HDFC Bank Q3 net increases 30%, on higher loan growth

- 1.

powered by bluebytes

Saturday , January 19, 2013

HDFC Bank Q3 net increases 30%, on higher loan growth

Publication: Financial Chronicle , Journalist:Manju AB

Edition:Delhi/Hyderabad/Mumbai/Bangalore , Page No: 14, Location: TopRight , Size(sq.cms): 1250

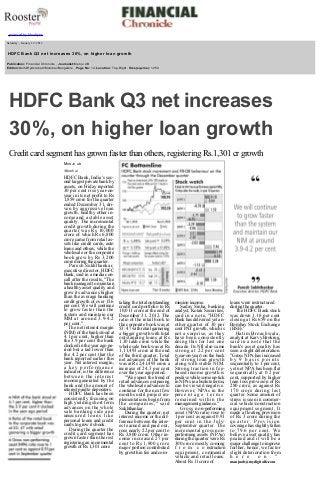

HDFC Bank Q3 net increases

30%, on higher loan growth

Credit card segment has grown faster than others, registering Rs.1,301 cr growth

MANJU AB

Mumbai

HDFC Bank, India's sec

ond largest private bank by

assets, on Friday reported

30 per cent rise yearon

year in its net profit to Rs

1,859 crore for the quarter

ended December 31, dri

ven by aggressive loan

growth, healthy other in

come and a stable asset

quality. The incremental

credit growth during the

quarter was Rs 10,000

crore of which Rs 6,800

crore came from retail as

sets like credit cards, auto

loans and others, while the

wholesale or the corporate

book grew by Rs 3,200

crore during the quarter.

Paresh Sukhthankar,

executive director, HDFC

Bank, said in a media con

call after the results, "The

bank managed to maintain

a healthy asset quality and

grew its advances higher

than the average banking

credit growth of over 15.6

per cent. We will continue

to grow faster than the

system and maintain our

M M a t a r o u n d 3 . 94.2

per cent."

The net interest margin

(NIM) of the bank stood at

4.1 per cent, higher than

the 3.9 per cent the bank

clocked in the year ago pe

riod but a tad lower than

the 4.2 per cent that the

bank reported earlier this

year. Net interest margin,

a key performance

indicator, is the difference

between the interest

income generated by the

bank and the amount of

interest paid to depositors.

HDFC Bank has been

consistently focusing on

high yielding short term

advances on the whole

sale banking side and

unsec u r e d l o a n s l i k e

personal loans and credit

cards to grow its book.

During the quarter the

credit card segment has

grown faster than the rest

registering an incremental

growth of Rs 1,301 crore

taking the total outstanding

credit card portfolio to Rs

10,011 crore at the end of

December 31, 2012. The

ratio of the retail book to

the corporate book was at

53: 47 with retail garnering

a bigger growth with total

outstanding loans at Rs

1.30 lakh crore while the

whole sale book was at Rs

1,11,493 crore at the end

of the third quarter. Total

net advances of the bank

was at Rs 2,41,493 crore a

increase of 24.3 per cent

over the year ago period.

"We expect the trend of

retail advances outpacing

the wholesale advances to

continue for the next few

months until project im

plementations begin from

the companies," said

Sukhthankar.

During the quarter, net

interest income or the dif

ference between the inter

est earned and paid out,

rose nearly 22 per cent to

Rs 3,800 crore. Other in

come increased 27 per

cent to Rs 1,800 crore

major portion contributed

by growth in fee and com

mission income.

Saday Sinha, banking

analyst, Kotak Securities,

said in a note, "HDFC

Bank has delivered yet an

other quarter of 30 per

cent PAT growth, which is

not a surprise, as they

have been consistently

doing this for last one

decade. Its NIl also came

strong at 22 per cent

(yearonyear) on the back

of strong loan growth

along with stable NIM.

Strong traction in fee

based income growth is

positive while some uptick

in NPAs in absolute terms,

can be viewed negative.

However, NPAs in the

perc e n t a g e t e r m s

remained within the

management guidance."

Gross nonperforming

asset (NPA) ratio rose to

1 per cent as against 0.91

p e r c e n t i n t h e J u l y

September quarter. The

incremental gross non

performing assets (NPAs)

during the quarter were Rs

300 crore mostly coming

f r o m c o nstruction

equipment, commercial

vehicle and retail loans.

About Rs 11 crore of

loans were restructured

during the quarter.

The HDFC Bank stock

was down 1.18 per cent

closing at Rs 659 on the

Bombay Stock Exchange

(BSE).'

Hatim Broachwala,

analyst at Karvy Broking,

said in a note that the

bank's asset quality has

seen a slight deterioration.

"Gross NPA has increased

by 9 basis points

sequentially to 1 per cent,

yet net NPA has been flat

sequentially at 0.2 per

cent, supported by higher

loan loss provision of Rs

280 crore, as against Rs

170 crore during last

quarter. Some amount of

stress is seen in commer

cial vehicle/construction

equipment segment. It

made a floating provision

of Rs 3 crore during the

quarter. Provision

coverage has slightly fallen

to 79.6 per cent. We

believe asset quality has

peaked and it will be a

major challenge to improve

further, hence, we factor

slight deterioration from

h e r e o n . "

manjuab@mydigitalfc.com