Wmt Model Template

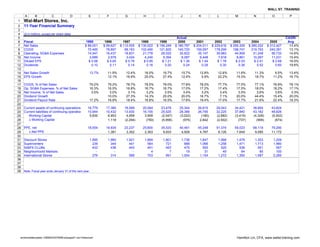

- 1. WALL ST. TRAINING A B C D E F G H I J K L M N O P 1 Wal-Mart Stores, Inc. 2 11-Year Financial Summary 3 4 ($ in millions, except per share data) 5 Actual CAGR/ 6 Fiscal 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 Avg 7 Net Sales $ 89,051 $ 99,627 $ 112,005 $ 130,522 $ 156,249 $ 180,787 $ 204,011 $ 229,616 $ 256,329 $ 285,222 $ 312,427 13.4% 8 COGS 70,485 78,897 88,163 102,490 121,825 140,720 159,097 178,299 198,747 219,793 240,391 13.1% 9 Operating, SG&A Expenses 14,547 16,437 18,831 21,778 26,025 30,822 35,147 39,983 44,909 51,248 56,733 14.6% 10 Net Income 2,689 2,978 3,424 4,240 5,394 6,087 6,448 7,818 8,861 10,267 11,231 15.4% 11 Diluted EPS $ 0.58 $ 0.65 $ 0.76 $ 0.95 $ 1.21 $ 1.36 $ 1.44 $ 1.76 $ 2.03 $ 2.41 $ 2.68 16.5% 12 Dividends 0.10 0.11 0.14 0.16 0.20 0.24 0.28 0.30 0.36 0.52 0.60 19.6% 13 14 Net Sales Growth 13.7% 11.9% 12.4% 16.5% 19.7% 15.7% 12.8% 12.6% 11.6% 11.3% 9.5% 13.4% 15 EPS Growth 12.1% 16.9% 25.0% 27.4% 12.4% 5.9% 22.2% 15.3% 18.7% 11.2% 16.7% 16 17 COGS, % of Net Sales 79.2% 79.2% 78.7% 78.5% 78.0% 77.8% 78.0% 77.7% 77.5% 77.1% 76.9% 78.1% 18 Op, SG&A Expenses, % of Net Sales 16.3% 16.5% 16.8% 16.7% 16.7% 17.0% 17.2% 17.4% 17.5% 18.0% 18.2% 17.1% 19 Net Income, % of Net Sales 3.0% 3.0% 3.1% 3.2% 3.5% 3.4% 3.2% 3.4% 3.5% 3.6% 3.6% 3.3% 20 Dividend Growth 10.0% 27.3% 14.3% 25.0% 20.0% 16.7% 7.1% 20.0% 44.4% 15.4% 20.0% 21 Dividend Payout Rate 17.2% 16.9% 18.4% 16.8% 16.5% 17.6% 19.4% 17.0% 17.7% 21.6% 22.4% 18.3% 22 23 Current assets of continuing operations 16,779 17,385 18,589 20,064 23,478 25,344 26,615 29,543 34,421 38,854 43,824 24 Current liabilities of continuing operations 10,944 10,432 13,930 16,155 25,525 28,366 26,795 32,225 37,840 43,182 48,826 25 Working Capital 5,835 6,953 4,659 3,909 (2,047) (3,022) (180) (2,682) (3,419) (4,328) (5,002) 26 ∆ Working Capital 1,118 (2,294) (750) (5,956) (975) 2,842 (2,502) (737) (909) (674) 27 28 PPE, net 18,554 19,935 23,237 25,600 35,533 40,461 45,248 51,374 59,023 68,118 79,290 29 ∆ Net PPE 1,381 3,302 2,363 9,933 4,928 4,787 6,126 7,649 9,095 11,172 30 31 Discount Stores 1,995 1,960 1,921 1,869 1,801 1,736 1,647 1,568 1,478 1,353 1,209 32 Supercenters 239 344 441 564 721 888 1,066 1,258 1,471 1,713 1,980 33 SAM'S CLUBs 433 436 443 451 463 475 500 525 538 551 567 34 Neighborhoold Markets - - - 4 7 19 31 49 64 85 100 35 International Stores 276 314 589 703 991 1,054 1,154 1,272 1,355 1,587 2,285 36 37 38 39 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xls<Historical> Hamilton Lin, CFA, www.wallst-training.com

