More Related Content

Similar to 2015 Taiwan-stocks-dividend-list

Similar to 2015 Taiwan-stocks-dividend-list (20)

More from Ying wei (Joe) Chou

More from Ying wei (Joe) Chou (20)

2015 Taiwan-stocks-dividend-list

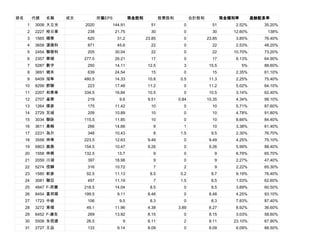

- 1. 排名 代號 名稱 成交 所屬EPS 現金股利 股票股利 合計股利 現金殖利率 盈餘配息率

1 3008 大立光 2020 144.91 51 0 51 2.52% 35.20%

2 2227 裕日車 238 21.75 30 0 30 12.60% 138%

3 1565 精華 620 31.2 23.85 0 23.85 3.85% 76.40%

4 3658 漢微科 871 45.6 22 0 22 2.53% 48.20%

5 2454 聯發科 205 30.04 22 0 22 10.70% 73.20%

6 2357 華碩 277.5 26.21 17 0 17 6.13% 64.90%

7 5287 數字 250 14.11 12.5 3 15.5 5% 88.60%

8 3691 碩禾 639 24.54 15 0 15 2.35% 61.10%

9 6409 旭隼 480.5 14.33 10.8 0.5 11.3 2.25% 75.40%

10 8299 群聯 223 17.48 11.2 0 11.2 5.02% 64.10%

11 2207 和泰車 334.5 16.84 10.5 0 10.5 3.14% 62.40%

12 2707 晶華 219 9.6 9.51 0.84 10.35 4.34% 99.10%

13 1264 德麥 175 11.42 10 0 10 5.71% 87.60%

14 2729 瓦城 209 10.89 10 0 10 4.78% 91.80%

15 3034 聯詠 115.5 11.85 10 0 10 8.66% 84.40%

16 3611 鼎翰 266 14.66 9 1 10 3.38% 61.40%

17 2231 為升 348 10.43 8 1.5 9.5 2.30% 76.70%

18 3558 神準 223.5 12.63 9.49 0 9.49 4.25% 75.10%

19 6803 崑鼎 154.5 10.47 9.26 0 9.26 5.99% 88.40%

20 1558 伸興 132.5 13.7 9 0 9 6.79% 65.70%

21 2059 川湖 397 18.98 9 0 9 2.27% 47.40%

22 5274 信驊 316 10.72 7 2 9 2.22% 65.30%

23 1580 新麥 92.5 11.13 8.5 0.2 8.7 9.19% 76.40%

24 3081 聯亞 457 11.19 7 1.5 8.5 1.53% 62.60%

25 4947 F-昂寶 218.5 14.04 8.5 0 8.5 3.89% 60.50%

26 8454 富邦媒 199.5 9.11 8.48 0 8.48 4.25% 93.10%

27 1723 中碳 106 9.5 8.3 0 8.3 7.83% 87.40%

28 3272 東碩 49.1 11.96 4.38 3.89 8.27 8.92% 36.60%

29 6452 F-康友 269 13.92 8.15 0 8.15 3.03% 58.60%

30 5508 永信建 26.5 9 6.11 2 8.11 23.10% 67.90%

31 2727 王品 133 9.14 8.09 0 8.09 6.09% 88.50%

- 2. 32 1477 聚陽 206.5 9.62 7.7 0.35 8.05 3.73% 80%

33 1476 儒鴻 407.5 11.51 8 0 8 1.96% 69.50%

34 8422 可寧衛 165 9.43 8 0 8 4.85% 84.80%

35 8114 振樺電 143.5 8.88 7.5 0.35 7.85 5.23% 84.50%

36 2451 創見 82 8.67 7.8 0 7.8 9.51% 90%

