5 March Daily market report

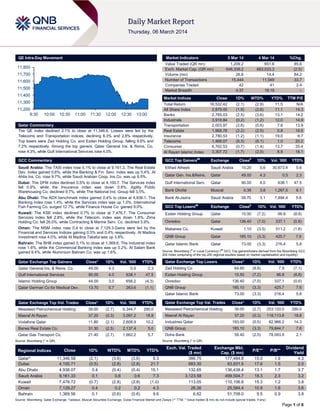

- 1. QE Intra-Day Movement Market Indicators 11,800 11,700 11,600 11,500 11,400 Market Indices 11,300 11,200 9:30 5 Mar 14 10:00 10:30 11:00 11:30 12:00 12:30 13:00 Qatar Commentary The QE index declined 2.1% to close at 11,346.6. Losses were led by the Telecoms and Transportation indices, declining 6.3% and 2.6% respectively. Top losers were Zad Holding Co. and Ezdan Holding Group, falling 8.6% and 7.2% respectively. Among the top gainers, Qatar General Ins. & Reins. Co. rose 4.3%, while Gulf International Services rose 4.0%. 4 Mar 14 %Chg. 1,209.2 646,339.2 26.6 15,444 42 4:37 Value Traded (QR mn) Exch. Market Cap. (QR mn) Volume (mn) Number of Transactions Companies Traded Market Breadth 651.6 663,033.3 14.4 11,549 41 18:19 85.6 (2.5) 84.2 33.7 2.4 – Close Total Return All Share Index Banks Industrials Transportation Real Estate Insurance Telecoms Consumer Al Rayan Islamic Index 1D% WTD% YTD% TTM P/E 16,532.42 2,875.00 2,765.03 3,919.84 2,003.97 1,968.78 2,780.53 1,468.07 6,762.53 3,307.72 (2.1) (1.9) (2.5) (0.2) (2.6) (2.2) (1.2) (6.3) (0.7) (1.7) (2.9) (2.8) (3.6) (1.2) (0.6) (2.5) (1.1) (8.1) (1.4) (2.0) 11.5 11.1 13.1 12.0 7.8 0.8 19.0 1.0 13.7 8.9 N/A 14.3 14.2 14.9 13.9 19.5 6.7 20.2 25.4 18.1 GCC Commentary GCC Top Gainers## Exchange Close# Saudi Arabia: The TASI index rose 0.1% to close at 9,161.3. The Real Estate Dev. Index gained 0.6%, while the Banking & Fin. Serv. index was up 0.4%. Al Ahlia Ins. Co. rose 9.7%, while Saudi Arabian Coop. Ins.Co. was up 9.5%. Etihad Atheeb 1D% Saudi Arabia 15.20 5.6 30,673.4 5.6 Qatar Gen. Ins.&Reins. Qatar 49.00 4.3 0.5 2.3 Dubai: The DFM index declined 0.5% to close at 4,100.7. The Services index fell 0.9%, while the Insurance index was down 0.8%. Agility Public Warehousing Co. declined 9.7%, while The National Ind. Group fell 3.5%. Gulf International Serv. Qatar 90.00 4.0 638.1 47.5 Bank Dhofar Muscat 0.38 3.8 1,267.5 6.1 Abu Dhabi: The ADX benchmark index gained 0.4% to close at 4,938.1. The Banking index rose 1.4%, while the Services index was up 1.0%. International Fish Farming Co. surged 12.7%, while Finance House Co. gained 9.0%. Bank Al-Jazira 39.70 3.1 7,894.4 5.6 GCC Top Losers Exchange Kuwait: The KSE index declined 0.7% to close at 7,476.7. The Consumer Services index fell 2.8%, while the Telecom. index was down 1.8%. Zima Holding Co. fell 26.0%, while Contracting & Marine Serv. Co. declined 5.9%. Ezdan Holding Group Qatar 15.50 (7.2) 96.8 (8.8) Ooredoo Qatar 136.40 (7.0) 337.1 (0.6) Oman: The MSM index rose 0.4 to close at 7,129.3.Gains were led by the Financial and Services Indices gaining 0.5% and 0.4% respectively. Al Madina Investment rose 4.0%, while Al Madina Takaful was up 3.8%. Mabanee Co. Kuwait 1.10 (3.5) 511.2 (1.8) QNB Group Qatar 185.10 (3.3) 425.7 7.6 Qatar Islamic Bank Qatar 73.00 (3.3) 216.4 5.8 Bahrain: The BHB index gained 0.1% to close at 1,369.6. The Industrial index rose 1.6%, while the Commercial Banking index was up 0.2%. Al Salam Bank gained 9.4%, while Aluminium Bahrain Co. was up 1.6%. Qatar Exchange Top Gainers Qatar General Ins. & Reins. Co. Close* 1D% Vol. ‘000 YTD% 49.00 4.3 0.5 2.3 Saudi Arabia ## # Close Vol. ‘000 1D% Vol. ‘000 YTD% YTD% Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) Close* 1D% Vol. ‘000 YTD% Zad Holding Co 64.60 (8.6) 7.9 (7.1) 15.50 (7.2) 96.8 (8.8) Qatar Exchange Top Losers Gulf International Services 90.00 4.0 638.1 47.5 Ezdan Holding Group Islamic Holding Group 44.00 3.0 656.2 (4.3) Ooredoo 136.40 (7.0) 337.1 (0.6) Qatar German Co for Medical Dev. 13.70 0.7 263.6 (1.1) QNB Group 185.10 (3.3) 425.7 7.6 73.00 (3.3) 216.4 5.8 Qatar Islamic Bank Close* 1D% Val. ‘000 YTD% Mesaieed Petrochemical Holding 39.00 (2.7) 