- 2. WALL ST. TRAINING A B C D E F G H I J K L M N O P 1 Wal-Mart Stores, Inc. 2 Income Statement 3 4 (All figures in millions, except per share data) 5 Actual Estimated Projected 6 Fiscal 2003 2004 2005 2006 2007 2008 2009 2010 Projection Notes 7 8 Revenue 9 Net Sales 229,616 $ 256,329 $ 285,222 $ 312,427 $ 341,602 $ 372,818 $ 406,141 $ 441,631 $ 479,338 % Growth 10 Other Income, net 1,961 2,352 2,910 3,227 3,550 3,905 4,295 4,725 5,197 % Growth 11 Total Revenue $ 258,681 $ 288,132 $ 315,654 $ 345,152 $ 376,723 $ 410,437 $ 446,355 $ 484,535 Sum 12 Cost of Sales (198,747) (219,793) (240,391) (262,156) (285,367) (310,061) (336,271) (364,024) % of Net Sales 13 Gross Profit $ 59,934 $ 68,339 $ 75,263 $ 82,996 $ 91,356 $ 100,376 $ 110,084 $ 120,511 Sum 14 Operating, SG&A Expenses (44,909) (51,248) (56,733) (62,725) (69,216) (76,231) (83,795) (91,932) % of Revenue 15 Operating Income $ 15,025 $ 17,091 $ 18,530 $ 20,271 $ 22,140 $ 24,145 $ 26,289 $ 28,579 Sum 16 Interest Expense (729) (934) (1,171) (1,493) (1,811) (1,943) (2,036) (2,096) Debt Sweep 17 Capital Lease Interest Expense (267) (253) (249) (250) (250) (250) (250) (250) Assumption 18 Interest Income 164 201 248 257 240 240 240 240 Debt Sweep 19 Pre-Tax Income $ 14,193 $ 16,105 $ 17,358 $ 18,785 $ 20,320 $ 22,191 $ 24,243 $ 26,473 Sum 20 Income Taxes (5,118) (5,589) (5,803) (6,575) (7,112) (7,767) (8,485) (9,266) Tax Rate 21 Minority Interest (193) (214) (249) (324) (373) (428) (493) (567) (652) % Growth 22 Net Income $ 8,861 $ 10,267 $ 11,231 $ 11,837 $ 12,779 $ 13,932 $ 15,191 $ 16,556 Sum 23 24 Diluted Shares Outstanding 4,373 4,266 4,188 4,188 4,188 4,188 4,188 4,188 Assumption 25 26 Diluted Earnings per Share $ 2.03 $ 2.41 $ 2.68 $ 2.83 $ 3.05 $ 3.33 $ 3.63 $ 3.95 Net Income / Diluted S/O 27 28 EBITDA $ 18,877 $ 21,355 $ 23,247 $ 25,429 $ 27,770 $ 30,278 $ 32,959 $ 35,820 Op. Inc + Depr + Amort 29 EBITDA Margin 7.3% 7.4% 7.4% EBITDA / Revenue 30 31 Income Statement Assumptions 32 33 Net Sales Growth (0.2)% 11.6% 11.3% 9.5% 9.3% 9.1% 8.9% 8.7% 8.5% Decrease 20 bps 34 Other Income, net Growth 19.9% 23.7% 10.9% 10.0% 10.0% 10.0% 10.0% 10.0% Assumption 35 36 COGS, % of Net Sales (0.2)% 77.5% 77.1% 76.9% 76.7% 76.5% 76.3% 76.1% 75.9% Decrease 20 bps 37 Op, SG&A, % of Revenue 0.2% 17.4% 17.8% 18.0% 18.2% 18.4% 18.6% 18.8% 19.0% Increase 20 bps 38 39 Minority Interest Growth 10.88% 16.36% 30.12% 15.0% 15.0% 15.0% 15.0% 15.0% Assumption 40 41 Effective Tax Rate 36.1% 34.7% 33.4% 35.0% 35.0% 35.0% 35.0% 35.0% Assume normalized tax rate 42 43 Depreciation & Amortization $ 3,852 $ 4,264 $ 4,717 $ 5,158 $ 5,630 $ 6,133 $ 6,670 $ 7,241 % of Revenue 44 D&A, % of Net Revenue 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 1.5% 45 46 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xls<IS> Hamilton Lin, CFA, www.wallst-training.com