37 2597 潤弘 38.05 8.38 7.5 0 7.5 19.70% 89.50%

38 3131 弘塑 204 11.9 7.5 0 7.5 3.68% 63%

39 5904 寶雅 298 8.22 7.4 0.1 7.5 2.48% 90%

40 6286 立錡 189 10.09 7.5 0 7.5 3.97% 74.30%

41 6451 F-訊芯 92.8 10.23 7.5 0 7.5 8.08% 73.30%

42 8083 瑞穎 124.5 8.75 7.5 0 7.5 6.02% 85.70%

43 4545 銘鈺 71.2 8.01 6.2 1 7.2 8.71% 77.40%

44 5264 F-鎧勝 140.5 14.49 7.2 0 7.2 5.12% 49.70%

45 2542 興富發 34.45 11.44 4 3 7 11.60% 35%

46 2912 統一超 200 8.74 7 0 7 3.50% 80.10%

47 3130 一零四 137.5 9.41 7 0 7 5.09% 74.40%

48 4137 F-麗豐 290 9.51 7 0 7 2.41% 73.60%

49 6121 新普 98.3 10.98 7 0 7 7.12% 63.80%

50 6464 台數科 113 8.51 7 0 7 6.19% 82.30%

51 5203 訊連 66 7.06 6.98 0 6.98 10.60% 98.90%

52 6023 元大期 35.1 3.75 6.94 0 6.94 19.80% 185%

53 4733 上緯 140 8.93 6.93 0 6.93 4.95% 77.60%

54 2926 誠品生 214 8.17 6.92 0 6.92 3.23% 84.70%

55 9914 美利達 137 11.2 6.8 0 6.8 4.96% 60.70%

56 2308 台達電 144.5 8.49 6.7 0 6.7 4.64% 78.90%

57 3152 璟德 170 6.85 6.66 0 6.66 3.92% 97.20%

58 8406 F-金可 358 15.64 6.6 0 6.6 1.84% 42.20%

59 9921 巨大 201.5 10.96 6.6 0 6.6 3.28% 60.20%

60 1256 F-鮮活 128.5 9.85 5.5 1 6.5 4.28% 55.80%

61 1537 廣隆 125 8.09 6.5 0 6.5 5.20% 80.40%

62 2929 F-淘帝 111 12.98 6.5 0 6.5 5.86% 50.10%

63 3450 聯鈞 112 9.77 4.5 2 6.5 4.02% 46.10%

- 3. 64 6206 飛捷 90.7 7.25 5.95 0.5 6.45 6.56% 82.10%

65 3356 奇偶 69.2 7 5.4 1 6.4 7.80% 77.10%

66 3541 西柏 74.5 7.6 4.5 1.5 6 6.04% 59.20%

67 2379 瑞昱 73 7.71 6 0 6 8.22% 77.80%

68 2474 可成 218.5 23.52 6 0 6 2.75% 25.50%

69 2915 潤泰全 54.9 8 6 0 6 10.90% 75%

70 3529 力旺 342 5.52 6 0 6 1.75% 109%

71 6271 同欣電 68.1 9.27 6 0 6 8.81% 64.70%

72 6414 樺漢 331.5 8.63 6 0 6 1.81% 69.50%

73 8081 致新 54.4 7.09 6 0 6 11% 84.60%

74 8255 朋程 105.5 7.91 6 0 6 5.69% 75.80%

75 1589 F-永冠 207.5 9.78 6 0 6 2.89% 61.40%

76 2395 研華 210 7.8 6 0 6 2.86% 76.90%

77 6146 耕興 191 7.53 5.61 0.19 5.8 2.94% 74.50%

78 6277 宏正 67 6.37 5.7 0 5.7 8.51% 89.50%

79 6488 環球晶 69.4 6.6 5.7 0 5.7 8.21% 86.40%

80 3693 營邦 94 9.53 5.66 0 5.66 6.02% 59.40%

81 3045 台灣大 98 5.56 5.6 0 5.6 5.71% 101%