253,120.0 290.0 18.8 Masraf Al Rayan 37.20 (0.3) 118,113.6 18.8 2,608.9 10.2 Industries Qatar 193.00 (0.5) 82,966.2 14.3 (2.5) 2,137.4 5.0 QNB Group 185.10 (3.3) 79,844.7 7.6 (2.7) 1,662.2 5.7 Doha Bank 59.40 (2.5) 78,093.9 2.1 Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 39.00 (2.7) 6,344.7 290.0 Masraf Al Rayan 37.20 (0.3) 3,097.2 Vodafone Qatar 11.80 (2.1) Barwa Real Estate Co. 31.30 Qatar Gas Transport Co. 21.40 Qatar Exchange Top Vol. Trades Source: Bloomberg (* in QR) Source: Bloomberg (* in QR) Regional Indices Qatar* Dubai Abu Dhabi Saudi Arabia Kuwait Oman Bahrain Qatar Exchange Top Val. Trades Close 1D% WTD% MTD% YTD% 11,346.58 4,100.71 4,938.07 9,161.33 7,476.72 7,129.27 1,369.56 (2.1) (0.5) 0.4 0.1 (0.7) 0.4 0.1 (3.6) (2.8) (0.4) 0.6 (2.8) 0.2 (0.6) (3.6) (2.8) (0.4) 0.6 (2.8) 0.2 (0.6) 9.3 21.7 15.1 7.3 (1.0) 4.3 9.6 Exch. Val. Traded ($ mn) 386.75 683.30 132.65 3,123.58 113.05 26.26 6.82 Exchange Mkt. Cap. ($ mn) 177,484.8 83,831.5 136,438.4 499,504.7 110,106.6 25,584.4 51,708.0 P/E** P/B** 15.0 17.6 13.1 18.3 15.3 10.9 9.5 1.9 1.5 1.7 2.3 1.2 1.6 0.9 Dividend Yield 4.3 2.0 3.7 3.2 3.8 3.6 3.8 Source: Bloomberg, Qatar Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) Page 1 of 6

- 2. Qatar Market Commentary The QE index declined 2.1% to close at 11,346.6. The Telecoms and Transportation indices led the losses. Zad Holding Co. and Ezdan holding group were the top losers, falling 8.6% and 7.2% respectively. Among the top gainers, Qatar General Ins. & Reins. Co. rose 4.3%, while Gulf International Services rose 4.0%. Overall Activity Buy %* Sell %* Net (QR) Qatari 65.49% 60.51% 60,215,531.57 Non-Qatari 34.51% 39.49% (60,215,531.57) Source: Qatar Exchange (* as a % of traded value) Volume of shares traded on Wednesday rose by 84.2% to 26.6mn from 14.4mn on Tuesday. Further, as compared to the 30-day moving average of 12.2mn, volume for the day was 117.1% higher. Mesaieed Petrochemical Holding Co. and Masraf Al Rayan were the most active stocks, contributing 23.9% and 11.6% to the total volume respectively. Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/05 US MBA MBA Mortgage Applications 28-February 03/05 US ISM ISM Non-Manf. Composite February 9.40% – -8.50% 51.6 53.5 03/05 EU Markit PMI Services 54.0 February 52.6 51.7 03/05 EU Markit 51.6 PMI Composite February 53.3 52.7 03/05 EU 52.9 Eurostat Retail Sales MoM January 1.60% 0.80% -1.30% 03/05 03/05 EU Eurostat Retail Sales YoY January 1.30% -0.20% -0.40% EU Eurostat GDP SA QoQ 4Q2013 0.30% 0.30% 0.30% 03/05 EU Eurostat GDP SA YoY 4Q2013 0.50% 0.50% 0.50% 03/05 France Markit PMI Services February 47.2 46.9 48.9 03/05 Germany Markit PMI Services February 55.9 55.4 53.1 03/05 UK Markit PMI Services February 58.2 58.0 58.3 03/05 Italy Markit PMI Services February 52.9 49.9 49.4 03/05 China Markit HSBC/Markit Services PMI February 51.0 – 50.7 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Al Khaliji to finance QR117mn greenfield recycling project in Qatar – Al Khalij Commercial Bank (Al Khaliji) is financing one of the largest greenfield projects for recycling materials in Qatar, estimated to cost QR117mn. The 20,000-square meter modern recycling plant located in Mesaieed Industrial City is focused on recycling used tires and rubber materials in line with government‟s efforts to make recycling a standard practice that promotes environmental sustainability, as well as creating economic opportunities that contribute to diversifying state revenues. The funding initiative comes as part of the Generation Green Program at Al Khaliji, which is the first incentive-driven loan initiative for green projects by a bank in Qatar. (GulfTimes.com) EFG-Hermes sells Damas stake to MCCS for $150mn – According to sources, the