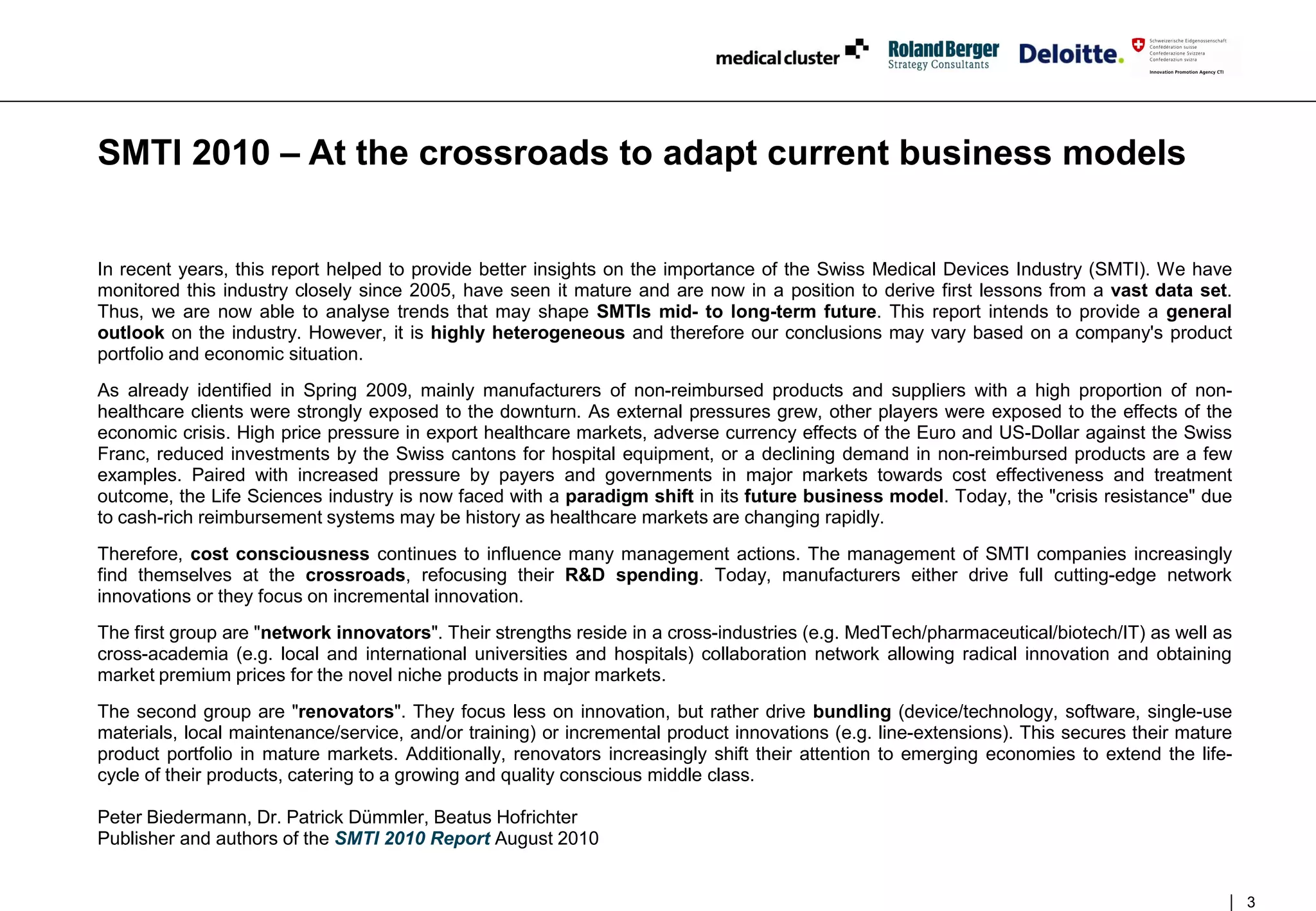

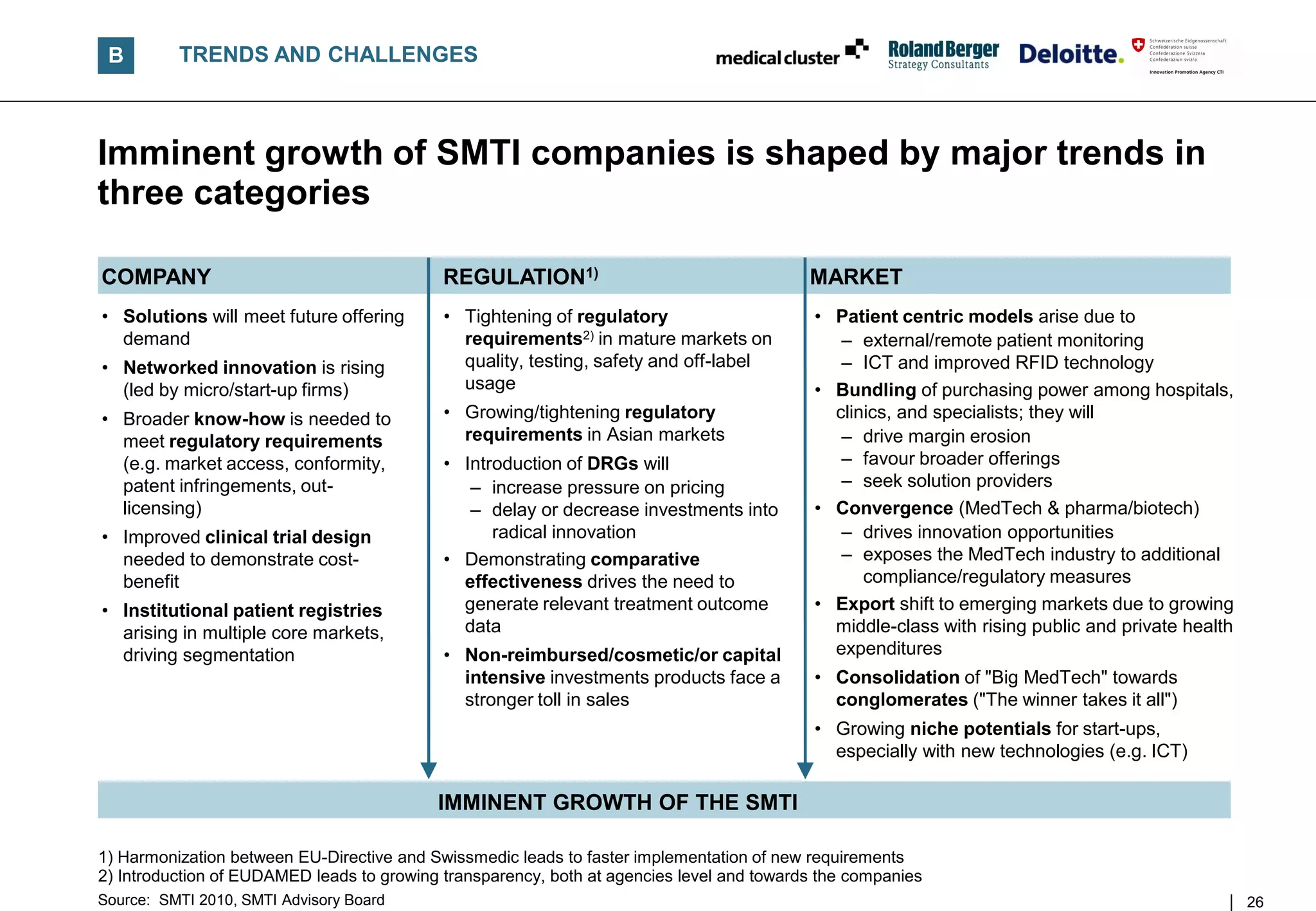

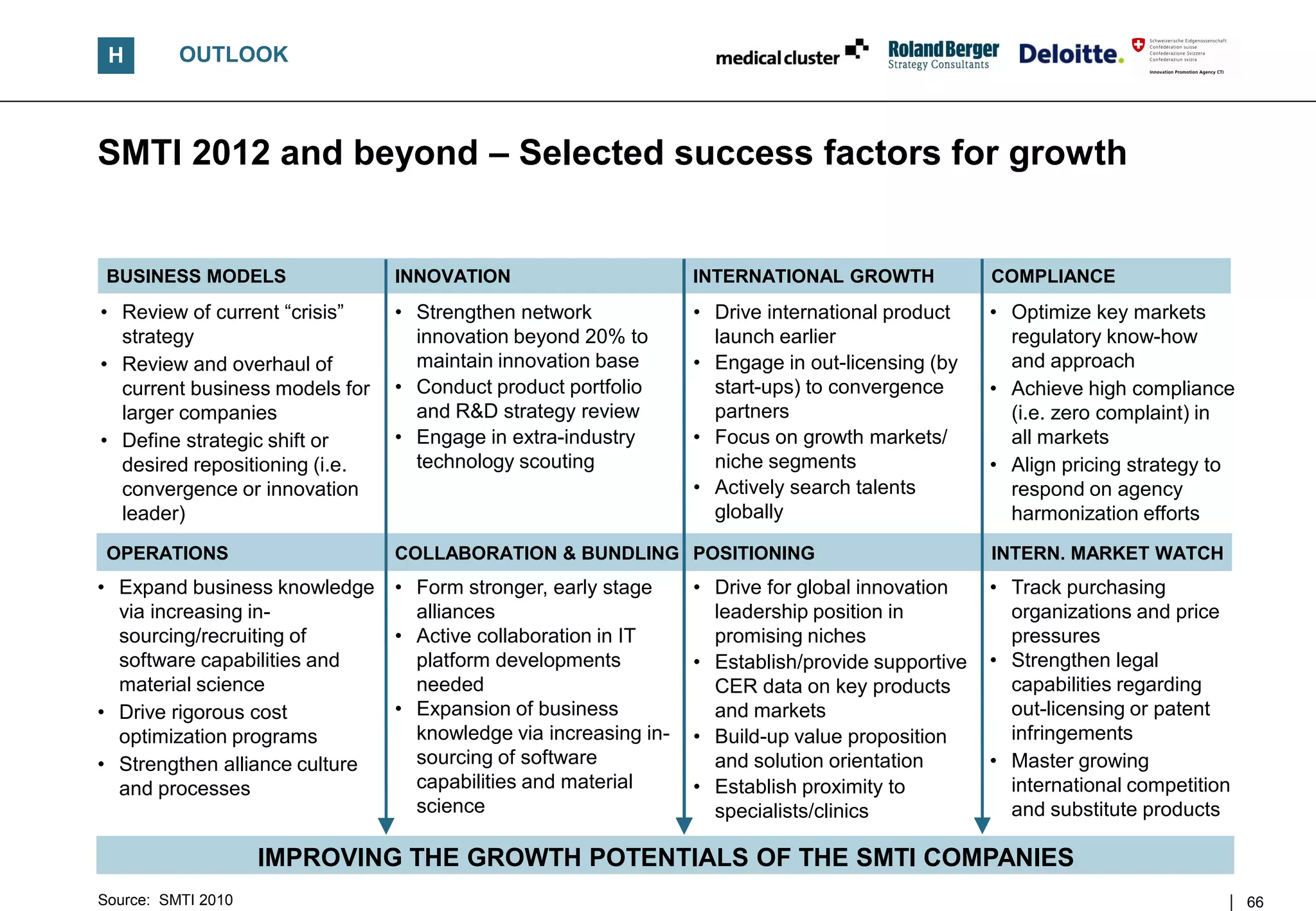

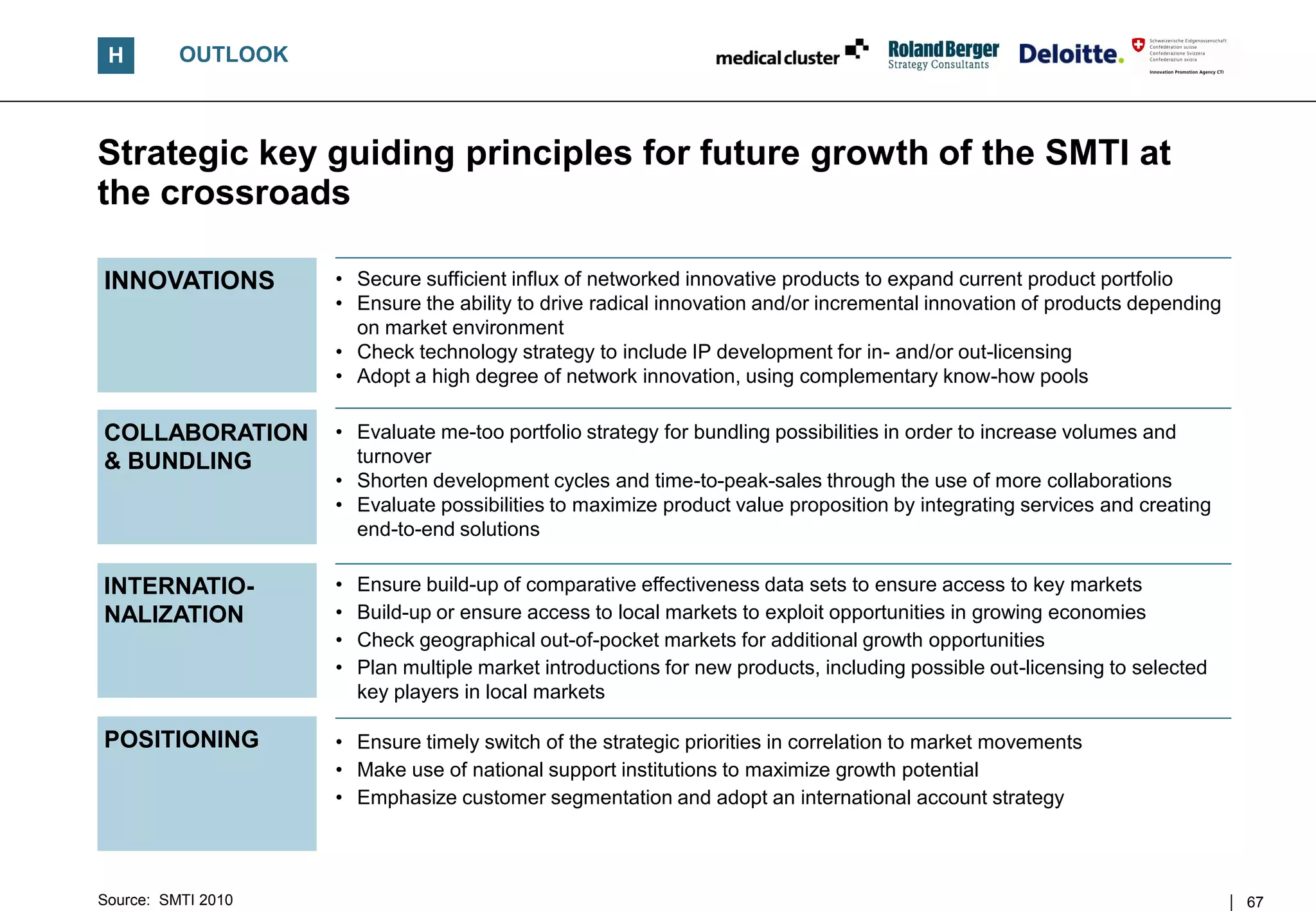

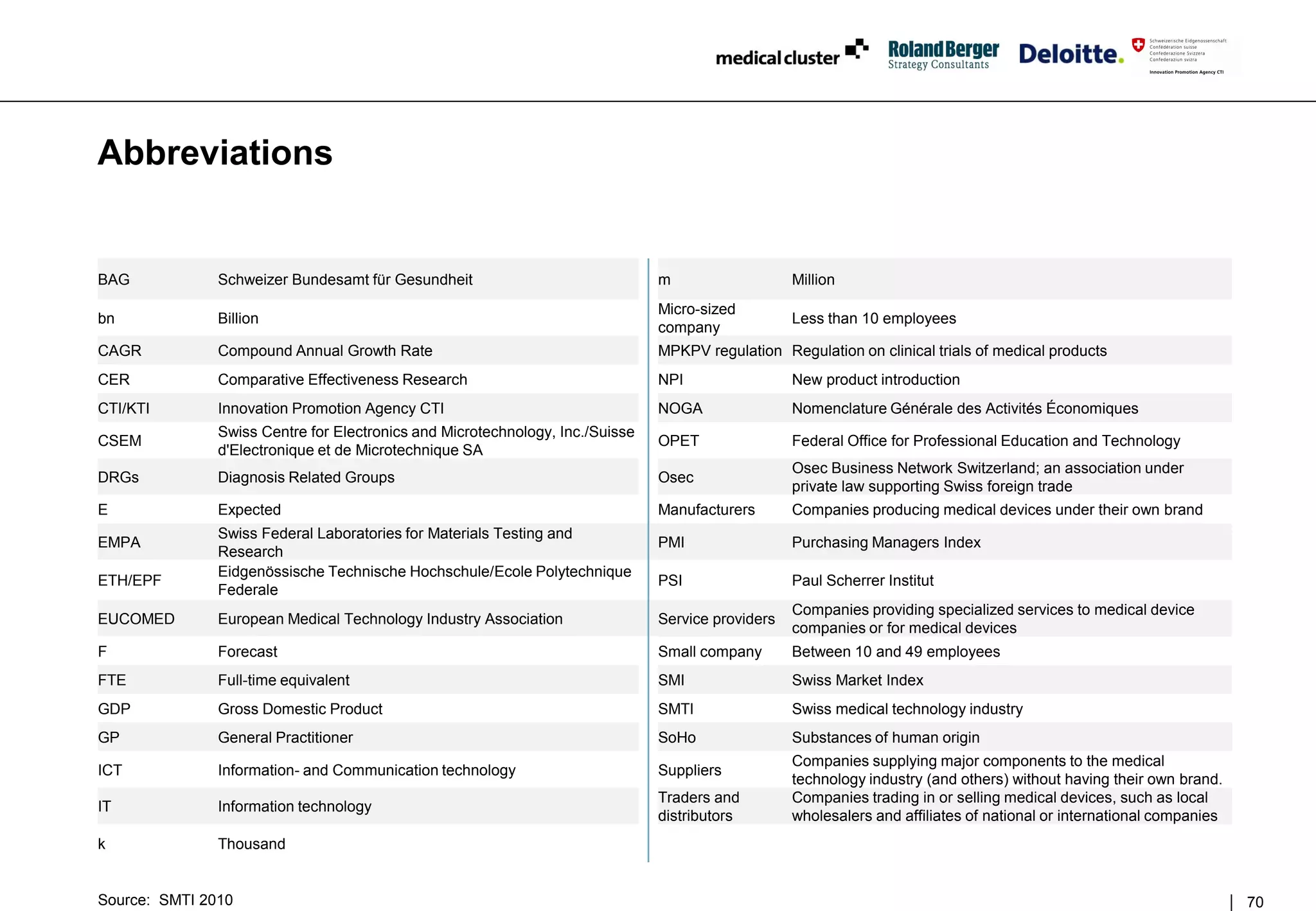

The 2010 SWISS Medical Technology Industry report highlights the maturation of the medtech sector, indicating a shift from a focus on non-reimbursed products to innovation and strategic collaboration. It emphasizes the need for companies to adapt their business models and engage in research and development to sustain growth amidst increasing global competition and market pressure. The overall outlook suggests continued growth potential, particularly through emerging markets and innovative product offerings.