82 6279 胡連 127 8 5.6 0 5.6 4.41% 70%

83 2066 世德 98 6.56 5.5 0 5.5 5.61% 83.80%

84 3533 嘉澤 113 11.53 5.5 0 5.5 4.87% 47.70%

85 4987 科誠 62.5 7.52 5 0.5 5.5 8% 66.50%

86 5356 協益 34.75 11.45 5.5 0 5.5 15.80% 48%

87 6176 瑞儀 60 8.01 5.5 0 5.5 9.17% 68.70%

88 8416 實威 90 7.24 5.5 0 5.5 6.11% 76%

89 3665 F-貿聯 140.5 7.28 4.97 0.5 5.47 3.54% 68.30%

90 2640 大車隊 54.5 6.09 4.9 0.5 5.4 8.99% 80.50%

91 9951 皇田 158 7.81 5.4 0 5.4 3.42% 69.10%

92 1590 F-亞德 130 10.39 4.8 0.5 5.3 3.69% 46.20%

93 1707 葡萄王 171.5 7.24 5.3 0 5.3 3.09% 73.20%

94 8044 網家 295 7.82 4.52 0.7 5.22 1.53% 57.80%

95 4736 泰博 95.8 6.61 5.2 0 5.2 5.43% 78.70%

- 4. 96 6177 達麗 19.5 9.02 4 1.2 5.19 20.50% 44.40%

97 6195 詩肯 43.4 6.11 5.11 0 5.11 11.80% 83.60%

98 6261 久元 45.1 6.04 5 0.1 5.1 11.10% 82.80%

99 9941 裕融 70 5.9 5.1 0 5.1 7.28% 86.40%

100 2740 天蔥 65.5 5.85 3.06 2 5.06 4.68% 52.30%

101 3388 崇越電 60.4 5.14 5 0 5 8.28% 97.30%

102 1232 大統益 73.3 6.17 5 0 5 6.82% 81%

103 1340 F-勝悅 58 10.6 2 3 5 3.45% 18.90%

104 1788 杏昌 100 6.28 5 0 5 5% 79.60%

105 2114 鑫永銓 71.6 7.34 5 0 5 6.98% 68.10%

106 2437 旺詮 48 5.8 5 0 5 10.40% 86.20%

107 2548 華固 52.3 5.08 5 0 5 9.56% 98.40%

108 3211 順達 43.7 6.09 5 0 5 11.40% 82.10%

109 4163 鐿鈦 115.5 7.87 5 0 5 4.33% 63.50%

110 4977 F-眾達 51.4 5 4.5 0.5 5 8.75% 90%

111 5225 F-東科 39.85 4.36 5 0 5 12.60% 115%

112 5289 宜鼎 82.2 8.57 4.5 0.5 5 5.47% 52.50%

113 5903 全家 197 5.8 5 0 5 2.54% 86.20%

114 6143 振曜 47.75 5.25 5 0 5 10.50% 95.20%

115 2331 精英 18.1 2.09 5 0 5 27.60% 239%

116 4966 F-譜瑞 224 16.48 4.98 0 4.98 2.22% 30.20%

117 6214 精誠 48.95 3.07 4.98 0 4.98 10.20% 162%

118 2412 中華電 101 4.98 4.86 0 4.86 4.81% 97.60%

119 2439 美律 50 6.72 4.8 0 4.8 9.61% 71.40%

120 2233 宇隆 62.4 6.3 4.75 0 4.75 7.61% 75.40%

121 2385 群光 67 6.22 4.65 0.05 4.7 6.94% 74.80%

122 3556 禾瑞亞 44.5 4.49 4.3 0.3 4.6 9.66% 95.80%

123 4153 鈺緯 70.3 4.71 2.59 1.97 4.56 3.69% 55%

124 4912 F-聯德 80.1 6.73 4.5 0 4.5 5.62% 66.90%

125 1535 中宇 54.8 5.5 4.5 0 4.5 8.21% 81.80%

