DI Assesment

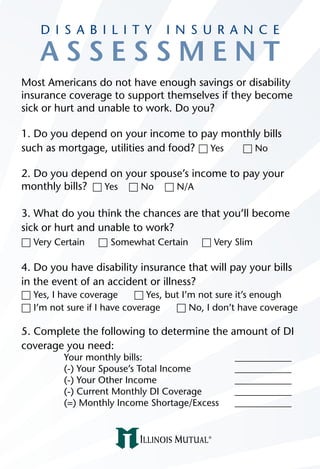

- 1. D I S A B I L I T Y I N S U R A N C E ASSESSMENT Most Americans do not have enough savings or disability insurance coverage to support themselves if they become sick or hurt and unable to work. Do you? 1. Do you depend on your income to pay monthly bills such as mortgage, utilities and food? h Yes h No 2. Do you depend on your spouse’s income to pay your monthly bills? h Yes h No h N/A 3. What do you think the chances are that you’ll become sick or hurt and unable to work? h Very Certain h Somewhat Certain h Very Slim 4. Do you have disability insurance that will pay your bills in the event of an accident or illness? h Yes, I have coverage h Yes, but I’m not sure it’s enough h I’m not sure if I have coverage h No, I don’t have coverage 5. Complete the following to determine the amount of DI coverage you need: Your monthly bills: ____________ (-) Your Spouse’s Total Income ____________ (-) Your Other Income ____________ (-) Current Monthly DI Coverage ____________ (=) Monthly Income Shortage/Excess ____________

- 2. rEviEW your ANSWErS 1. When a disability strikes, your income stops…but your bills don’t. By purchasing a disability insurance policy, you can protect your income. 2. If you depend on two incomes today, how would you survive on one income tomorrow? If you are a single income household, how do you expect to survive on no income? 3. This chart* shows your actual chances of suffering a disability before the age of 65. Age 30 40 50 60 Likelihood 1 in 3 3 in 10 5 in 22 1 in 10 *Source: 1985 Commissioners Disability Individual Table A 4. You should always review what existing DI coverage you may have. Your group coverage or other disability plans through your employer may not be enough. 5. Now it’s time to contact your agent to review your needs from this DI assessment and discover the options available through Illinois Mutual. YOUR INCOME IS YOUR MOST VALUABLE ASSET… WhAT ArE you doiNg To proTEcT iT? DIAM09-AC