Egyptian investment bank EFGHermes has sold its 19% stake in UAE-based jeweler Damas to Mannai Corporation (MCCS) for $150mn. MCCS and EFGHermes took control of the jeweler in April 2012, with MCCS holding 66% of shares and EFG-Hermes owning 19%. (Reuters) Qatar Cool to open third district cooling plant in Doha – Qatar Cool is preparing to open its third plant in the Doha region to meet the cooling demands of residential and commercial towers in West Bay. Qatar Cool said its two existing cooling plants in West Bay are currently serving some 46 towers. With the opening of its third plant, the company can provide around 40,000 tons of refrigeration of cooling. Qatar Cool‟s Chairman Bader al-Meer said that developers prefer district cooling, since not only does it reduce operating costs and building maintenance costs but it also helps reduce carbon footprints. (Gulf-Times.com) Qatar Steel, Vale sign iron ore supply contract – Qatar Steel has signed an iron ore pellets supply contract with Vale, a global player specializing in the exploration of iron ore utilized for steel production. The contract is for a period of three years and is renewable for another three years. The contract was signed by Ali bin Hassan Al Muraikhi, Managing Director & General Manager of Qatar Steel. (Peninsula Qatar) QA to get 3 A380s in June; to receive the first A350 – Qatar Airways‟ (QA) Chief Executive Akbar Al Baker said that the airline will take delivery of its first three Airbus A380 aircraft in June 2014 and inaugurate its superjumbo services with a daily flight to London. Al Baker said QA has also ordered 10 more A380s and said it has a total of 300 Airbus and Boeing jets on order. Further, Al Baker said that Airbus was on schedule to deliver its first A350 to Qatar towards the end of this year. QA is the launch customer for Airbus‟ new mid-sized passenger jet, with 80 A350s on order. (Reuters) QE deposits QFLS’ bonus shares – The Qatar Exchange (QE) announced the addition of bonus shares to the shareholder Page 2 of 6

- 3. accounts of QFLS. With this, the company‟s new capital stands at QR844.6mn. (QE) QGMD’s BoD to meet on March 20 – Qatari German Company for Medical Devices‟ (QGMD) board of directors will meet on March 20, 2014 to discuss the company‟s financial results ending on December 31, 2013. (QE) MERS’ AGM scheduled on March 26 – Al Meera Consumer Goods Company‟s (MERS) AGM is scheduled to meet on March 26, 2014 at the Regency Halls in Doha. In case of lack of quorum, an alternate meeting will be held on April 7, 2014. The AGM‟s agenda includes discussing and approving the board‟s recommendation for the distribution of 80% cash dividends, representing QR8 per share for the year 2013, among others. (QE) QOIS’ AGM scheduled on March 24 – Qatar Oman Investment Company‟s (QOIS) AGM is scheduled to be held on March 24, 2014 in Doha. In case of lack of quorum, an alternate meeting will be held on March 31, 2014. The AGM‟s agenda includes discussing the board‟s proposal of distributing 6% cash dividends, which represent 60 Dirhams per share, among others. (QE) International Yellen commits Fed to boost weak US economy – The US Federal Reserve (Fed) Chair Janet Yellen vowed to take all possible measures to boost the US economy that is performing well short of the central bank's objectives. Yellen said the economy continues to operate considerably short of Fed's objectives of maximum employment and stable prices, though she said the economy is stronger and the financial system is sounder. The brief comments broadly reiterated what she told two congressional committees last month: that the US appears to be clawing its way back from the 2007-2009 recession but that the Fed is in no rush to tighten policy. The world's