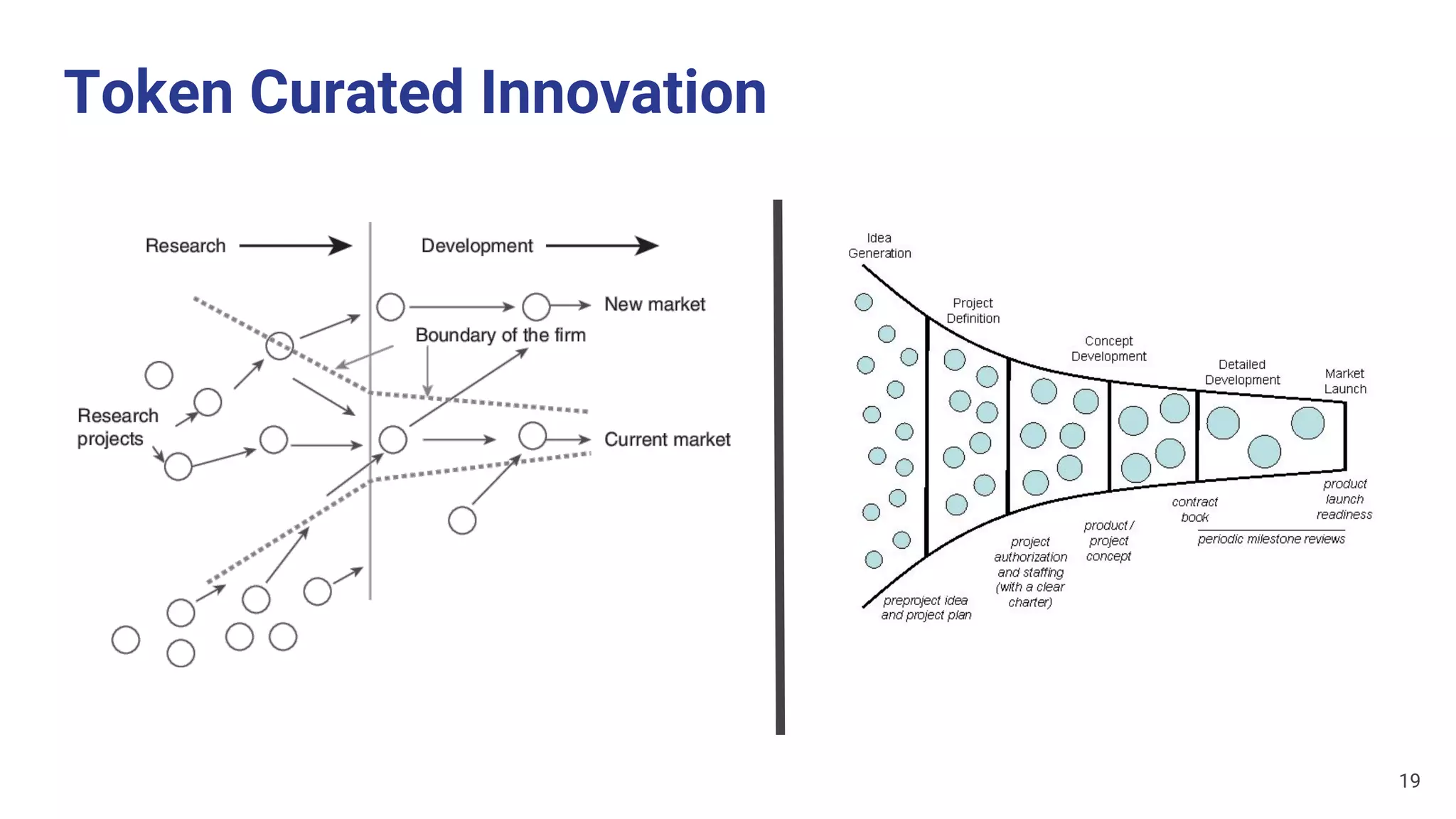

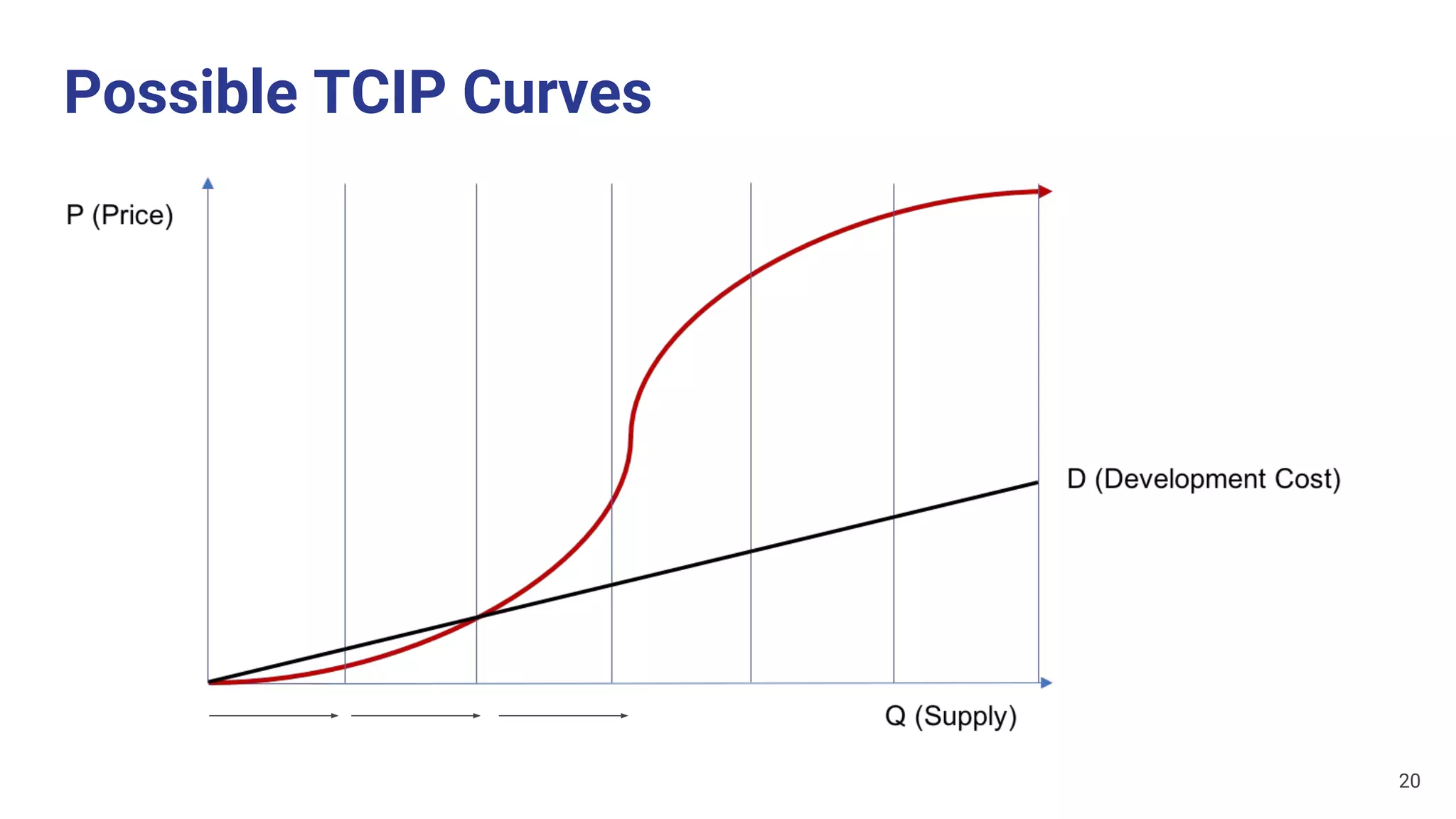

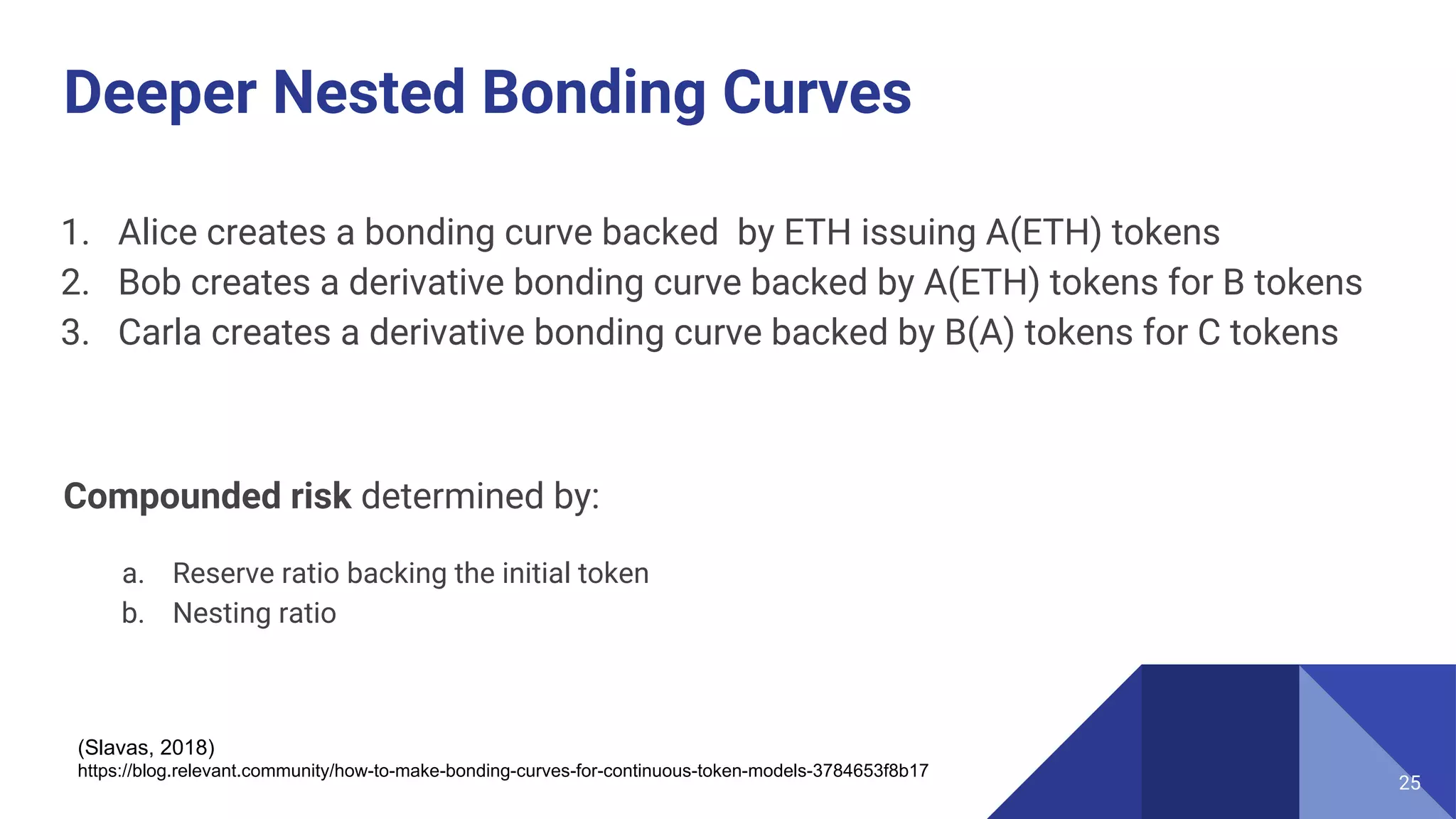

The document presents an overview of continuous token models and bonding curves, and explores their applications in curation markets and intellectual property. It discusses the mechanics of token bonding contracts, different types of bonding curves, and potential benefits like on-chain liquidity and reduced market manipulation. Challenges such as curve governance and the need for skilled talent are also highlighted.