Hungary: 2016 Oil & Gas Bid Round

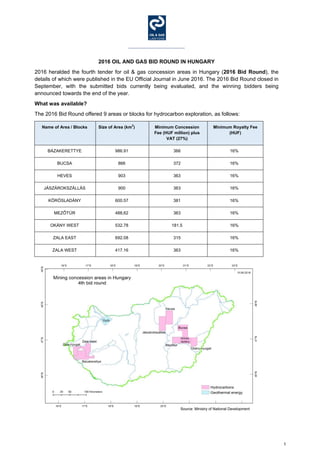

- 1. ___________________________ 1 2016 OIL AND GAS BID ROUND IN HUNGARY 2016 heralded the fourth tender for oil & gas concession areas in Hungary (2016 Bid Round), the details of which were published in the EU Official Journal in June 2016. The 2016 Bid Round closed in September, with the submitted bids currently being evaluated, and the winning bidders being announced towards the end of the year. What was available? The 2016 Bid Round offered 9 areas or blocks for hydrocarbon exploration, as follows: Name of Area / Blocks Size of Area (km 2 ) Minimum Concession Fee (HUF million) plus VAT (27%) Minimum Royalty Fee (HUF) BÁZAKERETTYE 986.91 366 16% BUCSA 866 372 16% HEVES 903 363 16% JÁSZÁROKSZÁLLÁS 900 363 16% KÖRÖSLADÁNY 600.57 381 16% MEZŐTÚR 488,62 363 16% OKÁNY WEST 532.78 181.5 16% ZALA EAST 692.08 315 16% ZALA WEST 417.16 363 16% Source: Ministry of National Development

- 2. ___________________________ 2 How did it go this time? Following the close of the 2016 Bid Round, the Ministry of National Development has informally announced that it received 11 bids for 6 out of the 9 blocks offered, which means that 3 blocks did not receive any bids. The 11 bids were made by 3 companies, all of whom have participated in previous bid rounds. These bids are currently being evaluated and it is expected that winners will be announced in the next month or so, which in turn means that new concession agreements should be signed in Q1 2017. How does it compare with the previous Bid Rounds? Looking back over the previous 3 bid rounds from 2013 to 2015, it is clear that there is a continued and growing interest for companies to participate in the tenders. However, it is also worth noting that the participants are generally the same companies and most of whom are already active in Hungary. Reduced Royalty Rate: One good point to note is the reduction in the applicable royalty rate which has been reduced from 19% to 16%. Increased Investment: the aggregate value of committed or obligatory investment expenditure has increased, as may be seen in the below diagram. In 2013, the total committed exploration investment value was HUF 5 Bn (approx. EUR 16.5m) with a significantly larger value attributable to optional exploration activity. In 2014, this increased to HUF 7 Bn (approx. EUR 23.1m) with a sizeable reduction in value of the optional exploration activity. In 2015, the committed expenditure significantly increased to HUF 16 Bn (approx. EUR 52.8m) and there was also a modest increase in the value of the optional exploration activity. It will be interesting to see how the recent trend compares once the 2016 Bid Round has been evaluated, but we would expect to see a similar value for the optional activity now that participating companies have a better understanding of the obligations to which they need to commit and the allocation of “points” during the bid evaluation procedure. Reduction in number of bids submitted: whilst there was again 9 blocks on offer, the number of bids reduced from 17 in 2015 to 11 in 2016. The diagrams below show the companies who have submitted bids in each round to date, including the number of bids submitted, and the number of winning bids by each such company. Source: Ministry of National Development

- 3. ___________________________ 3 Number of bids submitted Number of winning bids In 2013, 4 blocks were made available: 1 block received no bids, and there were 4 bids for remaining 3 blocks, which resulted in 3 blocks being awarded. In 2014, 6 blocks were made available: 1 block received no bids, and there were 7 bids for remaining 5 blocks, which resulted in 5 blocks being awarded. In 2015, 9 blocks were made available: 1 block received no bids, and there were 17 bids for remaining 8 blocks, which resulted in 5 blocks being awarded. In 2016, 9 blocks were made available: 1 block received no bids, and there were 11 bids for the remaining 8 blocks, which we expect to result in 8 blocks being awarded. What do Hungary’s concession areas look like now? The map of Hungary below shows the successful bidders who are now holders of concession areas, and for reference it also includes (in purple) the blocks which were made available during the 2016 Bid Round, although these have not yet been awarded. Source: Ministry of National Development Source: Ministry of National Development