![A STATE OF THE MEDTECH INDUSTRY

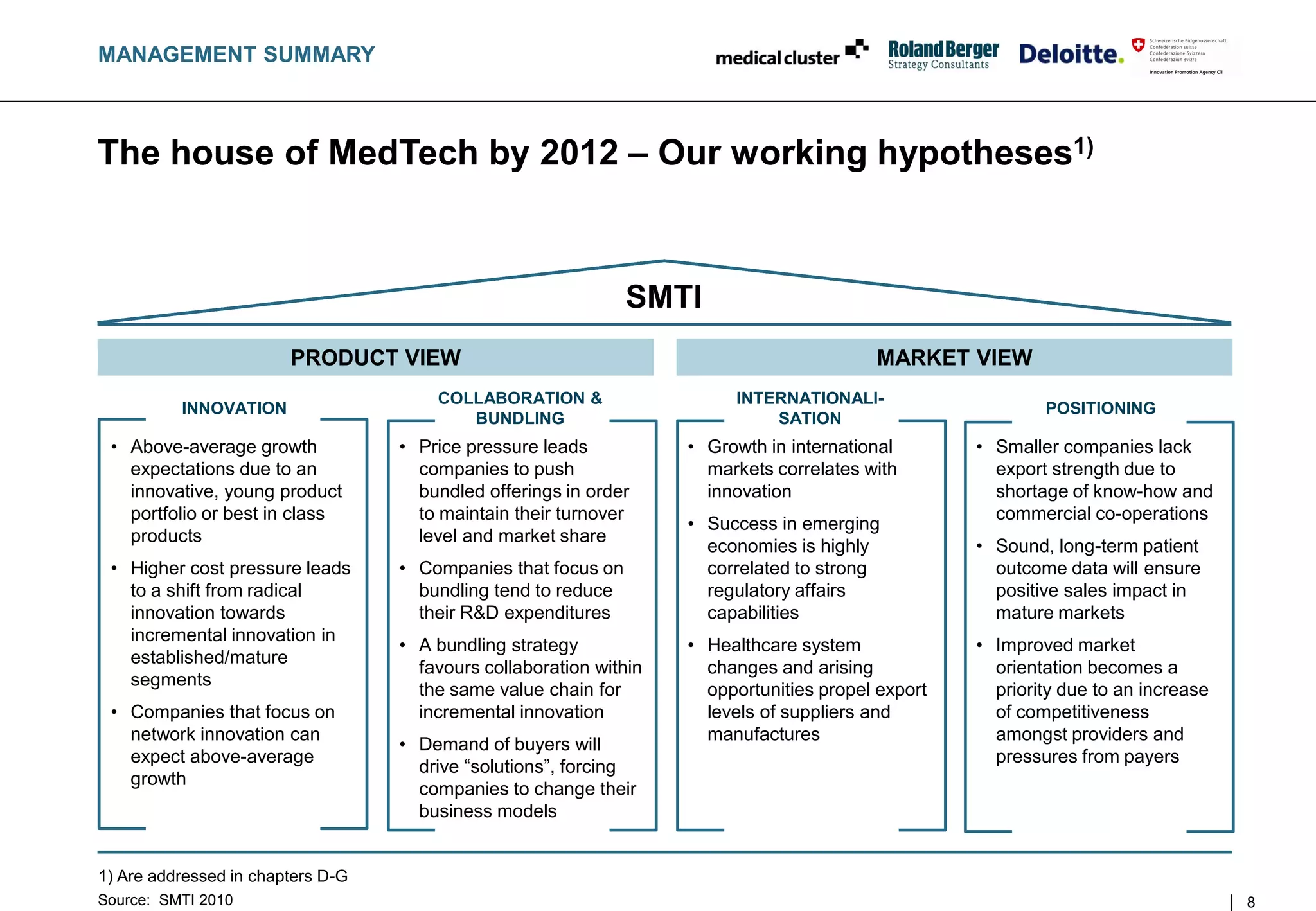

Switzerland is among the global hotspots for MedTech

INTERNATIONAL MEDTECH FOCUS [% of respective total]1) COMMENTS

1,1 Switzerland • Switzerland possesses an active medical

0,3 Germany technology industry that can rely on a strong

Employment 0,2 UK network of related companies and institutions

EU that create an ideal breeding ground for the

0,2

USA industry (cluster)

0,2

• Compared to other countries the relative

1,9 domestic share of the SMTI is significantly higher

0,7 • Remarkable – and in line with several other

GDP 0,6 Swiss industries – is the high relative share of

0,5 exports reflecting the international strength of

0,5 Swiss MedTech products

5,0

1,4

Exports 1,7

n.a.

2,8

1) Data from 2008 or, where not available, from 2007

Source: SMTI 2010, Destatis, Eucomed, Eurostat, UK National Statistics 10](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-10-2048.jpg)

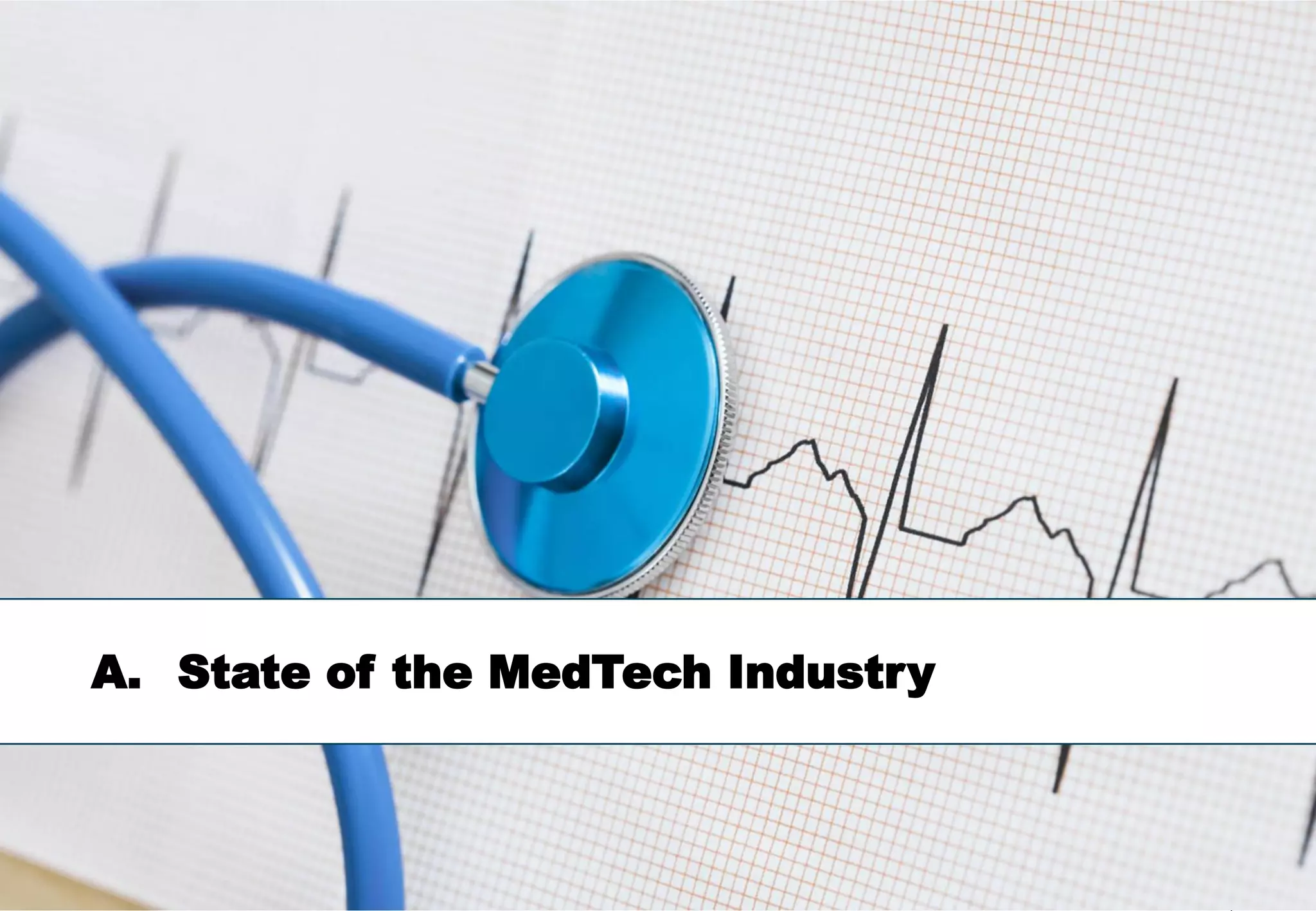

![A STATE OF THE MEDTECH INDUSTRY

Switzerland is highly attractive for international companies –

Top 10 companies employ around ¼ of SMTI employees1)

1 Year sales R&D Sales/

Head- Employees in Sales R&D/sales

No. Company Sub-section of market growth expenses employee

quarters Switzerland [CHFm] [%] 3)

[%] [CHFm] [CHFk]

