Oz Metals 26 Oct 2014

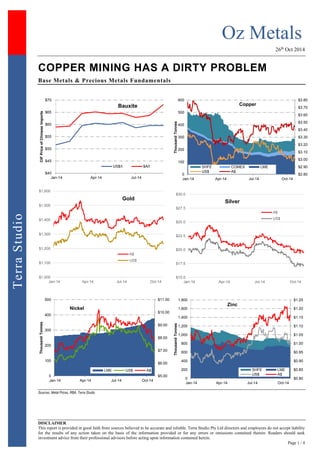

- 1. Oz Metals 26th Oct 2014 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 1 / 4 Terra Studio COPPER MINING HAS A DIRTY PROBLEM Base Metals & Precious Metals Fundamentals Sources: Metal Prices, RBA, Terra Studio $40 $45 $50 $55 $60 $65 $70 Jan-14 Apr-14 Jul-14 CIF Price of Chinese Imports Bauxite US$/t $A/t $2.80 $2.90 $3.00 $3.10 $3.20 $3.30 $3.40 $3.50 $3.60 $3.70 $3.80 0 100 200 300 400 500 600 Jan-14 Apr-14 Jul-14 Oct-14 Thousand Tonnes Copper SHFE COMEX LME US$ A$ $1,000 $1,100 $1,200 $1,300 $1,400 $1,500 $1,600 Jan-14 Apr-14 Jul-14 Oct-14 Gold A$ US$ $15.0 $17.5 $20.0 $22.5 $25.0 $27.5 $30.0 Jan-14 Apr-14 Jul-14 Oct-14 Silver A$ US$ $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 $11.00 0 100 200 300 400 500 Jan-14 Apr-14 Jul-14 Oct-14 Thousand Tonnes Nickel LME US$ A$ $0.80 $0.85 $0.90 $0.95 $1.00 $1.05 $1.10 $1.15 $1.20 $1.25 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Jan-14 Apr-14 Jul-14 Oct-14 Thousand Tonnes Zinc SHFE LME US$ A$

- 2. Oz Metals 26th Oct 2014 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 2 / 4 Terra Studio Markets & Majors A new report by GFMS, a metals and mining consultancy, highlights another problem many of the newer copper mines face: dirty concentrate. According to the authors the proportion of deleterious elements such as arsenic, antimony and bismuth have crept up relative to copper concentrate grades over the past decade as result of a greater proportion of low grade – high tonnage operations. This has resulted in producers incurring progressively higher penalty charges and receiving lower payables from smelters. Thanks to increasing environmental restrictions most smelters no longer accept concentrates with greater than 0.5% arsenic. In a bid to help finance its US$29 billion investment program, Chilean copper miner Codelco is planning to sell about US$8 billion worth of bonds over the next five years, according to an Oct. 21 report from Bloomberg News. Codelco Chairman Oscar Landerretche said in an interview that the company is seeking to invest US$24 billion in the next four to five years, with plans to invest another US$5 billion over the next 10 years, to increase annual production rates from the current 1.7 million tons to approximately 2.5 million tons by 2025. The chairman also warned that the company is in a "make or break situation" regarding its investments, adding that Codelco could risk nearly running out of copper by 2030 if it does not invest billions of dollars at all of its mines. Codelco's board of directors approved a restructuring of management in early October. The shake- up includes changes at the miner's Chuquicamata, Radomiro Tomic, Mina Ministro Hales and Salvador operations. The Age - Rio Tinto is leaving US$4.2 billion in financing needed to move forward its troubled Oyu Tolgoi project in limbo until the miner can get greater clarity from the Mongolian government. Rio copper boss Jean-Sebastien Jacques said the miner had not requested a formal extension to a lapsed deadline for project financing because the ball was in the Mongolian government's court. Rio has been in a long-running standoff with the Mongolian government over their joint venture, the massive Oyu Tolgoi copper and gold mine, and let a September 30 project financing deadline pass for US$4.2 billion to fund the underground expansion. SNL - China is accelerating its global expansion in the gold sector following the recent signing of a strategic cooperation agreement between the China Gold Association and the World Gold Association. China National Gold Group Corp. General Manager Song Xin told