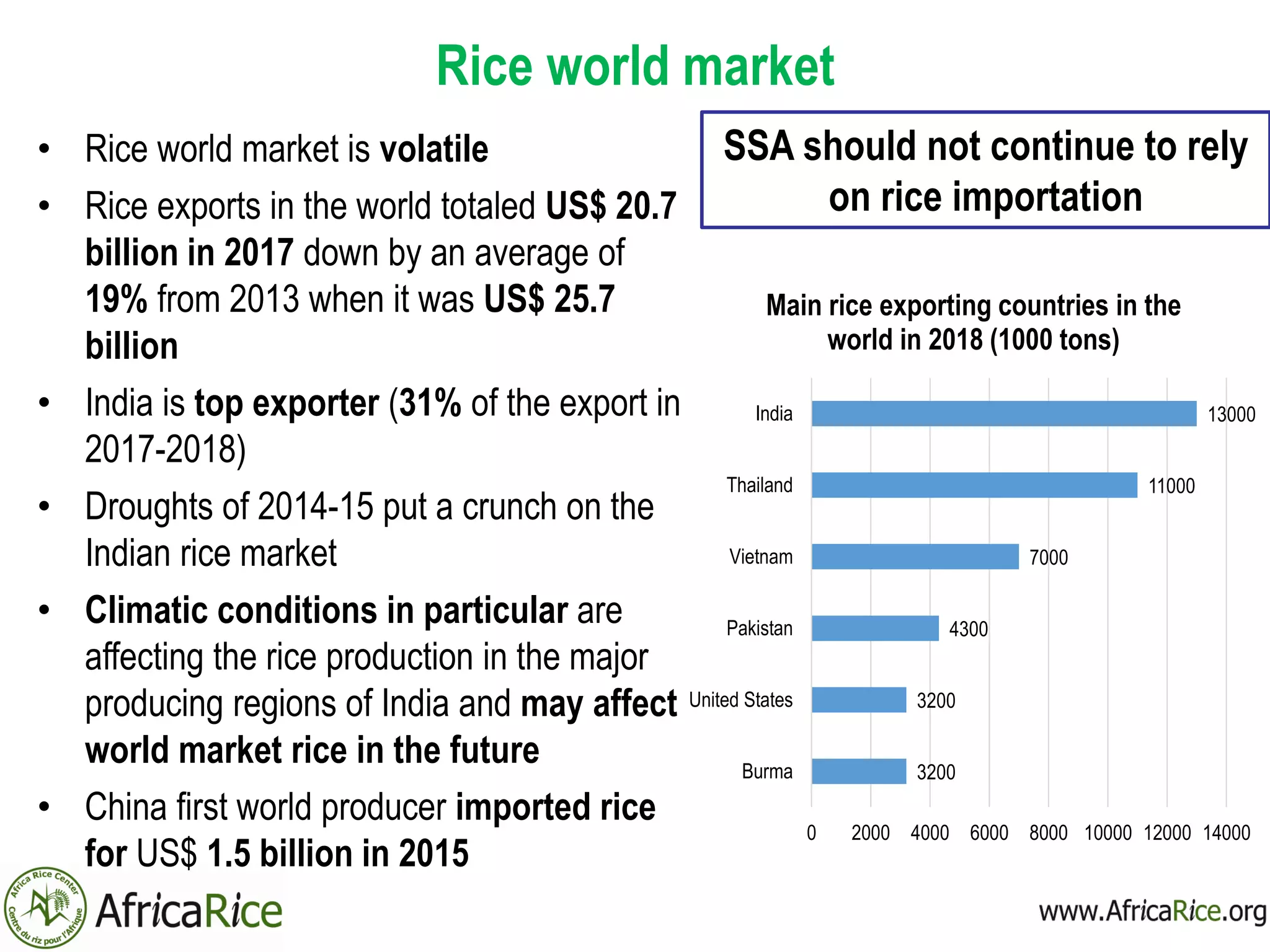

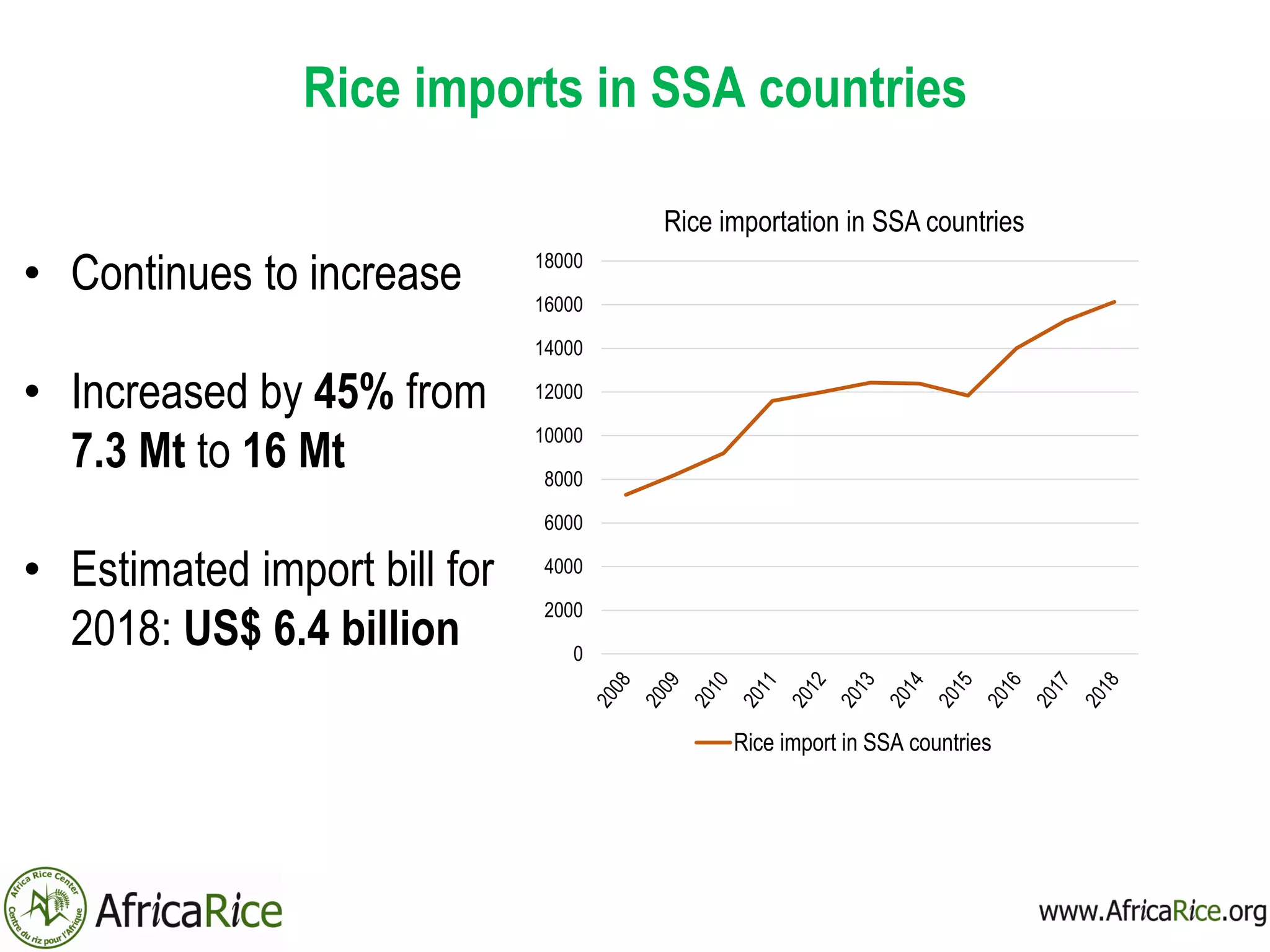

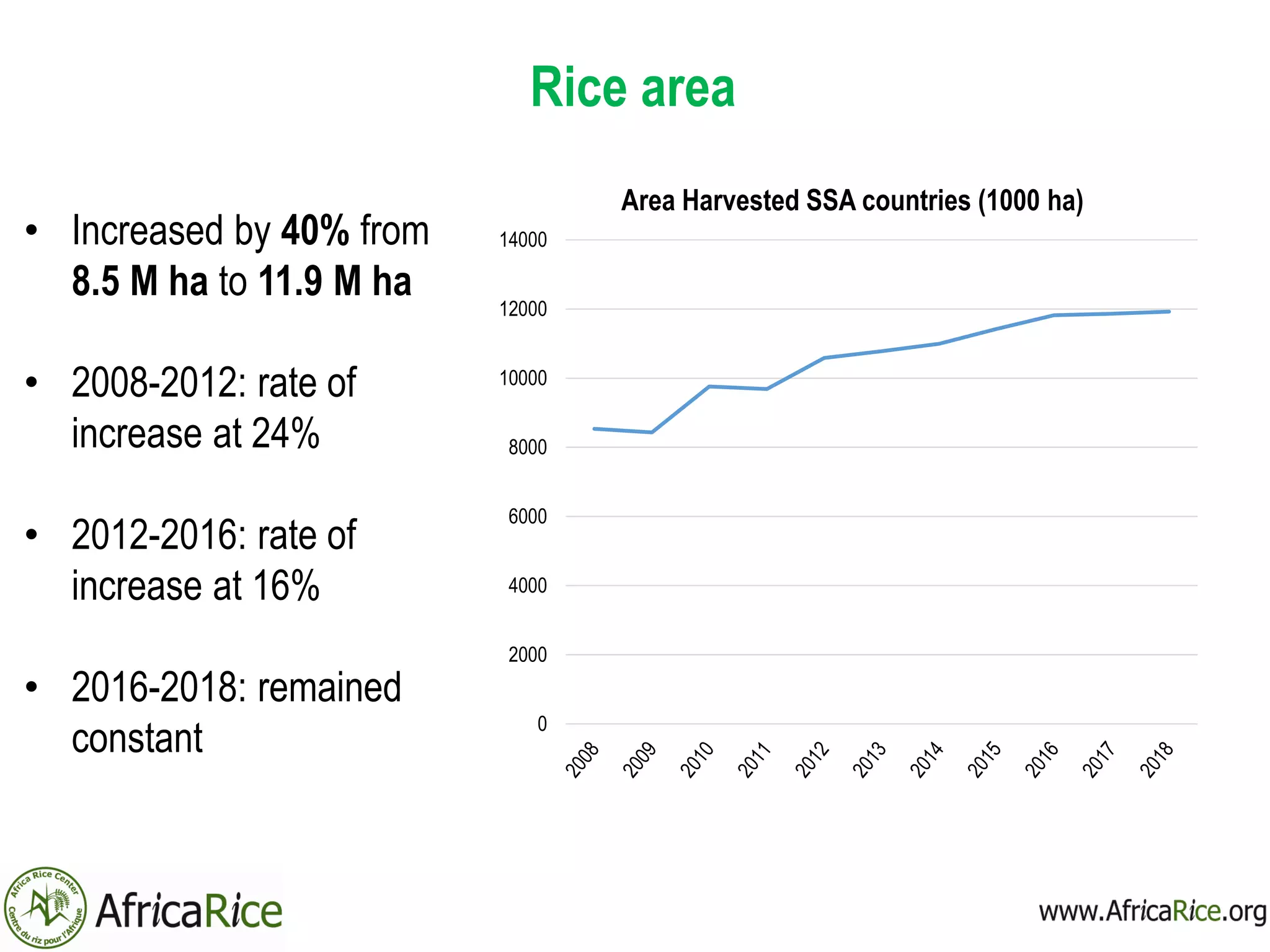

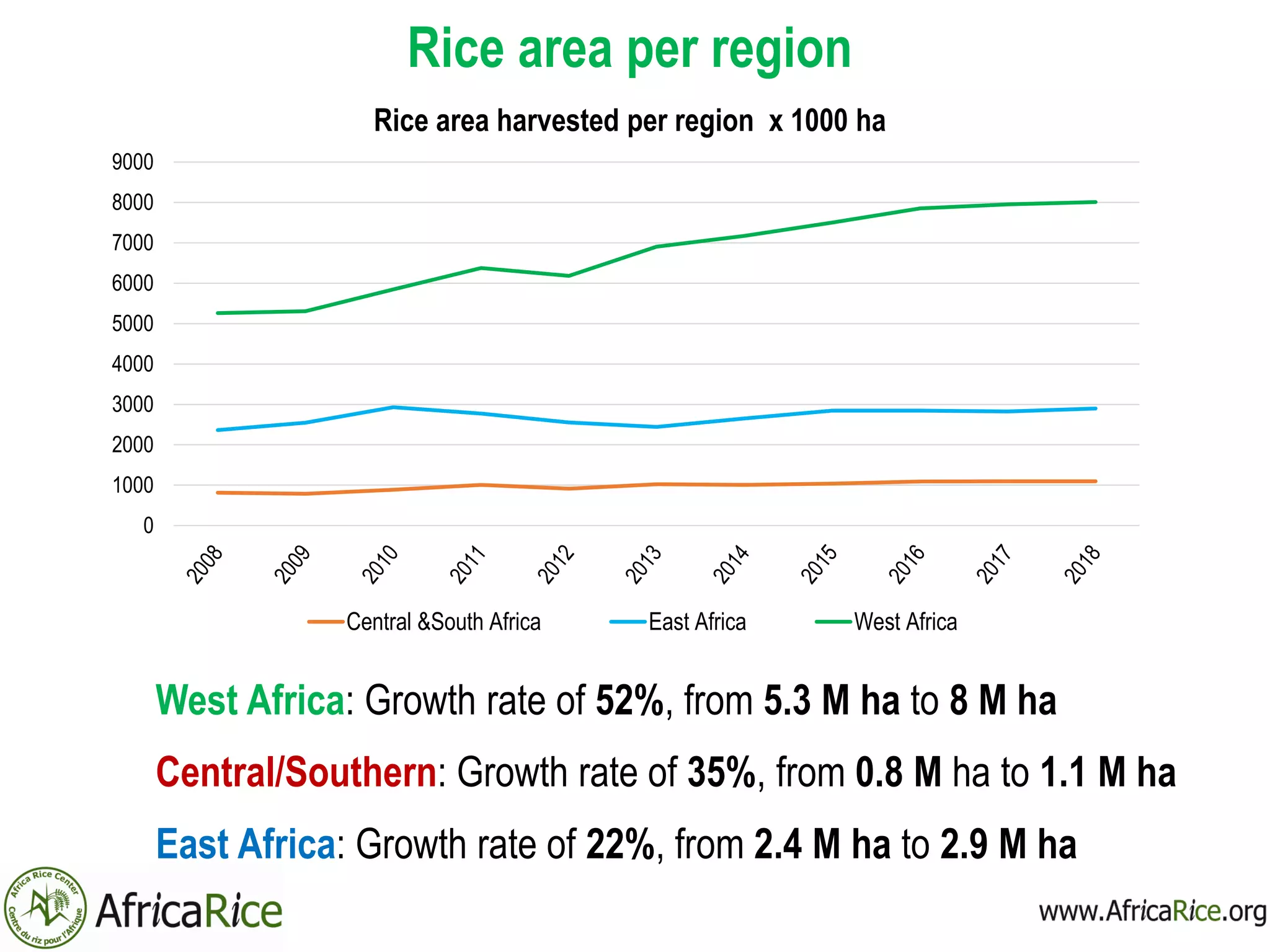

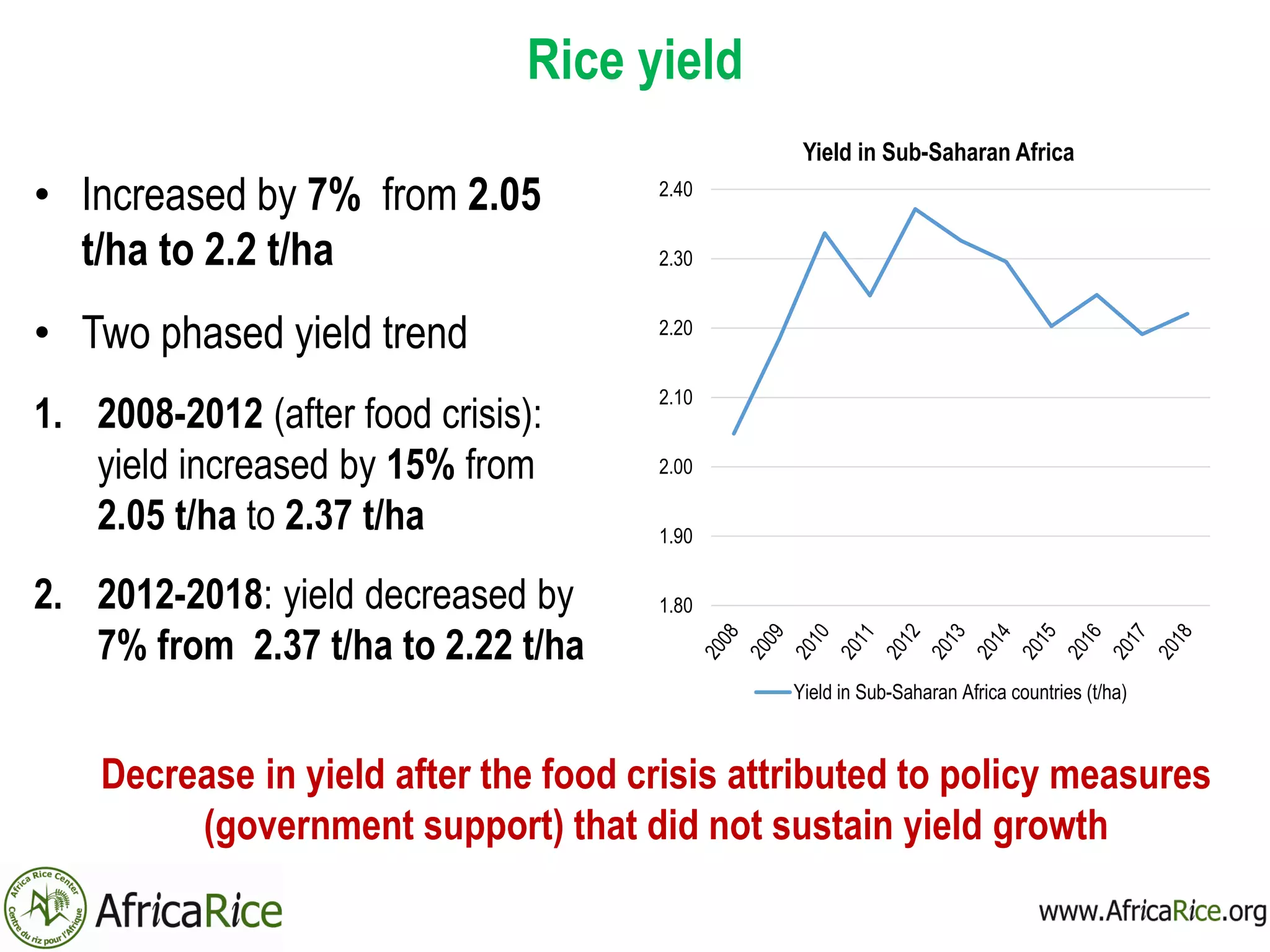