- 3. WALL ST. TRAINING A B C D E F G H I J K L M N O P Q 1 Wal-Mart Stores, Inc. 2 Balance Sheet 3 4 ($ in millions) 5 Actual Estimated Projected 6 Fiscal 2004 2005 2006 2007 2008 2009 2010 Notes 7 ASSETS 8 Current Assets 9 Cash & Equivalents $ 5,488 $ 6,414 $ 6,000 $ 6,000 $ 6,000 $ 6,000 $ 6,000 From CF statement 10 Receivables 1,715 2,662 2,911 3,177 3,461 3,764 4,086 365 Days A/R: Revenue * No. Days / 365 11 Inventories 29,762 32,191 34,962 37,901 41,011 44,293 47,750 365 Days Inv: COGS * No. Days / 365 12 Prepaid Expenses and Other 1,889 2,557 2,796 3,052 3,325 3,616 3,925 % of Revenue 13 Total Current Assets $ 38,854 $ 43,824 $ 46,669 $ 50,130 $ 53,797 $ 57,673 $ 61,761 Sum 14 15 Net PPE $ 65,400 $ 75,875 $ 88,217 $ 97,588 $ 107,454 $ 117,784 $ 128,543 Beg Bal - negative CapEx - Depr 16 Net Capital Leases 2,718 3,415 3,415 3,415 3,415 3,415 3,415 Constant; assume no net changes 17 Goodwill 10,803 12,188 12,188 12,188 12,188 12,188 12,188 Constant; assume no acquisitions 18 Other Assets and Deferred Charges 2,379 2,885 3,155 3,443 3,751 4,080 4,429 % of Revenue 19 TOTAL ASSETS $ 120,154 $ 138,187 $ 153,643 $ 166,763 $ 180,606 $ 195,140 $ 210,336 Sum 20 21 LIABILITIES 22 Current Liabilities 23 Commercial Paper $ 3,812 $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 From Debt Sweep 24 Revolver - - 10,407 15,975 20,351 25,631 28,126 From Debt Sweep 25 Accounts Payable 21,987 25,373 27,921 30,668 33,623 36,792 40,186 365 Days A/P: Expenses * No. Days / 365 26 Accrued Liabilities 12,120 13,465 14,723 16,070 17,508 19,040 20,669 % of Revenue 27 Accrued Income Taxes 1,281 1,340 1,340 1,340 1,340 1,340 1,340 Constant 28 Current Portion of Long-Term Debt 3,759 4,595 3,320 2,858 4,639 2,877 3,000 From Debt Sweep 29 Current Portion of Capital Leases 223 299 299 299 299 299 299 Constant; assume no net changes 30 Total Current Liabilities $ 43,182 $ 48,826 $ 61,765 $ 70,964 $ 81,513 $ 89,734 $ 97,373 Sum 31 32 Long-Term Debt $ 20,087 $ 26,429 $ 23,109 $ 20,251 $ 15,612 $ 12,735 $ 9,735 From Debt Sweep 33 Capital Leases 3,171 3,742 3,742 3,742 3,742 3,742 3,742 Constant; assume no net changes 34 Deferred Income Taxes & Other 2,978 4,552 4,552 4,552 4,552 4,552 4,552 Constant 35 Minority Interest 1,340 1,467 1,467 1,467 1,467 1,467 1,467 Constant 36 TOTAL LIABILITIES $ 70,758 $ 85,016 $ 94,635 $ 100,976 $ 106,886 $ 112,230 $ 116,869 Sum 37 38 SHAREHOLDERS' EQUITY 39 Common Stock $ 423 $ 417 $ 417 $ 417 $ 417 $ 417 $ 417 Held constant 40 APIC(Additional Paid In Capital) 2,425 2,596 2,596 2,596 2,596 2,596 2,596 Beg Bal + Stock Issued 41 Retained Earnings 43,854 49,105 54,942 61,722 69,653 78,844 89,400 Beg Bal + Net Inc - Dividends - Repurchases 42 Accumulated Other Comp. Income 2,694 1,053 1,053 1,053 1,053 1,053 1,053 Constant 43 TOTAL SHAREHOLDERS' EQUITY $ 49,396 $ 53,171 $ 59,008 $ 65,788 $ 73,719 $ 82,910 $ 93,466 Sum 44 45 TOTAL LIABILITIES & SHAREHOLDERS' EQUITY $ 120,154 $ 138,187 $ 153,643 $ 166,763 $ 180,606 $ 195,140 $ 210,336 Sum 46 47 Check $ - $ - $ - $ - $ - $ - $ - Calculation 48 49 Total Revenue $ 288,132 $ 315,654 $ 345,152 $ 376,723 $ 410,437 $ 446,355 $ 484,535 From Income Statement 50 Cost of Sales 219,793 240,391 262,156 285,367 310,061 336,271 364,024 From Income Statement 51 Operating, SG&A Expenses 51,248 56,733 62,725 69,216 76,231 83,795 91,932 From Income Statement 52 Total Expenses 271,041 297,124 324,881 354,583 386,292 420,066 455,956 Sum of COGS and Op, SG&A 53 54 Days Receivable Outstanding 2.2 3.1 3.1 3.1 3.1 3.1 3.1 A/R * 365 / Revenue 55 Days Inventories Outstanding -0.2 49.4 48.9 48.7 48.5 48.3 48.1 47.9 Inventory * 365 / COGS, decrease by .2 days 56 Prepaid, % of Revenue 0.7% 0.8% 0.8% 0.8% 0.8% 0.8% 0.8% Prepaid / Revenue 57 Other Assets, % of Revenue 0.8% 0.9% 0.9% 0.9% 0.9% 0.9% 0.9% Other Assets / Revenue 58 Days Payable Outstanding 0.2 29.6 31.2 31.4 31.6 31.8 32.0 32.2 A/P * 365 / Total Expenses, increase by .2 days 59 Accrued Liabilities, % of Revenue 4.2% 4.3% 4.3% 4.3% 4.3% 4.3% 4.3% Accrued Liabilities / Revenue 60 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xls <BS> Hamilton Lin, www.wallst-training.com