biggest economy expanded at a decent 2.4% rate in the fourth quarter, but has slowed later this year due to severe weather. The US unemployment rate is down to 6.6%, from a high of 10% in 2009, but it still remains high and jobs growth is erratic. The Fed is targeting 2% inflation and is seeking to bring down unemployment to around 5.5%. (Reuters) Fed confirms weather’s effect on US economy in early 2014 – The US Federal Reserve stated that severe weather across the US took a toll on shopping and consumer spending in recent weeks, leading to slower economic growth or outright contraction in some areas of the country. Growth slowed in Chicago but activity was stable in Kansas City. While the other eight districts reported growth, the Fed said it was characterized as "modest to moderate" in most cases, an overall downgrade from its last report on January 15, which showed "moderate" growth in nine regions. However, the report showed business contracts were still upbeat, with real estate picking up in some areas and travel & tourism remaining strong. The Fed said that the outlook for most districts remained optimistic. (Reuters) IMF calls for ECB rate cut, quantitative easing – IMF officials said that the European Central Bank (ECB) should cut its interest rates or inject more liquidity into the banking system via its Long-Term Refinancing Operations (LTRO) or start asset purchases. The ECB is due to hold a meeting on its monetary policy this week. Consumer inflation has been stuck in what the ECB called „the danger zone of below 1%‟ for five months. (Reuters) China signals focus on reforms; job creation to be main goal – China has sent the strongest signal yet that its days of chasing breakneck economic growth were over, promising to wage a war on pollution and reduce the pace of investment to a decade-low as it pursues more sustainable expansion. China's Finance Minister Lou Jiwei has set job creation as the country's most important policy goal, saying it was less important whether GDP growth was slightly above or below the government's 7.5% target. Jiwei's comments echoed those of Chinese Premier Li Keqiang, who told the parliament that reform would be the government's priority rather than the fast growth witnessed in recent years. Li Keqiang said China aimed to expand its economy by 7.5% this year, the highest among the world's major powers, although he stressed that growth would not get in the way of reforms. To aid the transformation, the National Development & Reform Commission will target 17.5% growth in fixed-asset investment this year, the slowest in 12 years. (Reuters) Regional Moody’s: GCC inflation to rise in 2014 – According to a report by Moody‟s, all GCC economies, except Bahrain, are expected to witness a rise in inflation in 2014. The report said that despite the governments‟ efforts to control price increases, inflation has picked up in Saudi Arabia, Qatar and the UAE and it is expected to rise further in 2014. While the rise in inflation will absorb some of the benefits from government spending on per capita income, the report predicted that headline rates will stay at manageable, low single-digit levels in the region. Unlike previous periods of high oil prices, inflation has remained subdued during 20112013. Inflationary pressures in the UAE, Qatar and Kuwait were contained due to a domestic boom-bust cycle in real estate, which reigned in rising rents. The report also highlighted a sharp fiscal divide between the oil exporting GCC and rest of the MENA region. Moody‟s predicted that GCC economies would grow 4.3% in 2014 and 4.2% in 2015, fueled by the nonhydrocarbon sector. However, fiscal policies will not provide much of a boost to growth in the GCC, the report said. (GulfBase.com) Mobily