How the slowing has impacted the luxury sector

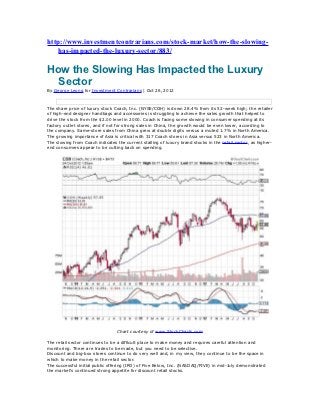

- 1. http://www.investmentcontrarians.com/stock-market/how-the-slowing- has-impacted-the-luxury-sector/883/ How the Slowing Has Impacted the Luxury Sector By George Leong for Investment Contrarians | Oct 26, 2012 The share price of luxury stock Coach, Inc. (NYSE/COH) is down 28.4% from its 52-week high; the retailer of high-end designer handbags and accessories is struggling to achieve the sales growth that helped to drive the stock from the $2.00 level in 2000. Coach is facing some slowing in consumer spending at its factory outlet stores, and if not for strong sales in China, the growth would be even lower, according to the company. Same-store sales from China grew at double digits versus a muted 1.7% in North America. The growing importance of Asia is critical with 317 Coach stores in Asia versus 523 in North America. The slowing from Coach indicates the current stalling of luxury brand stocks in the retail sector, as higher- end consumers appear to be cutting back on spending. Chart courtesy of www.StockCharts.com The retail sector continues to be a difficult place to make money and requires careful attention and monitoring. There are trades to be made, but you need to be selective. Discount and big-box stores continue to do very well and, in my view, they continue to be the space in which to make money in the retail sector. The successful initial public offering (IPO) of Five Below, Inc. (NASDAQ/FIVE) in mid-July demonstrated the market’s continued strong appetite for discount retail stocks.

- 2. Luxury retail stocks had been on a tear in 2011, but have now lost some luster amongst investors in the retail sector. Luxury jeweler Tiffany & Co. (NYSE/TIF), after beating Thomson Financial consensus earnings-per-share (EPS) estimates in three straight quarters, has fallen short in the last three consecutive quarters. While Coach and Tiffany face some growth issues in the retail sector, you cannot say the same for high- end clothing retailer Michael Kors Holdings Limited (NYSE/KORS), which Thomson Financial estimates to report sales growth of 51.3% in fiscal 2013 and 30.3% in fiscal 2014. Michael Kors beat on Thomson Financial EPS estimates by 122.2% in its fiscal third quarter, 37.5% in its fiscal fourth quarter, and 70.0% in its 2013 fiscal first quarter. The stock debuted on December 15, 2011 and doubled in price before the recent weakness. Based on the operating results, Michael Kors could be a special stock going forward. Chart courtesy of www.StockCharts.com The key to investing in the retail sector is to search for companies that offer some sort of niche or a product that makes it different from its competitors. The luxury retail sector stocks are a niche that has a growing target market with the new-found riches in the BRIC countries (Brazil, Russia, India, and China). These stocks tend to have strong global brand awareness and are sought after by those who are the newly rich and those who are the old money. In the short term, I think the money in the retail sector will likely be made in the discount and big-box retail stocks. http://www.investmentcontrarians.com