F&B snapshot

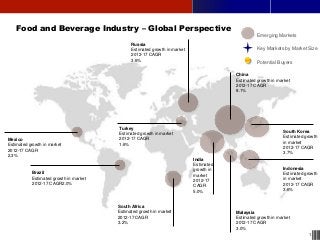

- 1. 1 Food and Beverage Industry – Global Perspective Key Markets by Market Size Emerging Markets Potential Buyers China Estimated growth in market 2012-17 CAGR 8.1% Russia Estimated growth in market 2012-17 CAGR 3.6% Turkey Estimated growth in market 2012-17 CAGR 1.6% Brazil Estimated growth in market 2012-17 CAGR2.0% South Korea Estimated growth in market 2012-17 CAGR 3.7% Indonesia Estimated growth in market 2012-17 CAGR 3.6% Malaysia Estimated growth in market 2012-17 CAGR 3.0% India Estimated growth in market 2012-17 CAGR 5.0% South Africa Estimated growth in market 2012-17 CAGR 3.2% Mexico Estimated growth in market 2012-17 CAGR 2.3%

- 2. 2 Food and Beverage Industry – Global Perspective Key Markets by Market Size Emerging Markets Potential Buyers China Estimated growth in market 2012-17 CAGR 8.1% Russia Estimated growth in market 2012-17 CAGR 3.6% Turkey Estimated growth in market 2012-17 CAGR 1.6% Brazil Estimated growth in market 2012-17 CAGR2.0% South Korea Estimated growth in market 2012-17 CAGR 3.7% Indonesia Estimated growth in market 2012-17 CAGR 3.6% Malaysia Estimated growth in market 2012-17 CAGR 3.0% India Estimated growth in market 2012-17 CAGR 5.0% South Africa Estimated growth in market 2012-17 CAGR 3.2% Mexico Estimated growth in market 2012-17 CAGR 2.3% United States of America Japan

- 3. 3 Food and Beverage Industry – Global Perspective Key Markets by Market Size Emerging Markets Potential Buyers China Estimated growth in market 2012-17 CAGR 8.1% Russia Estimated growth in market 2012-17 CAGR 3.6% Turkey Estimated growth in market 2012-17 CAGR 1.6% Brazil Estimated growth in market 2012-17 CAGR2.0% South Korea Estimated growth in market 2012-17 CAGR 3.7% Indonesia Estimated growth in market 2012-17 CAGR 3.6% Malaysia Estimated growth in market 2012-17 CAGR 3.0% India Estimated growth in market 2012-17 CAGR 5.0% South Africa Estimated growth in market 2012-17 CAGR 3.2% Mexico Estimated growth in market 2012-17 CAGR 2.3% United States of America Japan Thailand

- 4. 4 Food and Beverage Industry – Snapshot • The world restaurant industry generated nearly $1.6 trillion in revenue in 2010. Marked growth is expected to slow to 3% yearly through 2015 to almost $1.8 trillion by the close of 2015. The restaurant market segment covers sales of food, soft drinks and alcoholic drinks through cafés, restaurants, catering businesses, drinking places and fast-food retail outlets. • The foodservice industry is expected to reach almost $992 billion in 2014, with a volume of over 586 billion transactions. This represents more than 18% growth in five years. Cafés and restaurants represent the leading market segment at over 50% of overall industry value. Regionally, Asia-Pacific holds almost 43% of the world foodservice industry market share. • The ten fastest-growing food and non-alcoholic beverage markets in the next five years will be emerging markets and their potential outweighs their greater risk. Even when applied equally to developed markets, the LinkLaters’ Index gives six of the top ten places globally to emerging markets. • The LinkLaters’ report also notes that key emerging markets are less likely to be adversely affected by possible global economic crises, such as a Eurozone break-up or a hike in oil prices, than many food and beverage markets in the developed world. • According to research from HSBC, the middle class of the emerging markets is going to grow to 1.2 billion people by 2030 – up from 250 million in the year 2000. The CIVETS nations (Colombia, Indonesia, Vietnam, Egypt, Turkey, and South Africa), and these other emerging restaurant markets will be in the center of this growth. Restaurant chains that are willing to act boldly, work with local partners, and find ways to adapt their brands and menus to local customs and tastes, will be likely to reap big gains from the emerging restaurant markets of the next 10 years. *These are estimations based on industry reports by MarketLine, Datamonitor, LinkLaters and AaronAllen- Restaurant Consultants.