27 August Daily market report

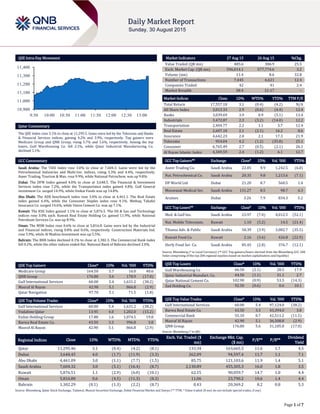

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QSE Index rose 3.1% to close at 11,295.5. Gains were led by the Telecoms and Banks & Financial Services indices, gaining 4.2% and 3.9%, respectively. Top gainers were Medicare Group and QNB Group, rising 5.7% and 5.6%, respectively. Among the top losers, Gulf Warehousing Co. fell 2.1%, while Qatar Industrial Manufacturing Co. declined 1.1%. GCC Commentary Saudi Arabia: The TASI Index rose 3.0% to close at 7,604.3. Gains were led by the Petrochemical Industries and Multi-Inv. indices, rising 5.3% and 4.4%, respectively. Aseer Trading, Tourism & Man. rose 9.9%, while National Petrochem. was up 9.8%. Dubai: The DFM Index gained 4.0% to close at 3,648.5. The Financial & Investment Services index rose 7.2%, while the Transportaion index gained 4.8%. Gulf General investment Co. surged 14.9%, while Unikai Foods was up 14.8%. Abu Dhabi: The ADX benchmark index rose 3.0% to close at 4,461.1. The Real Estate index gained 6.4%, while the Consumer Staples index rose 4.1%. Methaq Takaful Insurance Co. surged 14.6%, while Union Cement Co. was up 7.1%. Kuwait: The KSE Index gained 1.1% to close at 5,876.5. The Oil & Gas and Technology indices rose 3.0% each. Kuwait Real Estate Holding Co. gained 11.9%, while National Petroleum Services Co. was up 8.9%. Oman: The MSM Index rose 0.6% to close at 5,816.8. Gains were led by the Industrial and Financial indices, rising 0.8% and 0.6%, respectively. Construction Materials Ind. rose 5.9%, while Al Madina Investment was up 5.5%. Bahrain: The BHB Index declined 0.1% to close at 1,302.3. The Commercial Bank index fell 0.2%, while the other indices ended flat. National Bank of Bahrain declined 2.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 164.50 5.7 16.0 40.6 QNB Group 176.80 5.6 178.9 (17.0) Gulf International Services 60.00 5.4 1,631.2 (38.2) Masraf Al Rayan 42.90 5.1 866.8 (2.9) Qatar Navigation 97.70 5.1 71.5 (1.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Gulf International Services 60.00 5.4 1,631.2 (38.2) Vodafone Qatar 13.95 4.0 1,202.0 (15.2) Ezdan Holding Group 17.88 1.6 1,074.5 19.8 Barwa Real Estate Co. 43.50 3.3 996.8 3.8 Masraf Al Rayan 42.90 5.1 866.8 (2.9) Market Indicators 27 Aug 15 26 Aug 15 %Chg. Value Traded (QR mn) 485.6 386.9 25.5 Exch. Market Cap. (QR mn) 596,014.1 577,774.6 3.2 Volume (mn) 11.4 8.6 32.8 Number of Transactions 7,445 6,621 12.4 Companies Traded 42 41 2.4 Market Breadth 38:4 21:17 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,557.18 3.1 (0.4) (4.2) N/A All Share Index 3,013.33 2.9 (0.6) (4.4) 12.4 Banks 3,039.69 3.9 0.9 (5.1) 13.4 Industrials 3,472.87 2.3 (3.2) (14.0) 12.2 Transportation 2,404.77 2.2 1.1 3.7 12.4 Real Estate 2,607.18 2.1 (2.1) 16.2 8.6 Insurance 4,642.23 2.0 2.1 17.3 21.9 Telecoms 954.04 4.2 (1.2) (35.8) 25.1 Consumer 6,765.49 2.7 (0.5) (2.1) 26.1 Al Rayan Islamic Index 4,349.59 2.4 (1.2) 6.1 12.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Aseer Trading Co. Saudi Arabia 22.05 9.9 1,242.5 (6.8) Nat. Petrochemical Co. Saudi Arabia 20.35 9.8 1,213.6 (7.1) DP World Ltd Dubai 21.20 8.7 560.5 1.0 Mouwasat Medical Ser. Saudi Arabia 131.27 8.5 98.7 6.3 Aramex Dubai 3.26 7.9 834.3 5.2 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Med. & Gulf Ins. Saudi Arabia 23.97 (7.0) 4,012.5 (52.1) Nat. Mobile Telecomm. Kuwait 1.10 (5.2) 14.5 (21.4) Tihama Adv. & Public Saudi Arabia 58.39 (3.9) 3,082.7 (35.5) Kuwait Food Co. Kuwait 2.16 (3.6) 426.8 (22.9) Herfy Food Ser. Co. Saudi Arabia 85.45 (2.8) 376.7 (12.1) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Gulf Warehousing Co 66.50 (2.1) 28.5 17.9 Qatar Industrial Manufact. Co. 44.50 (1.1) 31.1 2.7 Qatar National Cement Co. 102.90 (0.9) 53.5 (14.3) Zad Holding Co. 92.50 (0.6) 0.6 10.