MIDF , TNB and IPP

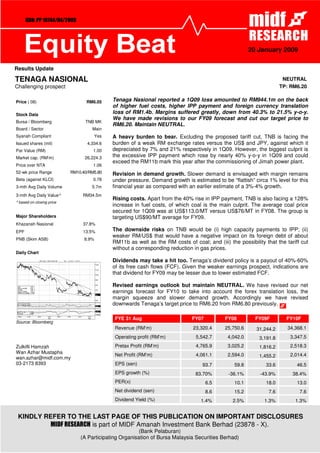

- 1. KDN: PP 10744/04/2009 20 January 2009 Results Update TENAGA NASIONAL NEUTRAL Challenging prospect TP: RM6.20 Price ( 08) RM6.05 Tenaga Nasional reported a 1Q09 loss amounted to RM944.1m on the back of higher fuel costs, higher IPP payment and foreign currency translation Stock Data loss of RM1.4b. Margins suffered greatly, down from 40.3% to 21.5% y-o-y. We have made revisions to our FY09 forecast and cut our target price to Bursa / Bloomberg TNB MK RM6.20. Maintain NEUTRAL. Board / Sector Main Syariah Compliant Yes A heavy burden to bear. Excluding the proposed tariff cut, TNB is facing the Issued shares (mil) 4,334.6 burden of a weak RM exchange rates versus the US$ and JPY, against which it Par Value (RM) 1.00 depreciated by 7% and 21% respectively in 1Q09. However, the biggest culprit is Market cap. (RM’m) 26,224.3 the excessive IPP payment which rose by nearly 40% y-o-y in 1Q09 and could exceed the RM11b mark this year after the commissioning of Jimah power plant. Price over NTA 1.06 52-wk price Range RM10.40/RM5.80 Revision in demand growth. Slower demand is envisaged with margin remains Beta (against KLCI) 0.78 under pressure. Demand growth is estimated to be “flattish” circa 1% level for this 3-mth Avg Daily Volume 5.7m financial year as compared with an earlier estimate of a 3%-4% growth. 3-mth Avg Daily Value^ RM34.5m Rising costs. Apart from the 40% rise in IPP payment, TNB is also facing a 128% ^ based on closing price increase in fuel costs, of which coal is the main culprit. The average coal price secured for 1Q09 was at US$113.0/MT versus US$76/MT in FY08. The group is Major Shareholders targeting US$90/MT average for FY09. Khazanah Nasional 37.8% EPF 13.5% The downside risks on TNB would be (i) high capacity payments to IPP; (ii) weaker RM/US$ that would have a negative impact on its foreign debt of about PNB (Skim ASB) 8.9% RM11b as well as the RM costs of coal; and (iii) the possibility that the tariff cut without a corresponding reduction in gas prices. Daily Chart Dividends may take a hit too. Tenaga’s dividend policy is a payout of 40%-60% of its free cash flows (FCF). Given the weaker earnings prospect, indications are that dividend for FY09 may be lesser due to lower estimated FCF. Revised earnings outlook but maintain NEUTRAL. We have revised our net earnings forecast for FY10 to take into account the forex translation loss, the margin squeeze and slower demand growth. Accordingly we have revised downwards Tenaga’s target price to RM6.20 from RM6.80 previously. FYE 31 Aug FY07 FY08 FY09F FY10F Source: Bloomberg Revenue (RM’m) 23,320.4 25,750.6 31,244.2 34,368.1 Operating profit (RM’m) 5,542.7 4,042.0 3,191.8 3,347.5 Zulkifli Hamzah Pretax Profit (RM’m) 4,765.9 3,025.2 1,816.2 2,518.3 Wan Azhar Mustapha Net Profit (RM’m) 4,061.1 2,594.0 1,455.2 2,014.4 wan.azhar@midf.com.my 03-2173 8393 EPS (sen) 93.7 59.8 33.6 46.5 EPS growth (%) 83.70% -36.1% -43.9% 38.4% PER(x) 6.5 10.1 18.0 13.0 Net dividend (sen) 8.6 15.2 7.6 7.6 Dividend Yield (%) 1.4% 2.5% 1.3% 1.3% KINDLY REFER TO THE LAST PAGE OF THIS PUBLICATION ON IMPORTANT DISCLOSURES MIDF RESEARCH is part of MIDF Amanah Investment Bank Berhad (23878 - X). (Bank Pelaburan) (A Participating Organisation of Bursa Malaysia Securities Berhad)

