Rec Newsletter V1 Issue 8 Apr

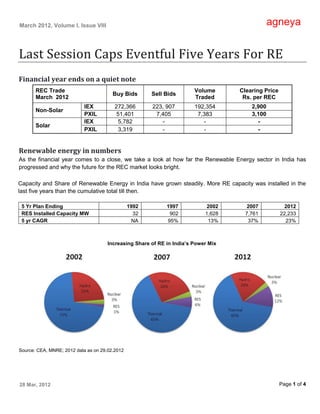

- 1. March 2012, Volume I, Issue VIII agneya Last Session Caps Eventful Five Years For RE Financial year ends on a quiet note REC Trade Volume Clearing Price Buy Bids Sell Bids March 2012 Traded Rs. per REC IEX 272,366 223, 907 192,354 2,900 Non-Solar PXIL 51,401 7,405 7,383 3,100 IEX 5,782 - - - Solar PXIL 3,319 - - - Renewable energy in numbers As the financial year comes to a close, we take a look at how far the Renewable Energy sector in India has progressed and why the future for the REC market looks bright. Capacity and Share of Renewable Energy in India have grown steadily. More RE capacity was installed in the last five years than the cumulative total till then. 5 Yr Plan Ending 1992 1997 2002 2007 2012 RES Installed Capacity MW 32 902 1,628 7,761 22,233 5 yr CAGR NA 95% 13% 37% 23% Increasing Share of RE in India’s Power Mix Source: CEA, MNRE; 2012 data as on 29.02.2012 28 Mar, 2012 Page 1 of 4

- 2. March 2012, Volume I, Issue VIII agneya Distribution of total installed power generating capacity Distribution of Total Capacity and RE Capacity and capacity of Renewable Energy is skewed amongst Regions. South accounts for 27% of total installed power generation capacity but 49% of installed RE capacity Total North South East West owing to wind energy capacity in Tamil Nadu. RE Source: CEA, East includes North East, South includes 0% 20% 40% 60% 80% 100% Islands; 2012 data as on 29.02.2012 REC trading was launched in March 2011. It Cumulative Trade Value in FY2011-12: Rs. 286 provides a market driven route for addressing Crores skewed availability of RE. After a hesitant first 286 few months, the market has now picked up and is substantial in size now – total traded value of 228 RECs in FY2011-12 was Rs. 286 crores. 165 113 80 49 13 23 0 3 5 8 Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2011 2011 2011 2011 2011 2011 2011 2011 2011 2012 2012 2012 Source: REC Registry, Trade Numbers in ‘000 RECs Participants are warming up to the REC market. Evidence of this can be seen in various aspects of market performance in the last twelve months. a. Higher prices of RECs – prices picked up from floor level of Rs. 1500 to Rs. 3000 by last quarter of FY 2011- 12. There is more clarity now on what levels of pricing can be expected in the coming financial year. b. Increase in number of participants in trading – number of participants rose from mere double digits in first few months to around 400 in the last trading session. Higher number of participants encouraged better price discovery for RECs. c. More successful buy as well as sell bids – higher proportion of bids were cleared both from sellers as well as buyers. This shows better clarity on prices, which have been stable in the range of Rs 2,700 to Rs. 3100. 28 Mar, 2012 Page 2 of 4

- 3. March 2012, Volume I, Issue VIII agneya Prices and Trade Volumes in FY2011-12 3,051 3,065 2,907 2,891 2,950 2,710 200 2,300 172 206 1,789 1,500 1,500 1,505 1,554 112 106 96 46 25 19 16 19 0 Apr May Jun Jul 2011 Aug Sep Oct Nov Dec Jan Feb Mar 2011 2011 2011 2011 2011 2011 2011 2011 2012 2012 2012 Traded Volume Average Price Source: REC Registry, IEX % Redemption of available RECs in the month The REC market displays seasonal 81% 86% 85% characteristics. Pattern of increase in price and redemption may change in coming 57% financial year. 48% 44% 51% 40% 39% 34% 37% a. Prices reached higher levels in last quarter – this could be partly attributed to 6% compliance pressure from buyers’ side and to urgency of sellers to cash in on the Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2011 2011 2011 2011 2011 2011 2011 2011 2011 2012 2012 2012 energy generated within the financial year. b. More redemption in last quarter – driven by expectation of higher prices. Prices may Cumulative Redemption for FY by month end increase in the first and second quarters in the coming FY with more buyers looking to 94% 96% 97% comply with RPO early in the year to avoid 71% 80% last quarter rush. Redemption may become 65% 64% 68% 58% 59% 60% even faster if quarterly compliance is followed. 14% Apr May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar 2011 2011 2011 2011 2011 2011 2011 2011 2011 2012 2012 2012 Source: REC Registry 28 Mar, 2012 Page 3 of 4

- 4. March 2012, Volume I, Issue VIII agneya Scope for REC market in India is wide – Installed Capacity vs. Registered Capacity of RE FY2011-12 was encouraging in many ways. a. Significant unutilized potential yet to Installed MW come on line – installed RE capacity grew by 23% in FY2011-12. REC mechanism Registered MW will further boost investment in wind energy while solar photovoltaic market is 0% 20% 40% 60% 80% 100% yet to start in earnest. b. Skew between installed capacity of RE Wind Bio-fuel cogeneration Biomass Small Hydro Solar Others and RE capacity registered for REC – Biomass and Cogen capacity has a comparatively bigger share in REC Registered REC capacity by State, MW registrations compared to installed wind Uttar Pradesh 658 energy capacity. Maharashtra 542 Tamil Nadu 529 c. Participation from more States to boost Gujarat 211 market further – Uttar Pradesh, Chhattisgarh 92 Rajasthan 50 Maharashtra and Tamil Nadu alone Punjab 46 Himachal Pradesh 35 account for three quarters of RE capacity Uttarakhand 24 registration (in MW). Gradual entry of Kerala 21 Madhya Pradesh 21 other States and more participation from J&K 18 them will strengthen REC market further. Haryana 9 agneya Promoted by alumni of IIM Ahmedabad and IIM Bangalore, we at agneya work with Renewable Energy Generators to manage their REC accreditation, registration, issuances and trading. We also work with companies covered by the Renewable Purchase Obligation (RPO) on optimum ways to fulfill these obligations. agneya also provides services in the following areas – Renewable Energy Project Management – advising clients on the best possible portfolio of renewable energy (wind, solar, bio) across tariff regimes, technology options, electricity sales structuring and availing incentives like REC and GBI. Electricity Market Regulations – advising clients on regulatory aspects of electricity market, options for realizing the maximum value from their energy assets and minimizing costs related to regulatory compliance. Carbon & Energy – measuring carbon footprint, energy audits and current/future energy profiling to assess risks and opportunities related to energy security and climate change. Sustainability – building robust long term foundations for business i.e. managing economic, environmental and social aspects of business. These include water management, sustainability management and reporting. For further information on Renewable Energy Certificates or other services, please contact us at – E-mail – rahul@agneya.in | Phone – +91-88 06 07 07 83 | Website – www.agneya.in 28 Mar, 2012 Page 4 of 4