delegates at China Mining 2014 in Tianjin, China, that gold is important to safeguarding China's economic and financial security. The Australian - Newcrest Mining’s NSW gold project is helping it keep on top of costs as it works to turn around its fortunes. Australia’s largest goldminer has cut its “all-in sustaining costs”, by 20% from a year ago, to $864/oz during the three months to the end of September. However, gold production in the September quarter fell to 561,731 oz, down 12% on the June quarter and 4% on the same period in 2013. SNL - Hong Kong Exchanges & Clearing Ltd.'s first Asia commodities contracts — London aluminium mini futures, London zinc mini futures and London copper mini futures — will begin trading Dec. 1, subject to market readiness. The three mini metals contracts will trade in Chinese yuan. Thomson Reuters - The Shanghai Gold Exchange (SGE) is working on plans for China's first forwards and options in gold, sources say, potentially putting China ahead in the race to set an Asian pricing benchmark that might eventually rival the London gold fix. China, which overtook India last year to become the world's biggest consumer of gold, bans trading in commodity options and forwards at present to limit speculation. But Beijing is setting the stage for the launch of such derivatives as it opens up its markets, and gold could be among the first commodities on the list, although it remains unclear when trading might start. The state-run SGE, at the forefront of China's efforts to dominate bullion pricing, opened an international bourse last month and foreign banks have shown strong interest in trading its yuan- denominated contracts. The exchange now wants to expand its product line to boost liquidity. Vale is growing its nickel output at a pace that not even its own executives were able to predict, with the Rio de Janeiro-based iron ore giant posting a 16% production increase. Nickel production totalled 72,100t in the September quarter, which is the best third-quarter performance since 2008, Vale said. The figure takes the miner’s total output of the metal this year to 201,400t and its next production target of 289,000t in 2014, higher than predicted by Norilsk Nickel, the world's largest producer of the metal. The figure takes the miner’s total output of the metal this year to 201,400t and its next production target of 289,000t in 2014, higher than predicted by Norilsk Nickel, the world's largest producer of the metal, which plans to produce 230,000t this year. Reuters quoted MMG CEO Andrew Michelmore as saying that the company's Century zinc mine in Queensland, will stop producing metal in 2015 as scheduled. Funding, Mergers & Acquisitions AFR - CuDeco Ltd. could look to raise up to A$100 million to help complete its Queensland, Australia-based Rocklands copper project by the latest target date of March 2015, and secure working capital. Norilsk Nickel inked definitive transaction agreements to sell its 50% participation interest in the Nkomati nickel mine in South Africa and its 85% stake in Tati Nickel Mining Co. Pty. Ltd. in Botswana, to BCL Ltd. for US$337 million. The transaction marks Norilsk Nickel's full exit from its African business, which together with earlier disposals of its Australian assets represents the complete exit from international operations marked for disposal. Talisman has reached a binding agreement with Xstrata Nickel Australasia Operations Pty Ltd, a subsidiary of Glencore, to acquire the Sinclair Nickel Project in WA for $8 million plus a deferred $2m payment contingent upon a recommencement of mine production. Sinclair was placed on care & maintenance in August 2013.