126 1582 信錦 43.7 5.71 4.5 0 4.5 10.30% 78.80%

127 1595 川寶 53.8 7.58 4.5 0 4.5 8.36% 59.40%

- 5. 128 2732 六角 71.8 5.71 4 0.5 4.5 5.57% 70%

129 3299 帛漢 45 4.71 4.5 0 4.5 10% 95.50%

130 3527 聚積 38.65 5.53 4.5 0 4.5 11.60% 81.40%

131 3598 奕力 48.9 6.67 4.5 0 4.5 9.20% 67.50%

132 4416 三圓 90 8.75 4.5 0 4.5 5% 51.40%

133 4432 銘旺實 65.5 5.54 4 0.5 4.5 6.11% 72.20%

134 4536 拓凱 107 6.07 4.5 0 4.5 4.21% 74.10%

135 5534 長虹 42.25 7.22 4 0.5 4.5 9.47% 55.40%

136 6605 帝寶 108.5 10.07 4.5 0 4.5 4.15% 44.70%

137 8016 矽創 85 6.02 4.5 0 4.5 5.29% 74.80%

138 2330 台積電 137 10.18 4.5 0 4.5 3.28% 44.20%

139 3454 晶睿 78.9 5.01 4 0.35 4.35 5.07% 79.80%

140 1521 大億 80.5 4.9 4.3 0 4.3 5.34% 87.80%

141 2317 鴻海 75.3 8.85 3.8 0.5 4.3 5.05% 42.90%

142 3030 德律 43.9 5.34 4.3 0 4.3 9.79% 80.50%

143 3689 湧德 28.8 7.38 4.3 0 4.3 14.90% 58.30%

144 8109 博大 56.7 5.31 4.3 0 4.3 7.58% 81%

145 3662 樂陞 73 3.55 0.6 3.66 4.26 0.82% 16.90%

146 4113 聯上 9.73 6.41 0.95 3.29 4.24 9.80% 14.80%

147 3617 碩天 98 5.64 4.23 0 4.23 4.32% 75%

148 2731 雄獅 100 5.48 4.2 0 4.2 4.20% 76.60%

149 6224 聚鼎 59.3 5.01 4.2 0 4.2 7.08% 83.80%

150 8472 夠麻吉 105 4.84 4.2 0 4.2 4% 86.80%

151 9930 中聯資 57.8 4.57 4.2 0 4.2 7.27% 91.90%

152 3607 谷崧 43.15 6.05 4.15 0 4.15 9.63% 68.60%

153 1560 中砂 47.5 4.63 4.1 0 4.1 8.63% 88.60%

154 3491 昇達科 62 3.57 4.08 0 4.08 6.59% 114%

155 5489 彩富 50.5 5.78 4.08 0 4.08 8.08% 70.60%

156 4938 和碩 64.9 6.24 4.04 0 4.04 6.22% 64.70%

157 1808 潤隆 24.8 3.73 4.01 0 4.01 16.20% 108%

158 6223 旺矽 51.7 6.62 4.01 0 4.01 7.75% 60.60%

159 2327 國巨 52.2 2.3 4 0 4 7.66% 174%

- 6. 160 2235 謚源 111 5.44 4 0 4 3.60% 73.50%

161 2382 廣達 49.9 4.9 4 0 4 8.02% 81.60%

162 2545 皇翔 20.05 5.6 4 0 4 20% 71.40%

163 3036 文曄 33.35 5.18 3 1 4 9% 57.90%

164 3189 景碩 63.3 8.11 4 0 4 6.32% 49.30%

165 3376 新日興 107.5 6.36 4 0 4 3.72% 62.90%

166 3416 融程電 53.3 4.12 4 0 4 7.50% 97.10%

167 3515 華擎 36.1 4.4 4 0 4 11.10% 90.90%

168 3570 大塚 50 5.49 4 0 4 8% 72.90%

169 3587 閎康 57.2 4.54 4 0 4 6.99% 88.10%