1 Synthes Orthopedics USA 2'900 3'523 6 175 5 329

Roche

2 In-vitro diagnostics CH 1'750 10'055 4 987 10 387

Diagnostics

J&J

3 2) Orthopedics USA 1'400 24'492 2 1'830 7 556

Medical

4 Zimmer Orthopedics USA 1'150 4'250 -1 213 5 518

5 Sonova Hearing systems CH 1'030 1'500 20 87 6 221

6 Ypsomed Injection systems CH 1'000 254 -8 32 12 212

Active and passive implants,

7 Medtronic USA 900 15'151 8 1'406 9 399

vascular diseases and diabetes

8 B. Braun Orthopedics, hospital aids DE 840 5'992 6 207 3 152

9 Straumann Dental implants CH 800 736 5 39 5 339

10 Stryker Orthopedics USA 600 6'977 0 349 5 375

∑ 12'020 Ø 4 Ø 7

1) Approximately, manufacturers only, figures for reporting year 2009/10, exchange rates: USD/CHF: 1.03, EUR/CHF: 1.49 on 31.12.2009

1) J&J Medical: Numbers are the total for orthopaedics, surgery, cardiology and diagnostics

Source: SMTI 2010, Annual reports, Companies press offices, Factiva, Oanda 11](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-11-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

The SMTI has a strong home market – Investments in high-class

medical infrastructure meets patients demands

SWISS HEALTHCARE EXPENDITURES [CHF bn per year] COMMENTS

• Continuous investments in up-to-date medical

infrastructure leads to rising healthcare

expenditures – during the last ten years by

CAGR 63,3 nearly 50%

4,0% 61,0

58,1 • The CAGR of healthcare expenditures of

55,2

52,8 4.0% is significantly higher than the

51,0 52,0

47,4

49,3 respective GDP growth of 1.1%

45,6

42,8 FURTHER OBSERVATIONS

• Today Switzerland has the third highest GDP

share of healthcare expenditures (10.6%)

after the USA (16% in 2007) and France

(11% in 2007)

• To constrain rising national healthcare costs,

policies will increasingly focus on cost-

benefit comparison of treatments

• The SMTI companies will have to monitor

upcoming policy changes and be ready to

2000 2001 2002 2003 2004 2005 2006 2007 2008E1) 2009E 2010F1)

adapt the business model accordingly

1) E = Expected 2) F = Forecast

Source: SMTI 2010, BAG, BfS, Healthcare Monitor 2009, KOF 13](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-13-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

SMTI manufacturers are evenly segmented across the different

industry categories

MANUFACTURERS BY CATEGORY [%, 2010] COMMENTS

• The manufacturing base of SMTI is

segmented into 16 categories, ranging from a

Hospital share of 16% for hospital hardware to 1% for

Others1)

hardware

biological products

16%

19% • SMTI manufacturers exhibit a broad

technological knowledge base and

Reusable Dental diversification

instruments technology – Bulk risks are reduced

5%

14%

– Benefits interdisciplinary R&D

Radiotherapy

5% collaborations

devices

– Strengthens network innovation

Disposable 6%

items 11%

Inactive

FURTHER OBSERVATIONS

Technical aids 7%

implants

for disabled 8% 8% • There exists a high degree of collaboration

In-vitro Electro- amongst suppliers, manufacturers, and

diagnostics mechanical academia to

– broaden the offering scope

n = 320 – obtain key skills and know-how

1) Others include, in descending order: lab equipment, ophthalmology, patient aids, anaesthetic and respiratory technology,

active implants and biological products

Source: SMTI 2010 15](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-15-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Suppliers and service providers support the MedTech industry with

essential know-how within augmentable value chain processes

SUPPLIERS BY CATEGORY [%, 2010] SERVICE PROVIDERS BY CATEGORY [%, 2010]

Components,

Others1) Financing HR

systems

Auxiliary material, 11% 5%

Analytics IT

green ware 1%

5% 25%

18% 30%

Electronics 7%

Surface

8%

treatment

19% 20%

Machines, auto- 11% Metal Engineering,

mated devices processing planning, 26%

13% Management

design

Plastics consulting

processing

n = 410 n = 410

• The SMTI supplier base is broadly specialized, • IT and management consulting are the most

although components, systems and material prominent categories among service providers

processing contribute to more than 55% • Support SMTI with growth capabilities

1) Others (in descending order) include: medical packaging, measuring, ceramics and sterilization

Source: SMTI 2010 16](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-16-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Manufacturers and traders/distributors are highly focused on

medical devices sales

SHARE OF TURNOVER [%, 2009] COMMENTS

• Many SMTI companies are not exclusively

100 100 100 100 focused on medical technology – the share

15

of sales to other industries and consumers is

19

Turnover from

39%

47

other products 56 • Traders and distributors as well as suppliers

and services Ø 61 show an increased focus on MedTech

compared to 2007

81 85

• Suppliers are more diversified in their

Turnover from 53

44 customer portfolio

medical devices

FURTHER OBSERVATIONS

Suppliers Manu- Traders Service

facturers and providers • A high focus on medical devices is needed in

distributors order to meet the industry specific traits

Turnover and sales requirements

from medical • On the whole, SMTI remains unchanged

39% 84% 80% 59% Ø 65

devices in since 2007, indicating that consolidation has

2007 not been triggered yet by the financial crisis

• For many suppliers from other industries,

2009 n = 212 2007 n = 122 MedTech became highly attractive

Source: SMTI 2010 17](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-17-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Manufacturers form the backbone of the industry –

Average turnover per company is CHF 68 million

AVERAGE COMPANY TURNOVER1) [CHF m, 2009] COMMENTS

• The SMTI has a manufacturer centric market

model

68

• Turnover with medical devices is driven by

– Offering/portfolio strategy, i.e. niche vs. big

player

– Company size

– Upfront investments, i.e. machinery, IP

– Position within the value chain

– Competitive landscape, i.e. number of

competitors within/adjacent to the industry

22 FURTHER OBSERVATIONS

• Future sustainable turnover is mainly

11

determined by the following influencers

3 – Overcome critical mass

– Achieve higher expertise to maintain

Suppliers Manu- Traders and Service compliance

facturers distributors providers – Anticipate power shift towards payers

– Meet changes in sourcing strategies of

n = 171 payers

1) Only with medical devices or components for medical devices

Source: SMTI 2010 18](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-18-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Manufacturers and suppliers provide the highest employment,

accounting for 92% of the total SMTI workforce

DISTRIBUTION OF EMPLOYEES [%, 2009] COMMENTS

• The surveyed companies employ around

27% of the total SMTI sector workforce

56%

• Traders, distributors and service providers

account for 8% of the surveyed workforce

• Across all SMTI firms approximately an

average of 59 people are employed

36% – 126 by manufacturers

– 55 by suppliers

– 25 by traders and distributors

– 7 by service providers

• However, a significant bandwidth has to be

taken into account; of all surveyed companies

– 94% employ less than 250 employees

5% – 75% employ less than 50 employees

3%

– 42% employ less than 10 employees

Suppliers Manu- Traders and Service

facturers distributors providers

n = 199

Source: SMTI 2010 19](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-19-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Average turnover was influenced by high staff levels – This led to

an underperformance of turnover per capita for manufacturers

AVERAGE TURNOVER PER EMPLOYEE AVERAGE GROWTH IN NUMBER OF EMPLOYEES

[CHF k] [% change vs. previous two years]

2008/2009 Ø = +10% 2006/2007 Ø = +20%

244 11

Suppliers

246 7

530 30

Manufacturers

465 5

Traders and 683 15

distributors 818 12

301 2007 n = 185 18 2007 n = 186

Service providers

287 2009 n = 163 21 2009 n = 164

• Traders/distributors experienced growth in turnover per capita, the others remained stable or declined vs. 2007

• The build-up of employees in 2006/2007 led to an overcapacity in 2008/2009, SMTI companies responded by

adapting their recruitment policies

• Unlike many other Swiss industries the SMTI continue to hire above market average, but at a slower pace,

continuing to provide attractive jobs for skilled employees, especially in the fields of R&D, regulatory affairs and

international marketing & sales

Source: SMTI 2010 20](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-20-2048.jpg)

![A STATE OF THE MEDTECH INDUSTRY

Putting past SMTI growth expectations into perspective –

Adjustments were taken fast and early in the downturn

GROWTH EXPECTATIONS FOR 2008 AND 2009 [%] COMMENTS

Growth Share of responses • In 2008, SMTI expected an average growth of

expectations 100% 6%. 77% of CEOs predicted a positive growth

rate1)

Strong growth • The "crisis resistance" of the MedTech

(> 10%) industry became attractive for non-industry

players (mainly suppliers), they were

– Trying to enter a profitable market

– Broaden sales channels and offerings

• As the market turned in Q3 2008 and took its

Moderate growth full impact in 2009 on a global scale, SMTI

(0 to 10%) companies adjusted their growth expectations

– Then, only 54% of companies expected a

Neutral (0%) positive growth rate

Moderate decline – The number of companies expecting a

(-5 to 0%)

negative impact on sales doubled

Strong decline

– Suppliers with a higher non-MedTech

(< -5%)

product portfolio proportion were hit harder

2008 2009 – Manufacturers of non-reimbursed product

n = 280, Ø = 6% n = 21, Ø = 0.1% suffered

1) SMTI 2008 data collected in spring and report released end of August 2008

Source: SMTI 2010 (based on SMTI survey May 2010), CS Economic Research, OECD 21](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-21-2048.jpg)

![B TRENDS AND CHALLENGES

Competition for the SMTI intensified severely since 2008 –

Costs and prices are under pressure in a changing market

RANKING OF MAJOR CHALLENGES

[% of answers, 2010]1) COMMENTS

Ranking • As of 2009, SMTI companies experienced

2008

1. Increasing price

intensifying competitive pressures

79 3.

competition – Suppliers with a high proportion of non-

healthcare clients were hit first

2. Increasing cost pres-

77 4. – Manufacturers of non-reimbursed products

sure from purchasers

were hit by tighter consumer spending

3. Intensified competition 75 5. • Today, the majority of SMTI managers are still

in the "crisis mode" observing operational

4. Increasing pressure to

challenges, e.g. higher price competition, cost

68 - pressure and an intensified competition2)

reduce production costs

5. Availability of FURTHER OBSERVATIONS

68 1.