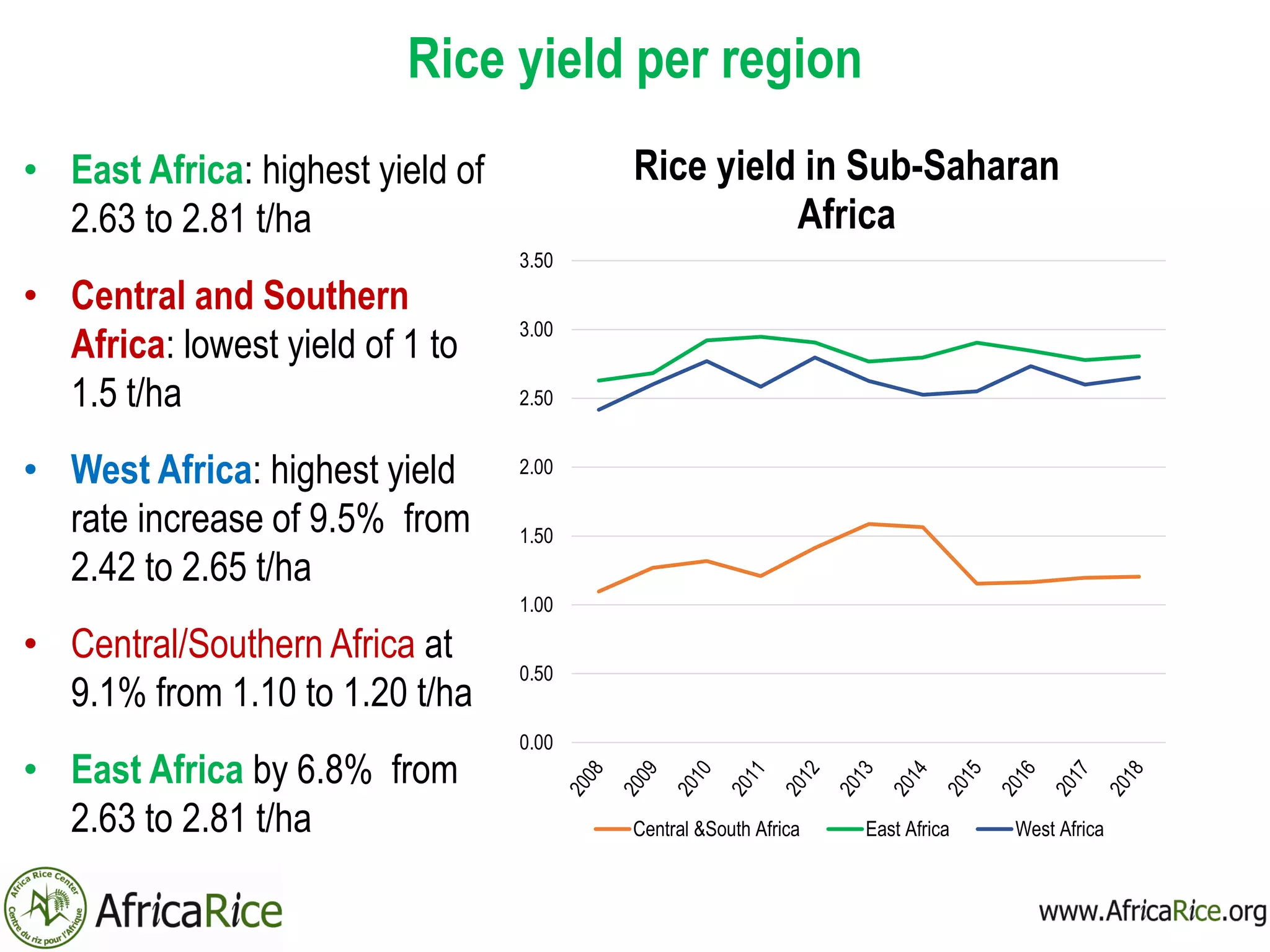

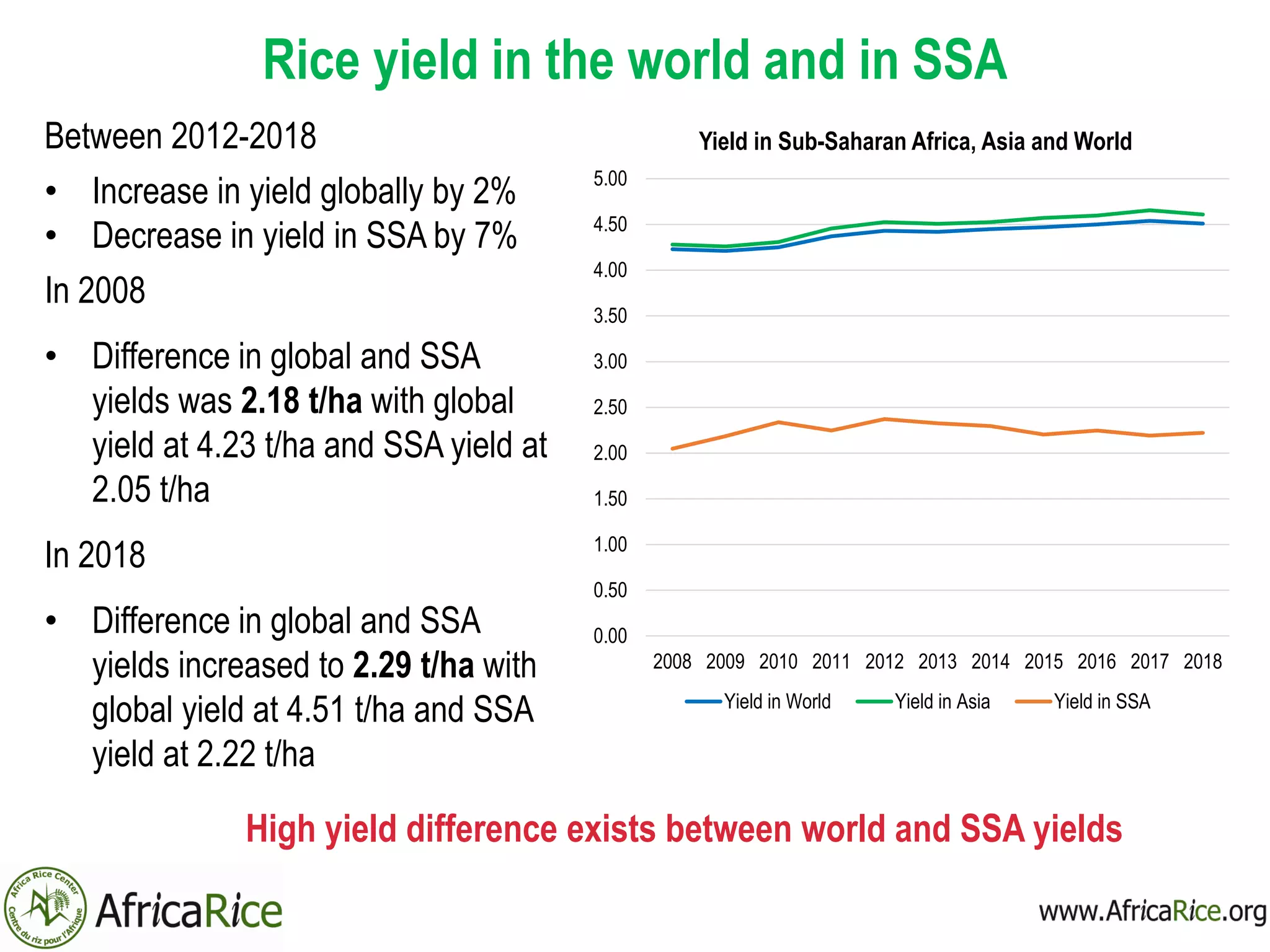

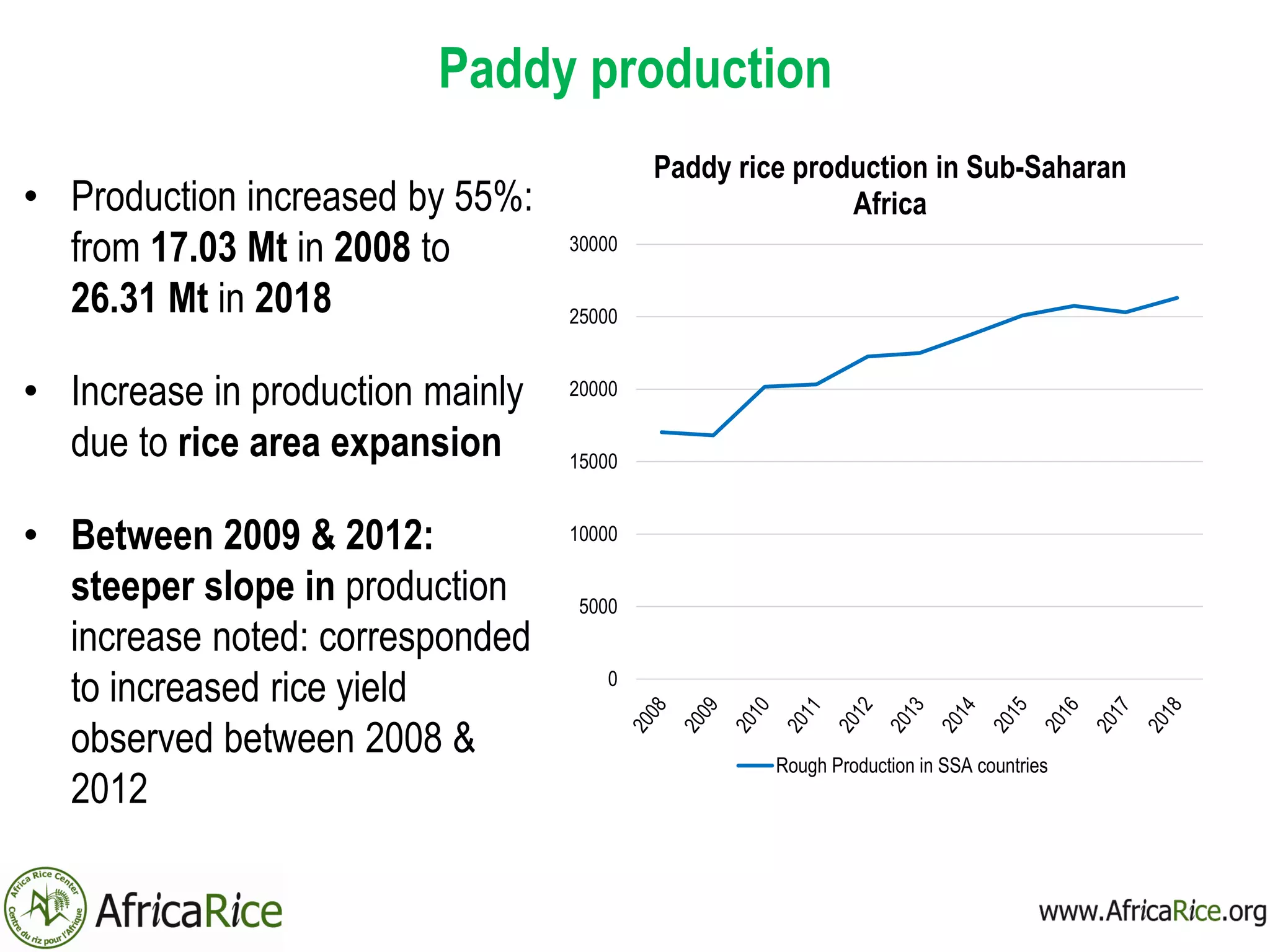

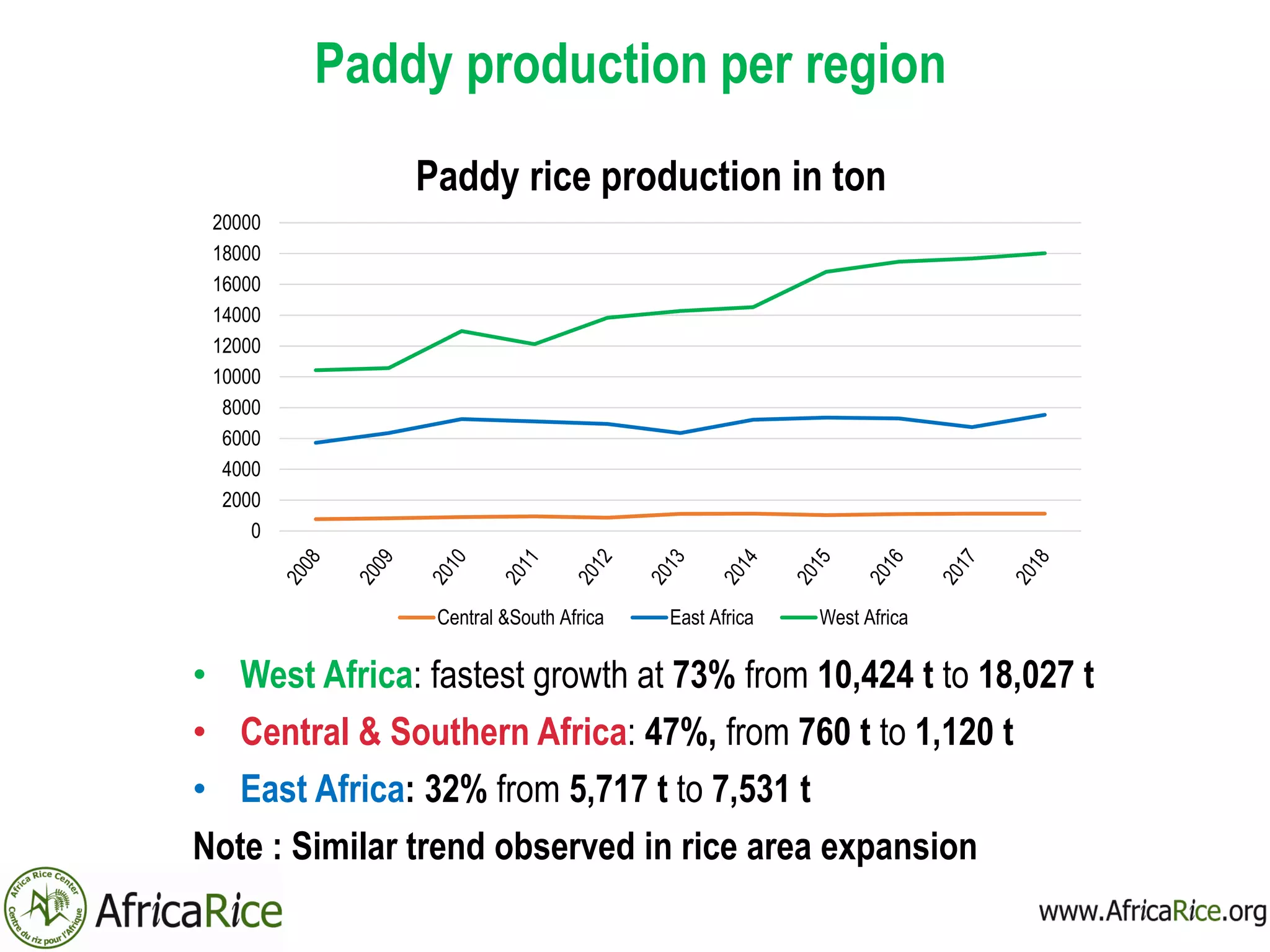