170 3628 盈正 49.15 4.71 4 0 4 8.14% 84.90%

171 4103 百略 84 5.63 4 0 4 4.76% 71%

172 4542 科嶠 17.6 5.62 3 1 4 17% 53.40%

173 4549 桓達 60 5.68 3.8 0.2 4 6.33% 66.90%

174 4930 燦星網 13.1 3.68 4 0 4 30.50% 109%

175 4999 鑫禾 37.6 6.74 4 0 4 10.60% 59.40%

176 5434 崇越 51.8 5.44 3.7 0.3 4 7.14% 68%

177 6210 慶生 41.5 5.77 4 0 4 9.64% 69.30%

178 6230 超眾 125 6.6 4 0 4 3.20% 60.60%

179 8066 來思達 92 4.71 4 0 4 4.35% 84.90%

180 8349 恒耀 79.5 3.65 4 0 4 5.03% 110%

181 8446 華研 84.1 5.43 2 2 4 2.38% 36.80%

182 9910 豐泰 166 5.33 3.7 0.3 4 2.23% 69.40%

183 9917 中保 92.4 4.74 4 0 4 4.33% 84.40%

184 9942 茂順 70.9 6.32 4 0 4 5.64% 63.30%

185 9943 好樂迪 49.25 4.4 4 0 4 8.12% 90.90%

186 6104 創惟 40.6 4.89 4 0 4 9.85% 81.80%

187 8942 森鉅 81.7 4.52 4 0 4 4.89% 88.50%

188 9945 潤泰新 38.65 5.69 4 0 4 10.30% 70.30%

189 2393 億光 49.85 5.12 3.99 0 3.99 8% 77.90%

190 3088 艾訊 60.3 4.75 3.99 0 3.99 6.61% 84%

191 6415 F-矽力 360 10.55 3.97 0 3.97 1.10% 37.60%

- 7. 192 6485 點序 48.8 7.68 3.42 0.49 3.91 7.02% 44.50%

193 6281 全國電 55.3 4.3 3.9 0 3.9 7.05% 90.70%

194 4551 智伸科 64.6 4.27 3.85 0 3.85 5.96% 90.20%

195 4745 F-合富 51.6 5.7 3.64 0.2 3.84 7.06% 63.90%

196 8050 廣積 46.9 4.07 3.33 0.5 3.83 7.10% 81.80%

197 1726 永記 69.6 6.39 3.8 0 3.8 5.46% 59.50%

198 3653 健策 39.1 3.83 3.8 0 3.8 9.72% 99.20%

199 5522 遠雄 33.2 5.99 3.8 0 3.8 11.40% 63.40%

200 4904 遠傳 67.3 3.52 3.75 0 3.75 5.57% 107%

201 3490 單井 67.5 9.15 3.71 0 3.71 5.50% 40.60%

202 1338 F-廣華 117 7.78 3.7 0 3.7 3.16% 47.60%

203 4958 F-臻鼎 65 9.12 3.67 0 3.67 5.65% 40.20%

204 2458 義隆 39.05 3.61 3.66 0 3.66 9.37% 101%

205 3563 牧德 39.6 4.03 3.63 0 3.63 9.16% 90.10%

206 4144 F-康聯 49.6 5.35 3.62 0 3.62 7.29% 67.70%

207 3257 虹冠電 39.65 5.58 2.75 0.85 3.6 6.94% 49.30%

208 5312 寶島科 80 5.87 3.6 0 3.6 4.50% 61.30%

209 5530 龍巖 56 5.49 3.6 0 3.6 6.43% 65.60%

210 5878 台名 40.4 3.86 1 2.6 3.6 2.48% 25.90%

211 4994 傳奇 57.1 3.98 1 2.5 3.51 1.75% 25.10%

212 5272 笙科 31.2 2.97 2.5 1 3.5 8.01% 84.20%