forms alliance with Etisalat on LTE roaming – Emirates Telecommunications Corporation (Etisalat) has formed a partnership with Etihad Etisalat Company (Mobily) to provide a seamless 4G-LTE roaming experience to subscribers in Saudi Arabia and the UAE. Mobily connects its subscribers via Etisalat‟s SmartHub IPX, which provides 4G-LTE roaming services, voice service, signaling, messaging service, GRX data exchange between mobile network operators, fixed network operators, application service providers and other players through a single connection. Saudi Arabia and the UAE are the top roaming destinations for Mobily, therefore this partnership can deliver LTE roaming services to users in both countries. (GulfBase.com) Ras Al Khaimah explores stake sale in RAK Ceramics – According to sources, the ruling Al Qasimi family of Ras Al Khaimah is exploring a sale of its shares in Ras Al Khaimah Ceramic Company (RAK Ceramics). Talks on the possible sale have been underway over the last six months. Members of the Emirate's ruling family own at least 45% of RAK Ceramics. (GulfBase.com) Saudi non-oil private sector economy expands – According to the headline SABB HSBC Saudi Arabia Purchasing Managers‟ Index (PMI) for February 2014, growth in the non-oil business activity in Saudi Arabia slowed to a three-month low in February. The PMI report found that output increases and new orders have moderated, but growth was still faster than in most months of 2013. However, growth rates were a little softer with the headline PMI falling to a three-month low of 58.6 as compared to 59.7 in January. The report published by the Saudi Page 3 of 6

- 4. British Bank (SABB) and HSBC, reflects the economic performance of non-oil producing private sector companies in the Kingdom. (GulfBase.com) United Investment, SCCI to build hotel in Sharjah – United Investment and Sharjah Chamber of Commerce & Industry (SCCI) have signed an agreement to build a hotel named „Expo Hotel Sharjah‟ at a cost of AED100mn. Located near the Expo Centre Sharjah, the 200-room hotel will primarily cater to the participants of numerous events at the Expo Centre as well as serve touristic purposes in the Emirate. (GulfBase.com) Dubai World prepays $284.5mn debt – According to sources, Dubai World has prepaid $284.5mn worth of debt to creditors under its $25bn debt restructuring plan. The conglomerate obtained money for the prepayment from asset sales. Under the terms of the restructuring deal, cash raised from asset sales above a threshold of $300mn is to be distributed as early repayments to creditors, which include big Western and Gulf banks. Under its restructuring plan, Dubai World is to completely repay creditors over coming years by selling its assets that were bought at peak prices in 2006-07. The plan includes a $4.4bn loan maturity in May 2015. In December 2013, a unit of Dubai World sold its 50% stake in Miami Beach‟s landmark Fontainebleau hotel back to Florida developer, Turnberry. (Peninsula Qatar) Emirates NBD declares 25% cash dividend – Emirates NBD‟s AGM has approved the distribution of 25% cash dividend (25 fils per share) for the year ended December 31, 2013. (DFM) DSI’s German unit secures AED50mn contracts in India – Passavant-Roediger, a wholly-owned German subsidiary of Drake & Scull International (DSI), has been awarded two major contracts of a combined value of AED50mn for water and wastewater treatment plants in India. Passavant-Roediger will undertake the work for the state government of Rajasthan and Ford India at its new plant in Ahmedabad, Gujarat. (DFM) Arabtec wins AED1.037bn construction contract – Arabtec Holding‟s subsidiary ArabTec Construction has been awarded a contract worth AED1.037bn to construct 1,582 