Macc final 2

- 1. 1 MEMORANDUM To: Dr. Sue Gill, Dr. Beau Barnes, Dr. Richard Toolson From: Joseph Lo Date: February 4, 2014 Subject: Master of Accounting Final-Auto Palace Discontinued Operations Relevant Facts: Auto Palace Inc., a calendar year-end SEC registrant, is a leading automotive retail and service chain which operates exclusively in the automotive aftermarket industry. The company has two operating units: Auto Motive Retail Centers, which sells parts and accessories, and Quick Stop Service & Tire Centers, which performs maintenance, repairs, parts installation, and tire sales. Due to the poor performance of the Quick Stops segment, the company has reevaluated this segment. The accelerating deterioration in the financial performance of these stores has convinced the CEO that it is in the best interest of Auto Palace and its shareholders to cease these operations. Auto Palace is currently deciding between two alternatives for the Quick Stops stores: closing the stores and consolidating their activities into the Auto Motive facilities or selling the Quick Stops. Regardless of which option is undertaken, the transaction will be completed by June 30, 2013. If Auto Palace chooses to close the Quick Stop Service Centers (Quick Stops), the 30 facilities will be closed on or before June 30, 2013 (by the end of the second quarter of 2013). It is then expected that the Auto Motive Centers will be ready to take over services currently handled by the Quick Stops. Closing the stores is expected to generate significant cash flow in 2013 and to increase free cash flow in 2013 and beyond. In addition, these actions are expected to yield improvements in operating earnings of approximately $58 million in 2013 and $67 million thereafter. Auto Palace is also considering selling its Quick Stop Centers. The company is currently in negotiations with a private equity company. The terms of which states that Auto Palace will receive approximately $140 million in cash from the sale plus royalty fees equal to 12 percent of future Quick Stop Center revenues for a period of six years. The terms of the royalty agreement do not provide Auto Palace with the ability to be involved in the operations of the Quick Stops. Special Issues: First, determine whether or not the Quick Stops, if closed, should be reported as a discontinued operation in Auto Palace's second quarter financial statements. Second, determine whether Quick Stop Centers, if sold, should be reported as a discontinued operation

- 2. 2 in Auto Palace's second quarter financial statements. Discuss the financial statement impact of reporting the Quick Stop Centers as discontinued operations and management’s likely preference as to whether or not they would be in favor of reporting the operations as discontinued operations or not. Conclusion: The Quick Stop Center segment should not be reported as a discontinued operation in Auto Palace's second quarter financial statements if it is closed. This is due to the fact that the operations and cash flows of the component have not been eliminated from the ongoing operations of the parent entity. On the contrary, if the Quick Stop segment is to be sold, it should be reported as a discontinued operation in Auto Palace's second quarter financial statements. This is because the operations and cash flows of the Quick Stops component have been eliminated and Auto Palace will not have any significant continuing involvement in the component's operations. Support: The Quick Stop Centers can be classified as a component of an entity, which was determined by Auto Palace. FASB ASC 205-20-20 defines "component of an entity" saying: "A component of an entity comprises operations and cash flows that can be clearly distinguished, operationally and for financial reporting purposes, from the rest of the entity. A component of an entity may be a reportable segment or an operating segment, a reporting unit, a subsidiary, or an asset group ." Included in the facts of the case, it is stated that: "For financial reporting purposes, Auto Palace has two operating and reportable segments in accordance with FASB ASC 280, Segment Reporting." Since much of the GAAP relevant to this case uses the phrase "component of an entity", it is important to understand that both Auto Motive Centers and Quick Stops Centers are in fact components of Auto Palace. This is important in order to continue the discussion of whether or not the closing or selling of Quick Stops can be reported as a discontinued operation. There are two major sources of regulations from GAAP that will be used in this discussion. The first is FASB ASC 205-20-45-1, which states: "the results of operations of a component of an entity that either has been disposed of or is classified as held for sale under the requirements of paragraph 360-10-45-9, shall be reported in discontinued operations in accordance with paragraph 205-20-45-3 if both of the following conditions are met: (a)" The operations and cash flows of the component have been (or will be) eliminated from the ongoing operations of the entity as a result of the disposal transaction." (b) "The entity will not have any significant continuing involvement in the operations of the component after the disposal transaction."