- 3. Oz Metals 26th Oct 2014 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 3 / 4 Terra Studio Tiger Resources completed the acquisition of the remaining 40% shareholding in Société d'Exploitation de Kipoi, the owner of the Kipoi copper project in the Democratic Republic of the Congo. This follows the drawdown of US$50 million against a finance facility with Taurus Mining Finance Fund. Minotaur Exploration executed a conditional sale and purchase deed for the sale of its Lake Purdilla gypsum deposits in South Australia. The sale price is $4.8 million. The West Australian - Mutiny Gold shares have been suspended to give it more time to resolve merger talks with Doray Minerals. Doray and Mutiny are understood to be in talks about an all-scrip deal to create a pro forma $100 million gold miner. WSJ - Shandong Zhaojin Group Co. Ltd. Chairman Lu Dongshang said the company is in discussions to acquire gold-mining assets in North America and Australia. Bauxite Sector Source: ASX Copper Producers Source: SNL Copper Developers & Explorers Source: SNL Gold Producers Source: SNL Gold Developers & Explorers Source: SNL Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABX Australian Bauxite 0.31 ▲ 2% 39% 39 2 37 BAU Bauxite Resources 0.13 ▲ 4% 4% 29 41 (12) CBX Cape Alumina 0.016 ▼ (11%) (47%) 4 1 3 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA ABY Aditya Birla Minerals 0.22 ▼ (2%) (37%) 67 137 (69) NM AOH Altona Mining 0.23 ▼ (2%) 39% 123 18 108 3.0x DML Discovery Metals 0.030 — 0% (43%) 19 5 139 2.4x HGO Hillgrove Resources 0.59 ▲ 14% (19%) 86 16 101 2.4x KBL KBL Mining 0.044 ▲ 10% 0% 17 7 33 2.0x OZL OZ Minerals 4.07 ▲ 3% 29% 1,235 364 1,080 5.9x PNA PanAust 1.72 ▼ (2%) (5%) 1,092 146 1,308 NA SFR Sandfire Resources 5.70 ▲ 3% (12%) 887 58 990 4.5x SRQ Straits Resources 0.005 — 0% (38%) 6 13 129 17.5x TGS Tiger Resources 0.27 ▲ 18% (23%) 303 42 432 NA 985 CST Mining 0.006 ▼ (2%) (36%) 171 146 16 NM 1208 MMG 0.37 ▼ (3%) 55% 1,969 154 3,864 4.3x 3993 China Molybdenum 0.67 ▼ (2%) 31% 5,645 347 6,356 NA MWE Mawson West 0.18 ▼ (3%) (70%) 30 54 25 NM Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ARE Argonaut Resources 0.018 — 0% (24%) 8 2 5 AVB Avanco Resources 0.090 ▲ 3% 27% 150 32 117 AVI Avalon Minerals 0.004 — 0% (60%) 6 1 5 AZS Azure Minerals 0.023 ▲ 5% (23%) 19 1 18 BTR Blackthorn Resources 0.26 ▲ 2% 0% 43 12 30 CDU CuDeco 1.30 ▼ (6%) (28%) 306 9 297 ENR Encounter Resources 0.20 ▲ 14% 5% 27 4 23 ERM Emmerson Resources 0.034 — 0% (12%) 13 2 11 FND Finders Resources 0.150 — 0% (28%) 101 8 86 GCR Golden Cross Resources 0.100 ▼ (5%) 0% 9 2 7 GPR Geopacific Resources 0.071 ▲ 1% 137% 21 3 20 HAV Havilah Resources 0.135 ▲ 8% (44%) 21 6 18 HCH Hot Chili 0.21 ▼ (11%) (52%) 71 13 69 HMX Hammer Metals 0.105 ▼ (9%) (48%) 9 1 8 IAU Intrepid Mines 0.24 ▼ (2%) (24%) 134 11 (26) IRN Indophil Resources 0.29 ▲ 2% 73% 343 215 134 KDR Kidman Resources 0.075 ▲ 1% (59%) 