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 60.00 5.4 97,124.0 (38.2) Barwa Real Estate Co. 43.50 3.3 43,394.0 3.8 Commercial Bank 55.10 0.7 42,511.2 (11.5) Masraf Al Rayan 42.90 5.1 36,508.8 (2.9) QNB Group 176.80 5.6 31,185.8 (17.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,295.46 3.1 (0.4) (4.2) (8.1) 133.34 163,665.5 11.6 1.7 4.5 Dubai 3,648.45 4.0 (1.7) (11.9) (3.3) 262.09 94,597.4 11.7 1.1 7.1 Abu Dhabi 4,461.09 3.0 (1.1) (7.7) (1.5) 85.75 121,103.6 11.9 1.4 5.1 Saudi Arabia 7,604.32 3.0 (5.1) (16.4) (8.7) 2,130.89 455,305.3 16.0 1.8 3.5 Kuwait 5,876.51 1.1 (2.9) (6.0) (10.1) 62.15 90,059.7 14.7 1.0 4.4 Oman 5,816.80 0.6 (4.5) (11.3) (8.3) 11.06 23,790.2 10.6 1.4 4.4 Bahrain 1,302.29 (0.1) (1.3) (2.2) (8.7) 0.43 20,369.2 8.2 0.8 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,900 11,000 11,100 11,200 11,300 11,400 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QSE Index rose 3.1% to close at 11,295.5. The Telecoms and Banks & Financial Services indices led the gains. The index rose on the back of buying support from non-Qatari and GCC shareholders despite selling pressure from Qatari shareholders. Medicare Group and QNB Group were the top gainers, rising 5.7% and 5.6%, respectively. Among the top losers, Gulf Warehousing Co. fell 2.1%, while Qatar Industrial Manufacturing Co. declined 1.1%. Volume of shares traded on Thursday rose by 32.8% to 11.4mn from 8.6mn on Wednesday. Further, as compared to the 30-day moving average of 5.1mn, volume for the day was 122.9% higher. Gulf International Services and Vodafone Qatar were the most active stocks, contributing 14.4% and 10.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 08/27 US Bureau of Economic Analysis GDP Annualized QoQ 2Q2015 3.70% 3.20% 2.30% 08/27 US Bureau of Economic Analysis Personal Consumption 2Q2015 3.10% 3.10% 2.90% 08/27 US Bureau of Economic Analysis GDP Price Index 2Q2015 2.10% 2.00% 2.00% 08/27 US Bureau of Economic Analysis Core PCE QoQ 2Q2015 1.80% 1.80% 1.80% 08/27 US Bloomberg Bloomberg Consumer Comfort 23-August 42.0 – 41.1 08/27 US National Assoc. of Realtors Pending Home Sales NSA YoY July 7.20% 8.30% 11.10% 08/28 US Bureau of Economic Analysis Personal Income July 0.40% 0.40% 0.40% 08/28 US Bureau of Economic Analysis Personal Spending July 0.30% 0.40% 0.30% 08/27 EU European Central Bank M3 Money Supply YoY July 5.30% 4.90% 4.90% 08/27 EU European Central Bank M3 3-month average July 5.10% 5.00% 5.10% 08/28 EU European Commission Economic Confidence August 104.2 103.8 104.0 08/28 EU European Commission Business Climate Indicator August 0.2 0.3 0.4 08/27 France INSEE Business Confidence August 100.0 99.0 99.0 08/28 France INSEE PPI MoM July -0.10% – 0.10% 08/28 France INSEE PPI YoY July -1.60% – -1.80% 08/27 Germany Destatis Import Price Index MoM July -0.70% -0.30% -0.50% 08/27 Germany Destatis Import Price Index YoY July -1.70% -1.40% -1.40% 08/28 Germany Destatis CPI MoM August 0.00% -0.10% 0.20% 08/28 Germany Destatis CPI YoY August 0.20% 0.10% 0.20% 08/28 UK ONS GDP QoQ 2Q2015 0.70% 0.70% 0.70% 08/28 UK ONS GDP YoY 2Q2015 2.60% 2.60% 2.60% 08/28 UK ONS Exports QoQ 2Q2015 3.90% 2.00% 0.40% 08/28 UK ONS Imports QoQ 2Q2015 0.60% 0.60% 2.30% 08/28 UK ONS Total Business Investment QoQ 2Q2015 2.90% 1.50% 2.00% 08/28 UK ONS Total Business Investment YoY 2Q2015 5.00% 3.80% 5.70% 08/28 Spain INE Retail Sales SA YoY July 4.10% 2.70% 