- 4. ___________________________ 4 What happens next? The Ministry of National Development, acting through an appointed evaluation committee, will evaluate each valid bid submitted. The criteria has a maximum total of 300 points, of which 60% may be awarded according to the financial elements (i.e. any additional concession fee payable and any increased royalties payable), with c. 13% awarded in terms of the fiscal and technical ability of the bidder to perform the obligations, and the balance being based on technical parameters set out in the work program. The winner is to be selected and announced within 90 days of the closing date of the tender, which for the 2016 Bid Round means an announcement should be made around the end of the year. A winning bidder then has 60 days (with an optional extension of an additional 60 days) from the date of the award of their block(s) in which to negotiate the concession agreement with the Ministry of National Development and execute it. Now that several concession agreements have been signed, it is clear that there is actually little room for negotiations and a large period of the time is taken up with formalities prior to signature. Once signed by both parties, then the winning bidder must establish a concession company in Hungary within 90 days. And a technical operating plan needs to be submitted and approved in order for it to be permitted to commence activities. We expect that concession agreements in respect of the successfully awarded blocks in the 2016 Bid Round to be executed in Q1 2017, which means an average period of 10 months from the opening date of the bid round to contract signature. How does the future look? We will not know for certain until the Ministry publishes its formal announcement, but the next bid round is expected in 2017. There are up to 21 blocks, as shown in the map below, that are eligible to be made available, although we understand that only up to 10 may be included in the 2017 bid round. Source: Ministry of National Development

- 5. ___________________________ 5 With a similar number of blocks being made available, and a continuing trend for companies to secure exploration acreage, we expect that the 2017 bid round will continue to build on the recent successes of previous bid rounds. Whilst the oil price has shown some recent signs of strengthening, following announcements from OPEC and Russia, the fact remains that the industry continues to face a difficult environment. Perhaps the impending IPO of Aramco by Saudia Arabia will help increase the oil price? It is a positive sign that Hungary appears committed to furthering exploration and production operations in its territory, particularly when some of its neighbours remain in some kind of time warp, with limited progress being made across a number of exploration activities, from seismic acquisition to ratifying previously awarded exploration licenses, and others having conceded that the great shale boom of Europe will not be happening any time soon. In any case, Hungary, which has a long and proud history of hydrocarbon exploration and production, remains an attractive destination for oil & gas companies, benefitting from a constant interest from existing operators and a growing interest from new entrants. 19 October 2016 Steven Conybeare Oil & Gas Lawyer Conybeare Solicitors UK Office CEE Office* UK: +44 870 753 0925 6th Fl., Mutual House 6th Fl. HU: +36 1 577 9936 70 Conduit Street Szent Istvan ter 11 www.conybeare.com London W1S 2GF Budapest 1051 Steven Conybeare of Conybeare Solicitors "is personable and responsive, and his work on international transactions was just fantastic" according to impressed clients. Steven is a long‐standing presence in CEE. Clients are extensive in praising his Budapest‐based corporate practice, particularly his "broad cross‐border expertise. He sees the full picture, while also being detail‐oriented. He always makes sure that his client's interests are fully protected." He advises on M&A across a range of industries, with particular activity on cross‐border and CEE‐wide mandates, as well as transactions arising from the UK market. His experience is notably strong in the energy and real estate sectors. Clients state: "He is able to quickly and efficiently understand the commercial requirements of a transaction, and is fantastic at negotiations with counterparty lawyers." Chambers & Partners Global Guide 2016. M&A boutique Conybeare Solicitors’ ‘very ambitious’ team is a key name for oil and gas transactions, and is commended for its ‘industry knowledge’ and ‘commercial understanding’. Legal 500 EMEA Guide 2016