skilled employees

• Current management thinking may fuel

6. Access to specialized consolidation to maintain critical mass to

59 2.

know-how

obtain

7. Organizational issues – A more diverse/innovative product portfolio

53 6.

resulting from growth – Better access to knowledge pools

n = 232; multiple answers possible

1) Challenge is of "high relevance" or "very high relevance" to SMTI companies 2) These represent a "triple challenge" to the SMTI

Source: SMTI 2010 27](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-27-2048.jpg)

![B TRENDS AND CHALLENGES

Megatrend – Clinical based evidence requirements force

companies to focus on higher product efficacy and communication

DEVELOPMENTS IN HEALTHCARE MARKET

[% of answers, 2010]1) COMMENTS

• Increasing competition and tightening public

Higher requirements for evidence healthcare budgets force companies to invest

of product efficacy 87

more into proofing product efficacy

• Gaining data from comparative effectiveness

Increasing communication needs with research and cost-benefit-analyses will gain

with authorities/healthcare institutions 73

in importance for many SMTI companies

• The communication efforts with customers and

Growth of purchasing cooperatives

61 authorities need to be intensified in order to

(among customers)

optimally position own products

Higher competition for reim- FURTHER OBSERVATIONS

bursement entitlement 56

• Recent healthcare developments will drive

Higher requirements for product – Higher costs to register and fulfil increasing

positioning among DRGs 51 compliance requirements

– Substantial price decreases in mature markets

Negative impact of DRG introduction

45 • EU wide harmonization of pharma prices is

on average product price

currently discussed; this will also influence the

SMTI

n = 134

1) Companies describing the development "applicable" or "partially applicable"; no 2008 data exist

Source: SMTI 2010 28](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-28-2048.jpg)

![C STRATEGIC ACTIONS

SMTI companies are focusing on profitability to meet current

challenges at the cost of potentially losing their innovative edge

RANKING OF ACTIONS 2010

[% of answers]1) COMMENTS

Ranking • In contrast to 2007 CEOs express a strong

2008

shift in priorities

1. Improving profitability 85 6.

• To support future growth, three rather

operational actions are in focus

2. Optimizing marketing 77 3.

– Improving profitability

3. Further development of

77 7. – Optimizing marketing & sales effectiveness

org. structure and processes

– Enhancing organizational structures and

4. Optimizing distribution 67 4. processes

5. Strengthening FURTHER OBSERVATIONS

63 1.

product innovation

• SMTI companies seem to approach business

6. Developing new

business models

62 5. conservatively before returning to a "growth

mode"

7. Integrating new partners 59 8.

• An international Life Sciences survey2)

8. Geographic expansion/ indicated contrary management responses

56 2.

internationalization – Developing a robust R&D pipeline

– Accelerating geographical expansion

n = 232; multiple answers possible – Forming alliances with pharma/biotech

1) Strategic actions mentioned as being relevant to SMTI companies 2) Deloitte/The future of the Life Science industries

Source: SMTI 2010 30](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-30-2048.jpg)

![C STRATEGIC ACTIONS

SMTI companies expect 10-12% growth p.a. in the next two years

EXPECTED GROWTH FOR 2010 AND 2011 [%, p.a.] COMMENTS

• On average SMTI CEO's are highly confident

Ø =10% Ø =12%

100% – 10% growth for 2010

– 12% growth for 2011

• Some caution should remain; these

expectations are related to the economic

Strong growth situation in May 2010

55% 59%

(> 10%)

• Start-ups are particularly enthusiastic

• Established companies expect moderate

growth as they face stronger price pressures

Moderate growth

(0 to 10%)

FURTHER OBSERVATIONS

Neutral (0%) 28%

26%

Moderate decline

(-5 to 0%) • If such up-turn is achievable, a shift towards

6% strategic investments and increased

Strong decline 1% 13%

(< -5%) 10% convergence will occur

1% 1% • Current economic forecast for the Swiss Life

2010 2011 Sciences sector as a whole is 6.5%

n = 194 n = 188

Source: SMTI 2010, Credit Suisse, SwissRe 31](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-31-2048.jpg)

![C STRATEGIC ACTIONS

Engaging in the right strategic actions correlates with above-

average growth expectations

EXPECTED GROWTH RATES 2010 AND 2011

[%, companies having the respective strategic action in focus] COMMENTS

16

Companies focusing

15 • Several CEOs focus on a set of strategic

on strengthening Ø 12 actions to enhance their growth potential

regulatory know- Ø 10

how/studies, e.g.

– Strengthening regulatory know-

cost-benefit analyses how/studies

n = 51

– Establishing new production/service

facilities

17 – Engaging in new business models

Companies focusing

on establishing new

12

Ø 12

• If a company focuses e.g. on strengthening

production/service Ø 10 of regulatory know-how/studies, they expect

facilities, e.g. in a growth rate that is 6% above the average

emerging markets

n = 42 for 20101)

15 FURTHER OBSERVATIONS

Companies focusing

on engaging in new

10 Ø 12

business models,

Ø 10 • Companies focusing on new business models

e.g. new kind of do not expect an immediate above-average

services n = 64 effect on their growth rate

2010 2011

Ø = average growth expectations across all survey participants

1) Data does not support a cumulative growth impact of combining the actions

Source: SMTI 2010 32](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-32-2048.jpg)

![C STRATEGIC ACTIONS

The majority of SMTI companies face increasing challenges –

Negative impact on growth is expected

EXPECTED GROWTH RATE [%, companies that are

affected by the mentioned challenges] COMMENTS

Ø 12 • 50% of SMTI companies face a triple

challenge

10 – Increasing price pressure

Ø 10 – Increasing cost pressure

8

– Intensifying competition

• These companies

– Expect a below average growth rate for

2010/2011

– Cannot hope for a fast improvement of their

situation

• All survey participants face at least one of the

three mentioned challenges

FURTHER OBSERVATIONS

• Tighter public healthcare expenditures will

2010 2011

– Keep the pressure on prices

Companies experiencing the "triple challenge"1) – Intensify competition among companies

Ø = Average growth expectations across all survey participants – Force them to decrease their costs basis

• Within this setting companies tend to invest

2010 n = 128, 2011 n = 221 more in product line extensions/renovations

1) Companies stating that increased pressure on prices, costs and intensifying

competition were of "high relevance" or "very high relevance" to them

Source: SMTI 2010 33](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-33-2048.jpg)

![D WINNING THROUGH INNOVATION

The SMTI shows a balanced product portfolio maturity –

Especially smaller companies drive product innovation

AGE OF PRODUCT PORTFOLIO BY COMPANY SIZE1, 2)

[in %, 2010] COMMENTS

Years

• In general, the maturity of the product

portfolio is well balanced – but the larger the

100%

company, the more mature the portfolio

+10 20%

26% 27% • 25% of the (weighted) SMTI product portfolio

33% is younger than three years

• 81% of the product portfolio of larger

5-10 21% companies is older than three years

27% FURTHER OBSERVATIONS

33% 20%

3-5 25% • Lower priority of product innovation

combined with cost constraining measures

20%

25% is likely to

24% – Lead to fewer novelties

0-3 34% – Prompt more renovation activities

27% • Close attention should be paid to the

22%

16%

maturing product portfolio (see strategic

actions) in order not to fall into an

Micro Small Medium Large innovation gap, as average product

development time is around three years

n = 124

1) Only manufacturers and suppliers 2) In proportion of their product portfolio

Source: SMTI 2010 36](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-36-2048.jpg)

![D WINNING THROUGH INNOVATION

Relative R&D expenditure is highest for small companies –

Manufacturers spend more on innovation than suppliers

BENCHMARKS

R&D EXPENDITURES [% of turnover]1,2) [in % of turnover, 2009]4) COMMENTS

BY COMPANY TYPE • R&D expenditures remained

12 12 stable or even increased since

10 Biotech 22 2007, but were increasingly

5 shifted to incremental innovation

• Manufacturers drive SMTI

innovation; their share of R&D

Pharma 16

2007 2009 spending is higher than for

n = 90

suppliers

• The less turnover a SMTI

Medical

BY TURNOVER company has, the higher the

technology 11

[in CHF and % of turnover 2009]3) industry relative spend on R&D

14

FURTHER OBSERVATIONS

11 10

9 Ø 10.6 Electronics

7 7 5 • Compared with adjacent

industry

industries, the SMTI spends

less on R&D than the biotech

and pharma industry, but

< 5m 5-10m 11-50m n = 90 Machine significantly more than the

4

industry mechanical engineering and

Suppliers Manufacturers electronics industry

1) Only manufacturers and suppliers 2) R&D expenditure was not weighted to turnover

3) Companies with more than CHF 50m turnover were omitted due to a limited sample size 4) Based on a sample of selected companies

Source: SMTI 2010 37](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-37-2048.jpg)

![D WINNING THROUGH INNOVATION

Shortening of the innovation cycle is of significant relevance,

especially to medium and large sized companies

SIGNIFICANCE OF A SHORTENED INNOVATION CYCLE [2010, in %]1)

BY COMPANY TYPE BY COMPANY SIZE

Manu-

45 25 30 Micro 36 26 38

facturers

Suppliers 62 17 21 Small 60 16 24

No or low significance Medium 80 16 4

High significance

Very high significance

Large 78 22 0

n = 129

• The majority of companies feel the market and • Micro companies seem to be flexible enough to adapt

competitive pressures to shorten innovation to shortened innovation life cycles. Their dependency

cycles in order to launch new or improved products on often only one or two products makes it a critical

more rapidly task to stay ahead of competitors

• It seems that manufacturers are partly passing on • The larger a company is, the less flexible it seems to

this pressure, evaluating different suppliers for the speed-up the innovation cycle, mainly because of

most innovative and cost effective solution internal processes and compliance requirements