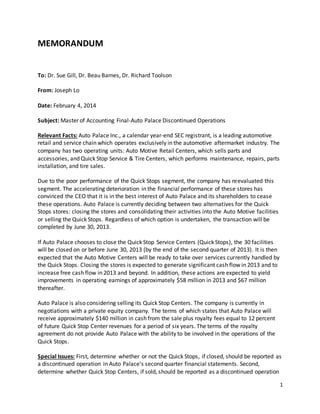

- 3. 3 The second regulation is FASB ASC 205-20-55-3, which is a four step process which may be used to evaluate the two conditions of paragraph 205-20-45-1: Step one: "Are continuing cash flows expected to be generated by the ongoing entity?" Step two: "Do the continuing cash flows result from a migration or continuation of activities?" Step three: "Are the continuing cash flows significant?" Step four: "Does the ongoing entity have significant continuing involvement in the operations of the disposed component?" If the answer to any of steps one, two, or three are "no", then step four must be evaluated. If the requirement in step four is met, classification as a discontinued operation is allowed. If not, then it is not. If steps one through three are all met, then the operation in question should not be reported as a discontinued operation. These steps are depicted in a flow chart that is shown in Exhibit 1 below. Closing the Quick Stop Centers: To recap, the facts of the case state: "If Auto Palace chooses to close the Quick Stop Centers, all of the thirty facilities will be closed by June 30, 2013, and it is expected that the Auto Motive Centers will be fully prepared to take over all of the automotive service and tire business currently handled by the Quick Stops." In order to determine if part (a) of 205-20-45-1 is met, "whether the operations and cash flows of the component have been eliminated", 205-20-55-3 needs to be examined. The first step asks: "are continuing cash flows expected to be generated by the ongoing entity?" The answer to this question can be found in the facts of the case, which states that: " After the closure of the centers, Auto Palace estimates that there will be continuing cash flows from the sale of automotive services and tires by the ongoing Auto Motive Centers of approximately $600 million." In this case the ongoing entity is Auto Palace which has Auto Motive Center as an operating segment. Therefore it can be said that step one of 205-20-55-3 has been met with a "yes". FASB ASC 205-20-55-4 states: "the evaluation of whether the operations and cash flows of a disposed component have been or will be eliminated from the ongoing operations of the entity depends on whether continuing cash flows have been or are expected to be generated and, if so, whether those continuing cash flows are direct or indirect." Since it was shown in step one of 205-20-55-3 that continuing cash flows are expected to be generated, FASB ASC 205-20-55-7 can be used. It states that: "The revenue-producing activities (cash inflows) of the component

