Financial Analysis - Barclays PLC is a global financial services provider engaged in retail banking, credit cards, wholesale banking, investment banking, wealth management and investment management services

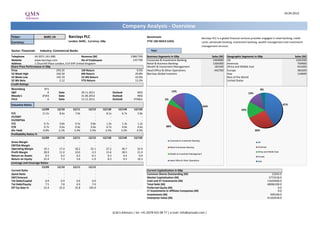

- 1. 24.04.2013 Ticker: Barclays PLC Benchmark: Currency: London: BARC, Currency: GBp FTSE 100 INDEX (UKX) Sector: Financials Industry: Commercial Banks Year: Telephone 44-2071-161-000 Revenue (M) Business Segments in GBp Sales (M) Geographic Segments in GBp Sales (M) Website www.barclays.com No of Employees Corporate & Investment Banking 1464000 UK 1201200 Address 1 Churchill Place London, E14 5HP United Kingdom Retail & Business Banking 1266300 Americas 759900 Share Price Performance in GBp Wealth & Investment Management 181500 Africa and Middle East 451000 Price 293.35 1M Return 0.5% Head Office & Other Operations -442700 Europe 381600 52 Week High 326.50 6M Return 29.8% Barclays Global Investors Asia 110600 52 Week Low 145.19 52 Wk Return 43.0% Rest of the World 52 Wk Beta 2.12 YTD Return 13.2% United States Credit Ratings Bloomberg HY1 S&P A Date 29.11.2011 Outlook NEG Moody's (P)A3 Date 21.06.2012 Outlook NEG Fitch A Date 15.12.2011 Outlook STABLE Valuation Ratios 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E P/E 11.5x 8.6x 7.0x - 8.1x 6.7x 5.8x EV/EBIT - - - - - - - EV/EBITDA - - - - - - - P/S 0.7x 0.8x 0.5x 0.8x 1.3x 1.3x 1.2x P/B 0.7x 0.6x 0.4x 0.6x 0.7x 0.6x 0.6x Div Yield 0.9% 2.1% 3.4% 2.5% 2.5% 3.2% 4.5% Profitability Ratios % 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Gross Margin - - - - - - - EBITDA Margin - - - - - - - Operating Margin 19.1 17.4 18.2 22.1 27.2 30.7 32.9 Profit Margin 28.9 11.0 10.0 -3.3 15.6 18.5 21.0 Return on Assets 0.5 0.2 0.2 -0.1 0.3 0.4 0.4 Return on Equity 22.4 7.3 5.6 -1.9 8.3 9.5 10.3 Leverage and Coverage Ratios 12/09 12/10 12/11 12/12 Current Ratio - - - - Current Capitalization in GBp Quick Ratio - - - - Common Shares Outstanding (M) 12243.0 EBIT/Interest - - - - Market Capitalization (M) 3773318.0 Tot Debt/Capital 0.9 0.9 0.9 0.9 Cash and ST Investments (M) 11635600.0 Tot Debt/Equity 7.5 7.8 6.9 7.0 Total Debt (M) 48096100.0 Eff Tax Rate % 23.4 25.0 32.8 195.9 Preferred Equity (M) 0.0 LT Investments in Affiliate Companies (M) 0.0 Investments (M) 929100.0 Enterprise Value (M) 41162918.0 Barclays PLC is a global financial services provider engaged in retail banking, credit cards, wholesale banking, investment banking, wealth management and investment management services. BARC LN 3'883'700 143'700 Company Analysis - Overview 44% 38% 5% 13% Corporate & Investment Banking Retail & Business Banking Wealth & Investment Management Head Office & Other Operations 41% 26% 16% 13% 4% UK Americas Africa and Middle East Europe Asia Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 2. Barclays PLC Target price in GBp Date Buy Hold Sell Date Price Target Price Broker Analyst Recommendation Target Date 29-Mar-13 64% 27% 9% 24-Apr-13 293.35 363.64 Deutsche Bank JASON NAPIER buy 380.00 24-Apr-13 28-Feb-13 63% 28% 9% 23-Apr-13 298.30 363.64 