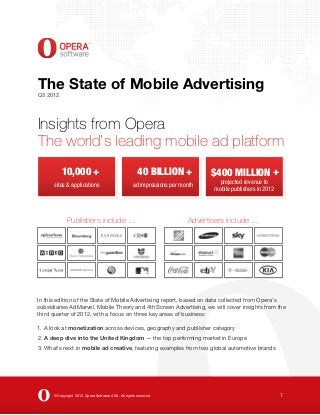

State of Mobile Advertising Q3 2012 by opera

- 1. The State of Mobile Advertising

Q3 2012

Insights from Opera

The world’s leading mobile ad platform

10,000 + 40 BILLION + $400 MILLION +

projected revenue to

sites & applications ad impressions per month

mobile publishers in 2012

Publishers include … Advertisers include …

In this edition of the State of Mobile Advertising report, based on data collected from Opera’s

subsidiaries AdMarvel, Mobile Theory and 4th Screen Advertising, we will cover insights from the

third quarter of 2012, with a focus on three key areas of business:

1. A look at monetization across devices, geography and publisher category

2. A deep dive into the United Kingdom — the top performing market in Europe

3. What’s next in mobile ad creative, featuring examples from two global automotive brands

© Copyright 2012, Opera Software ASA. All rights reserved. 1

- 2. The State of Mobile Advertising

iPhone continues as the top OS in monetization performance

Once again, this quarter, iOS leads the pack in monetization performance with an average

eCPM of $1.64. This outperforms the global average eCPM of $1.31 by over 25%.

Traf c share

iOS Android Other RIM Symbian

46.37% 25.66% 20.04% 4.40% 3.35%

OS share % of traf c % of revenue eCPM

iOS 46.37% 58.40% $1.64

- iPhone 30.43% 34.38% $1.48

- iPad 5.08% 17.19% $4.42

- iTouch 10.81% 6.83% $0.82

Android 25.66% 16.79% $0.88

RIM 4.40% 4.15% $1.06

Symbian 3.53% 0.99% $0.37

Other 20.04% 19.67% $1.28

© Copyright 2012, Opera Software ASA. All rights reserved. 2

- 3. The State of Mobile Advertising

Sports = No. 1 category for mobile ad revenue

Mobile apps drive 73% of revenue across the platform

The overperformance of mobile web is attributed to the relative scarcity of impressions, which

results in a higher eCPM for publishers.

Business, Finance & Investing continues to generate the most revenue per impression

Among all of the publisher categories, Business, Finance & Investing generates more

revenue per impression than any other publisher category. However, this last quarter, the rapidly

growing Sports category — closely followed by Music, Video & Media — caught, and then

overtook, the Business category in terms of total revenue.

Site category

Social

Business, Finance & Investing

Music, Video & Media

Games

Computers & Electronics

News & Information

Sports

Arts & Entertainment

Health, Fitness & Self Help

Other

0 6.25 12.5 18.75 25

% of revenue % of impressions

One noteworthy trend to watch is

the fast trajectory of total Social Social News & Information

Media impressions. As publishers in

Business, Finance & Investing Sports

this category enhance and optimize

Music, Video & Media Arts & Entertainment

their ad offerings, look for levels of

Games Health, Fitness & Self Help

monetization to climb accordingly.

Computers & Electronics Other

© Copyright 2012, Opera Software ASA. All rights reserved. 3

- 4. The State of Mobile Advertising

North America is the home of 7 out of 10 mobile ad requests

Across the Opera platform, North America (United States & Canada) continues to generate the

vast majority of ad requests (70%).

While the list of top countries is similar to that of Q2, Top 25 countries by impressions

the average ll rate improved from 85.2% to 87.4%.