1) Only manufacturers and suppliers

Source: SMTI 2010 38](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-38-2048.jpg)

![D WINNING THROUGH INNOVATION

Launches during the last three years were difficult – On average

new products achieved less than 30% of companies turnover

REVENUE SHARE OF PRODUCTS THAT WERE LAUNCHED

SINCE 20071) [in % of each company class, 2010] COMMENTS

29 • Product launches in the last three years

Very small 16 were also affected by the global economic

(0%-10%) 13 setbacks

16

• A majority of companies stated that new

31 products contribute only to a minor part

Small 37 (less than 30%) to the current turnover

(10%-30%) 42

45 • For micro companies there seems to be a

clear split:

3

Medium 25 – Either they are older companies with a

(30%-50%) 26 mature "cash-cow" product portfolio

16 – Or they are start-ups with a successful

20

product launch just on the brink of

High 18 growing rapidly

(50%-70%) 13 • The other companies capture less returns

23 from new product launches

17 Micro

Very high 4

(>70%) 6 Small

0 Medium

Large

n = 128

1) Only manufacturers and suppliers

Source: SMTI 2010 39](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-39-2048.jpg)

![D WINNING THROUGH INNOVATION

Companies with a young product portfolio show above-average

growth expectations

EXPECTED GROWTH RATES OF COMPANIES ACCORDING

TO PRODUCT PORTFOLIO MATURITY1) [%] COMMENTS

• Companies with a young product portfolio

17

have significantly higher growth expectations

16 • Companies with a more mature product

portfolio may face – especially if combined

with decreased R&D rates – an innovation

Ø 12

gap that harms future growth rates

• In order to increase growth rates again, these

Ø 10 9 companies need to take into account an

7 average "idea to launch" time of approx. three

years

FURTHER OBSERVATIONS

• The SMTI is an innovation-centred

industry based on network innovation

2010 2011 – Launching new products is an essential

growth factor

Older portfolio (companies with less than 15% of the product portfolio

younger than three years), n = 42 – High priority on profitability2) drives bottom-

Younger portfolio (companies with more than 15% of the product portfolio

line improvements, but does not lead to

younger than three years), n = 56 higher growth rates

1) Only manufacturers and suppliers 2) 85% of survey participants stated improving profitability is a key strategic action

Source: SMTI 2010 40](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-40-2048.jpg)

![D WINNING THROUGH INNOVATION

Companies with a high focus on innovation show above-average

growth expectations

EXPECTED GROWTH RATES AND INNOVATION FOCUS1)

[%] COMMENTS

• Compared to 2008, strategic priority moved

away from strengthening product innovation

15 to profitability improvement measures

14

• Additionally, relative R&D expenditures have

– on average – declined

Ø 12

• Both of these two findings lead to assume a

Ø 10 9 lower focus on innovation

8

• However, firms that still focus on innovation

expect significantly higher growth rates

• They outperform expected average growth by

6% and 3% for 2010 and 2011 respectively,

assigning them a leading role in the further

development of the SMTI

2010 2011

FURTHER OBSERVATIONS

Low focus on innovation (low R&D ratio and strengthening of

product innovation not a priority), n = 33

• Listen to/involve patient groups in prototyping

High focus on innovation (high R&D ratio and strengthening of reviews to enable product generation jumps

product innovation a priority), n = 18

1) Only manufacturers and suppliers

Source: SMTI 2010 41](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-41-2048.jpg)

![D WINNING THROUGH INNOVATION

R&D contribution to growth expectations –

Increased R&D expenditure

GROWTH EXPECTATIONS BY R&D EXPENDITURES

[% of turnover] COMMENTS

Growth R&D expenditures 2009 R&D • The focus of many companies on profitability

expectation expenditures

2011 2007

improvement measures lead to a decrease of

average R&D spend to 10.6%1) from 15% in

0%

2007

Neutral 1

(0% p.a.) • However, a few exceptions exist: suppliers

n.a. 5% and manufacturers must invest more in order

to achieve moderate growth

8 2% • Companies that hardly invest in R&D do not

Moderate growth

(0-10% p.a.)

expect a positive growth rate, strengthening

10 6% the assumption that R&D is a key driver for

SMTI growth

7 10% FURTHER OBSERVATIONS

Strong growth

(> 10% p.a.)

16 15% • Suppliers needed to invest heavily into R&D

to meet shorter innovation cycle time

Suppliers' expenditures on R&D

• They may find themselves in a R&D trap due

Manufacturers' expenditures on R&D

to a high dependency on MedTech

2010 n = 61, 2008 n = 154 manufacturers

1) R&D expenditure was not weighted to turnover

Source: SMTI 2010 42](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-42-2048.jpg)

![E COLLABORATION AND BUNDLING

SMTI companies focus on collaborations between manufacturers

and suppliers – Strengthening incremental innovation

SHARE OF COMPANIES WITH COLLABORATIONS

[% of answers, by inter-industry collaboration type, 2010] COMMENTS

• The majority of SMTI companies closely

Manufacturers/ 88 collaborate with other manufacturers and

suppliers 82 suppliers, positioning themselves often as

"Renovators" working on improvements of

43 existing products

Universities

59

• Already second are collaborations with

Technology/IT service 13 universities; there SMTI companies often act

providers 28 as "Network innovators", working on

product innovations

12

Support organizations

24 • On average manufacturers show a higher

degree of collaboration – this is mainly due to

Private research 9

institutes 24 – Technology leadership in projects with

several collaborating parties

Strategy 9 – Higher value chain integration

consultants 4 • Not very widespread are collaborations with

service providers

Suppliers

Manufacturers • Roughly less than a quarter of SMTI

companies have respective collaborations

n = 122, multiple answers possible

Source: SMTI 2010 45](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-45-2048.jpg)

![E COLLABORATION AND BUNDLING

SMTI companies focus on applied research to drive incremental

innovations

FUNCTIONAL COLLABORATION WITH PARTNERS

[% of answers, by type, 2010] COMMENTS

SMTI companies, particularly manufacturers,

Applied research 43

61 engage in functional collaboration. Predominantly,

such activities are sought in the field of:

Quality control 45

46 • Applied research; underlining the focus on

25 incremental innovation

Basic research

35

• Quality control and production certification

Product certification 12 – Strengthening compliance and regulatory

41 know-how

Marketing/sales 30 – Managing innovation cycle

20 – Shifting innovation risks to suppliers

Distribution 17 • Basic research; focus on break-through

28

technology and materials

Training 12

13 • Training, launch/post launch, and after sales

After sales 7

collaborations are of minor importance to SMTI

services 7 firms despite

– Under-proportional returns on new products

5

Product launch

7 – Rising OPEX to sales ratios and process costs

Suppliers – Expected shifts in business models and

offerings

Manufacturers

n = 106, multiple answers possible

Source: SMTI 2010 46](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-46-2048.jpg)

![E COLLABORATION AND BUNDLING

The national innovation programs of CTI/KTI reach 29% of SMTI

companies – More than twice as much as international programs

NATIONAL PROGRAMS INTERNATIONAL PROGRAMS

[% of participation in innovation promotion programs1), 2010] [participation in %, 2010]

65 100 87

OTHER OTHER

CTI/KTI 22 EU

29

35

6

32

29 17 13

2

11

NO YES CTI/KTI micro small medium large NO YES

(distribution by company type)

n = 154 n = 155

EU programs: e.g. FP6, FP7

Other: e.g. COST, EUREKA

1) Suppliers and manufacturers

Source: SMTI 2010 47](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-47-2048.jpg)

![E COLLABORATION AND BUNDLING

Offerings are challenged by price pressures –

Changes ahead for 2012

POSITIONING AND BREADTH OF

OFFERINGS [illustrative] CHARACTERISTICS OF OFFERING STRATEGIES BY 2012

With reduced funding in health care systems, price pressure will

Best in Class

further increase. Paired with DRG, transparency on patient outcome

high

becomes available to payers

Own product This will influence the companies„ offering strategy – thus they may

choose from the following positioning in the future:

Price

Multiple

indications Commodity • "Best in Class" products

– Unique IP, processes, technology or materials and best

Commodity treatment outcome, thus often benefit drivers

product, single – Yield premium price positions

indication

• "Commodity" (less innovative or "me too"/single) products

low

low

Benefits

high – Aim at high volumes/lower margins pricing

Product categories

– Must provide supply flexibility/reliability

Single product Bundling types

• "Bundling" (to obtain an overall higher price benefit ratio)

own product – Own products, services, consumables, training and IT updates

convergence product – Convergences (combined pharma/biotech and MedTech

solutions product)

– Solutions1 (extended value creating services or complementary

products for a full DRG treatment incl. competitor products)

1) Solutions serving DRG related treatments are currently in early stage discussions amongst leading firms; positioning here is rather indicative

Source: SMTI 2010, SMTI Advisory Board 50](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-50-2048.jpg)