Investec IAN GORDON buy 345.00 24-Apr-13 31-Jan-13 55% 29% 16% 22-Apr-13 289.50 363.64 RBC Capital Markets FIONA SWAFFIELD outperform 375.00 24-Apr-13 31-Dec-12 52% 32% 16% 19-Apr-13 286.35 363.64 Keefe, Bruyette & Woods MARK J PHIN outperform 400.00 24-Apr-13 30-Nov-12 52% 35% 13% 18-Apr-13 283.75 363.64 Sanford C. Bernstein & Co CHIRANTAN BARUA outperform 400.00 24-Apr-13 31-Oct-12 48% 35% 16% 17-Apr-13 290.30 363.64 Canaccord Genuity Corp GARETH HUNT hold 280.00 24-Apr-13 28-Sep-12 55% 32% 13% 16-Apr-13 294.80 363.38 Nomura CHINTAN JOSHI reduce 305.00 24-Apr-13 31-Aug-12 61% 29% 10% 15-Apr-13 296.75 363.38 Numis Securities Ltd MICHAEL J TRIPPITT buy 400.00 24-Apr-13 31-Jul-12 65% 26% 10% 12-Apr-13 299.30 363.38 Oriel Securities Ltd VIVEK RAJA buy 380.00 24-Apr-13 29-Jun-12 63% 28% 9% 11-Apr-13 303.90 363.38 Societe Generale JAMES INVINE buy 380.00 23-Apr-13 31-May-12 67% 24% 9% 10-Apr-13 298.25 363.38 Credit Suisse CARLA ANTUNES-SILVA neutral 290.00 22-Apr-13 30-Apr-12 67% 24% 9% 9-Apr-13 286.00 363.38 JPMorgan RAUL SINHA overweight 375.00 22-Apr-13 8-Apr-13 277.20 363.38 Exane BNP Paribas TOM RAYNER outperform 400.00 22-Apr-13 5-Apr-13 280.00 363.38 Macquarie EDWARD FIRTH neutral 320.00 19-Apr-13 4-Apr-13 284.90 363.38 AlphaValue DAVID GRINSZTAJN buy 353.00 18-Apr-13 3-Apr-13 289.30 363.38 Bankhaus Lampe NEIL SMITH buy 370.00 17-Apr-13 2-Apr-13 297.50 363.38 Baden Hill LLP JAMIE MOYES sell 12-Apr-13 1-Apr-13 291.15 363.38 Berenberg Bank JAMES CHAPPELL sell 160.00 11-Apr-13 29-Mar-13 291.15 363.38 Day by Day VALERIE GASTALDY buy 361.00 10-Apr-13 28-Mar-13 291.15 363.38 Redburn Partners FAHED KUNWAR buy 8-Apr-13 27-Mar-13 287.90 365.84 Grupo Santander ARTURO DE FRIAS buy 340.00 2-Apr-13 26-Mar-13 287.20 365.84 Mediobanca SpA CHRISTOPHER J WHEELER outperform 425.00 28-Mar-13 25-Mar-13 282.10 365.84 Shore Capital Stockbrokers GARY GREENWOOD hold 28-Mar-13 22-Mar-13 292.00 364.32 Morgan Stanley CHRISTOPHER MANNERS Overwt/In-Line 438.00 25-Mar-13 21-Mar-13 294.60 364.32 EVA Dimensions AUSTIN BURKETT hold 21-Mar-13 20-Mar-13 295.20 364.32 HSBC PETER TOEMAN overweight 400.00 26-Feb-13 19-Mar-13 297.50 364.32 Espirito Santo Investment Bank Research SHAILESH RAIKUNDLIA buy 418.00 26-Feb-13 18-Mar-13 305.95 364.32 Goldman Sachs FREDERIK THOMASEN neutral/neutral 340.00 19-Feb-13 15-Mar-13 320.05 364.32 S&P Capital IQ FRANK BRADEN buy 380.00 13-Feb-13 14-Mar-13 317.90 364.32 Independent Research GmbH STEFAN BONGARDT buy 350.00 12-Feb-13 Company Analysis - Analysts Ratings Buy and Sell Recommendations vs Price and Target Price 67% 67% 63% 65% 61% 55% 48% 52% 52% 55% 63% 64% 24% 24% 28% 26% 29% 32% 35% 35% 32% 29% 28% 27% 9% 9% 9% 10% 10% 13% 16% 13% 16% 16% 9% 9% 0% 20% 40% 60% 80% 100% avr.12 mai.12 juin.12 juil.12 août.12 sept.12 oct.12 nov.12 déc.12 janv.13 févr.13 mars.13 BrokerRecommendation 0 50 100 150 200 250 300 350 400 Price Buy Hold Sell Price Target Price Brokers' Target Price 0 50 100 150 200 250 300 350 400 450 500 DeutscheBank Investec RBCCapitalMarkets Keefe,Bruyette&Woods SanfordC.Bernstein&Co CanaccordGenuityCorp Nomura NumisSecuritiesLtd OrielSecuritiesLtd SocieteGenerale CreditSuisse JPMorgan ExaneBNPParibas Macquarie AlphaValue BankhausLampe BadenHillLLP BerenbergBank DaybyDay RedburnPartners GrupoSantander MediobancaSpA ShoreCapitalStockbrokers MorganStanley EVADimensions HSBC EspiritoSantoInvestmentBank Research GoldmanSachs S&PCapitalIQ IndependentResearchGmbH LiberumCapitalLtd Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 3. 