9 3 6 KGL KGL Resources 0.28 ▲ 2% 162% 39 7 24 MEP Minotaur Exploration 0.17 ▲ 6% 17% 26 5 22 MNC Metminco 0.013 ▼ (7%) (58%) 23 8 20 PEX Peel Mining 0.077 — 0% (70%) 10 3 7 RDM Red Metal 0.17 ▼ (3%) 10% 29 2 27 RXM Rex Minerals 0.23 ▲ 1% (52%) 51 3 49 SMD Syndicated Metals 0.045 — 0% 32% 12 2 10 SRI Sipa Resources 0.040 ▲ 8% (29%) 12 2 10 SUH Southern Hemisphere 0.056 — 0% 12% 14 2 11 THX Thundelarra Resources 0.115 ▲ 22% 203% 37 1 36 XAM Xanadu Mines 0.10 ▼ (13%) 100% 24 4 25 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA AGD Austral Gold 0.12 — 0% (4%) 20 NA 80 6.7x ALK Alkane Resources 0.25 ▼ (8%) (28%) 101 16 86 12.7x AMI Aurelia Metals 0.32 ▼ (3%) 39% 110 22 195 NM BDR Beadell Resources 0.33 — 0% (58%) 264 10 325 2.6x DRM Doray Minerals 0.48 ▼ (4%) (14%) 80 16 79 2.4x EVN Evolution Mining 0.64 ▼ (5%) 4% 458 32 587 2.9x IGO Independence Group 4.46 ▲ 6% 43% 1,045 57 1,016 7.2x KCN Kingsgate Consolidated 0.76 ▲ 7% (14%) 170 54 270 NM KRM Kingsrose Mining 0.38 — 0% 13% 136 7 142 NM LSA Lachlan Star 0.045 ▲ 5% (78%) 7 2 25 9.1x MIZ Minera Gold 0.006 ▲ 10% (21%) 14 0 18 NM MLX Metals X 0.22 ▲ 2% 26% 356 57 299 4.3x MML Medusa Mining 0.71 ▼ (4%) (65%) 148 14 143 2.6x MOY Millennium Minerals 0.075 ▼ (15%) (61%) 16 2 55 5.6x NCM Newcrest Mining 10.03 ▲ 0% 29% 7,685 141 11,746 NM NGF Norton Gold Fields 0.14 — 0% 0% 126 38 226 NA NST Northern Star Resources 1.24 ▲ 0% 57% 731 82 655 7.8x OGC OceanaGold Corp. 2.38 ▼ (6%) 43% 717 28 841 3.8x PGI PanTerra Gold 0.031 ▲ 7% (24%) 25 6 91 4.5x PRU Perseus Mining 0.34 ▼ (8%) 39% 179 37 149 26.9x RMS Ramelius Resources 0.051 ▼ (2%) (47%) 24 12 14 NM RRL Regis Resources 1.50 ▼ (0%) (49%) 750 7 783 NM RSG Resolute Mining 0.34 ▼ (12%) (40%) 215 19 246 2.3x SAR Saracen Mineral Holdings 0.32 ▼ (3%) 78% 254 36 232 5.5x SBM St Barbara 0.14 ▼ (7%) (48%) 66 79 326 NM SLR Silver Lake Resources 0.33 ▼ (4%) (38%) 166 24 155 NM TBR Tribune Resources 3.10 ▲ 12% 33% 156 11 170 9.9x TRY Troy Resources 0.66 ▼ (1%) (16%) 129 43 126 NM UML Unity Mining 0.009 ▼ (10%) (78%) 10 7 4 NM Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) ABU ABM Resources 0.36 ▲ 1% 8% 97 10 87 AWV Anova Metals 0.039 ▼ (3%) 95% 9 1 7 AZM Azumah Resources 0.035 ▼ (3%) 25% 14 4 11 BLK Blackham Resources 0.13 — 0% (24%) 15 1 15 BSR Bassari Resources 0.016 — 0% 100% 19 - 19 CHN Chalice Gold Mines 0.13 ▲ 8% (4%) 37 44 (7) CHZ Chesser Resources 0.16 ▲ 10% 52% 35 1 36 DCN Dacian Gold 0.33 — 0% 38% 24 11 13 EXG Excelsior Gold 0.060 ▼ (2%) (13%) 27 1 26 FML Focus Minerals 0.011 ▼ (8%) (8%) 101 81 100 GCY Gascoyne Resources 0.13 ▼ (7%) (7%) 22 1 21 GMR Golden Rim Resources 0.010 ▲ 11% (9%) 11 1 12 GOR Gold Road Resources 0.29 ▲ 7% 193% 172 10 162 GRY Gryphon Minerals 0.09 ▼ (22%) (45%) 38 34 2 IDC Indochine Mining 0.019 ▲ 19% (56%) 23 0 24 KGD Kula Gold 0.070 ▲ 6% (33%) 11 3 10 MSR Manas Resources 0.025 ▲ 4% (22%) 11 6 9 MUX Mungana Goldmines 0.115 ▼ (23%) 326% 19 5 14 