- 4. 4 have been continued and therefore are considered direct cash flows if either of the following two conditions is met: (a) "Significant cash inflows are expected to be recognized by the ongoing entity as a result of a migration of revenues from the disposed component after the disposal transaction." (b)" Significant cash inflows are expected to be received by the ongoing entity as a result of the continuation of activities between the ongoing entity and the disposed component after the disposal transaction." This particular section brings the discussion into step two which presents the question of whether the continuing cash flows result from a migration or continuation of activities. 205-20-55-7a asks whether the cash flows to be recognized by the ongoing entity, Auto Palace, are a result of a migration of revenues from the disposed component. The regulation further states in an example: "There is a presumption that if the ongoing entity continues to sell a similar commodity on an active market after the disposal transaction, the revenues or costs would be considered a migration. " The facts from the case states: "because the Auto Motive Centers will be fully prepared to take over all of the automotive service and tire business currently handled by the Quick Stops, Auto Palace anticipates minimal loss of existing customers." This means that the Auto Motive Centers will more than likely continue to sell a similar commodity, tires and automotive services, on the open market to existing customers. Therefore it can be concluded that a migration of activities and revenues has occurred, which means that step two of 205-20-55-3 has been met. Since 205-20-55-7 only requires that one of the two requirements is met for there to be direct cash flows, part (b) can be skipped. Next, step three needs to be addressed, which asks: "are the continuing cash flows significant?" FASB ASC 205-20-55-14 can be used to determine this, which states: "If expected continuing cash inflows or outflows are the result of a migration of revenues or costs to the ongoing entity or a continuation of activities between the disposed component and the ongoing entity, the ongoing entity should consider whether the continuing cash flows will be significant." It was previously shown that the continuing cash flows are a result of a migration of revenues to the ongoing entity. 205-20-55-14 further explains how to evaluate significance by stating: "The evaluation as to whether continuing cash flows would be significant is a matter of judgment and should be based on a comparison between the expected continuing cash flows to be generated by the ongoing entity after the disposal transaction and the cash flows that would have been expected to be generated by the disposed component absent the disposal transaction." The facts from the case can be used in order to make this comparison: "Auto Palace estimates that the Quick Stops would have generated approximately $700 million of sales absent the disposal transaction." Coupled with the information that continuing cash flows

- 5. 5 for the ongoing entity will be approximately $600 million, it can be calculated that approximately 85.7 percent (exhibit 2, pg 9) of Quick Stops revenues will be continued by Auto Motive. In addition, the $600 million revenue stream can be considered significant when compared next to the net sales of Quick Stops for 2011 ($701 million) and 2012 ($689 million). This implies that even if Quick Stops had stayed as a reporting segment, the revenue streams going to Auto Palace would have been approximately the same. Therefore it can be safely said that the continuing cash flows are significant given the numerical figures and GAAP examined. The first three steps of 205-20-55-3 have been met: continuing cash flows are expected to be generated by the ongoing entity, the continuing cash flows result from a migration of activities, and the continuing cash flows are significant. Looking at the chart in Exhibit 1, pg 9, classification of the operating segment as a discontinued operation is not appropriate. Selling the Quick Stop Centers: To recap, the facts of the case state that Auto Palace is: "currently in negotiations with a buyer for the Quick Stop Centers and the majority of the sales terms have been agreed upon. The agreement provides that Auto Palace would receive approximately $140 million in cash from the sale plus royalty fees equal to 12 percent of future Quick Stop Center revenues for a period of six years." The same GAAP regulations can be used for this scenario. The first regulation was FASB ASC 205-20-45-1 and its two conditions: (a) the operations and cash flows have been eliminated (b) the entity will not have any significant involvement in the operations of the component after the disposal transaction. This regulation will also be supplemented with FASB ASC 205-20-55-3 and its four step process that looks at: 1) continuing cash flows 2) migration or continuation of activities 3) significance of cash flows 4) continuing involvement. Using a similar thought process used to evaluate the previous scenario, the four step process of 205-20-55-3 can be examined. Step one asks whether continuing cash flows are expected to be generated by the ongoing entity. The facts of the case state: "from the sale, Auto Palace will

