More Related Content

Similar to Rise Of Regional Service Providers

Similar to Rise Of Regional Service Providers (20)

Rise Of Regional Service Providers

- 1. Navigating the Globe: The Rise

of Regional Service Providers www.yankeegroup.com

by Camille Mendler and Agatha Poon | January 2009

Executive Summary

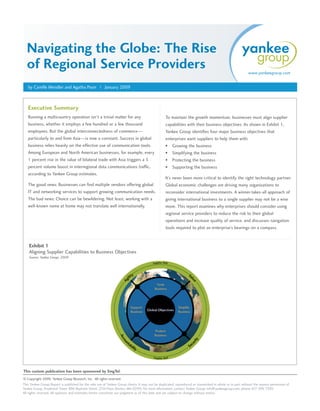

Running a multicountry operation isn’t a trivial matter for any To maintain the growth momentum, businesses must align supplier

business, whether it employs a few hundred or a few thousand capabilities with their business objectives. As shown in Exhibit 1,

employees. But the global interconnectedness of commerce— Yankee Group identifies four major business objectives that

particularly to and from Asia—is now a constant. Success in global enterprises want suppliers to help them with:

business relies heavily on the effective use of communication tools. • Growing the business

Among European and North American businesses, for example, every • Simplifying the business

1 percent rise in the value of bilateral trade with Asia triggers a 5 • Protecting the business

percent volume boost in interregional data communications traffic, • Supporting the business

according to Yankee Group estimates.

It’s never been more critical to identify the right technology partner.

The good news: Businesses can find multiple vendors offering global Global economic challenges are driving many organizations to

IT and networking services to support growing communication needs. reconsider international investments. A winner-takes-all approach of

The bad news: Choice can be bewildering. Not least, working with a giving international business to a single supplier may not be a wise

well-known name at home may not translate well internationally. move. This report examines why enterprises should consider using

regional service providers to reduce the risk to their global

operations and increase quality of service, and discusses navigation

tools required to plot an enterprise’s bearings on a compass.

Exhibit 1

Aligning Supplier Capabilities to Business Objectives

Source: Yankee Group, 2009

This custom publication has been sponsored by SingTel.

© Copyright 2009. Yankee Group Research, Inc. All rights reserved.

This Yankee Group Report is published for the sole use of Yankee Group clients. It may not be duplicated, reproduced or transmitted in whole or in part without the express permission of

Yankee Group, Prudential Tower, 800 Boylston Street, 27th Floor, Boston, MA 02199. For more information, contact Yankee Group: info@yankeegroup.com; phone: 617-598-7200.

All rights reserved. All opinions and estimates herein constitute our judgment as of this date and are subject to change without notice.

- 2. Navigating the Globe: The Rise of Regional Service Providers

Table of Contents

I. Globalization Erases Boundaries to Business Growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

Businesses Large and Small Go Global . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

II. Supplier Procurement Options Fail to Satisfy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Adopting a Best-of-Region Approach . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

III. Aligning Business Objectives with Service Provider Attributes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Proof Points for Goal-Oriented Regional Supplier Choice . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

IV. Conclusions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

I. Globalization Erases Boundaries to Business Growth Businesses Large and Small Go Global

Doing business internationally is now common practice, regardless of

There’s no doubt about the link between telecommunications and the

a company’s size. Today, three-quarters of major multinational

acceleration of global trade. Exactly 150 years ago, the first

corporations (MNCs) headquartered in Europe or North America have

transoceanic cable was launched. Then, the 99-word message from

connectivity needs into Asia. Smaller enterprises are also spreading

Queen Victoria congratulating U.S. President James Buchanan took 16

their ambitions globally. According to the Yankee Group Anywhere

hours to transmit across the Atlantic. Today, modern communication

Enterprise—Large: 2008 IT and Managed Services Survey, 60 percent

from much longer distances takes only milliseconds.

of European midsize enterprises (typically employing between 500

The death of distance has had profound effects on commerce between and 2,500 people) operate between two and nine offices abroad. The

Europe, North America and Asia. As Exhibit 2 illustrates, the value of proportion rises to 63 percent among North American midsize enterprises.

bilateral trade with Asia is growing more than 8 percent per annum. In

Even if economic challenges persist, trade patterns are now firmly

data traffic alone, the multitrillion-dollar trade between Asia and its

established—although pressure to reduce costs is now acute. The

European and North American trading partners has boosted Asia-centric

survivability of global infrastructure remains a perennial concern.

data communications volumes in excess of 40 percent per annum—a

Earthquakes, tsunamis and cuts in submarine cables are highly

trend that Yankee Group predicts will continue at similarly aggressive

damaging to businesses whose communications suppliers do not have

rates through 2012 and potentially beyond.

backup plans.

