Report

Share

Download to read offline

Recommended

More Related Content

Recently uploaded

How Generative AI Is Transforming Your Business | Byond Growth Insights | Apr...

How Generative AI Is Transforming Your Business | Byond Growth Insights | Apr...Hector Del Castillo, CPM, CPMM

Recently uploaded (20)

Introducing the Analogic framework for business planning applications

Introducing the Analogic framework for business planning applications

MEP Plans in Construction of Building and Industrial Projects 2024

MEP Plans in Construction of Building and Industrial Projects 2024

Unveiling the Soundscape Music for Psychedelic Experiences

Unveiling the Soundscape Music for Psychedelic Experiences

Go for Rakhi Bazaar and Pick the Latest Bhaiya Bhabhi Rakhi.pptx

Go for Rakhi Bazaar and Pick the Latest Bhaiya Bhabhi Rakhi.pptx

How Generative AI Is Transforming Your Business | Byond Growth Insights | Apr...

How Generative AI Is Transforming Your Business | Byond Growth Insights | Apr...

Strategic Project Finance Essentials: A Project Manager’s Guide to Financial ...

Strategic Project Finance Essentials: A Project Manager’s Guide to Financial ...

Simplify Your Funding: Quick and Easy Business Loans

Simplify Your Funding: Quick and Easy Business Loans

GUIDELINES ON USEFUL FORMS IN FREIGHT FORWARDING (F) Danny Diep Toh MBA.pdf

GUIDELINES ON USEFUL FORMS IN FREIGHT FORWARDING (F) Danny Diep Toh MBA.pdf

Psychic Reading | Spiritual Guidance – Astro Ganesh Ji

Psychic Reading | Spiritual Guidance – Astro Ganesh Ji

trending-flavors-and-ingredients-in-salty-snacks-us-2024_Redacted-V2.pdf

trending-flavors-and-ingredients-in-salty-snacks-us-2024_Redacted-V2.pdf

Vladyslav Fliahin: Applications of Gen AI in CV (UA)

Vladyslav Fliahin: Applications of Gen AI in CV (UA)

Islamic Banking

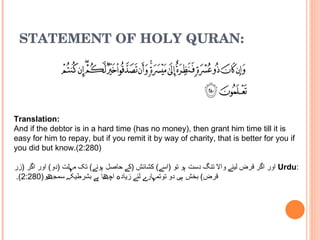

- 1. STATEMENT OF HOLY QURAN: Translation: And if the debtor is in a hard time (has no money), then grant him time till it is easy for him to repay, but if you remit it by way of charity, that is better for you if you did but know.(2:280) : Urdu اور اگر قرض لینے والا تنگ دست ہو تو ( اسے ) کشائش ( کے حاصل ہونے ) تک مہلت ( دو ) اور اگر ( زر قرض ) بخش ہی دو توتمہارے لئے زیادہ اچھا ہے بشرطیکہ سمجھو (2:280).

- 8. PREPARED BY: MUHAMMAD JUNAID SHERA