- 6. 6 receive "royalty fees" equal to 12 percent of future Quick Stop Center revenues for a period of six years." Thus, Auto Palace will receive continuing cash flows from the disposed Quick Stop Centers. Now that it has been determined that continuing cash flows will be generated by the ongoing entity, it must be determined if those cash flows will be direct or indirect. This can be done by examining FASB ASC 205-20-55-7, which will lead to an answer for step two. To recap, 205-20- 55-7 states: "the revenue-producing activities of the component have been continued and therefore are considered direct cash flows if significant cash flows are to be received by the ongoing entity as a result of: (a) migration of revenues or (b) continuation of activities." Included in part (a) is guidance which says: "there is a presumption that if the ongoing entity continues to sell a similar commodity on an active market after the disposal transaction, the revenues or costs would be considered a migration." There is no migration of revenues or costs in this case because, by selling the Quick Stop Centers segment, Auto Palace is no longer in the business of selling the automotive and tire services. There is no information from the facts of the case indicating that Auto Palace is keeping any part of those operations after the disposal. For part (b), there will be no continuation of activities between Auto Palace and the Quick Stop Centers segment after the latter is sold. Included in part (b) of 205-20-55-7 is an example that says: "the ongoing entity sold products or services to or purchased products or services from the disposed component before its disposal (recognized as intra-entity sales or cost of sales) and it continues to sell similar products or services to or purchase similar products or services from the disposed component or a related party after the disposal. " Auto Palace did not sell products or services to the Quick Stop Centers prior to the disposal and will not sell similar products or services afterward. In addition, FASB ASC 205-20-55-13 provides examples of continuing cash flows that would likely not be direct, and part (d) provides guidance that is relevant to this analysis: "passive royalty interests in the disposed component's operations." Therefore since neither of the two requirements in 205-20-55-7 has been met, along with guidance provided in 205-20-55-13, the revenue producing cash flows of the component cannot be considered as direct cash flows. The answer to step two is "no". Next, step three asks whether the continuing cash flows are significant. Once again, FASB ASC 205-20-55-14 can be used. 205-20-55-14 states: "If expected continuing cash inflows or outflows are the result of a migration of revenues or costs to the ongoing entity or a continuation of activities between the disposed component and the ongoing entity, the ongoing entity should consider whether the continuing cash flows will be significant." Since it was previously shown that there will not be a migration of revenues or a continuation of activities, there is no need to consider whether the continuing cash flows will be significant.

- 7. 7 Step four asks whether the ongoing entity will have any significant continuing involvement in the operations of the disposed component. The answer is "no". Per the case facts: "The terms of the royalty agreement do not provide Auto Palace with the ability to be involved in the operations of Quick Stop Centers." This means that the continuing involvement that Auto Palace will have with the Quick Stop Centers cannot be considered to be significant continued involvement. Therefore using the diagram in exhibit 1 pg 9, the answer to whether the Quick Stop Centers can be reported as a discontinued operation can be determined. Since step two was answered with a "no", the last question can be looked at: "whether or not there is significant continuing involvement by the ongoing entity." Since the answer to that is also "no", as previously proven, classification of the disposed component as a discontinued operation is appropriate. Management's Motivation: Having a discontinued operations for a company means that it can report separately the disposed component from the core business operations. This allows the company to report separately the gains or losses that come from the disposal of the component as described in FASB ASC 205-20-45-3. It states that: "in the period in which a component of an entity either has been disposed of or is classified as held for sale, the income statement of a business entity for current and prior periods shall report the results of operations of the component, including any gain or loss recognized in discontinued operations." The diagram in exhibit 3, pg 10 below further explains. For the scenario in which Auto Palace closes the Quick Stop Centers, the facts of the case state: "closing the stores...is expected to yield improvements in operating earnings of approximately $58 million in 2013 and approximately $67 million thereafter." This means by disposing the Quick Stop Centers, the overall earnings for the company will not be dragged down by the poor performance of the Quick Stop Centers. In addition, the disposal shows investors that the company is willing to eliminate parts of the business that are not performing well in order to provide sustained growth and performance for the future. For the scenario in which Auto Palace sells the Quick Stop Centers, the company will be able to provide a separate line under discontinued operations in the income statement for it. The company will then be able to record the losses fromthe disposed component of $172 million in 2011 and $88 million in 2012 under discontinued operations. This allows the investors to clearly see the distinction between the profitable and non-profitable components of the business and understand why the company as a whole was not performing as well as it should have been in previous years. In addition, total operating earnings will be higher than it was in 2011 ($107 million ) and 2012 ($120 million) with the removal of the losses from Quick Stops. Income from continuing operations will be higher as a result, which will make the financials look better and show a better financial outlook to outside investors and stakeholders.