24.04.2013 Barclays PLC Ownership Statistics Geographic Ownership Distribution Shares Outstanding (M) 12243.0 United States 34.10% Float 87.6% Britain 30.49% Short Interest (M) Unknown Country 9.95% Short Interest as % of Float Qatar 7.58% Days to Cover Shorts Luxembourg 2.84% Institutional Ownership 76.75% Japan 2.68% Retail Ownership 23.09% Switzerland 1.54% Insider Ownership 0.16% Others 10.83% Institutional Ownership Distribution Investment Advisor 63.18% Government 9.93% Bank 7.73% Individual 7.23% Pricing data is in GBp Others 11.93% Top 20 Owners: Holder Name Position Position Change Market Value % of Ownership Report Date Source Country QATAR HOLDINGS LLC 813'964'552 0 238'776'501'329 6.33% 01.02.2013 REG QATAR AL NAHYAN MANSOUR BI 758'437'618 0 222'487'675'240 5.90% 18.04.2013 RNS-MAJ n/a BLACKROCK 690'750'564 0 202'631'677'949 5.37% 22.04.2013 ULT-AGG UNITED STATES CAPITAL GROUP COMPAN 492'619'694 120'690'937 144'509'987'235 3.83% 31.03.2013 ULT-AGG UNITED STATES LEGAL & GENERAL 446'002'615 13'623'199 130'834'867'110 3.47% 01.02.2013 ULT-AGG FMR LLC 407'892'662 -62'197'802 119'655'312'398 3.17% 28.02.2013 ULT-AGG UNITED STATES SCOTTISH WIDOWS 304'001'751 7'602'767 89'178'913'656 2.36% 01.02.2013 ULT-AGG NORGES BANK INVESTME 293'887'216 9'654'863 86'211'814'814 2.28% 01.02.2013 REG NORWAY UPPER CHANCE GROUP L 248'872'808 0 73'006'838'227 1.93% 01.02.2013 REG UK DODGE & COX 247'149'298 -920'319 72'501'246'568 1.92% 31.03.2013 MF-AGG UNITED STATES DODGE & COX 247'149'298 -19'000'000 72'501'246'568 1.92% 01.02.2013 REG UNITED STATES STANDARD LIFE INVEST 235'301'396 -4'091'569 69'025'664'517 1.83% 01.02.2013 REG BRITAIN UBS 214'394'548 -58'774'511 62'892'640'656 1.67% 28.02.2013 ULT-AGG BARCLAYS PERSONAL IN 210'027'061 -18'528'345 61'611'438'344 1.63% 01.02.2013 REG BRITAIN SUMITOMO MITSUI FINA 194'608'412 -259'690 57'088'377'660 1.51% 01.02.2013 ULT-AGG JAPAN STATE STREET 184'817'876 -34'284'218 54'216'323'925 1.44% 23.04.2013 ULT-AGG UNITED STATES VANGUARD GROUP INC 160'323'919 -1'381'358 47'031'021'639 1.25% 31.03.2013 MF-AGG UNITED STATES FRANKLIN RESOURCES 149'488'179 -11'569'337 43'852'357'310 1.16% 01.02.2013 ULT-AGG UNITED STATES VANGUARD GROUP INC 146'704'193 6'134'884 43'035'675'017 1.14% 01.02.2013 REG UNITED STATES PEOPLES REPUBLIC OF 129'472'703 2'971'061 37'980'817'425 1.01% 01.02.2013 REG CHINA Top 5 Insiders: Holder Name Position Position Change Market Value % of Ownership Report Date Source DIAMOND JR ROBERT EDWARD 13'412'839 6'510 3'934'656'321 0.10% 15.06.2012 RNS-DIR JENKINS ANTONY P 2'452'083 536 719'318'548 0.02% 25.03.2013 RNS-DIR LUCAS CHRISTOPHER 1'114'623 9'860 326'974'657 0.01% 