townhouses developed by Emaar Properties in Reem. These villa townhouses are part of the Mira community, the first phase of Reem. The villas are being built in four different types, covering a total built area of 337,805 square meters. Construction work is scheduled to begin in 1Q2014 and the project will be delivered in 24 months. (DFM) Juma Al Majid tops the Consumer Friendliness Index – The Dubai Department of Economic Development announced that Juma Al Majid Automobiles has topped the Consumer Friendliness Index 2013. The main criteria for the index are: service quality, billing transparency, sharing of warranty information by salespersons and overall customer satisfaction. Juam Al Majid Automobiles took top spot in both the overall rating and the automobiles category. (GulfBase.com) Petrixo to invest $800mn in Fujairah bio-fuel refinery – Dubai-based Petrixo Oil & Gas will invest $800mn in a bio-fuel refinery in Fujairah. The company has plans to be a leader in bio-fuel production in the Middle East. Petrixo has completed the preparation of engineering designs to set up a bio-fuel refinery with a design capacity of 1mn tons per year of bio-fuel products, which include bio-diesel, green diesel, bio-jet, bio-naphtha and bio-LPG. The project will be set up over a 460,000-square meter land in proximity to Fujairah Free Zone and the Port of Fujairah. Petrixo has incorporated a consortium of major international companies and financial institutions to set up the project. (GulfBase.com) DMCC, BGC Partners to launch murabaha contracts – The Dubai Multi Commodity Centre (DMCC) and a US-based brokerage firm BGC Partners have signed a deal to promote murabaha products, as part of a drive to turn Dubai into an Islamic finance hub. Under the agreement, commodity murabaha contracts can be traded on the DMCC Tradeflow Platform. (GulfBase.com) Raytheon wins $655m Patriot missile deal in Kuwait – Raytheon Company has received a $655mn contract for newproduction fire units of the combat-proven Patriot Air & Missile Defense System for Kuwait. These units are an addition to the Patriot fire units, currently owned by Kuwait to counter threats. The US Army Aviation and Missile Command, Redstone Arsenal awarded the contract as a foreign military sale agreement and includes new Patriot fire units with increased computing power and radar processing efficiency. (GulfBase.com) MISC signs OMR27mn EPC contract with Six Construct – Majis Industrial Services Company (MISC) has signed an EPC contract (engineering, procurement and construction) worth OMR27mn with Six Construct for the construction of the Sea Water Intake Pumping Station 2 at SOHAR Port and Freezone. The contract is expected to be completed in 27 months inclusive of the three-month trial phase. The pumping station will be able to provide nearly 320,000 cubic meters per hour of industrial cooling water for the tenants at the Sohar Industrial Port Area. (GulfBase.com) GlassPoint appoints Oman project head – GlassPoint Sohar has appointed Tarik Hussain as the Director of Oman Projects based in Muscat. Hussain has in-depth engineering and project management experience, delivering large industrial and infrastructure projects in Oman. (GulfBase.com) AMIC’s BoD proposes distribution of free shares – Al Madina Takaful‟s (AMIC) board of directors has recommended the distribution of 8,333,330 free shares from the share premium. The proposed distribution is equivalent to 5% of the issued share capital of OMR16.7mn. The free shares would equate to 5 shares for every 100 shares held. (MSM) Oxy Oman surpasses production forecast in 2013 – Occidental Petroleum Corporation‟s (Oxy Oman) Vice President for Mukhaizna Operation, Robert Swain, said that the company has fulfilled its