United States

One area of particular interest is the widening gap Indonesia

between the average eCPM of US and EU5 countries and Canada

that of the global and “Rest of World” (ROW) countries. In

Q2, we saw the EU5 eCPM rate almost identical to the United Kingdom (EU5)

global average, while the ROW average was approximately India

17% less than the global average. Today, we find the EU5 Russian Federation

below the global average with the ROW trailing by almost

44%. Japan

Mexico

2% 2% Italy (EU5)

Australia

Vietnam

14% Africa Ukraine

Middle East France (EU5)

10% Asia Paci c

China

European Union

Central & Latin America South Africa

70% 1.3%

North America Netherlands

Saudi Arabia

Germany (EU5)

Singapore

Nigeria

eCPM by region Malaysia

Global average eCPM $1.31 Brazil

US eCPM $1.37 Philippines

EU5 eCPM $1.13 Spain (EU5)

Rest of World $0.73 Republic of Korea

© Copyright 2012, Opera Software ASA. All rights reserved. 4

- 5. The State of Mobile Advertising

Deep dive into the United Kingdom: Mobile as a culture companion,

wellness tool

The United Kingdom is our best performing market in Europe, ahead of Italy and France. It’s

a market with much promise: according to the latest Internet Advertising Bureau UK (IAB)

advertising expen- diture report, mobile ad spend grew 132% year-over-year to reach $291.6

million in the first half of 2012. Mobile now accounts for 7% of all digital ad spend in the United

Kingdom.

We took a deeper look at the types of impressions across our UK traffic and found that UK

mobile users are similar to the rest of the world in that their top destinations are Social

Networking (30%) and Music, Video & Media (22.5%) sites and apps. Comparatively, visits to

these categories are slightly higher than the global average.

However, UK mobile users are considerably less likely than their global counterparts to play

games, consume content about computers & electronics and use their phones for sports

information. They are more likely to interact with content in the Arts & Entertainment and the

Health, Fitness & Self Help categories.

Impressions

Social

Music, Video & Media

Business, Finance & Investing

Games

News & Information

Computers & Electronics

Sports

Arts & Entertainment

Health, Fitness & Self Help

Other

0 7.5 15 22.5 30

UK users Global average

© Copyright 2012, Opera Software ASA. All rights reserved. 5

- 6. The State of Mobile Advertising

Strong showing for UK smartphone usage

While the rest of the world, particularly the United States, seems to be moving away from RIM’s

BlackBerry device, UK adoption is still strong. Traf c from BlackBerry devices is

nearly 4 times that of the US levels.

53.9%

of UK traf c comes

from BlackBerry

14%

of US traf c comes

from Blackberry

© Copyright 2012, Opera Software ASA. All rights reserved. 6

- 7. The State of Mobile Advertising

What’s next in Mobile Creative? Mobile Creative

Perhaps the most exciting part about mobile advertising is the

opportunity to be truly creative, the ability to use (and even invent)

best practices

entirely new types of ad units and visual experiences that push Challenge the user’s

consumers to interact and engage with the brand. expectations.

For Mazda, we used a “break-in”

As we noted in Q2, campaigns that take full advantage of the unit that enters from the outside

sophisticated capabilities of modern smartphones (e.g., HTML5, and places the ad in position. The

camera, video) result in higher dwell times and interaction rates expanded unit dynamically drags

post-click. the ad across the screen, causing

surprise, as the user is accustomed

This quarter, we’ve observed from our most successful creative to the static screen content of their

mobile web browser.

campaigns that those that emphasize fun and simplicity catalyzed

the most user interaction and brand stickiness, while innovative,

Appeal to the senses.

new ad units delivered click-through rates of 5% and higher. They

Mazda’s robotic arm effect was

also generated the most revenue and publisher satisfaction.

visually satisfying because of the

movement, and Fiat’s bright, bold

These best practices are illustrated below, in two campaigns we colors served to add an element

ran in the United Kingdom for two global automotive brands. of fun to its campaign – also

in alignment with the nature of

the brand.

Mazda

Dynamic creative demonstrating the car as strong, but light. Invite the user to

create and customize.

Mobile users are accustomed both

to playing games and creative

expression such as taking photos,

sketching or even including

emoticons within email and text

messages. Ads that allow them to

continue to play and create on

their phones offer incredible brand

engagement opportunities. The Fiat

campaign, for example, allowed

Fiat 500 consumers to swipe the color onto

A swipe changes the color of the car, showing customizability the car, letting them customize the

image as they would want to

customize their cars in real life.

SHOW REEL

© Copyright 2012, Opera Software ASA. All rights reserved. 7