Carbon TAX

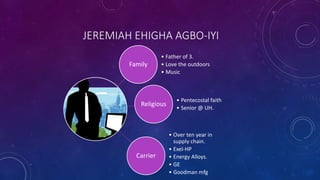

- 1. JEREMIAH EHIGHA AGBO-IYI Family • Father of 3. • Love the outdoors • Music Religious • Pentecostal faith • Senior @ UH. Carrier • Over ten year in supply chain. • Exel-HP • Energy Alloys. • GE • Goodman mfg

- 2. CARBON TAX 1. WHAT IS CARBON. 2. WHAT IS CARBON TAX 3. CAP AND TRADE 4. EFFECT OF CARBON IN THE ATMOSPHERE 5. THE RELATIONSHIP BETWEEN CARBON TAX AND TRANSPORTATION 6. HOW TO REDUCE CARBON

- 3. WHAT IS CARBON Carbon monoxide (CO) is a colorless, odorless gas emitted from combustion processes. Nationally and, particularly in urban areas, the majority of CO emissions to ambient air come from automobile sources. CO2 is the fourth most abundant gas in the earth’s atmosphere. CO2 is a byproduct of normal cell function. It is removed from the body via the lungs in the exhaled air. CO2 is also produced when fossil fuels are burned. Decaying vegetation can also produce CO2. Surface soils can sometimes contain high concentrations of this gas, from decaying vegetation or chemical changes in the bedrock. Carbon is causing damage to the atmosphere by causing and increasing global warming.

- 4. WHAT IS CARBON TAX • The problem with global warming is the way we live. However, we are not likely to change our behavior and inconvenience ourselves unless we are either punished or rewarded. • A carbon tax is a tax on the carbon content of fossil fuels such as coal, natural gas, and oil. The tax is imposed in order to encourage people and firms to use less of these fuels, which contribute to greenhouse gases in the atmosphere • Carbon tax is an economic instrument aimed either to make environmentally damaging behavior cost more or to make environmentally sound behavior more profitable. Polluters are not told what to do; rather, they find it expensive to continue in their old ways. They have a financial incentive to reduce emissions. • A carbon tax increases the price of CO2–emitting energy sources, making investments in cleaner, alternative energy generation a more competitive and financially attractive way of generating power.

- 5. CAP AND TRADE Cap and trade is the most environmentally and economically sensible approach to controlling greenhouse gas emissions, the primary driver of global warming. • Carbon trading, sometimes called emissions trading, is a market-based tool to limit GHG. The carbon market trades emissions under cap-and-trade schemes or with credits that pay for or offset GHG reductions. • The scheme's governing body begins by setting a cap on allowable emissions. It then distributes or auctions off emissions allowances that total the cap. Member firms that do not have enough allowances to cover their emissions must either make reductions or buy another firm's spare credits. Members with extra allowances can sell them or bank them for future use. Cap-and-trade schemes can be either mandatory or voluntary.

- 6. EFFECT OF CARBON IN THE ATMOSPHERE Scientists are confident that many of the observed changes in the climate can be linked to the increase in greenhouse gases in the atmosphere, caused largely by people burning fossil fuels to generate electricity, heat and cool buildings, and vehicles. Causing the Earth's climate to change. Temperatures are rising, snow and rainfall patterns are shifting, and more extreme climate events—like heavy rainstorms and record high and low temperatures. CO can cause harmful health effects by reducing oxygen delivery to the body's organs (like the heart and brain) and tissues. At extremely high levels, CO can cause death.

- 7. THE EFFECT OF CARBON TAX ON TRANSPORTATION. Greater government assistance and tax reform is required to assist transportation business in dealing with the carbon tax and implementing cleaner technology. So many policies are put in place that are aimed at fuel conservation. The government made it possible for business to access incentives to retire their older vehicles, encouraging the choice of cleaner transportation. Public transport is generally considered the most efficient way to move people in dense urban areas. Such as buses and light trains Introduction of Park and ride. The subsidiaries for the introduction and manufacturing of electric cars. Most transportation businesses in the industry are committed to implementing cleaner technologies this will require additional expenditure and commitments to research and development. Research has proved that the excise (fuel tax) on aviation will rise and nearly double over the transition period and this will have an impact on margins.

- 8. HOW TO REDUCE CARBON Planting of trees. Regulations are codified annually in the U.S. Code of Federal Regulations (CFR). Title 40: Protection of Environment is the section of the CFR that deals with EPA's mission of protecting human health and the environment. Fuel Switching. Improving Fuel Efficiency with Advanced Design, Materials, and Technologies. Improving Operating Practices. Reducing Travel Demand.