commitments to its projects in Oman in 2013 and even outperformed its forecasts. Oxy Oman had promised a production rate of 222,000 barrels of oil equivalent per day (boepd) in 2013, but its production reached 228,000 boepd. The promised production volume was 81mn boepd, but the company achieved the production volume of 83mn boepd. Further, Oxy Oman has made over 20 oil & gas discoveries in the last three years. Oxy Oman's average rig count in 2013 stood at 14 and the expected average rig count in 2014 would be 15. (GulfBase.com) Bahrain to see further bank mergers in 2014 – Bahrain's central bank governor said that he expects further consolidation among Bahraini banks in 2014 after a spree of tie-ups in 2013, and the regulator is encouraging Islamic banks to get credit ratings to improve their transparency. Mergers in the Middle Eastern banking sector are rare as powerful local shareholders are often unwilling to give up controlling positions except for vastly-inflated valuations. However, in Bahrain, the central bank has been encouraging smaller lenders to merge to bolster institutions weakened by a local real estate crash and fall-out from the island kingdom's political unrest in 2011. (GulfBase.com) Page 4 of 6

- 5. BKIC declares 30% cash dividend – Bahrain Kuwait Insurance Company‟s (BKIC) AGM has approved the distribution of 30% cash dividends (30 fils per share) amounting to BHD2.1mn for 2013. (Bahrain Bourse) CPARK declares 10% cash dividend – Bahrain Car Park Company‟s (CPARK) AGM has approved the distribution of 10% cash dividends (10 fils per share) for 2013. (Bahrain Bourse) Page 5 of 6

- 6. Rebased Performance Daily Index Performance 180.0 170.0 160.0 150.0 140.0 130.0 120.0 110.0 100.0 90.0 80.0 143.9 131.2 0.5% 0.4% 0.1% 0.1% 0.4% 0.0% (0.5%) (1.0%) (0.5%) (0.7%) (1.5%) (2.0%) S&P Pan Arab Dec-13 S&P GCC Source: Bloomberg Asset/Currency Performance Gold/Ounce Silver/Ounce Crude Oil (Brent)/Barrel (FM Future) Natural Gas (Henry Hub)/MMBtu North American Spot LPG Propane Price North American Spot LPG Normal Butane Price Euro Source: Bloomberg Close ($) 1D% WTD% YTD% 1,336.90 0.2 0.8 10.9 21.17 (0.0) (0.3) 8.7 107.76 (1.4) (1.2) 6.42 (19.0) 106.75 Global Indices Performance Close 1D% WTD% YTD% 16,360.18 (0.2) 0.2 (1.3) S&P 500 1,873.81 (0.0) 0.8 1.4 (2.7) NASDAQ 100 4,357.97 0.1 1.2 4.3 36.7 47.7 STOXX 600 337.06 (0.0) (0.3) 2.7 (2.3) (4.7) (15.6) DAX 9,542.02 (0.5) (1.5) (0.1) 119.50 (1.8) (2.0) (12.0) FTSE 100 6,775.42 (0.7) (0.5) 0.4 4,391.25 (0.1) (0.4) 2.2 14,897.63 1.2 0.4 (8.6) DJ Industrial 1.37 (0.1) (0.5) (0.1) CAC 40 102.30 0.1 0.5 (2.9) Nikkei GBP 1.67 0.3 (0.1) 1.0 MSCI EM CHF 1.13 0.0 (0.8) 0.7 SHANGHAI SE Composite AUD 0.90 0.4 0.7 0.8 USD Index 80.11 (0.1) 0.5 RUB 36.10 0.0 0.7 BRL 0.43 1.0 1.0 2.0 Yen Dubai May-13 Oman Oct-12 Abu Dhabi QE Index Mar-12 Bahrain Aug-11 Kuwait Jan-11 (2.1%) Qatar (2.5%) Saudi Arabia Jun-10 1.0% 163.0 959.18 0.3 (0.7) (4.3) 2,053.08 (0.9) (0.2) (3.0) HANG SENG 22,579.78 (0.3) (1.1) (3.1) 0.1 BSE SENSEX 21,276.86 0.3 0.7 0.5 9.8 Bovespa 46,589.00 (1.1) (1.1) (9.5) 1,182.05 (0.2) (6.7) (18.1) Source: Bloomberg RTS Source: Bloomberg Contacts Saugata Sarkar Ahmed M. Shehada Keith Whitney Sahbi Kasraoui Head of Research Head of Trading Head of Sales Manager - HNWI Tel: (+974) 4476 6534 Tel: (+974) 4476 6535 Tel: (+974) 4476 6533 Tel: (+974) 4476 6544 saugata.sarkar@qnbfs.com.qa ahmed.shehada@qnbfs.com.qa keith.whitney@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar DISCLAIMER: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange; QNB is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. While this publication has been prepared with the utmost degree of care by our analysts, QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6