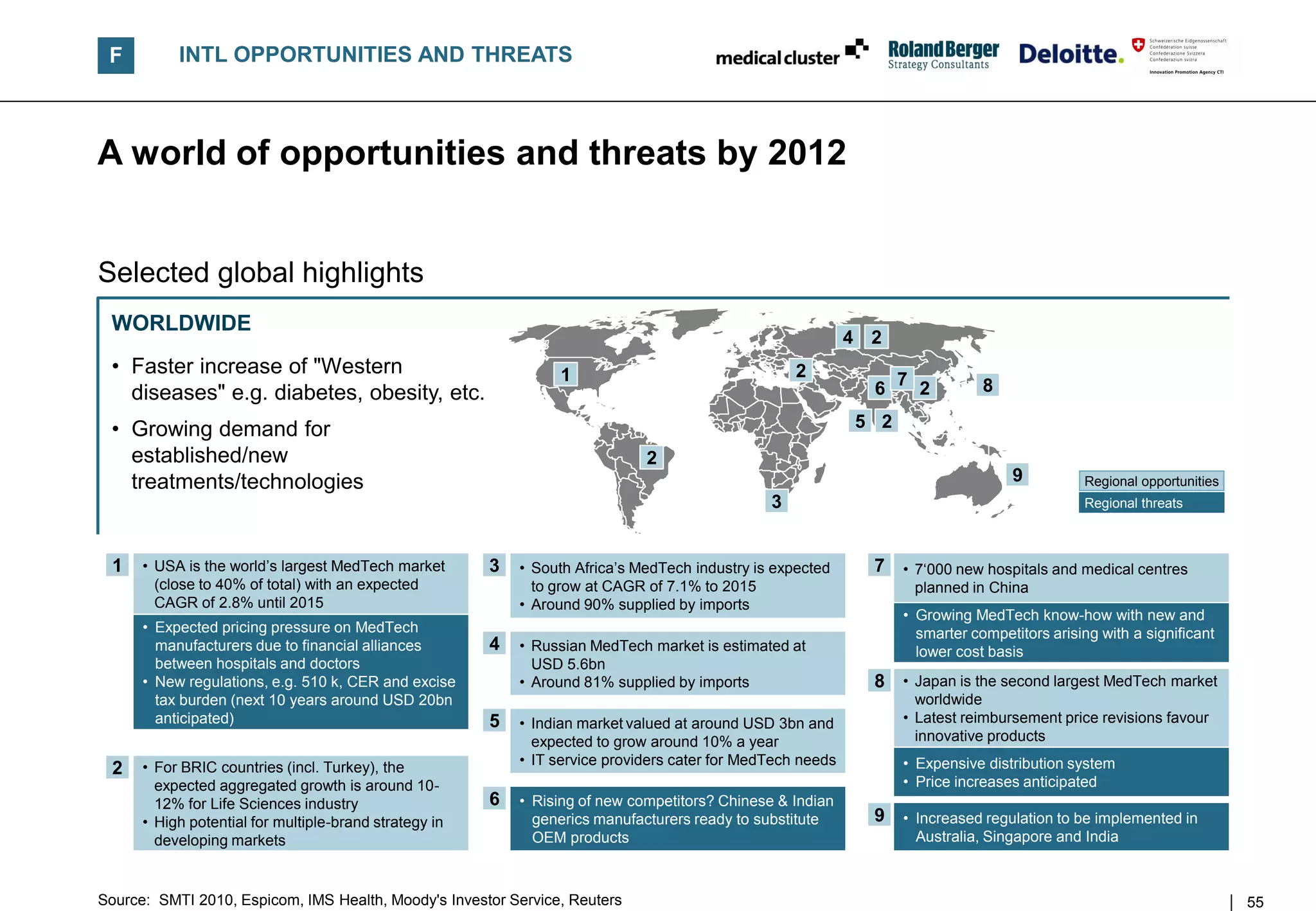

![F INTL OPPORTUNITIES AND THREATS

SMTI companies still perceive the strongest growth potential in the

Swiss home market, closely followed by the EU

COUNTRIES WITH HIGHEST EXPECTED GROWTH

POTENTIAL FOR THE NEXT 2 YEARS [% of mentions, 2010]1) COMMENTS

Switzerland Abroad • Compared to 2008, there were no significant

2010: 35% 2010: 65%

changes:

2008: 34% 2008: 66%

– The Swiss market is still expected to have the

35 34 highest growth potential

– More than half of the SMTI companies expect

30 the highest potential in the EU, USA and BRIC

29

markets

• For the other geographical regions, Swiss

companies tend not to expect important growth

13 13 contributions:

11

10 – In Japan registration and regulatory

7 requirements, as well as cultural differences,

6

are a major hurdle

3 3

2 2

1 1 – The rest of the world market does not yet

contribute significantly to the growth of SMTI

Switzerland EU USA / Japan BRIC Other Other Other companies

Canada countries countries countries

in Asia in Latin

2010 n = 141 America

2008 n = 132

1) Includes suppliers, manufacturers, traders/distributors and service providers

Source: SMTI 2010 52](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-52-2048.jpg)

![F INTL OPPORTUNITIES AND THREATS

Manufacturers are more internationalized than suppliers – More

than 50% perceive strongest growth outside EU and Switzerland

COUNTRIES WITH HIGHEST EXPECTED GROWTH

POTENTIAL FOR THE NEXT 2 YEARS [% of mentions, 2010] COMMENTS

Switzer- • Companies expect the strongest stimulus from EU

land Abroad

countries, followed by Switzerland

• Overall manufacturers seem to be more

35 internationalized than suppliers

32 – About 54% of manufacturers expect highest

30 growth from business with countries outside the

EU and Switzerland

– In the focus are EU, USA/Canada, the BRIC

20 countries and only fourth the Swiss home

18

16 market

14 – Suppliers have a higher focus on the EU and

the Swiss home market, representing for more

8 8 than two thirds of companies the regions with

6 6

the highest growth potential

2 2 2

0 1

FURTHER OBSERVATIONS

Switzerland EU USA / Japan BRIC Other Other Rest of

Canada countries countries the world • Suppliers seem to need a geographical closeness

in Asia in Latin to manufacturers in order to optimally fulfil their

Suppliers n = 49 America

customer requirements

Manufacturers n = 72

Source: SMTI 2010 53](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-53-2048.jpg)

![F INTL OPPORTUNITIES AND THREATS

The economic outlook for main SMTI export markets is positive –

Return to growth expected

GDP GROWTH [% change vs. previous year] COMMENTS

• Most of the main SMTI export markets are

3,1 expected to return to growth in 2010 (0.8 and

2,7 3.1%) and 2011 (1.5 and 2.7%)

2,4

2,1

1,8 1,8 • The OECD average growth rate is expected

1,6 1,5 to slightly outperform Switzerland and to

0,8 recover considerably faster than in the EU-27

0,7

0,5 0,4 • This increases the growth potential through

sales – both in Switzerland and abroad

• Growth prospects are even brighter outside

the traditional European markets, e.g. in the

Switzerland emerging economies in Asia and South

OECD America

-2,4 EU-27

-2,5

USA

-3,3

-4,2

2008 E 2009 E 2010 F 2011 F

E = Estimate, F = Forecast

Source: SMTI 2010, BAG, BfS, KOF 54](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-54-2048.jpg)

![F INTL OPPORTUNITIES AND THREATS

The US Healthcare Reform will also influence SMTI companies

CONVERGENCE OF FOUR FORCES [illustrative] EXPECTED OPPORTUNITIES

• Higher numbers of patients

• Opportunity for highly innovative treatment

demand

• Opportunity to position bundled offerings/solutions

to buying consortiums

• Increased opportunities for preventive/early

indication devices

EXPECTED THREATS

• Higher price transparency

• Higher compliance and registration efforts for new

products, incl. registration fees

• Higher re-negotiation costs of existing products

• Tighter reimbursement for me-too products

• Higher tax burden

Source: SMTI 2010 57](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-57-2048.jpg)

![F INTL OPPORTUNITIES AND THREATS

Registration and introduction of new products are perceived to be

less difficult in Europe than in other markets

ESTIMATED DIFFICULTIES FOR PRODUCT REGISTRATION

AND INTRODUCTION [% of mentions, 2010]1) COMMENTS

• Registration and introduction of new products

1 2 are expected to be a challenging task for 45%

Very difficult 15 13 of manufacturers and suppliers

23

27

26 • However, Switzerland as well as the EU

42 (almost the same processes and structures)

are expected to be less complex than

Difficult 30 38 registration in the US, Japan or BRIC markets

• Japan is considered to be a very difficult

39

52 market due to high requirements regarding

51 28 sensible documents (drawings, IP etc.), high

fees, and long approval times

Neutral 43

• US FDA regulations are perceived as hard to

46 be met, even for large companies

30

20

27 • FDA recently announced higher regulatory

Easy 20 requirements, increasing registration

Very easy 11

4 5 complexity and processing time

1 0 0 0 3 0 3

• Especially smaller SMTI companies face the

Total Switzerland EU USA JAPAN BRIC challenge to meet these requirements due to

n = 90 the lack of internal expertise

1) Only manufacturers and suppliers

Source: SMTI 2010, SMTI Advisory Board, Swissmedic 58](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-58-2048.jpg)

![G INTERNATIONAL POSITIONING

For the first time the SMTI work-force abroad grew at a higher rate

than in Switzerland, showing an increasing internationalization

GROWTH IN LOCAL VS. FOREIGN EMPLOYMENT

[% over last 2 years, end 2007 & 2009]1) COMMENTS

• SMTI companies continue to hire – but at a

21 reduced rate

Switzerland

7

• For the first time growth of employee

16 numbers has been bigger abroad and signals

Abroad

8 a shift in management focus

2007

2007: n = 186 • This result documents the increasing

2009

2009: n = 81 internationalization effort of SMTI companies

• The survey results indicate that no significant

WORKFORCE ABROAD work-force shifts from and to Switzerland

[% of total workforce according to company size, 2009]1) have taken place

• Micro to small companies employ around 4%

Micro 4 of their workforce abroad compared to 20-

40% of medium to large sized companies

Small 4

Medium 20 FURTHER OBSERVATIONS

Large 42

• Micro and small companies are lacking

access to experienced hires in order to obtain

n = 139 international expert know-how

1) Only manufacturers and suppliers

Source: SMTI 2010 60](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-60-2048.jpg)

