How Massive Outreach of Banking Services Can Enable Women Entrepreneurship to Flourish

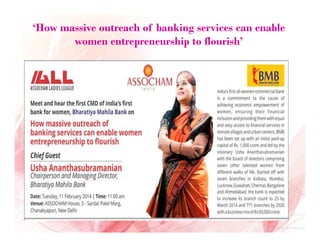

- 1. ‘How massive outreach of banking services can enable women entrepreneurship to flourish’

- 2. ‘How massive outreach of banking services can enable women entrepreneurship to flourish’ “Bharatiya Mahila Bank is a great step forward and by having its branches all over the country it can serve the interests of women even in the remotest of regions,” said Dr. Harbeen Arora, Global Chairperson, ASSOCHAM Ladies League in her welcome address and also appreciated BMB’s growth plans.

- 3. An Interactive Session with the CMD of Bharatiya Mahila Bank and Finance Experts “Women are the most underutilized economic asset of our country. India can have 10% growth if women enterprise flourishes,” said Usha Anathasubramanian, CMD of Bharatiya Mahila Bank

- 4. ‘How massive outreach of banking services can enable women entrepreneurship to flourish’ Women entrepreneurs and management students of NIILM-CMS, top ranked Bschool of India participated in an interactive session organized by ASSOCHAM Ladies League. The session highlighted the need for banking among women.

- 5. “How massive outreach of banking services can enable Since inauguration, Bharatiya Mahila Bank (BMB) is looked women entrepreneurship to flourish” Anup as a great step forward to uplift economic status of Interactive Session, organized by ASSOCHAM Ladies League on February 11, 2014 women in India.

- 6. The first ever women bank of India, Bharatiya Mahila Bank is appreciated worldwide. Joachim Gauck, President of Germany; on meeting Usha Anathaubramanian, was keen on knowing about the different measures BMB has adopted in assisting women’s financial needs. Joachim Gauck, an anti-communist civil right activist and a generous patron of women’s social issues appreciated the pivotal role BMB is playing in creating a financially inclusive society.

- 7. Usha Anathasubramanian, CMD of Bharatiya Mahila Bank underscored the salient features of banking among women. Emphasizing the significance of economic empowerment for women, CMD of Bharatiya Mahila Bank said that, “10% growth for India assured with greater women empowerment and enterprise.” Usha Ananthasubramanian believes in women’s great ability to make progress for themselves and their families when economic opportunities are made available to them.

- 8. To have entrepreneurial skills developed among women, BMB takes a whole new approach: BMB runs training center where they hire expert women who can develop soft skills and impart financial knowledge to other women. BMB have drawn 40-50 products to serve the interests of women. Like Kitchen loans, Day Care Loans, which will encourage women to start being entrepreneurial right from their homes.

- 9. BMB inculcates the habit of formal saving among women. As women are good savers, BMB introduces systematic saving system to them.

- 10. BMB promotes women entrepreneurship and small scale businesses.

- 11. “There are various businesses that can be better operated by women like parlors, spas, dress-designing, home food services, etc,” said Usha Ananthasubramanian, the CMD of BMB

- 12. Women are the most abled workforce of our country, as they carry out farming activities in the absence of their husbands. As adept homemakers, they are continuously engaged in household works and take time out from their busy schedule for art works like weaving, sewing, drawing, and many more.

- 13. The esteemed panelists have raised some important issues:

- 14. The esteemed panelists have raised some important issues: “Listing of micro finance institutions should not take place,” recommended Neena Prasad, Chief Representative, Singapore Exchange Ltd. As microfinance institutions provides microfinance products and services to low income group customers.

- 15. The esteemed panelists have raised some important issues: “We need to get over urban obsession” underlined Mathew Titus, Executive Director, Sa- Dhan, The Association of Community Development Finance Institutions He referred to the large scale migration of rural population to urban centers. Specifically men from interiors move to cities in search of better livelihood, there is a huge feminization of rural India happening in this way.

- 16. The esteemed panelists have raised some important issues: “Financial literacy is very important” said Usha Anathasubramanian, the CMD of Bharatiya Mahila Bank She referred to the 44 million women living in rural areas who are oblivious about this key factor which contributes in development of the banking sector.

- 17. The talk was followed by Q & A session: some interesting questions which keep resonating with the audience and had an impact on their minds are as follows: Ms. Sangeeta Mehra, a woman entrepreneur posed a question: “Given the ups and downs of a business, how can a bank help a business in ensuring basic financial security for all the people engaged in the business?” She inquired whether BMB is taking any holistic approach that works out well to secure the priorities of a woman entrepreneur which includes profits but also the well-being of the people she is responsible for. Her concern was that, a businesswoman can claim for life insurance at times when she suffers due to adverse health, but what about those lives that are associated with the business she runs and how they can be insured against business risks.

- 18. The talk was followed by Q & A session: Mansi Mahajan, Chapter Chairperson of Noida Chapter of ASSOCHAM Ladies League asked: “On what grounds Bharatiya Mahila Bank offers loans to women and is it going to be rigid in case of providing loans?” She said that she had faced some grave problems when she claimed loans. She had been through lots of paper works and underwent some sleepless nights. Finally what comes to her was no less than a shock, she was refused to be given loan as she was unmarried and could not provide collaterals.

- 19. The talk was followed by Q & A session: Ms. Kausy Madhavan, Founder of Shopkhoj asked: “What are the different schemes BMB has introduced to promote asset ownership among women?” As there are parts in India, where patriarchal laws are still at work. Women are not entitled to property, properties are bought on the names of men; only they are the privileged sect who own properties and are considered to be the rightful holders of assets.

- 20. The talk was followed by Q & A session: A student of NIILM-CMS asked a question about how bank sees the budding talent of young women: “Is Bharatiya Mahila Bank taking up any step to promote small scale businesses and create a space where women can grow and excel in their own fields of expertise?” She had given an example of her native place, interiors of Gujarat, where young girls are very good Mehndi artist, soft toys maker, and beauticians; but they remain empty handed. What they might be lacking could be proper guidance and encouragement, the result being their dissociation with the different art forms; once they were used to be expert in.

- 21. Inspiring success stories of women entrepreneurs: SEWA (Self Employed Women’s Association) a trade union registered in 1972. An initiative started by women to help their peer group members. SEWA is an organization of poor, self-employed women workers, where women can earn a living through their own labor or small businesses.

- 22. Inspiring success stories of women entrepreneurs: Shri Mahila Griha Udyog, the makers of Lijjat Papad, symbolizes the strength of women. The organization restricts its membership to women only, starting with papad, it now offers a wide range of food products.

- 23. Inspiring success stories of women entrepreneurs: A moving story was told by Usha Ananthasubramanian about a rag-picker turned director, Manju Ben of Gujarat. Manju Ben used to roam around from place to place to pick rags, since her adolescent days she was into this business of rag picking. Gradually she developed business skills to address her job smartly. Over the time, she groomed and today there are 750 women rag-pickers reporting her every day and works under her direction.

- 24. Students of NIILM-CMS, top ranked B School of India at the session Dr. Harbeen Arora, Global Chairperson, ASSOCHAM Ladies League with students of NIILM-CMS, top ranked B School of India.

- 25. Students of NIILM-CMS, top ranked B School of India at the session

- 26. Open a Bank Account with BMB ☺ All present in audience volunteered to open a Bank Account with BMB to play a humble role in its success