More Related Content

Similar to NSIT Financial Overview Analysis

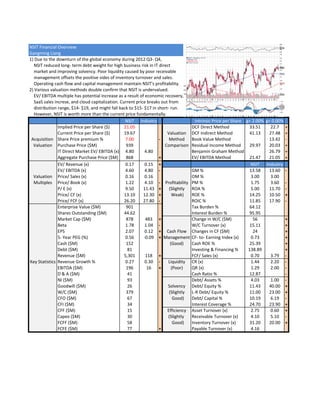

Similar to NSIT Financial Overview Analysis (20)

More from Leon Liang (20)

NSIT Financial Overview Analysis

- 1. NSIT

Financial

Overview

Gangming

Liang

1)

Due

to

the

downturn

of

the

global

economy

during

2012

Q3-‐

Q4,

NSIT

reduced

long-‐

term

debt

weight

for

high

business

risk

in

IT

direct

market

and

improving

solvency.

Poor

liquidity

caused

by

poor

receivable

management

offsets

the

positive

sides

of

inventory

turnover

and

sales.

Operating

cash

flow

and

capital

management

maintain

NSIT's

profitability.

2)

Various

valuation

methods

double

confirm

that

NSIT

is

undervalued.

EV/

EBITDA

multiple

has

potential

increase

as

a

result

of

economic

recovery,

SaaS

sales

increse,

and

cloud

capitalization.

Current

price

breaks

out

from

distribution

range,

$14-‐

$19,

and

might

fall

back

to

$15-‐

$17

in

short-‐

run.

However,

NSIT

is

worth

more

than

the

current

price

fundamentally.

NSIT Industry Intrinsic

Price

per

Share g=

2.00% g=

0.00%

Implied

Price

per

Share

($) 21.05 DCF

Direct

Method 33.51 22.7 +

Current

Price

per

Share

($) 19.67 Valuation DCF

Indirect

Method 41.13 27.48 +

Acquisition

Share

Price

premium

% 7.00 -‐ Method Book

Value

Method 13.42 -‐

Valuation Purchase

Price

($M) 939 Comparison Residual

Income

Method 29.97 20.03 +

IT

Direct

Market

EV/

EBITDA

(x) 4.80 4.80 Benjamin

Graham

Method 26.79 +

Aggregate

Purchase

Price

($M) 868 + EV/

EBITDA

Method 21.47 21.05 +

EV/

Revenue

(x) 0.17 0.15 + NSIT Industry

EV/

EBITDA

(x) 4.60 4.80 -‐ GM

% 13.58 13.60 -‐

Valuation Price/

Sales

(x) 0.16 0.16 OM

% 3.00 3.00

Multiples Price/

Book

(x) 1.22 4.10 -‐ Profitability PM

% 1.75 3.60 -‐

P/

E

(x) 9.50 11.43 + (Slightly ROA

% 5.00 11.70 -‐

Price/

CF

(x) 13.10 12.30 +

Weak) ROE

% 14.25 10.50 +

Price/

FCF

(x) 26.20 27.80 -‐ ROIC

% 11.85 17.90 -‐

Enterprise

Value

($M) 901 Tax

Burden

% 64.12

Shares

Outstanding

($M) 44.62 Interest

Burden

% 95.95

Market

Cap

($M) 878 483 + Change

in

W/C

($M) 56 +

Beta 1.78 1.04 -‐ W/C

Turnover

(x) 15.11 +

EPS 2.07 0.12 + Cash

Flow Changes

in

CF

($M) 24 +

5-‐

Year

PEG

(%)

0.56 -‐0.09 + Management CF-‐

to-‐

Earning

Index

(x) 0.73 +

Cash

($M) 152 (Good) Cash

ROE

% 25.39 +

Debt

($M) 81 Investing

&

Financing

% 138.89 +

Revenue

($M) 5,301 118 + FCF/

Sales

(x) 0.70 3.79 -‐

Key

Statistics Revenue

Growth

% 0.27 0.30 -‐ Liquidity CR

(x) 1.44 2.20 -‐

EBITDA

($M) 196 16 + (Poor) QR

(x) 1.29 2.00 -‐

D

&

A

($M) 41 Cash

Ratio

% 12.87 -‐

NI

($M) 93 Debt/

Assets

% 4.03 1.00 -‐

Goodwill

($M) 26 Solvency Debt/

Equity

% 11.43 40.00 +

W/C

($M) 379 (Slightly L-‐R

Debt/

Equity

% 11.00 23.00 +

CFO

($M) 67

Good) Debt/

Capital

% 10.19 6.19 -‐

CFI

($M) 34 Interest

Coverage

% 24.70 23.90 +

CFF

($M) 15 Efficiency Asset

Turnover

(x) 2.75 0.60 +

Capex

($M) 30 (Slightly

Receivable

Turnover

(x) 4.10 5.10 -‐

FCFF

($M) 58

Good) Inventory

Turnover

(x) 31.20 20.00 +

FCFE

($M) 77 + Payable

Turnover

(x) 4.16