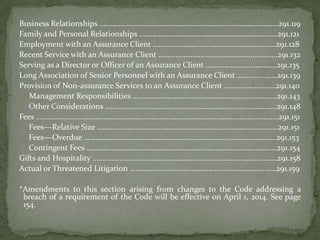

This document contains sections from the Handbook of the Code of Ethics for Professional Accountants discussing independence requirements for assurance engagements. It addresses various threats to independence, including financial and business interests, employment relationships, provision of non-assurance services, fees, gifts and hospitality, and actual or threatened litigation. Requirements are presented regarding network firms, related entities, documentation, restrictions on use of assurance reports, and evaluating independence over time.