Exhibit 2

Networked Economies: Bilateral Trade with Asia and Telecom Traffic Flows

Source: Yankee Group, 2009

2 © Copyright 2009. Yankee Group Research, Inc. All rights reserved.

- 3. January 2009

But that’s only part of the challenge for enterprises going global. The • The winner-takes-all approach: This approach involves

thornier issue is ensuring good supplier performance during the entire contracting with one service provider for all international

life cycle of the relationship, for day-to-day operation and not just the technology services. Typically, the choice defaults to the same

organization that provides domestic services in the company’s

dramatic. That means setting the right goals and expectations from the

headquartered country.

beginning.

- Promise: Potentially familiar with the business and its

needs, offering management simplicity and negotiating

II. Supplier Procurement Options Fail to Satisfy

power to buyers through volume discounting. Handles

What’s the best approach to choosing an international service

downstream negotiations with local suppliers in required

provider? According to the Yankee Group Anywhere Enterprise—

geographies and manages all service delivery.

Large: 2008 IT and Managed Services Survey, the average contract

- Reality: Built on the incorrect assumption that the sole

length is 5.5 years. With that in mind, it’s important to get it right.

Procurement trends have ebbed and flowed considerably during the supplier is consistently resourced and knowledgeable,

years. That’s because dissatisfaction with the options available has irrespective of global geography. In practice, this approach

prevented businesses from anchoring their approach. does not guarantee the global supplier deals with the best-

of-breed vendor in each country or obtains the best pricing

Until recently, enterprises have churned through three principal

terms. Service quality standards may be contractually

procurement options:

consistent, but often down to the basic service level. The

The consortium approach: Ten years ago, telecom operators were

•

relentless push for a regional footprint by a handful of

busy building global multivendor alliances with ambitious names

global service providers suggests that their worldwide

such as Unisource, Concert and Global One. They claimed they

resources are far from adequate. Global deals also risk

could deliver and manage seamless communications in any corner

supplier lock-in due to the complexity of disengagement.

of the earth.

- Promise: A tempting offer of management simplicity,

service consistency and vast volume discounts across

Adopting a Best-of-Region Approach

multiple operators’ networks. A fourth approach—the best-of-region approach—is building

momentum. Among the largest European and North American

- Reality: A promise unfulfilled; all global consortia have

multinationals that Yankee Group has surveyed during the past five

now collapsed—partly due to management squabbles. They

years, 49 percent make purchasing decisions centrally, charging back

never delivered service consistency or holistic

costs to regional divisions. A further 27 percent specify requirements

accountability. centrally, but devolve purchasing regionally.

The piecemeal approach: As its name implies, the piecemeal

•

According to interviews with CIOs that Yankee Group conducted for

approach means selecting a single vendor for each country where

this report, central purchasing divisions are increasingly open to

operations exist.

spreading risk by carving out networking and IT investments

- Promise: Potential to obtain the best-of-breed option in regionally. In part, this is a response to continuing poor levels of

every locality. service delivery and support. According to Yankee Group research,

more than 60 percent of international connectivity outages are the

- Reality: Difficult to scale; complex and costly to manage

fault of a local access provider. By choosing a regional service

a multiplicity of service providers, with minimal power to

provider (RSP) with physical proximity and regional familiarity,

negotiate preferential discounts. Service quality across global enterprises expect to exert better control and responsiveness.

service providers is inconsistent. This approach is also risky Indeed, CIOs that Yankee Group interviewed that have moved to a

because of the need to keep a direct eye on all moving parts best-of-region approach say the differences are clearest in account

of the company’s global communications infrastructure. management quality and responsiveness.

3

© Copyright 2009. Yankee Group Research, Inc. All rights reserved.