21.03.2013 RNS-DIR AGIUS MARCUS A P 232'244 68'128'777 0.00% 02.03.2012 Co File SUNDERLAND JOHN M 98'302 2'487 28'836'892 0.00% 19.02.2013 RNS-DIR Company Analysis - Ownership Ownership Type 77% 23% 0% Institutional Ownership Retail Ownership Insider Ownership Geographic Ownership 33% 11% 10% 3% 8% 3% 2% 30% United States Britain Unknown Country Qatar Luxembourg Japan Switzerland Others Institutional Ownership 63% 8% 12% 7% 10% Investment Advisor Government Bank Individual Others TOP 20 ALL Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 4. Barclays PLC Financial information is in GBp (M) Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Income Statement Revenue 1'769'500 1'886'700 2'181'700 2'721'500 3'508'500 3'966'800 3'715'900 4'178'900 4'005'800 3'842'800 3'883'700 2'927'873 3'010'932 3'108'065 - Cost of Goods Sold Gross Income - Selling, General & Admin Expenses 662'500 725'200 852'700 1'051'800 1'308'500 1'319'900 1'339'700 1'668'200 1'972'800 1'918'000 1'913'900 (Research & Dev Costs) Operating Income 321'800 381'200 448'800 524'400 635'600 700'600 72'000 619'000 564'900 547'200 690'800 795'113 923'525 1'022'500 - Interest Expense - Foreign Exchange Losses (Gains) - Net Non-Operating Losses (Gains) 1'300 -3'300 -9'200 -3'600 -78'000 -7'000 -441'600 160'500 -41'600 -40'700 666'200 Pretax Income 320'500 384'500 458'000 528'000 713'600 707'600 513'600 458'500 606'500 587'900 24'600 724'492 863'296 1'491'972 - Income Tax Expense 95'500 107'600 127'900 143'900 194'100 198'100 45'300 107'400 151'600 192'800 48'200 Income Before XO Items 225'000 276'900 330'100 384'100 519'500 509'500 468'300 351'100 454'900 395'100 -23'600 - Extraordinary Loss Net of Tax 0 0 0 0 0 0 -60'400 -677'700 0 0 0 - Minority Interests 2'000 2'500 4'700 39'400 62'400 67'800 90'500 89'500 98'500 94'400 80'500 Diluted EPS Before XO Items 32.55 41.02 48.72 51.76 68.41 65.30 49.86 22.78 28.62 24.01 (8.25) Net Income Adjusted* 223'000 274'000 322'300 344'700 438'400 441'700 197'600 288'500 328'248 304'300 421'800 455'748 557'023 652'873 EPS Adjusted 32.82 0.00 49.66 52.97 67.20 67.10 26.70 26.50 28.00 25.40 34.50 36.42 43.82 51.00 Dividends Per Share 17.87 19.96 23.37 25.91 30.19 33.11 11.50 2.50 5.50 6.00 6.50 7.24 9.36 13.19 Payout Ratio % 54.1 48.8 47.0 48.9 43.2 51.0 24.0 11.0 18.8 24.2 0.20 0.21 0.26 Total Shares Outstanding 6'757 6'744 6'627 6'664 6'710 6'778 8'372 11'412 12'182 12'199 12'243 Diluted Shares Outstanding 6'852 6'689 6'679 6'660 6'682 6'764 7'577 11'484 12'452 12'526 12'614 EBITDA *Net income excludes extraordinary gains and losses and one-time charges. Equivalent Estimates Company Analysis - Financials I/IV Fiscal Year Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 5. Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Balance Sheet Total Current Assets + Cash & Near Cash Items 436'700 373'200 352'500 580'700 975'300 763'700 3'171'400 8'307'600 9'901'400 10'870'600 8'763'100 + Short Term Investments 5'114'800 5'448'600 9'694'800 30'531'700 34'416'700 38'424'300 37'181'200 25'039'500 27'546'200 19'401'300 26'620'000 + Accounts & Notes Receivable + Inventories + Other Current Assets Total Long-Term Assets + Long Term Investments 5'385'500 5'794'300 5'142'000 6'361'000 0 Gross Fixed Assets Accumulated Depreciation + Net Fixed Assets 162'600 179'000 228'200 275'400 249'200 299'600 467'400 562'600 614'000 716'600 575'400 + Other Long Term Assets 3'149'400 3'666'700 4'096'500 15'008'000 15'305'900 26'389'200 100'490'400 43'504'200 43'751'600 55'698'700 48'717'200 Total Current Liabilities + Accounts Payable + Short Term Borrowings 11'794'300 11'418'200 21'738'100 15'006'900 16'181'900 17'816'600 22'165'900 15'491'200 17'782'300 16'260'000 12'852'300 + Other Short Term Liabilities 4'538'200 5'590'000 2'128'000 20'784'700 36'855'900 25'003'500 22'319'200 15'583'200 17'238'900 13'625'000 12'526'800 Total Long Term Liabilities + Long Term Borrowings 2'691'300 4'181'800 4'366'500 4'122'500 4'281'200 5'075'800 7'266'000 8'325'200 8'527'400 8'312'200 9'208'600 + Other Long Term Borrowings 2'596'900 2'983'700 2'159'900 14'092'400 249'700 25'151'000 97'026'800 40'524'500 42'057'500 54'303'500 47'843'800 Total Liabilities 38'770'500 42'660'500 52'141'700 89'992'700 96'939'700 119'488'500 200'556'900 132'045'100 142'738'300 149'833'100 142'736'400 + Long Preferred Equity 0 0 0 0 0 0 0 0 0 0 0 + Minority Interest 15'600 28'300 89'400 700'400 759'100 918'500 1'079'300 1'120'100 1'140'400 960'700 937'100 + Share Capital & APIC 753'900 767'600 806'400 819'900 745'200 170'700 613'800 1'080'400 1'233'900 1'238'000 1'247'700 + Retained Earnings & Other Equity 766'200 879'700 780'600 922'700 1'234'700 2'158'400 3'048'000 3'647'300 3'851'900 4'320'900 4'110'900 Total Shareholders Equity 1'535'700 1'675'600 1'676'400 2'443'000 2'739'000 3'247'600 4'741'100 5'847'800 6'226'200 6'519'600 6'295'700 Total Liabilities & Equity 40'306'200 44'336'100 53'818'100 92'435'700 99'678'700 122'736'100 205'298'000 137'892'900 148'964'500 156'352'700 149'032'100 Book Value Per Share 224.98 244.25 239.47 261.49 295.05 343.62 437.39 414.27 417.48 455.68 437.69 434.50 460.98 491.94 Tangible Book Value Per Share 166.76 178.92 169.20 152.08 186.16 221.23 313.14 337.21 346.09 391.37 373.04 Company Analysis - Financials II/IV Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 6. Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Cash Flows Net Income 223'000 274'400 325'400 344'700 457'100 441'700 438'200 939'300 356'400 300'700 -104'100 425'125 521'100 599'231 + Depreciation & Amortization 202'900 190'100 142'100 202'100 276'600 346'400 630'400 926'700 701'800 670'600 471'500 + Other Non-Cash Adjustments 1'272'200 941'800 -241'200 2'695'300 -1'715'900 -3'123'000 319'400 4'690'500 760'500 -742'000 -1'502'700 + Changes in Non-Cash Capital -3'634'100 -2'546'000 -2'176'100 -3'270'100 31'000 0 0 0 Cash From Operating Activities -1'936'000 -1'139'700 -1'949'800 -28'000 -951'200 -2'334'900 1'388'000 6'556'500 1'818'700 229'300 -1'135'300 + Disposal of Fixed Assets 28'900 9'700 12'500 9'800 78'600 61'700 79'900 37'200 55'600 + Capital Expenditures -30'100 -31'000 -53'200 -58'800 -65'400 -124'100 -164'300 -115'000 -176'700 -145'400 -60'400 + Increase in Investments -2'812'800 -3'688'600 -4'752'000 -5'348'300 -4'708'600 -2'689'900 -5'775'600 -7'842'000 -7'641'800 -6'752'500 -8'079'600 + Decrease in Investments 2'138'400 3'853'100 4'116'300 5'111'100 4'606'900 3'842'300 5'142'900 8'855'900 7'125'100 6'694'100 7'376'900 + Other Investing Activities -61'200 -93'000 -24'900 -234'200 -26'900 -83'600 -149'100 252'700 75'100 12'600 53'200 Cash From Investing Activities -1'618'000 -832'900 -4'977'600 -6'838'100 -2'853'900 -6'792'300 -6'709'300 3'737'000 -6'883'900 3'642'800 -486'800 + Dividends Paid -114'600 -124'900 -142'500 -189'400 -221'500 -255'900 -269'700 -63'300 -130'700 -138'700 -142'700 + Change in Short Term Borrowings 0 0 0 0 0 0 + Increase in Long Term Borrowings 217'300 192'600 66'600 117'900 4'943'700 9'521'400 576'300 354'900 213'100 88'000 225'800 + Decrease in Long Term Borrowings -37'600 -97'400 -61'100 -46'400 -36'600 -68'300 -120'700 -438'300 -121'100 -400'300 -268'000 + Increase in Capital Stocks 8'700 11'300 6'000 13'800 17'900 249'400 959'200 80'600 153'500 4'100 9'700 + Decrease in Capital Stocks -54'600 -20'400 -73'400 -14'300 -3'100 -185'000 -17'300 0 -98'900 -23'500 -97'900 + Other Financing Activities 65'600 331'300 453'400 1'606'600 119'400 78'100 -437'600 -324'000 384'200 -419'000 -422'000 Cash From Financing Activities 3'433'300 1'935'400 6'993'700 6'786'400 4'819'800 9'339'700 8'464'500 -5'310'400 6'771'200 -2'044'800 -1'154'500 Net Changes in Cash -120'700 -37'200 66'300 -79'700 1'014'700 212'500 3'143'200 4'983'100 1'706'000 1'827'300 -2'776'600 Free Cash Flow (CFO-CAPEX) -1'966'100 -1'170'700 -2'003'000 -86'800 -1'016'600 -2'459'000 1'223'700 6'441'500 1'642'000 83'900 -1'195'700 Free Cash Flow To Firm Free Cash Flow To Equity -1'757'500 -1'065'800 -1'985'000 -5'500 3'969'100 7'055'800 1'759'200 6'395'300 1'789'600 -228'400 -1'237'900 Free Cash Flow per Share -288.97 -175.86 -305.70 -13.34 -155.74 -373.60 165.61 591.51 140.11 7.00 -97.81 Company Analysis - Financials III/IV Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 7. Periodicity: 12/02 12/03 12/04 12/05 12/06 12/07 12/08 12/09 12/10 12/11 12/12 12/13E 12/14E 12/15E Ratio Analysis Valuation Ratios Price Earnings 11.4x 11.8x 11.5x 11.2x 10.2x 7.3x 3.0x 11.5x 8.6x 7.0x 8.1x 6.7x 5.8x EV to EBIT EV to EBITDA Price to Sales 1.4x 1.7x 1.7x 1.4x 1.3x 0.8x 0.3x 0.7x 0.8x 0.5x 0.8x 1.3x 1.3x 1.2x Price to Book 1.7x 2.0x 2.4x 2.3x 2.4x 1.4x 0.4x 0.7x 0.6x 0.4x 0.6x 0.7x 0.6x 0.6x Dividend Yield 4.8% 4.1% 4.1% 4.4% 4.2% 6.7% 7.5% 0.9% 2.1% 3.4% 2.5% 2.5% 3.2% 4.5% Profitability Ratios Gross Margin EBITDA Margin - - - Operating Margin 27.1% 29.2% 30.4% 29.0% 28.3% 29.2% 3.5% 19.1% 17.4% 18.2% 22.1% 27.2% 30.7% 32.9% Profit Margin 18.8% 21.0% 22.0% 19.1% 20.4% 18.4% 21.3% 28.9% 11.0% 10.0% -3.3% 15.6% 18.5% 21.0% Return on Assets 0.6% 0.6% 0.7% 0.5% 0.5% 0.4% 0.3% 0.5% 0.2% 0.2% -0.1% 0.3% 0.4% 0.4% Return on Equity 15.0% 17.3% 20.1% 20.7% 24.6% 20.5% 14.6% 22.4% 7.3% 5.6% -1.9% 8.3% 9.5% 10.3% Leverage & Coverage Ratios Current Ratio Quick Ratio Interest Coverage