Summitry Worldwide Case Studies

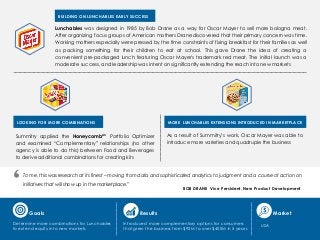

- 1. Lunchables was designed in 1985 by Bob Drane as a way for Oscar Mayer to sell more bologna meat. After organizing focus groups of American mothers Drane discovered that their primary concern was time. Working mothers especially were pressed by the time constraints of fixing breakfast for their families as well as packing something for their children to eat at school. This gave Drane the idea of creating a convenient pre-packaged lunch featuring Oscar Mayer's trademark red meat. The initial launch was a moderate success, and leadership was intent on significantly extending the reach into new markets Summitry applied the Honeycombsm Portfolio Optimizer and examined “Complementary” relationships (no other agency is able to do this) between Food and Beverages to derive additional combinations for creating kits As a result of Summitry’s work, Oscar Mayer was able to introduce more varieties and quadruple the business MORE LUNCHABLES EXTENSIONS INTRODUCED IN MARKETPLACELOOKING FOR MORE COMBINATIONS Goals Determine more combinations for Lunchables to extend equity into new markets Introduced more complementary options for consumers that grew the business from $92M to over $400M in 5 years USA To me, this was research at its finest – moving from data and sophisticated analytics to judgment and a course of action on initiatives that will show up in the marketplace.” BOB DRANE Vice President, New Product Development Results Market BUILDING ON LUNCHABLES EARLY SUCCESS

- 2. The hair coloring market is an intensely competitive market that is reliant on new product innovations to sustain current buyers and drive incremental growth amongst new users. The President, Steve Sadove, was keen on understanding how to optimally manage the Clairol Portfolio, while looking for the hidden “new” gem The first step was to create the Portfolio Landscape for Clairol using the Honeycombsm Optimizer. This initial foundational work uncovered an unmet need of “Natural/ Organic” that was highly undelivered. Summitry’s proprietary Eurekasm Self-Explicated Hybrid Conjoint Model, was then applied and over 260,000 potential new product combinations were tested. The “optimal” product that was derived, was an “organic” driven hair coloring product that contained no ammonia. The R & D team at Clairol downloaded the results of the study and developed a product that met the exact features/ levels of the design. The result was “Natural Instincts”. Clairol leverages success of Natural Instincts in sale to P & G NATURAL INSTINCTS BECOMES MOST SUCESSFUL INTRODUCTORY HAIR COLORING PRODUCT CONJOINT DELIVERS THE OPTIMAL PRODUCT FOR R & D Thanks for your excellent presentation. I do believe that the portfolio work is going to have a major impact on how we think about the business. Keep up the good work.” STEVE SADOVE Former President of Clairol KEEPING THE PIPELINE OF INNOVATION FRESH Goals Identify a New Product Entry that would become a market leader in the Hair Coloring Category Natural Instincts became a market leader and garnered the highest market share of any introductory hair coloring product at the time USA Results Market

- 3. Revlon had been perceived as a mass-marketed brand that lacked a premium image amongst women. The President, Kathy Dwyer, was aggressively pursuing strategies to elevate their brand personality, maximize synergies and compete head-to-head against department store brands. Through the use of Summitry’s Honeycombsm Portfolio Optimizer across the Eye, Lip, Face, Nail and Skin Categories, we were able to identify strategies to maximize Revlon’s brand synergy. We also looked very closely at approaches to move the Brand Personality closer to L’Oreal’s dominant foothold on the high-end premium cosmetic real estate. The “Revolutionary” campaign was validated through Summitry’s Brand Personality work in closing the “gap” between L’Oreal and Department-Store Brands. The campaign struck a chord with women and led to an increased penetration amongst this elusive target. THE “REVOLUTIONARY” CAMPAIGN MOVES REVLONCOMPETING AGAINST L’OREAL AND DEPARTMENT-STORE BRANDS Your recommendations are consistent with most of the strategies we are currently executing and also gives us new directions to compete more effectively.” KATHY DWYER President Of Revlon EXTENDING BEYOND A CURRENT PERCEPTION Goals Move Revlon Brand Personality from Mass- Merchandise Brand to High-End Department Store Image The “Revolutionary” Brand Campaign successfully moved Revlon into the Premium Market and helped them capture market share from L’Oreal USA Results Market

- 4. Management was seeking to transfer from Rx to OTC, its highly successful allergy brand Seldane, due to imminent patient expiration. In order to first understand the market potential of Seldane, we derived the Domain Structure (Situational Context) and Purchase-Based Market Structures of the Rx and OTC Upper Respiratory Ailment Market (Cold, Sinus, Allergy, Cough). In addition, we constructed the Need States/ Benefits, Brand Personality and Segmentation for a holistic understanding of the prospective Seldane consumer. Net, it was critical to transfer base Seldane to OTC, and introduce Seldane-D to retain Rx franchise. Our Eurekasm model forecasted that Seldane would become a $1 Billion dollar OTC business in three years. However, due to undesired side effects, the FDA did not approve the conversion. Although never released, the subsequent launch of Claritin (similar product to Seldane) validated the model, as the revenue was almost identical to our forecasts. Loved your work on Seldane. Your numbers are consistent with Benadryl’s transfer from Rx to OTC.” GEORGE QUESNELLE President, GlaxoSmithKline Consumer Healthcare MARKET POTENTIAL OF SELDANE NEVER REALIZED, BUT VALIDATED FIRST STEP IN RX -- > OTC TRANSFER : UNDERSTANDING YOUR FRAME OF REFERENCE RX TO OTC TRANSFER Goals Simulate the revenue/ volume potential of a Seldane RX conversion to OTC Eurekasm predicted by Year 3, Seldane had potential to obtain $1.1 Billion revenue USA Results Market