- 4. WALL ST. TRAINING A B C D E F G H I J K L M N 1 Wal-Mart Stores, Inc. 2 Cash Flow Statement 3 4 ($ in millions) 5 Estimated Projected 6 Fiscal 2006 2007 2008 2009 2010 Calculation 7 8 Cash From Operating Activities: 9 Net Income $ 11,837 $ 12,779 $ 13,932 $ 15,191 $ 16,556 From Income Statement 10 Plus: Depreciation & Amortization 5,158 5,630 6,133 6,670 7,241 From Income Statement 11 12 Changes in Working Capital: 13 (Increase)/Decrease in Receivables (249) (266) (284) (303) (322) Prior Year less Current Year 14 (Increase)/Decrease in Inventories (2,771) (2,939) (3,110) (3,283) (3,456) Prior Year less Current Year 15 (Increase)/Decrease in Prepaid Expenses and Other (239) (256) (273) (291) (309) Prior Year less Current Year 16 (Increase)/Decrease in Other Assets and Deferred Charges (270) (289) (308) (328) (349) Prior Year less Current Year 17 Increase/(Decrease) in Accounts Payable 2,548 2,747 2,954 3,170 3,393 Current Year less Prior Year 18 Increase/(Decrease) in Accrued Liabilities 1,258 1,347 1,438 1,532 1,629 Current Year less Prior Year 19 Total Change in Working Capital $ 278 $ 344 $ 417 $ 497 $ 586 Sum 20 Total Cash From Operating Activities $ 17,274 $ 18,753 $ 20,482 $ 22,359 $ 24,382 Sum 21 22 Cash From Investing Activities: 23 (Increase) in Capital Expenditures $ (17,500) $ (15,000) $ (16,000) $ (17,000) $ (18,000) Assumption 24 Total Cash From Investing Activities $ (17,500) $ (15,000) $ (16,000) $ (17,000) $ (18,000) Sum 25 26 Cash From Financing Activities: 27 Issuance of Common Stock $ - $ - $ - $ - $ - Assumption 28 Common Stock Dividends (2,500) (2,500) (2,500) (2,500) (2,500) Assumption 29 Net (Purchase) / Reissuance of Treasury Stock (3,500) (3,500) (3,500) (3,500) (3,500) Assumption 30 Cash Available / (Required) Before Debt $ (6,226) $ (2,247) $ (1,518) $ (641) $ 382 Sum of CFO, CFI and CFF items 31 32 Debt Borrowing / (Repayment) 5,812 2,247 1,518 641 (382) From Debt schedule 33 Total Cash From Financing Activities $ (188) $ (3,753) $ (4,482) $ (5,359) $ (6,382) Sum of all CFF items, exclude row 30 !! 34 35 Beginning Cash Balance $ 6,414 $ 6,000 $ 6,000 $ 6,000 $ 6,000 From Balance Sheet 36 Change in Cash (414) - - - - Sum of CFO, CFI and CFF 37 Ending Cash Balance $ 6,000 $ 6,000 $ 6,000 $ 6,000 $ 6,000 Sum => This goes to BS 38 Average Cash Balance 6,207 6,000 6,000 6,000 6,000 Average of Beg and End Balance 39 40 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xls <CF> Hamilton Lin, www.wallst-training.com

- 5. WALL ST. TRAINING A B C D E F G H I J K L M 1 Wal-Mart Stores, Inc. 2 Debt Schedule 3 4 ($ in millions) 5 Estimated Projected 6 Fiscal 2006 2007 2008 2009 2010 7 8 Cash Available/(Required) Before Debt $ (6,226) $ (2,247) $ (1,518) $ (641) $ 382 9 Plus: Beginning Cash on Balance Sheet 6,414 6,000 6,000 6,000 6,000 10 Less: Minimum Cash Balance avg of 05 and 06 (6,000) (6,000) (6,000) (6,000) (6,000) 11 Mandatory Debt Repayment (4,595) (3,320) (2,858) (4,639) (2,877) 12 Cash Before Discretionary Debt Repayment / (Borrowing) $ (10,407) $ (5,567) $ (4,376) $ (5,280) $ (2,495) 13 14 Tranche 1 15 Beginning Balance $ 31,024 $ 26,429 $ 23,109 $ 20,251 $ 15,612 16 Mandatory Debt Repayment (4,595) (3,320) (2,858) (4,639) (2,877) 17 Ending Balance $ 31,024 $ 26,429 $ 23,109 $ 20,251 $ 15,612 $ 12,735 18 Average Balance $ 28,727 $ 24,769 $ 21,680 $ 17,932 $ 14,174 19 20 Tranche 2 21 Beginning Balance $ - $ - $ - $ - $ - 22 Mandatory Debt Repayment - - - - - 23 Ending Balance $ - $ - $ - $ - $ - $ - 24 Average Balance $ - $ - $ - $ - $ - 25 26 Commercial Paper 27 Beginning Balance $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 28 Mandatory Debt Repayment - - - - - 29 Ending Balance $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 30 Average Balance $ 3,754 $ 3,754 $ 3,754 $ 3,754 $ 3,754 31 32 Revolver 33 Beginning Balance $ - $ 10,407 $ 15,975 $ 20,351 $ 25,631 34 Discretionary Sweep 10,407 5,567 4,376 5,280 2,495 35 Ending Balance $ - $ 10,407 $ 15,975 $ 20,351 $ 25,631 $ 28,126 36 Average Balance $ 5,204 $ 13,191 $ 18,163 $ 22,991 $ 26,878 37 38 Total Debt, Beginning Balance 34,778 40,590 42,838 44,356 44,997 39 Less: Mandatory Debt Repayment $ (4,595) $ (3,320) $ (2,858) $ (4,639) $ (2,877) 40 Revolver Debt Borrowing / (Repayment) $ 10,407 $ 5,567 $ 4,376 $ 5,280 $ 2,495 41 Total Debt, Ending Balance 40,590.4 42,837.5 44,355.5 44,996.8 44,614.6 42 Less: Current Portion (3,320) (2,858) (4,639) (2,877) (3,000) 43 Less: Commercial Paper (3,754) (3,754) (3,754) (3,754) (3,754) 44 Less: Revolver (10,407) (15,975) (20,351) (25,631) (28,126) 45 Total Long Term Debt $ 23,109 $ 20,251 $ 15,612 $ 12,735 $ 9,735 46 47 Beginning Cash Balance $ 6,414 $ 6,000 $ 6,000 $ 6,000 $ 6,000 48 Ending Cash Balance 6,000 6,000 6,000 6,000 6,000 49 Average Cash Balance 6,207 6,000 6,000 6,000 6,000 50 Note: Fiscal year ends January 31 of the next year. 51 wmtmodeltemplate-12808433079289-phpapp01.xls<Debt Sweep> Hamilton Lin, www.wallst-training.com