- 4. Navigating the Globe: The Rise of Regional Service Providers

The best-of-region approach requires the selection of a single best-of-

breed supplier that is responsible for all in-region needs. This strategy

III. Aligning Business Objectives with Service

will not work in every geographic region. To demonstrate well-

Provider Attributes

balanced regional capabilities such as management skill and service

Just as explorers such as Marco Polo relied on the sextant and the

quality of a supplier in all countries against competitive strengths in a

astrolabe to navigate international waters, successful global businesses

single or few geographical locations, an underlying requirement is the

also need effective navigation tools to select the right service

existence of healthy interregional trade and market competition. But

provider. Think of the navigation tools as bearings on a compass.

where the market conditions are right, the best-of-region approach can

There are four bearings that a service provider must have to live up to

outrank others, as Exhibit 3 suggests.

its promise on meeting enterprise requirements:

The best-of-region approach is valid in Asia because interregional

• Value: Assessing the true value of services on offer involves a

trade is growing fast, stimulated by both a domestic economic drive

detailed review of internal business costs using appropriate

and international investment. This has triggered strong demand for

performance and financial metrics. Those metrics may be unique

and investment in robust communications infrastructure. Today,

to a particular company, but the RSP should be able to map its

multiple RSPs are competing to deliver on the needs of regional

service intelligibly to them. Discussions with the RSP’s bid team

businesses and global MNCs that require reliable regional support.

should begin with a definition of business goals and then a road

The best-of-region approach shows great promise by lowering risk to

map of how to achieve them.

out-of-region customers with a local presence in the region because

delivering service in the region is a core business activity for the RSP. • Security: Choosing to work with an RSP should involve either an

Also, it offers “one throat to choke” on a regionalized basis, which acceptable business risk or a reduced exposure to risk for the

has proven to be a more manageable option than a piecemeal contracting enterprise. This includes disclosure of infrastructure

approach with its multiplicity of vendor relationships. Strategically, redundancy, certified skills, subcontracting parties to reach out to

the best-of-region approach enables enterprises to maintain

highly regulated markets such as Vietnam and China, and not

competitive tension and prevent the supplier lock-in that is commonly

least, supplier financial strength in a given region.

seen in a winner-takes-all context. Comparatively speaking, best-of-

region RSPs are nimble to demonstrate their service reach, superior

service levels, responsive support and preferential pricing through the

right mix of direct investment in regional network infrastructure and

support centers, as well as a deep and active network of local

partnerships to serve in-region customers.

Exhibit 3

Assessing International Procurement Methods

Source: Yankee Group, 2009

4 © Copyright 2009. Yankee Group Research, Inc. All rights reserved.

- 5. January 2009

• Accountability: The RSP must have world-class, end-to-end Exhibit 4

reporting processes and tools with a transparent governance Linking Business Objectives to Supplier Proof Points

framework for alerting and responding to issues. Typically, Source: Yankee Group, 2009

accountability is defined and governed contractually through

what’s known as a service-level agreement (SLA). It’s also seen in

the process certifications that the service provider maintains—for

example, routinely audited and certified skills in project

management and IT governance such as Six Sigma, ITIL and

COBIT, coupled with ISO quality accreditations. Contractual

commitments must be managed via trained customer service teams

and online customer portals that are accessible around the clock.

• Agility: During a multiyear contract, business priorities can

change and needs fluctuate. The relationship with the RSP should

be flexible enough to anticipate and plan for change. That’s a

factor related to the contract structure and the supplier’s

investment commitments, but also to the quality of the account

management team assigned to the relationship. Actively

participating in industry groups developing next-generation

services such as the Metro Ethernet Forum is a proactive way to

demonstrate service commitment.

Proof Points for Goal-Oriented Regional Supplier Choice

The core business objectives of most enterprises have nothing to do

with technology, but the right application of technology can ensure

they are met. At their core, these objectives include:

IV. Conclusions

Successful global businesses must be able to navigate calm or

• Growing the business: Ensure that the RSP is committed to be troubled waters. If they can’t predict the weather, they can at least

technically and strategically world class to support the enterprise’s growth. ensure that their operations are agile enough to adapt. That’s why the

choice of business partner for communications infrastructure services

• Protecting the business: Ensure that the RSP is transparent about

is crucial. The choices of approaches to handle international needs

its technical operations and commercial commitments. Real-time have been unsatisfactory or even risky for many years. But the

performance reporting tools that display a customer-centric view competitive landscape—coupled with robust infrastructure

of activity enable an enterprise to correctly assess its risk investment—has now matured to offer a wider range of options to

management profile. businesses with global operations.

• Simplifying the business: Ensure that the RSP invests in global The potential to work with an experienced regional partner can offer a

preferential balance between management simplicity and risk as well

standards and certifications to validate its ability to provide

as value and best-in-class performance. Businesses still must ensure

productivity-enhancing solutions to the enterprise and facilitate

that their regional partner’s capabilities are aligned with their specific

smooth global technology migration and communications with

objectives. But by following the right bearings, they will achieve their

other suppliers.

business goals effectively.