![G INTERNATIONAL POSITIONING

Manufacturers and suppliers are strongly export driven and

achieve on average 63% of revenues abroad

AVERAGE SHARE OF EXPORTS

[% of turnover, 2009] 1) COMMENTS

78 • Manufacturers generate around 78% of sales

abroad

Ø 63

• Suppliers play an important role in the local

53 market as 47% of their products and services

are sold within Switzerland

35 • Their export share decreased significantly,

reflecting economical difficulties in many

Ø 29

markets, e.g. declining demand, fiercer

16 competition, and adverse currency

fluctuations

• The same applies to a majority of

Suppliers Manu- Traders Service traders/distributors; they only achieved an

facturers and providers2) export share of 16% (-50% vs. 2007)

distributors

• Service providers are generating 35% of their

2007 data 62% 74% 34% turnover abroad, benefitting from the high

expertise gained in the home market

n = 174

1) Average for suppliers and manufacturers , based on average export share of all companies, not based on value of exports. Therefore varies from the

value mentioned in the management summary 2) Share of export of service providers was not surveyed in 2008

Source: SMTI 2010 61](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-61-2048.jpg)

![G INTERNATIONAL POSITIONING

A young product portfolio helps manufacturers to increase their

export share

EXPORT SHARE

[%, according to age of product portfolio, 2010] COMMENTS

• Suppliers and manufacturers realize different

82 export shares in respect to the age of their

Ø 78 product portfolio

72

• Suppliers

61

– Can export above-average mature

products

Ø 53

46 – Were faced with difficulties in capturing

export shares with young product

• Manufacturers

– Can capitalize on an innovative product

range in export markets

Younger PP1) – Tend to introduce new products or line

extensions faster abroad

Older PP2)

– Expect below avg. growth from mature

Suppliers Manufacturers products

n = 93

1) More than 50% of product portfolio younger than 5 years

2) More than 50% of product portfolio older than 5 years

Source: SMTI 2010 62](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-62-2048.jpg)

![G INTERNATIONAL POSITIONING

Growth expectations and export share – Positive correlation for

manufacturers, negative correlation for suppliers

EXPECTED GROWTH ACCORDING TO EXPORT SHARE

[%, only manufacturers and suppliers, 2010] COMMENTS

• Export is a “Must do” for growth

18

• Manufacturers are much stronger export

focused than suppliers

• Manufacturers with an above-average export

share

– expect significantly higher growth rates

10 – will outperform the market

Ø 10

– will outperform suppliers by far

7

• For suppliers, the situation is reversed – the

home market remains the key to growth.

4 They face difficulties to

– Overcome the external market access trap

Suppliers

– Find niches in a growing commodity market

Manufacturers

• By focusing on export, firms can

Low export share1) High export share2)

– Expand the potential customer base

– Drive regional account management

n = 114

1) Defined as less than 44%/81% of revenue from exports for suppliers/manufacturers

2) Defined as more than 44%/81% or revenue from exports for suppliers/manufacturers

Source: SMTI 2010 63](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-63-2048.jpg)

![4 INNOVATION AND SUPPORT

Share of newly introduced products and distribution of product

portfolio

SHARE OF SALES OF NEWLY INTRODUCED DISTRIBUTION OF PRODUCT PORTFOLIO

PRODUCTS (SINCE 2007) ACCORDING TO PRODUCT AGE

[% of answers, 2010] [% of answers, 2010]

28 28

27

Very small proportion 21

25

(0% - 10%) 18 24

23 23

22

Small proportion 36

(10% - 30%) 38

Medium proportion 21

(30% - 50%) 16

High proportion 16

(50% - 70%) 20

Very high proportion 6

(> 70%) 8

0-3 years 3-5 years 5-10 years `+10 years

Suppliers

Manufacturers

n = 127

Source: SMTI 2010 78](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-78-2048.jpg)

![4 INNOVATION AND SUPPORT

Share of inter-industry collaborations by partner

BY COMPANY CATEGORY [% of partners, 2010] BY COMPANY SIZE [% of partners, 2010]

88 94

Manufacturers/ Manufacturers/ 88

suppliers 81 suppliers 83

73

50

43 43

Universitites Universitites

59 55

91

13 9

IT service providers IT service providers 18

28 28

36

13

12 20

Support organizations Support organizations

24 14

27

9 16

Private research Private research 15

institutes 24 institutes 21

18 Micro

Suppliers 6 Small

9 8

Strategic consultants Manu- Strategic consultants Medium

4 facturers

7

9 Large

n = 105, multiple answers possible n = 105, multiple answers possible

Source: SMTI 2010 79](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-79-2048.jpg)

![4 INNOVATION AND SUPPORT

Share of functional collaborations

BY COMPANY CATEGORY [% by type, 2010] BY COMPANY SIZE [% by type, 2010]

43 54

Applied research Applied research 39 52

61 80

50

Quality control 45 Quality control 55

46 37

30

21

25 27

Basic research Basic research 37

35 40

21

12 24

Product certification Product certification 30

41

30

30 29

Marketing/sales Marketing/sales 21 33

20

17 15 25

Distribution Distribution

28 19 40

4

12 15

Training Training 19

13

20

7 Micro

After sales service 7 After sales service

Suppliers 7 Small

7 20

Manu- 4 Medium

Product launch 5 Product launch

7 facturers 3 11 Large

10

n = 105, multiple answers possible n = 105, multiple answers possible

Source: SMTI 2010 80](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-80-2048.jpg)

![4 INNOVATION AND SUPPORT

CTI/KTI initiatives are well known – The use of knowledge transfer

institutions is limited

KNOWLEDGE ABOUT CTI/KTI INNOVATION

PROMOTION PROGRAMS1) USE OF KNOWLEDGE AND TECHNOLOGY

[% of respondents that know CTI/KTI, 2010] TRANSFER INSTITUTIONS1) [%, 2010]

77 69

53

27

26 25

4

R&D Project Start-up Innovation Platform & No Yes Do not know any

Promotion Promotion Check Network Transfer Institutions

Promotion

n = 81, multiple answers possible n = 154

1) Suppliers and manufacturers

Source: SMTI 2010, CTI/KTI 82](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-82-2048.jpg)

![4 INNOVATION AND SUPPORT

Companies of all sizes use CTI/KTI services and support

DISTRIBUTION OF CTI/KTI USERS ACCORDING TO

COMPANY TURNOVER [%, 2010] COMMENTS

SUPPLIERS • If analyzed by company turnover, the

56 distribution of CTI/KTI users roughly

Ø 56

represents the total survey sample

32

• One major exception are manufacturers,

Ø 24 where companies with more than CHF 50m in

Ø 17

6 6 turnover are overrepresented

Ø3 – 50% of manufacturers that use CTI/KTI

programs have more than CHF 50m

CHF m <5 5-10 10-50 > 50

n = 16

turnover

– But only 23% of companies in the sample

have a turnover of more than CHF 50m

MANUFACTURERS 50

• However, these findings should not be over-

Ø 36

interpreted, as

19 19 Ø 23 Ø 23 – larger manufacturers usually have several

Ø 18 12 R&D projects running in parallel

– one CTI/KTI supported project therefore

only represents a fraction of all R&D

CHF m <5 5-10 10-50 > 50 projects

n = 16 – early CTI start-ups are not covered by this

Distribution of total SMTI sample, n = 105 report

Source: SMTI 2010, CTI/KTI 83](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-83-2048.jpg)

![4 INNOVATION AND SUPPORT

Distribution of CTI/KTI users according to company age shows

little deviation

DISTRIBUTION OF CTI/KTI USERS ACCORDING TO

COMPANY AGE1) [%, 2010] COMMENTS

61 • If analysed according to company age, the

Ø 61

distribution of CTI/KTI users shows little

deviation from the survey average

• Very young companies (< 5 years) account

for 15% of CTI/KTI users – slightly more

than their 12% share of the survey

• Young companies (5 to 10 years) make up

Ø 26 24 24% of CTI/KTI users – slightly less than

their 26% survey share

15

Ø 12 • Older companies (> 10 years) account for

61% of both CTI/KTI users and share of

overall survey participants

Very young Young Older

(< 5 years) (5 to 10 years) (> 10 years)

n = 41

= Distribution of total sample n = 137

1) Suppliers and manufacturers, CTI/KTI start-up support is not represented

Source: SMTI 2010, CTI/KTI 84](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-84-2048.jpg)

![5 GROWTH EXPECTATIONS

Growth expectations by segment and company size

GROWTH EXPECTATIONS BY SEGMENT GROWTH EXPECTATIONS BY COMPANY SIZE

[% of answers] [% of answers]

9 13

Suppliers Micro

11 14

13 9

Manufacturers Small

12 11

Tracers and 9 8

Medium

distributors 9 11

10 8

Service Providers Large

16 7

2010 2011

n = 215

Source: SMTI 2010 85](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-85-2048.jpg)

![6 SMTI REPORT DATABASE

The SMTI 2010 survey sample represents the whole industry

fairly well

Distribution of participating companies according to turnover

ACCORDING TO COMPANY TURNOVER ACCORDING TO COMPANY SIZE

[CHF] [number of employees]

Large

> 50m (250 and more)

8% 7%

Medium

(50 to 249) Micro

21%

11-50m

24% 40% (< 10)

68%

< 11m

32%

Small (10 to 49)

Source: SMTI 2010 87](https://image.slidesharecdn.com/swissmedicaltechnologyindustry2010report-110225052853-phpapp02/75/Swiss-medical-technology-industry-2010-report-87-2048.jpg)