- 6. WALL ST. TRAINING A B C D E F G H I J K L M 52 Wal-Mart Stores, Inc. 53 Interest Schedule 54 55 ($ in millions) 56 Estimated Projected 57 Fiscal Year Ending October 31, 2006 2007 2008 2009 2010 58 59 Interest Rates 60 Cash & Cash Equivalents 4.0% 4.0% 4.0% 4.0% 4.0% 61 Tranche 1 4.4% 4.4% 4.4% 4.4% 4.4% 62 Tranche 2 5.0% 5.0% 5.0% 5.0% 5.0% 63 Commercial Paper 3.4% 3.4% 3.4% 3.4% 3.4% 64 Revolver 5.0% 5.0% 5.0% 5.0% 5.0% 65 66 67 Interest Income 1 (1 = Beginning balance 68 Cash & Cash Equivalents 2 = Average Balance) $ 257 $ 240 $ 240 $ 240 $ 240 69 70 Interest Expense 71 Tranche 1 $ 1,365 $ 1,163 $ 1,017 $ 891 $ 687 72 Tranche 2 - - - - - 73 Commercial Paper 128 128 128 128 128 74 Revolver - 520 799 1,018 1,282 75 Total Interest Expense $ 1,493 $ 1,811 $ 1,943 $ 2,036 $ 2,096 76 77 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xls<Debt Sweep> Hamilton Lin, www.wallst-training.com

- 7. WALL ST. TRAINING N 1 2 3 4 5 6 Calculation 7 8 From CF statement 9 Balance Sheet 10 Assumption 11 Sum of mandatory pmts below 12 Sum 13 14 15 Equal to prior year's end balance 16 Given, Debt Footnote 17 Sum 18 Average of Beg and End Balance 19 20 21 Equal to prior year's end balance 22 Assumption 23 Sum 24 Average of Beg and End Balance 25 26 27 Equal to prior year's end balance 28 Balancing equation 29 Sum 30 Average of Beg and End Balance 31 32 33 Equal to prior year's end balance 34 Balancing equation 35 Sum 36 Average of Beg and End Balance 37 38 Sum of prior year's end balances 39 Sum of mandatory pmts, to CF 40 Reference revolver sweep, to CF 41 Sum 42 43 44 45 46 47 From CF statement 48 From CF statement 49 Calculation 50 51 wmtmodeltemplate-12808433079289-phpapp01.xls<Debt Sweep> Hamilton Lin, www.wallst-training.com

- 8. WALL ST. TRAINING N 52 53 54 55 56 57 Calculation 58 59 60 Assumption 61 Wtg'ed avg estimate, 10K p 39 62 Assumption 63 Given, Debt Footnote 64 Assumption 65 66 67 68 If switch = 1, take interest rate * 69 beginning balance, else rate * 70 average balance 71 72 73 74 75 76 77 wmtmodeltemplate-12808433079289-phpapp01.xls<Debt Sweep> Hamilton Lin, www.wallst-training.com

- 9. WALL ST. TRAINING A B C D E F G H I J K L M N O P 1 Wal-Mart Stores, Inc. 2 Discounted Cash Flow Analysis 3 4 ($ in millions, except per share data) 5 Estimated Projected 6 Fiscal 2006 2007 2008 2009 2010 7 8 EBITDA $ 25,429 $ 27,770 $ 30,278 $ 32,959 $ 35,820 9 EBIT 20,271 22,140 24,145 26,289 28,579 10 Less: Cash Taxes @ 35.0% 35.0% (7,095) (7,749) (8,451) (9,201) (10,003) 11 Tax-effected EBIT $ 13,176 $ 14,391 $ 15,694 $ 17,088 $ 18,577 12 Plus: Depreciation & Amortization 5,158 5,630 6,133 6,670 7,241 13 Less: Capital expenditures (17,500) (15,000) (16,000) (17,000) (18,000) 14 Plus / (Less): Change in net working capital 278 344 417 497 586 15 Unlevered free cash flow $ 1,112 $ 5,365 $ 6,244 $ 7,255 $ 8,403 16 17 WACC @ 10.0% 18 NPV of Unlevered free cash flow @ 10.0% $ 20,309 19 20 EBITDA MULTIPLE METHOD 21 Terminal Value Undiscounted Discounted 22 EBITDA Multiple 8.0x $ 286,561 $ 177,932 23 10.0x 358,201 222,414 24 25 DCF Range (Implied Enterprise Value) $ 198,241 – $ 242,724 Total Debt 36245 26 Cash -6414 27 Equity Value (a) $ 168,410 – $ 212,893 Net Debt 29831 28 Implied Price per Share (b) $ 40.21 – $ 50.83 S/Out 4188 29 30 – 31 PERPETUITY GROWTH METHOD 32 Terminal Value Undiscounted Discounted 33 Perpetuity Growth Rate 3.0% $ 273,341 $ 169,724 34 4.0% $ 321,994 $ 199,933 35 36 DCF Range (Implied Enterprise Value) $ 190,033 – $ 220,243 37 38 Equity Value (a) $ 160,202 – $ 190,412 39 Implied Price per Share (b) $ 38.25 – $ 45.47 40 41 Note: Fiscal year ends January 31 of the next year. 42 Note: Present Values as of January 31, 2005. 43 (a) Assumes $0,000M of net debt. 44 (b) Assumes 00,00.0MM shares outstanding. wmtmodeltemplate-12808433079289-phpapp01.xls<DCF> Hamilton Lin, CFA, www.wallst-training.com