MYG Mutiny Gold 0.049 ▲ 26% 55% 33 3 30 OBS Orbis Gold 0.69 ▲ 2% 176% 172 5 168 OGX Orinoco Gold 0.098 ▲ 4% (24%) 12 1 13 PXG Phoenix Gold 0.09 ▼ (1%) (41%) 34 9 25 RED Red 5 0.089 ▲ 2% 1% 68 38 29 RNI Resource & Investment 0.10 ▼ (9%) 89% 47 2 59 RNS Renaissance Minerals 0.074 ▲ 1% 23% 30 2 28 SIH Sihayo Gold 0.013 — 0% (56%) 13 0 9 SXG Southern Cross Goldfields 0.018 ▲ 38% 38% 24 3 26 TAM Tanami Gold 0.016 — 0% (27%) 19 1 25 WPG WPG Resources 0.046 — 0% 59% 12 5 7

- 4. Oz Metals 26th Oct 2014 DISCLAIMER This report is provided in good faith from sources believed to be accurate and reliable. Terra Studio Pty Ltd directors and employees do not accept liability for the results of any action taken on the basis of the information provided or for any errors or omissions contained therein. Readers should seek investment advice from their professional advisors before acting upon information contained herein. Page 4 / 4 Terra Studio Lithium & Tantalum Sector Source: SNL Nickel Sector Source: SNL Zinc & Poly-metallic Sector Source: SNL For further information, please contact: J-François Bertincourt m +61 406 998 779 jf@terrastudio.biz Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AJM Altura Mining 0.105 ▼ (5%) (25%) 48 3 63 GXY Galaxy Resources 0.031 ▼ (3%) (34%) 33 3 100 ORE Orocobre 2.75 ▲ 17% 10% 363 26 338 PLS Pilbara Minerals Ltd. 0.049 ▼ (11%) 308% 29 1 29 RDR Reed Resources 0.033 ▼ (8%) (43%) 16 7 11 Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) TEV/ EBITDA IGO Independence Group 4.46 ▲ 6% 43% 1,045 57 1,016 7.2x MCR Mincor Resources 0.60 ▲ 7% 1% 113 26 91 2.9x PAN Panoramic Resources 0.58 — 0% 132% 187 64 131 2.7x WSA Western Areas 4.43 ▲ 2% 87% 1,029 231 1,017 7.0x AVQ Axiom Mining 0.018 — 0% 20% 59 0 58 NM CZI Cassini Resources 0.18 ▼ (3%) 260% 21 8 13 NM LEG Legend Mining 0.008 — 0% 0% 16 5 12 NM MLM Metallica Minerals 0.067 — 0% 34% 11 1 10 NM PIO Pioneer Resources 0.02 — 0% 42% 10 1 9 NM POS Poseidon Nickel 0.16 ▼ (9%) 104% 93 4 124 NM SEG Segue Resources 0.014 ▲ 17% 250% 21 1 20 NM SGQ St George Mining 0.09 ▲ 11% (1%) 11 1 9 NA SIR Sirius Resources 2.94 ▲ 2% 30% 1,004 59 945 NM TLM Talisman Mining 0.19 ▲ 76% 76% 24 16 8 NM WIN Winward Resources 0.17 ▼ (6%) (15%) 11 6 5 NM Code Company Name Close Price Week r YTD r 52 Week Range Market Cap (A$m) Cash (A$m) TEV (A$m) AQR Aeon Metals 0.13 — 0% 0% 40 5 47 CCU Cobar Consolidated 0.058 — 0% (52%) 19 6 31 DGR DGR Global 0.044 ▼ (2%) 47% 18 0 19 HRR Heron Resources 0.15 — 0% 7% 54 33 21 IBG Ironbark Zinc 0.09 ▼ (5%) 60% 41 2 39 IPT Impact Minerals 0.023 ▼ (15%) (43%) 13 1 12 IVR Investigator Resources 0.027 ▼ (4%) (43%) 12 3 10 MRP MacPhersons Resources 0.11 ▼ (12%) (39%) 33 7 26 RDM Red Metal 0.17 ▼ (3%) 10% 29 8 21 ROL Robust Resources 0.49 ▼ (1%) 39% 95 17 81 RXL Rox Resources 0.041 ▼ (2%) 24% 35 3 32 TZN Terramin Australia 0.073 ▼ (6%) 161% 96 5 145 VXR Venturex Resources 0.005 ▼ (17%) (50%) 8 3 4