213 1583 程泰 61.1 6.88 3.5 0 3.5 5.73% 50.90%

214 2049 上銀 105 9.2 3.2 0.3 3.5 3.05% 34.80%

215 2228 劍麟 163 6.79 3.5 0 3.5 2.15% 51.60%

216 2420 新巨 39.7 3.84 3.5 0 3.5 8.82% 91.20%

217 3679 新至陞 40.5 3.67 3.5 0 3.5 8.64% 95.40%

218 4138 曜亞 58 4.02 3.5 0 3.5 6.03% 87.10%

219 4401 東隆興 79.9 3.65 3.5 0 3.5 4.38% 95.90%

220 4555 氣立 66.8 5.32 3.5 0 3.5 5.24% 65.80%

221 5007 三星 61.5 3.88 2.5 1 3.5 4.07% 64.40%

222 5288 F-豐祥 92.3 5.77 3.5 0 3.5 3.79% 60.70%

223 5371 中光電 26 4.46 3.5 0 3.5 13.50% 78.50%

- 8. 224 5474 聰泰 54.6 4.16 3.5 0 3.5 6.41% 84.10%

225 6202 盛群 48.15 3.5 3.5 0 3.5 7.27% 100%

226 6203 海韻電 29.2 4.38 3.5 0 3.5 12% 79.90%

227 6263 普萊德 38.8 4 3.3 0.2 3.5 8.51% 82.50%

228 6422 F-君耀 47.5 6.97 3 0.5 3.5 6.32% 43%

229 8070 長華 76.2 5.29 3.5 0 3.5 4.59% 66.20%

230 8213 志超 30 5.82 3.5 0 3.5 11.70% 60.10%

231 8433 弘帆 146.5 4.01 3.5 0 3.5 2.39% 87.30%

232 8437 F-大地 134.5 7.19 3.5 0 3.5 2.60% 48.70%

233 5251 天鉞電 28.4 4.01 3.49 0 3.49 12.30% 87%

234 6115 鎰勝 32.8 3.5 3.49 0 3.49 10.60% 99.70%

235 4965 商店街 101.5 3.94 2.44 1.05 3.49 2.41% 61.90%

236 6105 瑞傳 41.6 7.42 3.48 0 3.48 8.35% 46.90%

237 8091 翔名 55.9 4.69 3.42 0 3.42 6.12% 72.90%

238 3552 同致 308 5.76 3.4 0 3.4 1.10% 59%

239 2104 中橡 22.05 4.76 2.4 0.9 3.3 10.90% 50.40%

240 2347 聯強 30.3 3.16 3.3 0 3.3 10.90% 104%

241 3010 華立 42.15 5.5 3.3 0 3.3 7.83% 60%

242 8435 鉅邁 46.8 3.27 3 0.3 3.3 6.41% 91.70%

243 3026 禾伸堂 31.85 4.05 3.29 0 3.29 10.30% 81.20%

244 2433 互盛電 42.6 3.4 3.2 0 3.2 7.51% 94.10%

245 4175 杏一 75.6 4.04 3.2 0 3.2 4.23% 79.20%

246 5471 松翰 33.8 3.12 3.2 0 3.2 9.47% 103%

247 6188 廣明 21.35 3.85 3.2 0 3.2 15% 83.10%

248 5871 F-中租 50.4 6.23 2.8 0.4 3.2 5.56% 44.90%

249 6189 豐藝 29.65 3.48 3.2 0 3.2 10.80% 92%

250 5349 先豐 26.65 3.72 3.14 0 3.14 11.80% 84.40%

251 4119 旭富 75 3.83 3.11 0 3.11 4.15% 81.20%

252 3213 茂訊 39.15 3.88 3.1 0 3.1 7.92% 79.90%

253 3227 原相 67.5 2.95 3 0 3 4.45% 102%

254 5269 祥碩 195 4.04 3 0 3 1.54% 74.30%

255 3684 榮昌 53.9 3.4 2.7 0.3 3 5.01% 79.40%