- 10. WALL ST. TRAINING A B C D E G K L M N O P Q R S T U V W X Y 1 Analysis of Selected Publicly Traded Discount Retailers – Illustrative Training Template Only! 2 Financial Summary 3 4 (All figures in millions, except for per share data) 5 Stock 6 Price Equity Enterprise Revenue EBITDA EBIT EPS 7 Company Ticker 4/10/06 Value Value (a) 2005A 2006E 2007P 2005A 2006E 2007P 2005A 2006E 2007P 2005A 2006E 8 9 Costco COST $ 54.43 $ 26,087 $ 23,235 $ 55,431 $ 61,218 $ 67,658 $ 2,062 $ 2,319 $ 2,614 $ 1,566 $ 1,769 $ 2,001 $ 2.16 $ 2.37 10 JC Penney JCP 58.47 13,830 14,256 18,781 19,481 20,093 1,954 2,135 2,296 1,582 1,750 1,878 3.63 4.25 11 Kohl's KSS 53.95 18,805 19,515 13,402 15,096 17,120 1,755 2,026 2,373 1,416 1,633 1,909 2.43 2.86 12 Sears SHLD 138.31 21,993 21,023 54,261 53,700 53,748 2,969 3,502 4,106 2,148 2,096 2,363 6.03 7.72 13 Target TGT 51.62 45,347 53,470 52,620 59,050 65,539 5,732 6,466 7,241 4,323 4,916 5,464 2.71 3.12 14 TOTAL $ 126,062 $ 131,499 15 16 17 18 19 20 21 Wal-Mart WMT $ 45.70 $ 190,459 $ 220,290 $ 315,654 $ 352,541 $ 388,813 $ 23,299 $ 25,420 $ 29,002 $ 18,582 $ 20,650 $ 23,126 $ 2.63 $ 2.92 22 23 Source: Publicly available SEC filings, Bloomberg and IBES estimates. 24 Note: Figures have NOT been adjusted for extraordinary and non-recurring items and should be! 25 Note: All years ending approximately January 31 of the next year. 26 (a) Enterprise Value calculated as Equity Value plus Net Debt (Total Debt less Cash & Cash Equivalents). 27 28 29 wmtmodeltemplate-12808433079289-phpapp01.xlsRetail Comps Hamilton Lin, CFA, www.wallst-training.com

- 11. WALL ST. TRAINING Z 1 2 3 4 5 EPS6 7 2007P 8 9 $ 2.83 10 4.81 11 3.44 12 9.26 13 3.57 14 15 16 17 18 19 20 21 $ 3.34 22 23 24 25 26 27 28 29 wmtmodeltemplate-12808433079289-phpapp01.xlsRetail Comps Hamilton Lin, CFA, www.wallst-training.com

- 12. WALL ST. TRAINING AA AB AC AD AE AF AG AH AI AJ AK AL AM AN AO AP AQ AR AS AT AU AV AW 1 Analysis of Selected Publicly Traded Discount Retailers – Illustrative Training Template Only! 2 Valuation Multiples 3 4 5 Revenue/ Enterprise Value as a Multiple of Stock Price as a Multiple of 6 2005 Margins Number Store Revenue EBITDA EBIT Earnings per Share 7 Company Ticker EBITDA EBIT Stores ($MM's) 2005A 2006E 2007P 2005A 2006E 2007P 2005A 2006E 2007P 2005A 2006E 8 9 Costco COST 3.7% 2.9% 471 $ 117.7 0.42x 0.38x 0.34x 11.3x 10.0x 8.9x 14.8x 13.1x 11.6x 25.2x 23.0x 10 JC Penney JCP 10.4% 9.0% 1,019 18.4 0.76 0.73 0.71 7.3 6.7 6.2 9.0 8.1 7.6 16.1 13.8 11 Kohl's KSS 13.1% 10.8% 732 18.3 1.46 1.29 1.14 11.1 9.6 8.2 13.8 12.0 10.2 22.2 18.9 12 Sears SHLD 5.5% 3.9% 3,843 14.1 0.39 0.39 0.39 7.1 6.0 5.1 9.8 10.0 8.9 22.9 17.9 13 Target TGT 10.9% 8.3% 1,397 37.7 1.02 0.91 0.82 9.3 8.3 7.4 12.4 10.9 9.8 19.0 16.5 14 15 16 HIGH 13.1% 10.8% $ 117.7 1.46x 1.29x 1.14x 11.3x 10.0x 8.9x 14.8x 13.1x 11.6x 25.2x 23.0x 17 AVERAGE 8.7% 7.0% 41.2 0.81 0.74 0.68 9.2 8.1 7.2 12.0 10.8 9.6 21.1 18.0 18 MEDIAN 10.4% 8.3% 18.4 0.76 0.73 0.71 9.3 8.3 7.4 12.4 10.9 9.8 22.2 17.9 19 LOW 3.7% 2.9% 14.1 0.39 0.38 0.34 7.1 6.0 5.1 9.0 8.1 7.6 16.1 13.8 20 21 Wal-Mart WMT 7.4% 5.9% 6,141 $ 51.4 0.70x 0.62x 0.57x 9.5x 8.7x 7.6x 11.9x 10.7x 9.5x 17.4x 15.7x 22 23 Source: Publicly available SEC filings, Bloomberg and IBES estimates. 24 Note: Figures have NOT been adjusted for extraordinary and non-recurring items and should be! 25 Note: All years ending approximately January 31 of the next year. 26 (a) Enterprise Value calculated as Equity Value plus Net Debt (Total Debt less Cash & Cash Equivalents). 27 28 29 wmtmodeltemplate-12808433079289-phpapp01.xlsRetail Comps Hamilton Lin, CFA, www.wallst-training.com