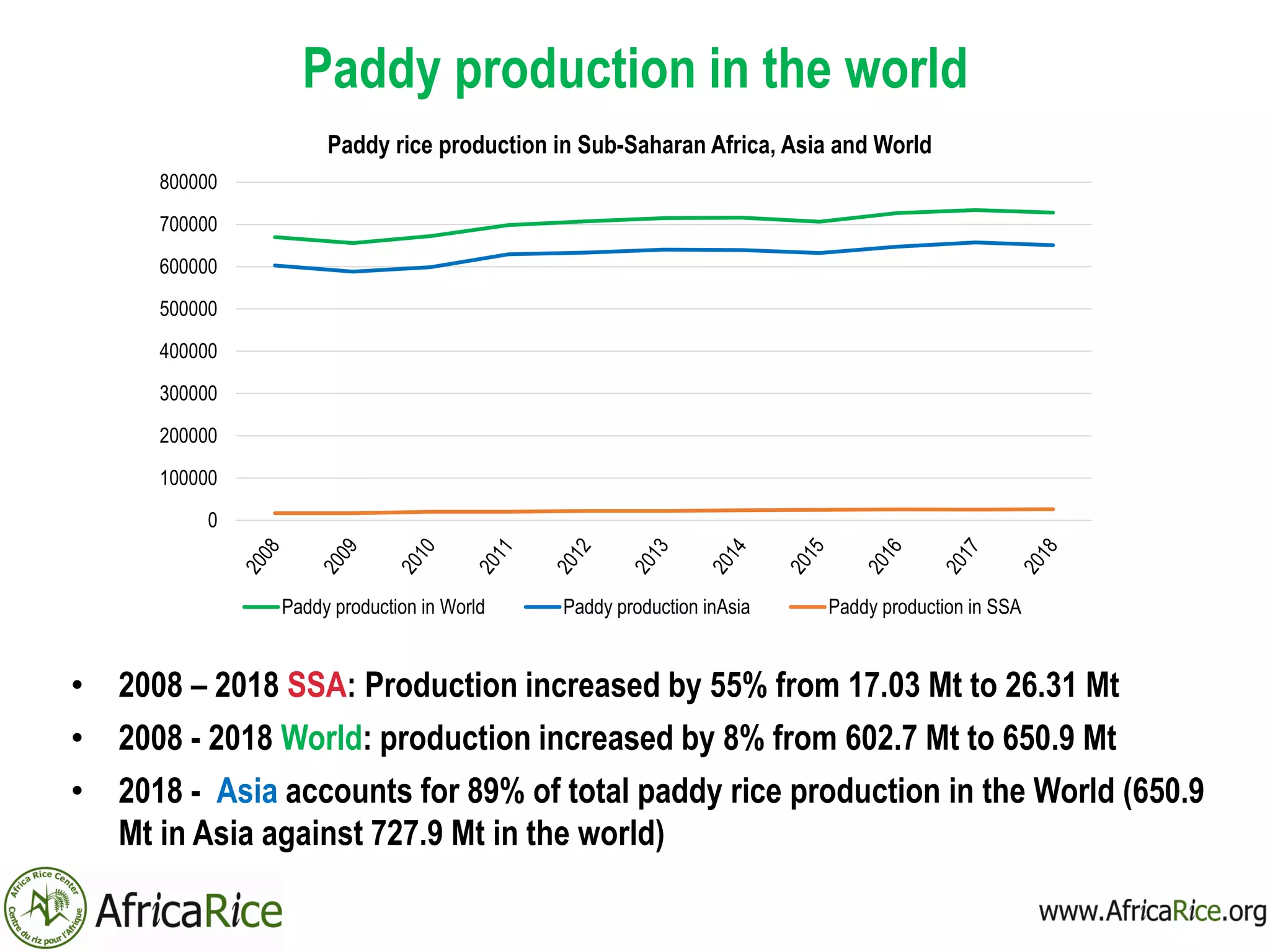

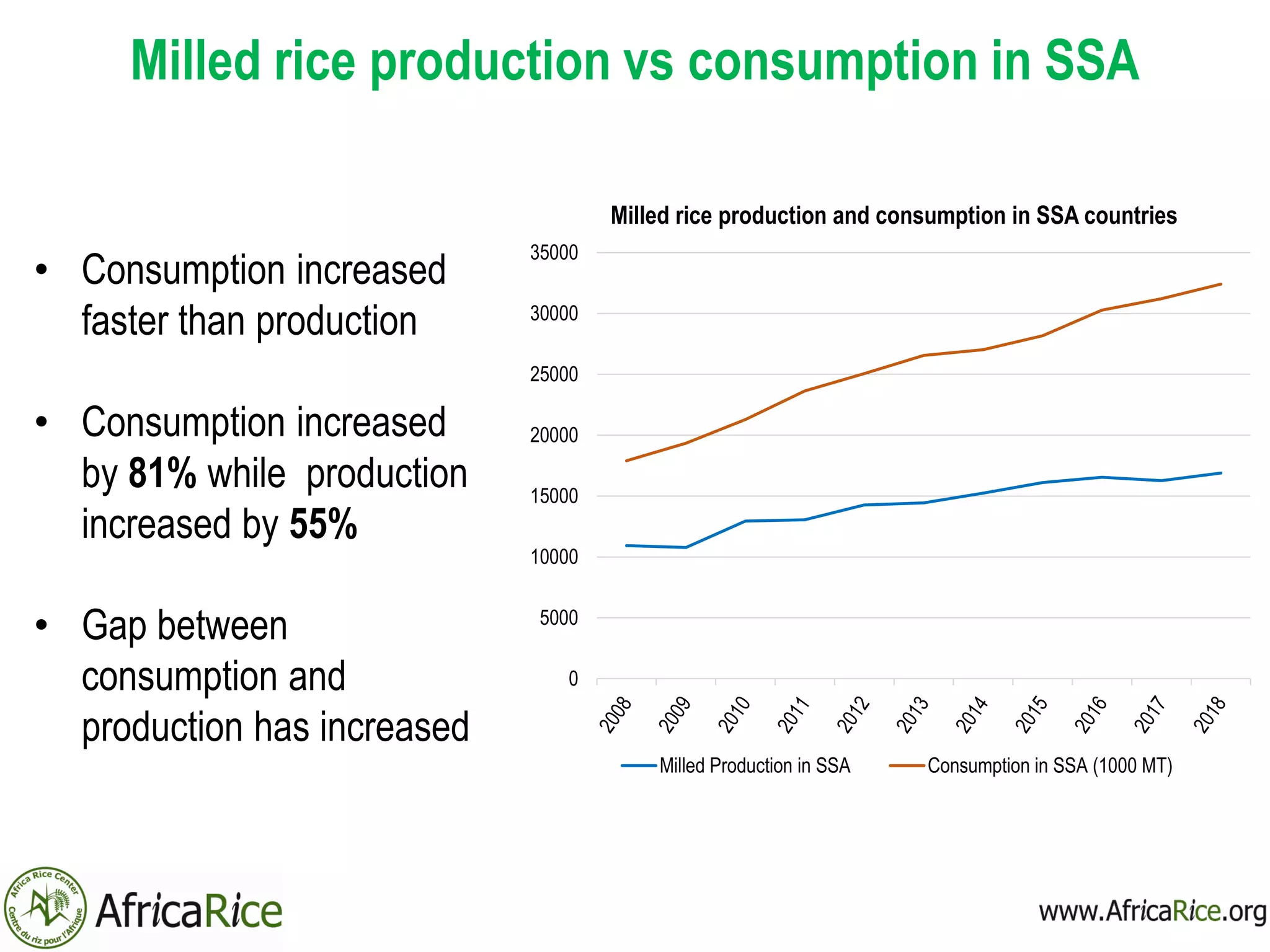

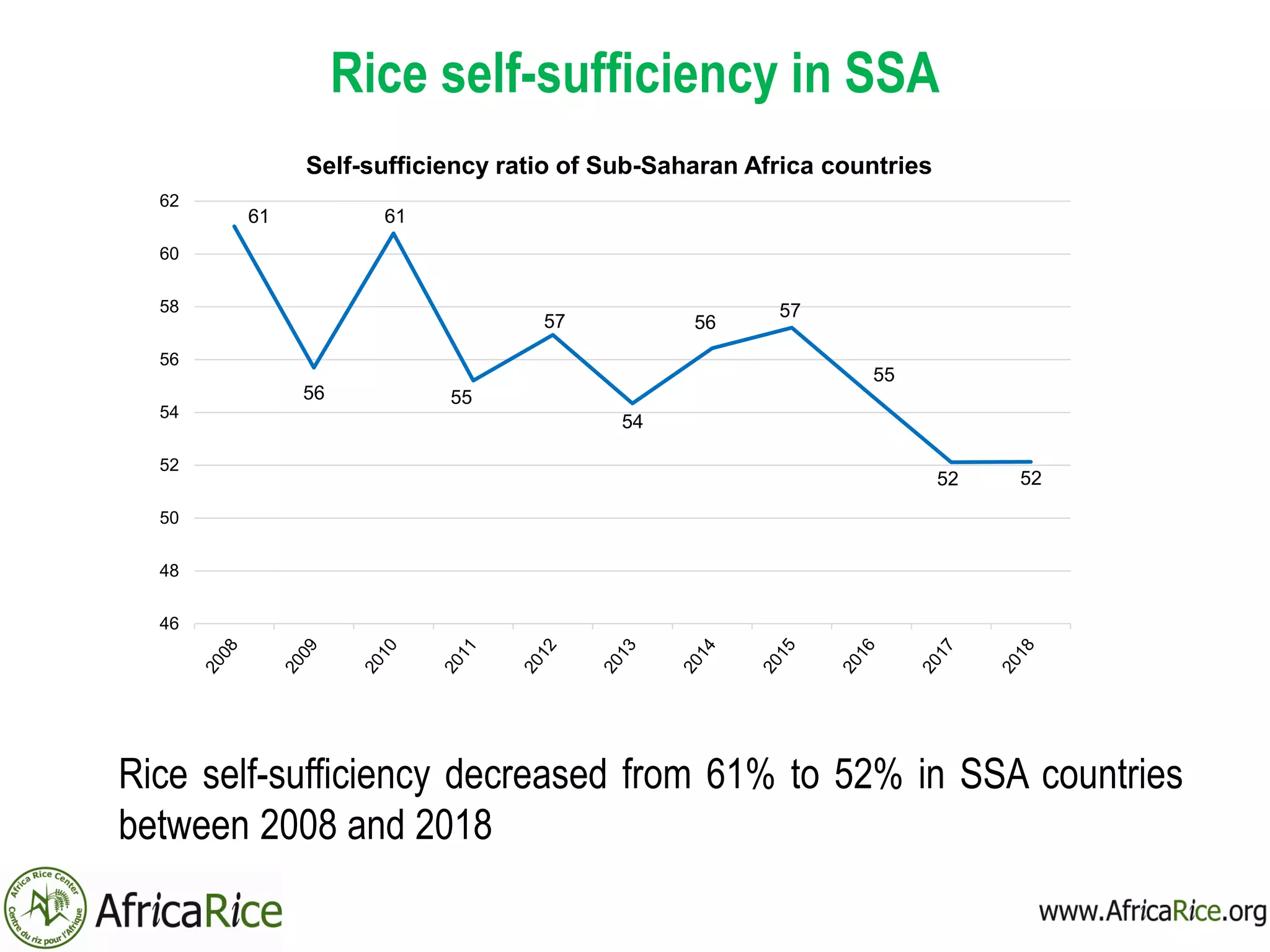

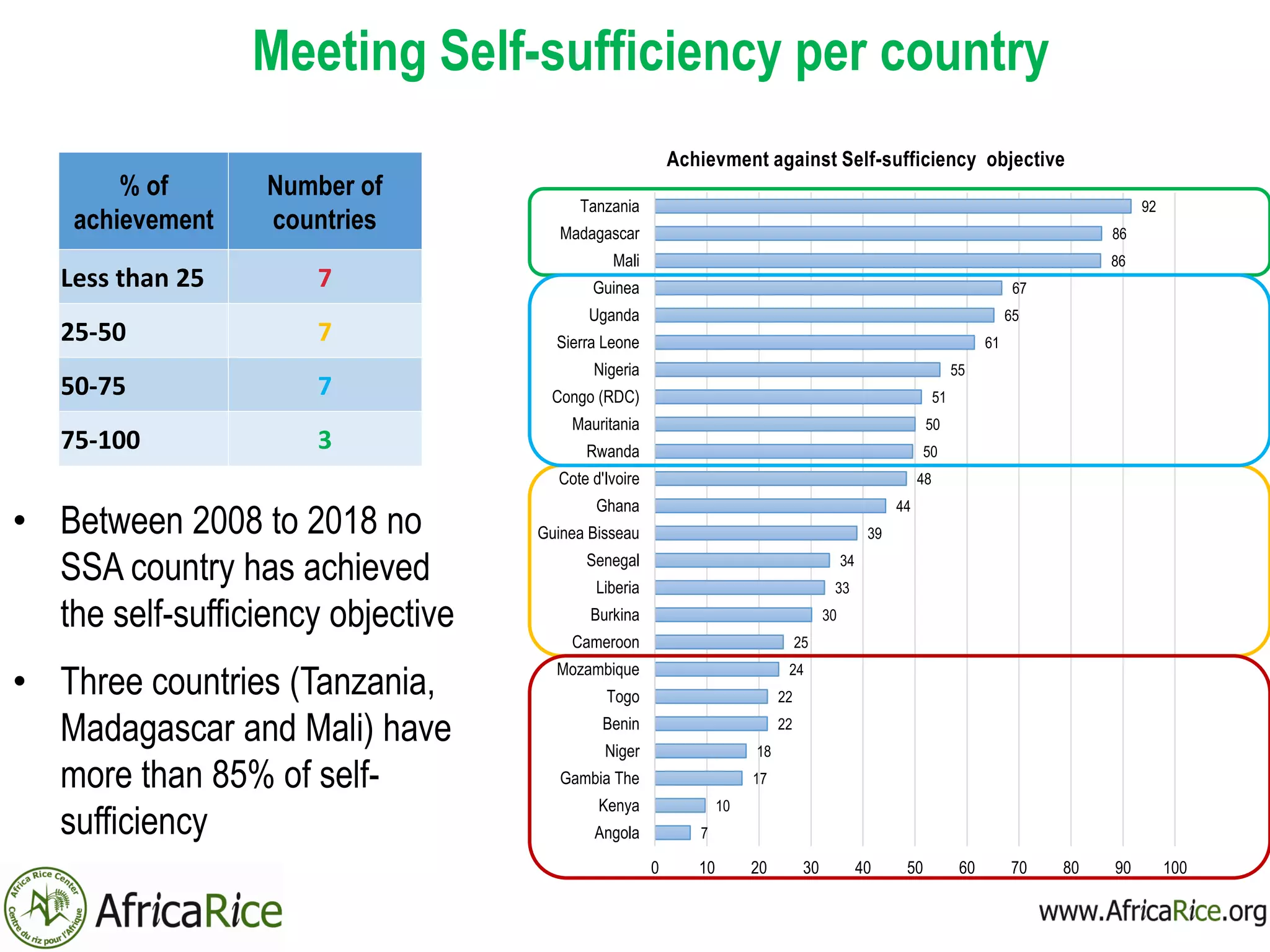

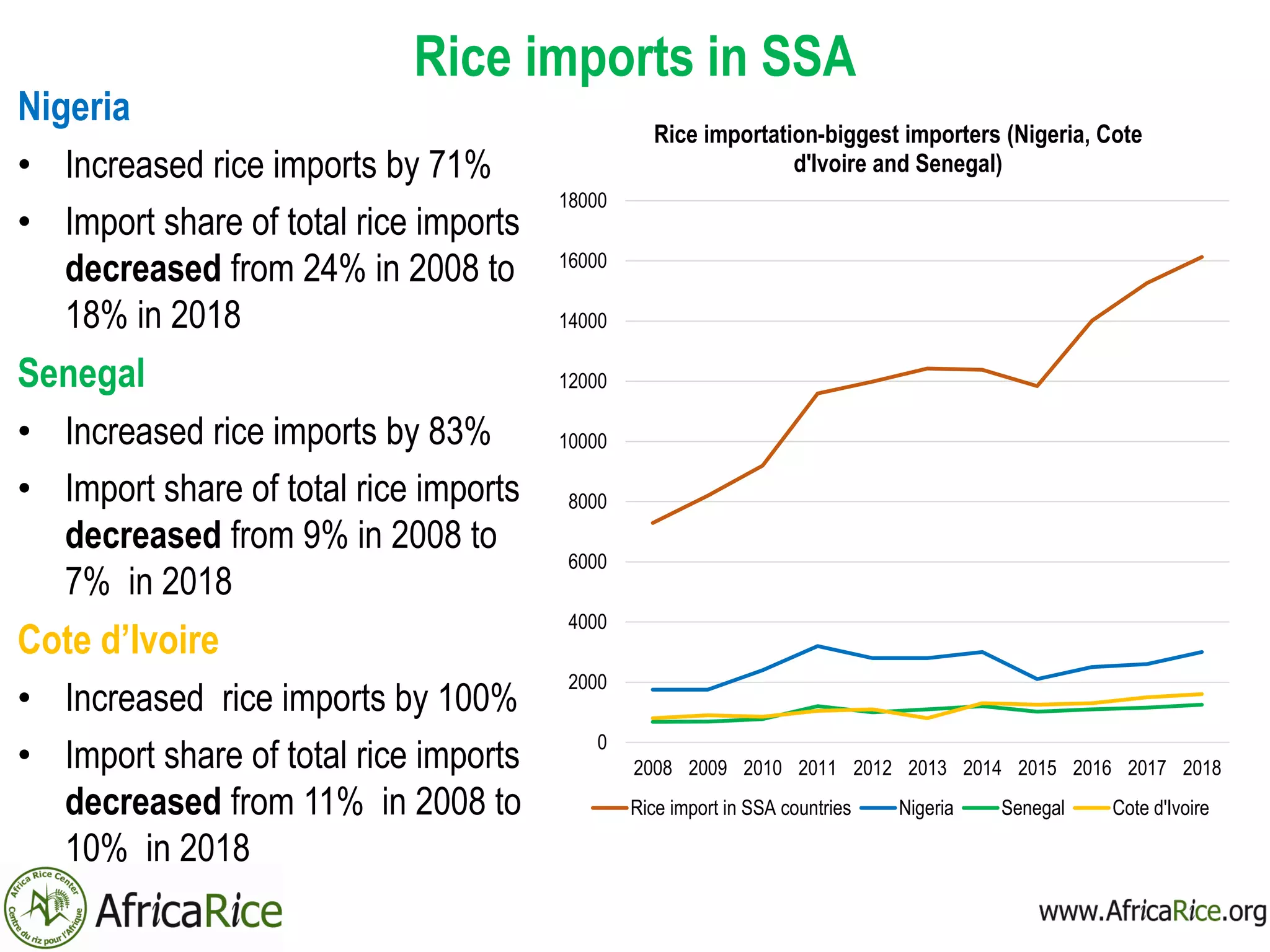