Ratio (EBIT/I) Tot Debt/Capital 0.90 0.90 0.94 0.93 0.93 0.92 0.91 0.88 0.89 0.87 0.87 Tot Debt/Equity 9.43 9.31 15.57 12.79 12.47 12.27 10.05 7.47 7.85 6.95 6.96 Others Asset Turnover 0.05 0.04 0.04 0.04 0.04 0.04 0.02 0.02 0.03 0.03 0.03 Accounts Receivable Turnover Accounts Payable Turnover Inventory Turnover Effective Tax Rate 29.8% 28.0% 27.9% 27.3% 27.2% 28.0% 8.8% 23.4% 25.0% 32.8% 195.9% Company Analysis - Financials IV/IV Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |

- 8. BARCLAYS PLC ROYAL BK SCOTLAN LLOYDS BANKING HSBC HLDGS PLC STANDARD CHARTER DEUTSCHE BANK- RG UBS AG-REG JPMORGAN CHASE CITIGROUP INC BANCO SANTANDER MITSUBISHI UFJ F BANK NY MELLON MIZUHO FINANCIAL ROYAL BANK OF CA CAN IMPL BK COMM 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 12/2012 03/2012 12/2012 03/2012 10/2012 10/2012 330.05 369.60 56.10 741.20 1'860.50 38.73 16.39 51.00 47.92 6.68 692.00 29.13 225.00 64.92 84.99 13.02.2013 28.01.2013 20.02.2013 14.03.2013 05.03.2013 01.02.2013 25.01.2013 14.03.2013 11.03.2013 14.01.2013 10.04.2013 14.03.2013 05.04.2013 20.02.2013 20.02.2013 148.20 193.30 24.75 501.20 1'092.00 22.11 9.69 30.83 24.61 3.98 328.00 19.30 110.00 48.70 69.13 26.07.2012 24.07.2012 30.05.2012 30.05.2012 07.08.2012 26.07.2012 24.07.2012 04.06.2012 04.06.2012 23.07.2012 04.06.2012 04.06.2012 04.06.2012 04.06.2012 04.06.2012 42'287'839 3'861'320 74'296'559 7'407'797 869'699 4'343'215 5'855'902 20'568'406 28'839'907 60'588'641 71'746'800 7'348'147 182'845'800 4'161'589 1'329'435 293.35 293.60 51.15 693.00 1'636.50 31.78 15.40 48.17 46.46 5.53 646.00 27.54 214.00 59.87 77.88 -11.1% -20.6% -8.8% -6.5% -12.0% -18.0% -6.0% -5.5% -3.0% -17.2% -6.6% -5.4% -4.9% -7.8% -8.4% 97.9% 51.9% 106.7% 38.3% 49.9% 43.7% 59.0% 56.2% 88.8% 39.1% 97.0% 42.7% 94.5% 22.9% 12.7% 12'243.0 11'170.8 70'423.8 18'476.0 2'413.0 929.2 3'747.4 3'804.0 3'028.9 10'321.0 14'145.0 1'163.5 24'011.1 1'444.8 404.5 37'733 32'907 36'480 128'651 39'569 29'535 59'089 182'555 141'373 60'004 9'146'446 32'000 5'171'281 86'592 31'206 437'951.0 316'688.0 194'299.0 284'987.0 111'255.0 278'501.0 267'401.0 695'583.0 623'537.0 367'524.0 53'760'773.0 62'098.0 54'752'099.0 113'303.0 26'167.0 - - - 2'728.0 - - - 9'058.0 2'562.0 - 390'001.0 1'068.0 410'368.0 4'813.0 1'706.0 9'371.0 2'318.0 685.0 7'887.0 693.0 407.0 4'353.0 - 1'948.0 9'672.0 1'674'821.0 1'011.0 1'957'699.0 1'761.0 172.0 128'120.0 108'458.0 105'871.0 256'366.0 129'424.0 147'433.0 66'383.0 471'833.0 36'453.0 182'116.0 9'384'046.0 145'340.0 7'527'509.0 22'872.0 4'727.0 - - - - - - 264'460 - 799'437 - - - - - - LFY 38'837.0 28'263.0 36'408.0 88'382.0 26'817.0 52'299.0 37'754.0 108'184.0 90'708.0 43'575.0 4'536'724.0 15'089.0 2'453'016.0 34'481.0 17'130.0 LTM 38'837.0 26'944.0 36'408.0 69'265.0 26'817.0 52'356.0 37'758.0 106'713.0 90'629.0 43'575.0 4'296'873.0 15'512.0 2'633'625.0 35'151.0 17'102.0 CY+1 29'278.7 22'844.4 18'178.4 68'573.2 20'687.2 33'805.5 26'834.9 99'662.3 78'925.3 44'058.6 3'548'294.1 14'735.2 2'143'031.7 30'935.5 12'985.8 CY+2 30'109.3 21'055.7 18'111.8 72'313.1 22'693.0 34'795.0 27'871.0 102'507.3 