- 9. 256 1436 華友聯 40.7 5.35 1.5 1.5 3 3.69% 28%

257 1507 永大 44.2 4.95 3 0 3 6.79% 60.60%

258 1527 鑽全 57.9 6.31 3 0 3 5.18% 47.50%

259 1777 生泰 82.4 4.93 3 0 3 3.64% 60.80%

260 2105 正新 50.1 4.94 3 0 3 5.99% 60.70%

261 2325 矽品 52.7 3.76 3 0 3 5.69% 79.80%

262 2373 震旦行 50.2 3.46 3 0 3 5.98% 86.70%

263 2377 微星 40.5 3.57 3 0 3 7.41% 84%

264 2497 怡利電 31.35 4.51 3 0 3 9.57% 66.50%

265 2539 櫻花建 23.95 4.64 1 2 3 4.18% 21.60%

266 2881 富邦金 36.8 5.89 3 0 3 8.15% 50.90%

267 3040 遠見 29.85 6.42 3 0 3 10% 46.70%

268 3443 創意 59.8 3.27 3 0 3 5.02% 91.70%

269 3666 光耀 20.7 5.13 3 0 3 14.50% 58.50%

270 4190 F-佐登 117 5.18 3 0 3 2.56% 57.90%

271 4995 晶達 36.7 3.33 3 0 3 8.17% 90.10%

272 5015 華祺 16.6 3.72 3 0 3 18.10% 80.60%

273 5215 F-科嘉 35.45 4.28 3 0 3 8.46% 70.10%

274 5907 F-大洋 22.65 5.38 3 0 3 13.20% 55.80%

275 6186 新潤 19.9 3.34 2.5 0.5 3 12.60% 74.80%

276 6192 巨路 41 5.34 3 0 3 7.32% 56.20%

277 6239 力成 66 4.24 3 0 3 4.55% 70.80%

278 6292 迅德 27.65 3.31 3 0 3 10.80% 90.60%

279 6470 宇智 43 4.79 2.5 0.5 3 5.81% 52.20%

280 8042 金山電 38.2 4.73 3 0 3 7.85% 63.40%

281 8210 勤誠 37.6 4.52 3 0 3 7.98% 66.40%

282 8426 F-紅木 28.15 4.05 3 0 3 10.70% 74.10%

283 8039 台虹 33.65 4.32 3 0 3 8.91% 69.40%

284 3623 富晶通 59.4 3.95 3 0 3 5.05% 76%

285 5388 中磊 77.8 4.21 2.99 0 2.99 3.85% 71%

286 8916 光隆 49.75 4 2.97 0 2.97 5.96% 74.20%

287 6435 大中 28.55 3.34 2.95 0 2.95 10.30% 88.30%

- 10. 288 3023 信邦 56 3.82 2.75 0.2 2.95 4.91% 72%

289 8103 瀚荃 22.6 5.18 2.93 0 2.93 13% 56.60%

290 5263 智崴 272.5 6.83 1.95 0.97 2.92 0.72% 28.60%

291 2637 F-慧洋 35.55 3.81 2.92 0 2.92 8.21% 76.60%

292 6285 啟碁 80.1 4.28 2.7 0.2 2.9 3.37% 63.10%

293 6166 凌華 67.6 3.21 1.9 0.9 2.8 2.81% 59.20%

294 2107 厚生 16.05 6.57 2.8 0 2.8 17.40% 42.60%

295 2441 超豐 32.55 3.98 2.8 0 2.8 8.60% 70.40%

296 2493 揚博 20.1 3.28 2.8 0 2.8 13.90% 85.40%

297 3209 全科 24.75 3.11 1.3 1.5 2.8 5.25% 41.80%

298 3293 鈊象 123 3.28 2.8 0 2.8 2.28% 85.40%

299 3479 安勤 68 3.5 2.8 0 2.8 4.12% 80%