- 2. MIDF EQUITY BEAT Tuesday, 20 January 2009 Tariff cut. The management has stated that any reduction in electricity tariff must be compensated with a corresponding reduction in gas prices. The main issue is whether Petronas would want to reduce its current gas price of RM14.31 per mmbtu which is already at a steep discount to the prevailing market price of about RM21 per mmbtu. Why pay the IPP so much? The biggest thorn in TNB is the high IPP capacity payment estimated to exceed RM11b for the financial year. With Jimah power plant to go on stream this year, TNB could incur an additional RM500m to RM1b IPP payment. This is generally viewed as excessive given TNB current reserve margin is at 47%. The big question is, why pay extravagantly for something you don’t need? TENAGA NASIONAL: 1QFY09 Results Summary Quarterly Results Comments FY Aug (RM’m) 1Q09 %YoY %QoQ Turnover 7,895.0 27.2% 11.4% Y-o-y higher revenue was due to the tariff hike in July 08, while q-o-q performance was undermined by a weaker demand growth at just 1.1% q-o-q. Operating profit 942.4 -44.0% 263.3% The group incurred a significantly higher operating expenses, up 48.9% y-o-y mainly due to: (i) 39.5% higher IPP payment (ii) 128.2% increase in fuel costs (iii) 40.5% increase in staff costs from an average of 6% salary increments and RM52m in back dated salary adjustment from a collective agreement. EBITDA margin was halved, from 40.5% to 21.5% y-o-y. Forex translation loss (1,439.7) -693.9% 398.5% US$ and JPY appreciated 6% and 21% respectively in the quarter under review on a total of RM11b in foreign debts. Forex transaction gain 2.0 -1100.0% -129.4% Associate 7.8 -17.0% -32.2% Pre-tax profit (772.7) -147.0% 180.8% Tax & zakat (168.0) 32.2% 2654.1% Minority interest 3.4 70.0% 112.5% Net Profit (944.1) -162.3% 233.7% Net profit before forex translation loss was at RM495.6m. 1Q09 FY08 FY07 Avg coal prices (US$) 113.9/MT 76.4/MT 45.3/MT The average coal price for the remaining quarters are expected to be lower with an estimated average of US$90/MT for FY09. 1Q09 4Q08 % chg RM/US$ 3.62 3.39 -6.8% We anticipate forex loss to ease in the upcoming quarters with the expectation of US$ and JPY to weaken against the RM/JPY 3.8 3.13 -21.4% RM. Source: Company, MIDF Research 2

- 3. MIDF EQUITY BEAT Tuesday, 20 January 2009 DISCLAIMER This report has been prepared by MIDF AMANAH INVESTMENT BANK BERHAD (23878-X). It is for distribution only under such circumstances as may be permitted by applicable law. Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. MIDF AMANAH INVESTMENT BANK BERHAD makes no representation or warranty, expressed or implied, as to the accuracy, completeness or reliability of the information contained therein and it should not be relied upon as such. This report is not, and should not be construed as, an offer to buy or sell any securities or other financial instruments. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. All opinions and estimates are subject to change without notice. The research analysts will initiate, update and cease coverage solely at the discretion of MIDF AMANAH INVESTMENT BANK BERHAD. The directors, employees and representatives of MIDF AMANAH INVESTMENT BANK BERHAD may have interest in any of the securities mentioned and may benefit from the information herein. Members of the MIDF Group and their affiliates may provide services to any company and affiliates of such companies whose securities are mentioned herein This document may not be reproduced, distributed or published in any form or for any purpose. MIDF AMANAH INVESTMENT BANK : GUIDE TO RECOMMENDATIONS STOCK RECOMMENDATIONS BUY Total return is expected to be > 5% compared with that of an assigned benchmark over the next 12 months. TRADING BUY Stock price is expected to rise within 3-months after an investment rating has been assigned due to positive newsflow. NEUTRAL Total return is expected to be between -5% and +5% compared with that of an assigned benchmark over the next 12 months. SELL Total return is expected to be < 5% compared with that of an assigned benchmark over the next 12 months. TRADING SELL Stock price is expected to fall within 3-months after an investment rating has been assigned due to negative newsflow. SECTOR RECOMMENDATIONS OVERWEIGHT The sector is expected to outperform the overall market over the next 12 months. NEUTRAL The sector is to perform in line with the overall market over the next 12 months. UNDERWEIGHT The sector is expected to underperform the overall market over the next 12 months. 3