- 13. WALL ST. TRAINING AX 1 2 3 4 Price as a Multiple of 5 rnings per Share 6 7 2007P 8 9 19.2x 10 12.2 11 15.7 12 14.9 13 14.5 14 15 16 19.2x 17 15.3 18 14.9 19 12.2 20 21 13.7x 22 23 24 25 26 27 28 29 wmtmodeltemplate-12808433079289-phpapp01.xlsRetail Comps Hamilton Lin, CFA, www.wallst-training.com

- 14. WALL ST. TRAINING F7: Should be latest Basic Shares Outstanding from front of latest 10K or 10Q or proxy (whichever is later) + effect of diluted shares due to treasury adjusted options H7: From latest balance sheet, EXCLUDING capital leases and INCLUDING correct minority interest figure I7: From latest balance sheet, don't forget to include short term investments and exclude restricted cash L9: Want actuals for 12 months ending 1/31/06, so take: 7/12 of 8/05 actual + 5/12 of 8/06 estimate (should really be straight from 10Q filings, but for illustrative training purposes and simplicity in this exercise, take estimate) M9: Want estimates for 12 months ending 1/31/07, so take: 7/12 of 8/06 estimate + 5/12 of 8/07 estimate N9: Want estimates for 12 months ending 1/31/08, so take: 7/12 of 8/07 estimate + 5/12 of 8/08 estimate P9: Want actuals for 12 months ending 1/31/06, so take: 7/12 of 8/05 actual + 5/12 of 8/06 estimate (should really be straight from 10Q filings, but for illustrative training purposes and simplicity in this exercise, take estimate) Q9: Want estimates for 12 months ending 1/31/07, so take: 7/12 of 8/06 estimate + 5/12 of 8/07 estimate R9: Want estimates for 12 months ending 1/31/08, so take: 7/12 of 8/07 estimate + 5/12 of 8/08 estimate T9: Want actuals for 12 months ending 1/31/06, so take: 7/12 of 8/05 actual + 5/12 of 8/06 estimate (should really be straight from 10Q filings, but for illustrative training purposes and simplicity in this exercise, take estimate) U9: Want estimates for 12 months ending 1/31/07, so take: 7/12 of 8/06 estimate + 5/12 of 8/07 estimate V9: Want estimates for 12 months ending 1/31/08, so take: 7/12 of 8/07 estimate + 5/12 of 8/08 estimate X9: Want actuals for 12 months ending 1/31/06, so take: 7/12 of 8/05 actual + 5/12 of 8/06 estimate (should really be straight from 10Q filings, but for illustrative training purposes and simplicity in this exercise, take estimate) Y9: Want estimates for 12 months ending 1/31/07, so take: 7/12 of 8/06 estimate + 5/12 of 8/07 estimate Z9: Want estimates for 12 months ending 1/31/08, so take: 7/12 of 8/07 estimate + 5/12 of 8/08 estimate L12: Given since Pro Forma figure including full year of Kmart and Sears results wmtmodeltemplate-12808433079289-phpapp01.xlsNotes Hamilton Lin, CFA, www.wallst-training.com