80'915.9 46'116.8 3'455'446.5 15'417.9 2'053'211.1 32'478.6 13'491.1 LFY - - - - - - 6.9x - 8.7x - - - - - - LTM - - - - - - 6.9x - 8.7x - - - - - - CY+1 -6.8x - - 1.0x - 1.9x - - - - - - - - - CY+2 -7.3x - - 0.4x - 1.9x - - - - - - - - - LFY - - - - - - 15'529.0 - 41'810.0 - - - - - - LTM - - - - - - 15'530.0 - 41'647.0 - - - - - - CY+1 - - - - - - - - - - - - - - - CY+2 - - - - - - - - - - - - - - - LFY - - - - - - 16.7x - 19.0x - - - - - - LTM - - - - - - 16.7x - 17.1x - - - - - - CY+1 - - - - - - - - - - - - - - - CY+2 - - - - - - - - - - - - - - - LFY 0.45 0.08 0.01 0.49 2.03 1.91 0.52 6.04 4.83 0.60 - 2.34 - 5.03 7.90 LTM -0.09 -0.51 -0.02 0.79 2.04 0.26 -0.67 5.97 4.15 0.24 48.70 2.30 25.01 4.98 7.88 CY+1 0.36 0.23 0.04 0.98 2.37 3.83 0.89 5.63 4.70 0.57 51.79 2.25 21.37 5.44 8.46 CY+2 0.44 0.33 0.06 1.09 2.61 4.93 1.19 5.94 5.32 0.67 51.83 2.56 18.44 5.81 8.84 LFY - - - 13.3x 12.3x 122.2x - 8.1x 11.2x 23.2x 13.3x 12.0x 8.6x 12.0x 9.9x LTM 6.5x 13.1x 35.5x - 12.3x 17.2x 30.1x 8.1x 11.2x 8.8x - 12.0x - 12.0x 9.9x CY+1 8.1x 13.0x 12.2x 10.8x 10.5x 8.3x 17.3x 8.6x 9.9x 9.8x 12.5x 12.2x 10.0x 11.0x 9.2x CY+2 6.7x 9.0x 9.0x 9.7x 9.6x 6.4x 12.9x 8.1x 8.7x 8.3x 12.5x 10.8x 11.6x 10.3x 8.8x 1 Year 1.1% (12.9%) 1.8% (6.8%) 9.8% (0.7%) (7.6%) (2.4%) (11.6%) (44.1%) 4.2% (4.5%) 0.1% 2.2% (1.6%) 5 Year (1.3%) - - - 4.0% 3.8% (10.1%) 0.8% (2.3%) 9.5% (3.2%) (2.9%) (1.9%) (0.6%) 14.4% 1 Year - - - - - - (11.1%) - (21.9%) - - - - - - 5 Year - - - - - - (31.3%) - (15.7%) - - - - - - LTM - - - - - - 41.1% - 45.8% - - - - - - CY+1 - - - - - - - - - - - - - - - CY+2 - - - - - - - - - - - - - - - Total Debt / Equity % 817.3% 464.8% 441.6% 165.2% 245.3% 515.7% 582.6% 356.7% 334.4% 492.3% 559.4% 175.6% 1216.4% 287.2% 172.6% Total Debt / Capital % 87.4% 81.8% 81.3% 60.9% 70.7% 83.7% 84.2% 77.3% 76.6% 81.3% 82.2% 62.4% 88.9% 71.1% 60.6% Total Debt / EBITDA - - - - - - 17.218x - 14.972x - - - - - - Net Debt / EBITDA - - - - - - 10.520x - 14.097x - - - - - - EBITDA / Int. Expense - - - - - - - - - - - - - - - S&P LT Credit Rating A A- A- A+ A+ A+ *- A A A- BBB A A+ A AA- A+ S&P LT Credit Rating Date 29.11.2011 29.11.2011 29.11.2011 29.11.2011 01.12.2011 26.03.2013 29.11.2011 29.11.2011 29.11.2011 16.10.2012 30.09.2008 29.11.2011 18.06.2007 15.11.1994 27.09.2002 Moody's LT Credit Rating (P)A3 Baa1 A3 Aa3 A2 A2 A2 A2 Baa2 (P)Baa2 - Aa3 - Aa3 Aa3 Moody's LT Credit Rating Date 21.06.2012 21.06.2012 21.06.2012 21.06.2012 26.11.2010 21.06.2012 21.06.2012 21.06.2012 21.06.2012 24.10.2012 - 08.03.2012 - 21.06.2012 28.01.2013 52-Week High Date 52-Week Low Latest Fiscal Year: 52-Week High Total Debt Market Capitalization Daily Volume 52-Week Low % Change Current Price (4/dd/yy) 52-Week High % Change Cash and Equivalents EBITDA EV/EBITDA Enterprise Value Valuation Preferred Stock 52-Week Low Date Minority Interest Total Common Shares (M) P/E Revenue Growth Total Revenue EV/Total Revenue EPS EBITDA Growth EBITDA Margin Credit Ratings Leverage/Coverage Ratios Company Analysis - Peers Comparision Q.M.S Advisors | tel: +41 (0)78 922 08 77 | e-mail: info@qmsadv.com |