Weekly Indian Economy Newsletter

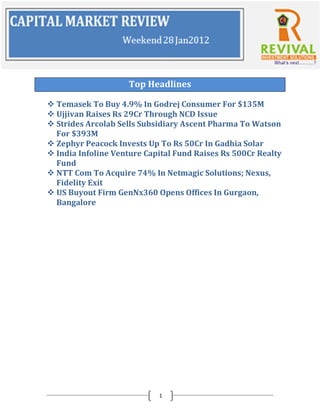

- 1. Top Headlines Temasek To Buy 4.9% In Godrej Consumer For $135M Ujjivan Raises Rs 29Cr Through NCD Issue Strides Arcolab Sells Subsidiary Ascent Pharma To Watson For $393M Zephyr Peacock Invests Up To Rs 50Cr In Gadhia Solar India Infoline Venture Capital Fund Raises Rs 500Cr Realty Fund NTT Com To Acquire 74% In Netmagic Solutions; Nexus, Fidelity Exit US Buyout Firm GenNx360 Opens Offices In Gurgaon, Bangalore 1

- 2. Weekly Executive Summary India's food inflation declined slightly to -1.03 per cent for the week ended January 14 as compared to -0.42 per cent for the previous week, staying in negative territory for the fourth straight week, as prices of essential items such as wheat, vegetables, potatoes and onions maintained a downtrend. The inflation rate for fuel, however, remained unchanged at the previous two weeks' level of 14.45 per cent, an official statement said here today, quoting provisional data. The Reserve Bank has sent a clear signal rates will be brought down in the coming months. Indeed, its monetary policy review on Tuesday emphasized growth rather than controlling inflation. RBI expects inflation to moderate to the targeted 7% by March--- even as growth falls to an estimated 7% from the old projection of 7.6%. But while RBI believes interest rate cuts can wait, it has moved quickly to inject some liquidity into the system. On Tuesday it cut the cash reserve ratio or CRR by 50 basis points to 5.5%. Moving on, Jet Airways is charting a new route towards reducing its debt. The airline plans to sell nine or ten of its Boeing 737s by April. It then plans to lease those aircraft back. The move will help it raise Rs666 crore. Jet has a debt of nearly Rs14, 000 crore. By leasing back its own aircraft, it’s following a path that other airlines have also used in the past to repair their balance sheets. Jet only owns 40 of the 101 planes it operates. Reliance Industries has set the dates for its planned buyback of some 120 million shares. The company said it would start the buyback on 1 February and end it on 19 January next year. RIL has set a maximum price of Rs870 per share and could spend 2.1 billion dollars on the buyback’s 2

- 3. Inside The Story Temasek to Buy 4.9% In Godrej Consumer For $135M Singapore’s sovereign wealth fund Temasek is investing Rs 685 crore($135 million) to buy 4.9 per cent stake in consumer products firm Godrej Consumer Products Ltd, in the single largest alternative investment deal in the Indian FMCG industry.Temasek is investing through a preferential allotment, making it the largest institutional shareholder in Godrej Consumer, the flagship of the $3.4- billion Godrej group. The Singapore government’s investment firm is picking up the stake through Baytree Investments (Mauritius) Pte Ltd, an indirect wholly-owned subsidiary. The fresh issue will be made at Rs 410 a share, a little over 2 per cent premium to the last traded share price of Godrej Consumer on Friday. The deal would help Godrej Consumer finance its aggressive inorganic strategy, wherein it has acquired seven companies across the world since 2010 and consolidated its holding in two joint ventures. Ujjivan Raises Rs 29Cr Through NCD Issue Bangalore-based microfinance firm Ujjivan Financial Services Pvt Ltd has raised Rs 29 crore ($5.8 million) through a private placement of non-convertible debentures (NCDs). The NCDs were subscribed by Developing World Markets (DWM) and listed on the Bombay Stock Exchange.The transaction comes a little over a year after Ujjivan raised Rs 40 crore through NCD placement with DWM only. The company followed that up with two issues with Standard Chartered Bank totalling Rs 55 crore. Ujjivan also raised over Rs 100 crore in debt funding from a set of public and private sector banks, including SIDBI, among others. 3

- 4. Strides Arcolab Sells Subsidiary Ascent Pharma to Watson For $393M Bangalore-based Strides Arcolab Ltd has sold its entire 94 per cent holding in Ascent Pharma Health Ltd, its subsidiary operating in Australia and South-east Asia, to NYSE-listed Watson Pharmaceuticals, Inc., at an enterprise value of AU$375 million ($393 million).Ascent is one of the top five generic pharmaceutical companies in Australia with presence across several South-east Asian countries like Singapore where it is the leading generic pharmaceutical company.As part of the transaction, Watson also acquired the remaining 6 per cent shareholding associated with Dennis Bastas, CEO of Ascent. The transaction was signed and closed simultaneously. Zephyr Peacock Invests Up To Rs 50Cr in Gadhia Solar Private equity firm Zephyr Peacock has invested up to Rs 50 crore in Mumbai-based Gadhia Solar. The solar energy company provides energy solutions by using parabolic concentrated technology and has implemented some of the world’s largest solar thermal systems during the past two decades. India Infoline Venture Capital Fund Raises Rs 500Cr Realty Fund India Infoline Venture Capital Fund, the private equity arm of the India Infoline group (IIFL), has completed raising a Rs 500 crore fund dubbed IIFL Real Estate Fund (Domestic) Series I, according to a company statement. The fund will mainly focus on the Indian real estate sector and invest in equity, debt and equity-linked instruments of promising real estate and construction companies, which are either involved in projects/ventures or have significant growth potential. 4

- 5. NTT Com to Acquire 74% in Netmagic Solutions; Nexus, Fidelity Exit NTT Communications Corporation (NTT Com), a wholly owned subsidiary of Nippon Telegraph and Telephone (NTT) Corporation, will acquire 74 per cent stake in data services firm Netmagic Solutions Pvt Ltd, the companies have jointly announced on Wednesday. According to Telecompaper, the acquisition price is around 10 billion Japanese yen (around $128 million).The addition of Netmagic Solutions’ datacentre services and sites will expand NTT Com’s capability to provide one-stop ICT solutions in the Indian market and also accelerate its global offering of seamless Cloud services. US Buyout Firm GenNx360 Opens Offices in Gurgaon, Bangalore US-based buyout firm GenNx360 Capital Partners has formed GenNx360 India Advisors Pvt Ltd, which will now operate out of two offices in Gurgaon and Bangalore. Launched in 2006, GenNx360 specializes in mid-market buyouts of industrial B2B companies. The firm focuses on opportunities in industrial water treatment, specialty chemicals & engineered materials, industrial machinery & equipment components, Global transportation component parts (auto, rail and infrastructure, aerospace & defense), oil & gas services (also, parts and equipment) and business services like logistics. It looks to invest in companies with revenues between $75 million and $500 million. GenNx360 is based in New York City, with additional offices in Seattle and Boston. This strategic initiative provides the firm with a truly global footprint, establishing a presence in both India and Asia 5

- 6. 6