• Supporting the business: Ensure that the RSP has a well-

structured cross-border sales program to address diverse business

requirements regionally and globally. The 24/7 help desk and

customer support center are considered table stakes. A key

differentiator is the platform and tools for customization,

integration and business process management.

As shown in Exhibit 4, linking these business objectives to supplier

attributes requires scrutiny of several proof points.

5

© Copyright 2009. Yankee Group Research, Inc. All rights reserved.

- 6. Yankee Group

Yankee Group | the global connectivity expertsTM

A global connectivity revolution is under way, transforming the way that businesses and consumers interact beyond

anything we have experienced to date. The stakes are high, and there are new needs to be met while power shifts among

Yankee Group has research and sales staff

traditional and new market entrants. Advice about technology change is everywhere—in the clamor of the media, the

boardroom approaches of management consultants and the technology research community. Among these sources, Yankee

located in North America, Europe, the Middle

Group stands out as the original and most respected source of deep insight and counsel for the builders, operators and users

East, Africa, Latin America and Asia-Pacific.

of connectivity solutions.

For more information, please contact one of

For 37 years, we have conducted primary research on the fundamental questions that chart the pace and nature of

the sales offices listed below.

technology changes on networks, consumers and enterprises. Coupling professional expertise in communications

development and deployment with hundreds of interviews and tens of thousands of data points each year, we provide

qualitative and quantitative information to our clients in an insightful, timely, flexible and economic offering.

Corporate Headquarters

Prudential Tower

Yankee Group Link

As technology connects more people, places and things, players must confront challenging questions to benefit from the

800 Boylston Street changes: which technologies, what economic models, which partners and what offerings? Yankee Group LinkTM is the

research membership uniquely positioned to bring you the focus, the depth, the history and the flexibility you need to

27th Floor answer these questions.

BOSTON, MASSACHUSETTS 02199

Yankee Group Link membership connects you to our qualitative analysis of the technologies, services and industries we

617-598-7200 phone assess in our research agenda charting global connectivity change. It also connects you to unique quantitative data from the

617-598-7400 fax dozens of annual surveys we conduct with thousands of enterprises and consumers, along with market adoption data,

comprehensive forecasts and global regulatory dashboards.

info@yankeegroup.com

Europe

56 Russell Square

Yankee Group Link Research

As a Link member, you have access to more than 250 research reports and notes that Yankee Group publishes each year.

LONDON WC1B 4HP Link Research examines current business issues with a unique combination of knowledge and services. We explore

UNITED KINGDOM topics in an easy-to-read, solutions-oriented format. With the combination of market-driven research and built-in direct

access to Yankee Group analysts, you benefit from the interpretation and application of our research to your individual

44-20-7307-1050 phone business requirements.

44-20-7323-3747 fax

euroinfo@yankeegroup.com

Yankee Group Link Interaction

Our analysts are at your further disposal with data, information or advice on a particular topic at the core of a Link

membership. We encourage you to have direct interaction with analysts through ongoing conversations, conference calls

and briefings.

Yankee Group Link Data

Yankee Group Link Data modules provide a comprehensive, quantitative perspective of global connectivity markets,

technologies and the competitive landscape. Together with Link Research, data modules connect you to the information

you need to make the most informed strategic and tactical business decisions.

Yankee Group Consulting

Who better than Yankee Group to help you define key global connectivity strategies, scope major technology initiatives

and determine your organization’s readiness to undertake them, differentiate yourself competitively or guide initiatives

around connectivity change? Our analysts apply Yankee Group research, methodologies, critical thinking and survey

results to your specific needs to produce expert, timely, custom results.

Yankee Group Signature Events

Yankee Group conferences, webinars and speaking engagements offer our clients new insight, knowledge and expertise to

better understand and overcome the obstacles to succeed in this connectivity revolution.

www.yankeegroup.com

The people of Yankee Group are the global connectivity experts™—the leading source of insight and counsel for builders, operators and users of connectivity solutions.

For more than 35 years, Yankee Group has conducted primary research that charts the pace of technology change and its effect on networks, consumers and enterprises.

Headquartered in Boston, Yankee Group has a global presence including operations in North America, Europe, the Middle East, Africa, Latin America and Asia-Pacific.

© Copyright 2009. Yankee Group Research, Inc. All rights reserved.