- 15. WALL ST. TRAINING A B C D E F G H I J K L M N O P Q R S T U 1 Wal-Mart Stores, Inc. 2 Illustrative Reference Range 3 4 (All figures in millions, except per share data) 5 Relevant Multiple Implied Enterprise Implied Equity Implied Price per 6 Methodology Statistic Range Value Value Share 7 8 Analysis of Selected Publicly Traded Discount Retailers 9 Net Revenue 2005A $ 315,654 0.75x – 0.80x $ 236,741 – $ 252,523 $ 206,910 – $ 222,692 $ 49.41 – $ 53.17 10 2006E 345,152 0.70x – 0.75x $ 241,606 – $ 258,864 $ 211,775 – $ 229,033 $ 50.57 – $ 54.69 11 2007P 376,723 0.65x – 0.70x $ 244,870 – $ 263,706 $ 215,039 – $ 233,875 $ 51.35 – $ 55.84 12 13 EBITDA 2005A $ 23,247 9.0x – 9.5x $ 209,223 – $ 220,847 $ 179,392 – $ 191,016 $ 42.83 – $ 45.61 14 2006E 25,429 8.0x – 8.5x $ 203,429 – $ 216,143 $ 173,598 – $ 186,312 $ 41.45 – $ 44.49 15 2007P 27,770 7.0x – 7.5x $ 194,390 – $ 208,275 $ 164,559 – $ 178,444 $ 39.29 – $ 42.61 16 17 EBIT 2005A $ 18,530 12.0x – 12.5x $ 222,360 – $ 231,625 $ 192,529 – $ 201,794 $ 45.97 – $ 48.18 18 2006E 20,271 10.5x – 11.0x $ 212,843 – $ 222,979 $ 183,012 – $ 193,148 $ 43.70 – $ 46.12 19 2007P 22,140 9.5x – 10.0x $ 210,334 – $ 221,404 $ 180,503 – $ 191,573 $ 43.10 – $ 45.74 20 21 EPS 2005A $ 2.68 21.5x – 22.5x $ 271,298 – $ 282,529 $ 241,467 – $ 252,698 $ 57.66 – $ 60.34 22 2006E 2.83 17.5x – 18.0x $ 236,986 – $ 242,905 $ 207,155 – $ 213,074 $ 49.46 – $ 50.88 23 2007P 3.05 15.0x – 15.5x $ 221,519 – $ 227,908 $ 191,688 – $ 198,077 $ 45.77 – $ 47.30 24 25 Reference Range $ 45.00 $ 55.00 26 27 28 Analysis of Selected Retail Acquisitions 29 2005A Net Revenue $ 315,654 0.75x – 1.00x $ 236,741 – $ 315,654 $ 206,910 – $ 285,823 $ 49.41 – $ 68.25 30 EBITDA 23,247 9.0x – 9.5x $ 209,223 – $ 220,847 $ 179,392 – $ 191,016 $ 42.83 – $ 45.61 31 EBIT 18,530 14.0x – 15.0x $ 259,420 – $ 277,950 $ 229,589 – $ 248,119 $ 54.82 – $ 59.25 32 EPS 2.68 19.5x – 22.5x $ 248,836 – $ 282,529 $ 219,005 – $ 252,698 $ 52.29 – $ 60.34 33 34 Reference Range $ 50.00 $ 60.00 35 36 37 Analysis of Selected Premiums Paid 38 Stock Price 4 Weeks Prior $ 45.33 10.0% – 20.0% – – – 39 4/7/2006 1 Day Prior 46.02 5.0% – 15.0% – – – 40 41 Reference Range $ 50.00 $ 55.00 42 43 44 Discounted Cash Flow Analysis 45 EBITDA Multiple Method 8.0x – 10.0x $ 198,241 – $ 242,724 $ 168,410 – $ 212,893 $ 40.21 – $ 50.83 46 Perpetuity Growth Method 3.0% – 4.0% 190,033 – 220,243 160,202 – 190,412 38.25 – 45.47 47 48 Reference Range $ 40.00 $ 50.00 49 50 51 Note: Fiscal year ends January 31 of the next year. wmtmodeltemplate-12808433079289-phpapp01.xlsRef Range Hamilton Lin, CFA, www.wallst-training.com

- 16. WALL ST. TRAINING A B C D E F G H I J 1 Wal-Mart Stores, Inc. 2 Illustrative Reference Range 3 4 52-week Trading Range $42.4 5 $ 6 Analysis of Selected Acquisitions 7 Discounted Cash Flow Analysis $40.00 $ 8 9 10 11 12 13 14 15 16 17 18 METHODOLOGY 19 20 21 22 23 24 25 26 27 28 29 30 31 $30.00 $40.0 32 33 Illustrative WMT 34 35 36 37 min max 38 52-week Trading Range $42.49 8.08 $50.57 39 Analysis of Selected Publicly Traded Discount Retailers $45.00 10.00 $55.00 40 Analysis of Selected Acquisitions $50.00 10.00 $60.00 41 Analysis of Selected Premiums Paid $50.00 5.00 $55.00 42 Discounted Cash Flow Analysis $40.00 10.00 $50.00 43 Reference Range $45.00 $55.00 44 45 Current Stock Price $ 45.70 0 46 $ 45.70 1 wmtmodeltemplate-12808433079289-phpapp01.xlsFootball Hamilton Lin, CFA, www.wallst-training.com

- 17. Treasury Method Calculation Number of Options 10.000 Exercise Price $ 45.00 Current Stock Price $ 100.00 Proceeds to Company $ 450.0 Proceeds to Holder $ 1,000.0 Difference $ 550.0 Share Dilution 5.500 Treasury Method 5.500 =max(0, # options * (1 - Exercise Price / Current Price)) The max function sets the equation to zero in the event that the exercise price is greater than the current stock price, in which event, the option is out-of-the-money and does not cause extra shares to be issued. Try the math yourself. Apply the formula for EACH tranche of options Treasury Adjusted Diluted Shares Outstanding = Basic Shares Outstanding + MAX ( 0, # options * (1 - Exercise Price / Current Price)) WALL ST. TRAINING ® (212) 537-6631 Hamilton Lin, CFA info@hlcp.net President hamilton@hlcp.net Wall St. Training is a registered servicemark of HL Capital Partners, Ltd. www.wallst-training.com