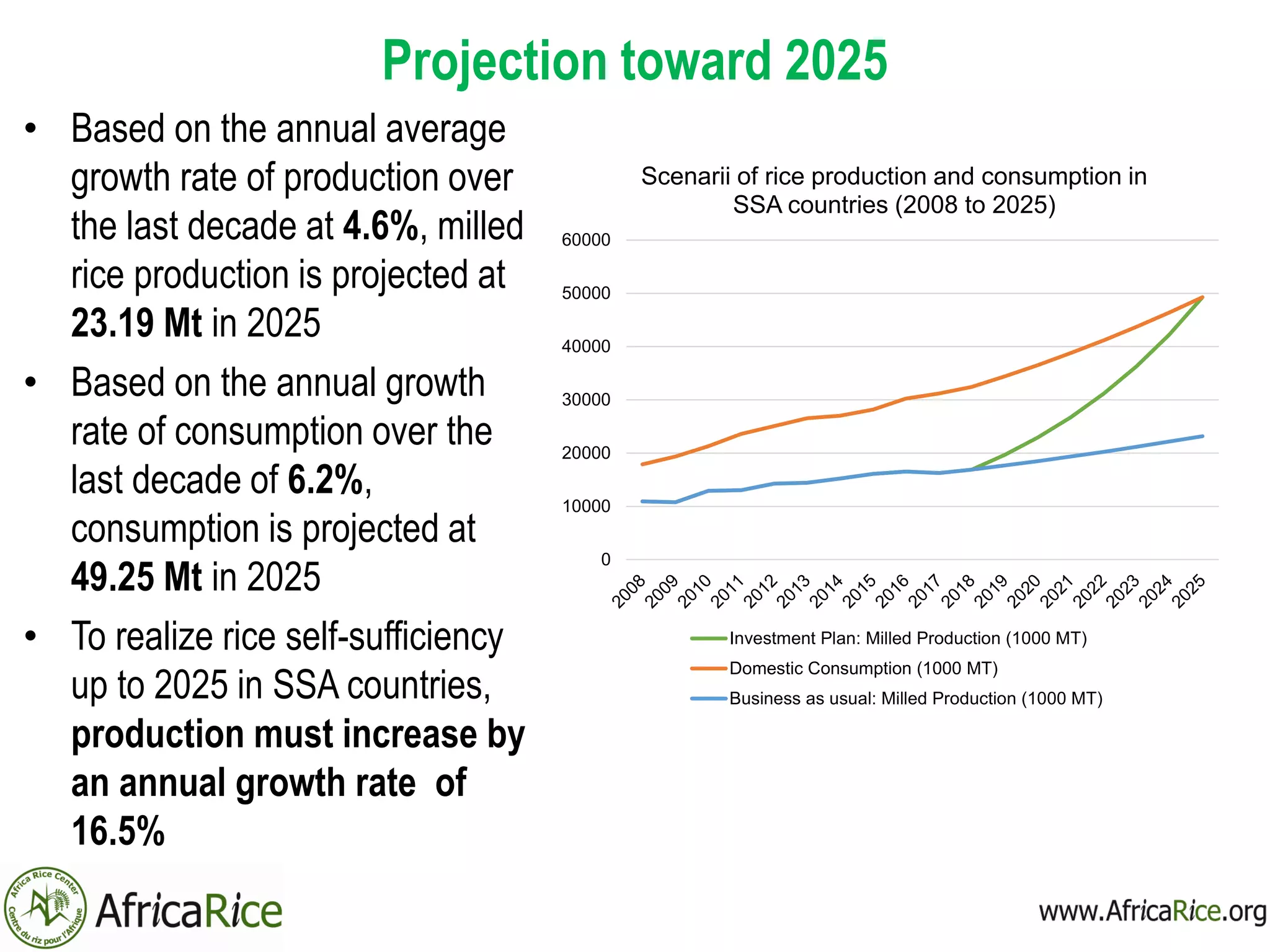

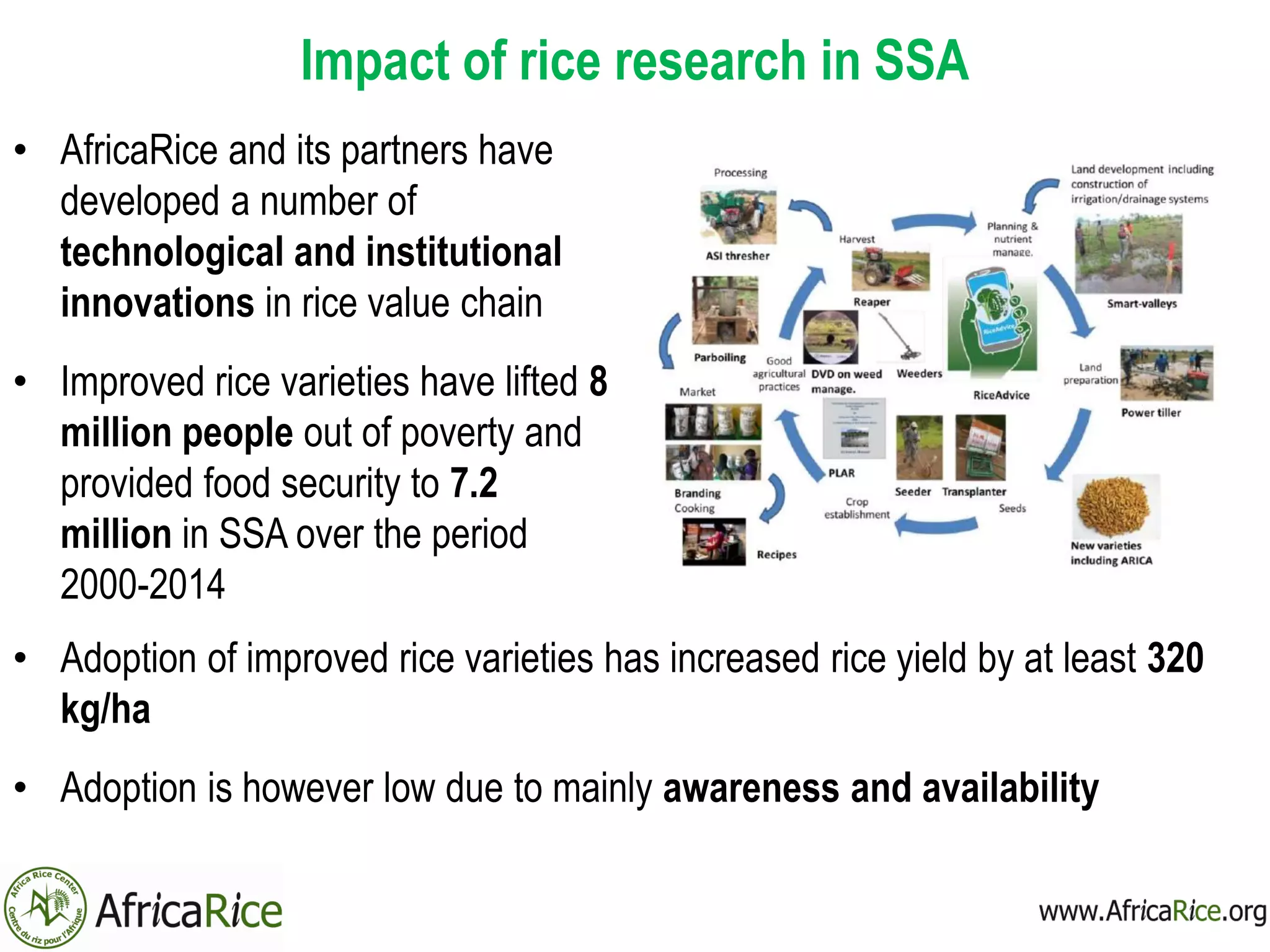

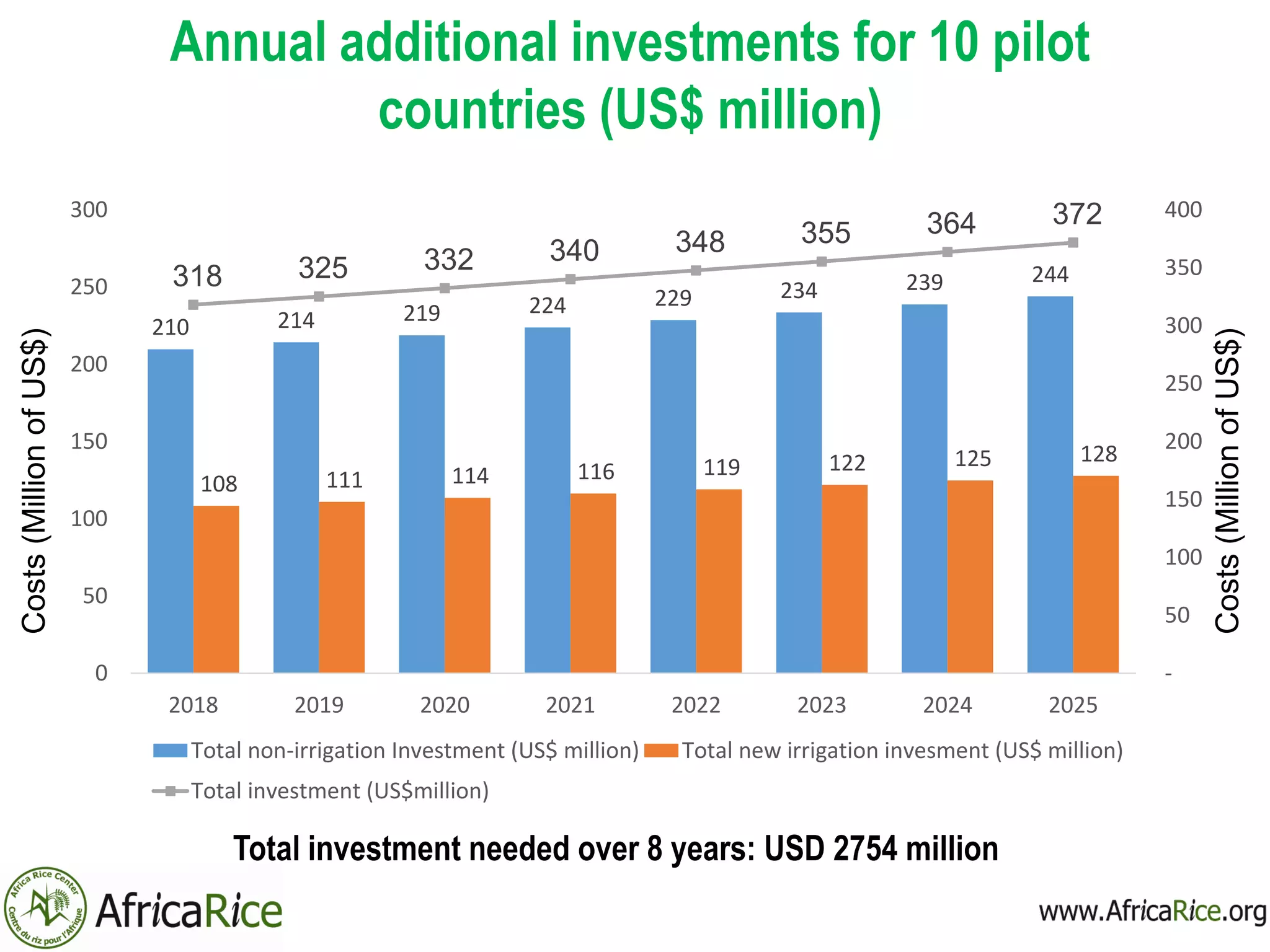

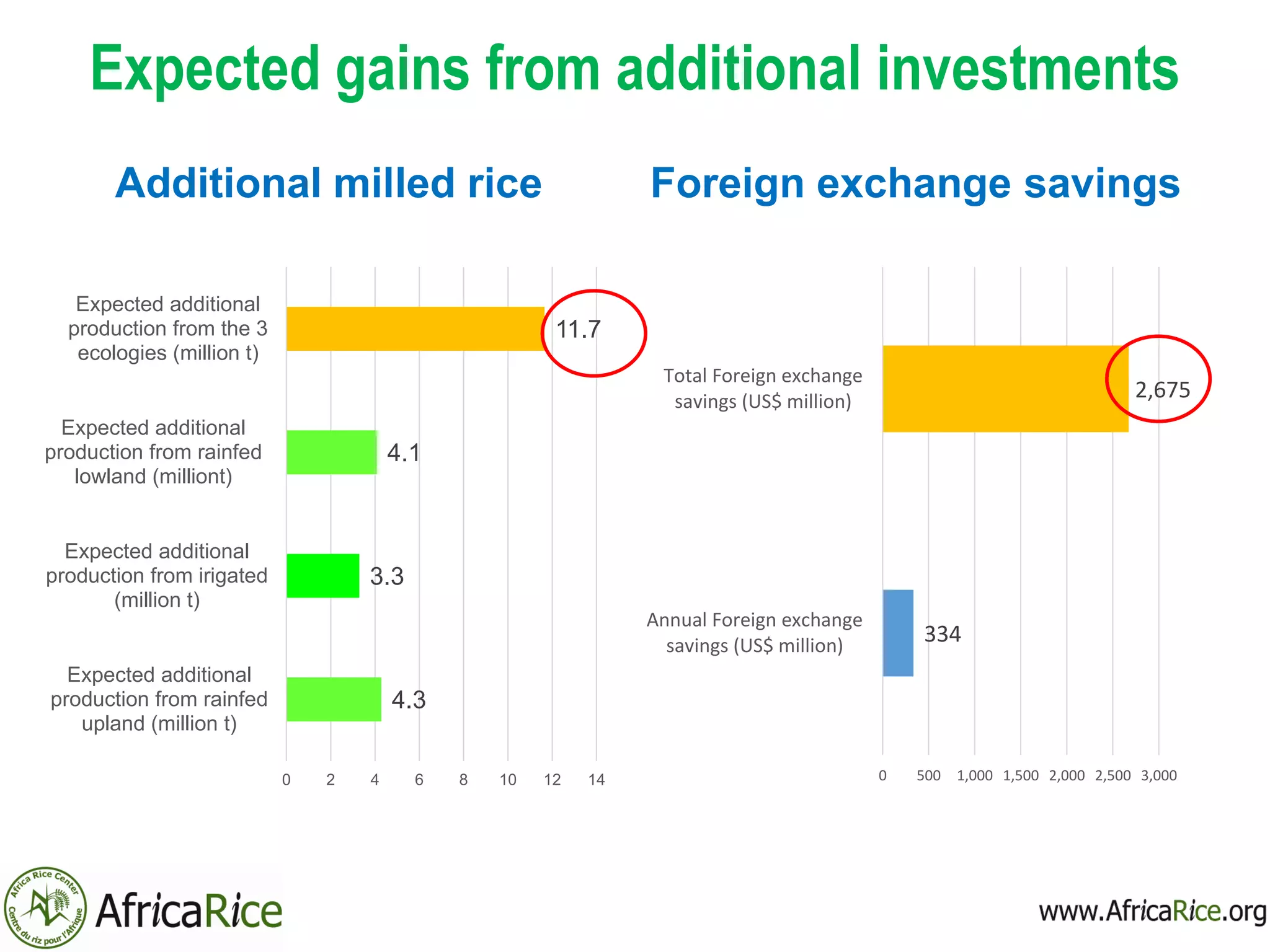

Rice production, area, and consumption have increased substantially in sub-Saharan Africa between 2008-2018, however self-sufficiency levels have decreased. While rice area and production grew by 40% and 55% respectively, consumption rose even faster at 81%, leading to a widening gap. Yield growth also slowed after initial increases following the 2008 food crisis. To achieve rice self-sufficiency by 2025, production would need to increase at over 16% annually through increased investments estimated at $2.7 billion under a new investment plan for 10 pilot countries in sub-Saharan Africa. Additional policy measures are also needed such as reducing rice imports and supporting improved technologies, organization of value chains, and market access for producers.