- 8. 8 There are two sources from GAAP that further dictate how the reporting of a discontinued operation that has been sold should be done. The first is FASB ASC 205-20-50-1, which states: "The following shall be disclosed in the notes to financial statements that cover the period in which a long-lived asset (disposal group) either has been sold or is classified as held for sale: (a) "A description of the facts and circumstances leading to the expected disposal." (b) "The gain or loss recognized." (c) "If applicable, amounts of revenue and pretax profit or loss reported in discontinued operations." (d) "If applicable, the segment in which the long-lived asset (disposal group) is reported under Topic 280." Since it was previously shown that the sale of the Quick Stop Centers will continue to provide continuing cash flows to Auto Palace, FASB ASC 205-20-50-4 needs to be examined. It states: "The following information shall be disclosed in the notes to financial statements for each discontinued operation that generates continuing cash flows: (a) "The nature of the activities that give rise to continuing cash flows." (b) "The period of time continuing cash flows are expected to be generated." (c) "The principal factors used to conclude that the expected continuing cash flows are not direct cash flows of the disposed component." Auto Palace must disclose what exactly the disposed segment is and the monetary values that arise from the sale. Action(s) to be Taken: : Inform Auto Palace, Inc.'s management that, according to GAAP, if they decide to close the Quick Stop operating segment, it will not be able to report it as a discontinued operation. If they decide to sell the segment, it will be reportable as a discontinued operation.

- 9. 9 Exhibit 1: Exhibit 2 $600 million / $700 million = .857 = 85.7%

- 10. 10 Exhibit 3

- 11. 11 March 1, 2014 John Doe, CEO Auto Palace, Inc. 425 NE Campus St. Pullman, WA 99163 Dear Mr. Doe, It was a pleasure seeing you at the FASB function last month! It seemed like you had a great time, with all that pressure off of your shoulders after your big acquisition of XYZ! If you recall from a couple months back you asked me to help your company determine the appropriate financial reporting of your Quick Stops business under a couple of alternatives you were considering. You wanted to see what you had to do regarding Generally Accepted Accounting Principles (GAAP) if you ended up deciding to sell or shut down Quick Stops. The topic in question here is discontinued operations and whether or not that distinction can be made regarding your decision to close or sell the business in question. What my team and I found is if Auto Palace, Inc. ends up deciding to close Quick Stops, it will not be able to report it as a discontinued operation. The regulation required that the money flows and operations of that business are completely eliminated. As we delved deeper into the Quick Stop business, we found out that its activities, namely the automobile service and tire repairs, will be shifted to the Auto Motive Centers. That means that Auto Palace, Inc. will continue to receive cash flows directly from Quick Stops via the Auto Motive Centers. As a result, it was concluded that the money flows from Quick Stops have not eliminated according to GAAP standards, they are just being shifted to Auto Motive. Your company estimated that revenue from the automotive and tire services by Auto Motive will be approximately $600 million. If the Quick Stop Centers were not closed, its revenues would be approximately $700 million. As a result, the business that was formally called the Quick Stop Centers is not being eliminated, it is merely being combined into the Auto Motive business, with revenues shifting over. Conversely, if your company ends up deciding to sell Quick Stops, you will be able to report it as being eliminated from your overall business. We have concluded that the revenues and money flows from the Quick Stop Centers to Auto Palace will be eliminated. Even though your company will receive royalty fees, they will not constitute money flows that are part of your company's core business. In addition, your company will not have any significant involvement in the Quick Stop Centers after the sale because of the agreement that was made between Auto Palace and Giant Private Equity Company. As a result of our analysis, we have concluded that by selling the Quick Stop Centers, your company will be able to report that it as a discontinued operation, meaning that it has been eliminated from your business.

- 12. 12 This is a good result for your company with regard to what the financial statements will look like. The losses that came about from the Quick Stop Centers will no longer be a part of your core business. Investors will see that your company took the proactive approach in preventing any future losses that will surely occur in an underperforming business segment. I hope our analysis and conclusion has made a complicated topic easier to comprehend. Please contact my office if you have any questions regarding how to proceed or if you would like to discuss our engagement further. Best, Joseph Lo Audit Manager XYZ Firm, LLC.