2.40% 08/28 Spain INE CPI EU Harmonised YoY August -0.50% -0.30% 0.00% 08/28 Spain INE CPI MoM August -0.30% -- -0.90% 08/28 Spain INE CPI YoY August -0.40% -0.10% 0.10% 08/28 Italy ISTAT Consumer Confidence Index August 109.0 107.0 106.7 08/28 Italy ISTAT Business Confidence August 102.5 103.6 103.5 08/28 Italy ISTAT Economic Sentiment August 103.7 – 104.3 08/28 Italy ISTAT Hourly Wages YoY July 1.20% – 1.10% 08/28 China National Bureau of Statistics Industrial Profits YoY July -2.90% – -0.30% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 53.91% 57.40% (16,986,288.73) GCC 7.36% 4.71% 12,845,428.28 Non-Qatari 38.73% 37.88% 4,140,860.45

- 3. Page 3 of 7 News Qatar QNB Group: Qatar’s overall inflation set to bottom out in 2015 – QNB Group (QNBK) has said that Qatar’s consumer price index (CPI) inflation remained moderate in the first seven months of 2015. According to the Ministry of Development, Planning & Statistics (MDPS), CPI inflation is estimated to have averaged 1.5% in the year up to July compared with 3.1% in 2014. Inflation has been lower in 2015 mainly due to lower domestic inflation as a result of falling rents as well as lower foreign inflation owing to declining international food prices. Foreign inflation has been lower in 2015 as global food prices have been on a gradual declining path since their peak in the summer of 2012. Prices in the other components of foreign inflation (clothing & footwear, furnishings & household equipment) also remained weak in the first seven months of 2015. Weak international commodity prices are likely to keep foreign inflation in check for the remainder of 2015. Going forward, QNBK forecasted overall inflation to bottom out in 2015, before picking up in 2016-17. QNBK said overall inflation will increase slightly in 2016-17 as population growth is expected to pick up. Domestic inflationary pressures have been weak despite strong population growth. This is mainly because housing inflation (21.9% weight in the CPI) slowed. Inflation in this component, which mainly consists of rents, slowed from an estimated 4.6% YoY in January to 2.3% in July, despite strong population growth. Strong supply of additional housing units might be driving down rental costs. More supply of low-to-middle- income housing is probably coming onto the market, which is meeting the bulk of the demand from expatriates. Furthermore, transportation inflation (14.6% weight in the CPI basket) slowed to 3.2% YoY in July from an estimated 7.6% YoY in January 2015. QNBK said that in June and July, inflation picked up slightly owing primarily to the rebound in food prices due to seasonal Ramadan effects. Food prices in Qatar tend to increase every year during Ramadan and food inflation is, therefore, likely to moderate during the remainder of 2015. (Gulf-Times.com) Fitch affirms Qatar at ‘AA', outlook stable; Emadi hails report – Rating agency Fitch has affirmed Qatar’s long-term foreign and local currency issuer default ratings (IDR) at ‘AA’ with a stable outlook. The country ceiling has been affirmed at ‘AA+’ and the short-term foreign currency IDR at ‘F1+’. The ‘AA’ rating reflects Qatar’s strong net external sovereign assets and current efforts to address the impact of lower oil prices on the fiscal balance. It also factors in the dependence on hydrocarbons and a weak but improving weak institutional framework. The oil price decline is expected to lead to a drop of 29% in Qatar’s revenue in 2015. Meanwhile, Minister of Finance HE Ali Shareef Al Emadi welcomed the report and said the fact that Qatar remains highly rated by Fitch and other rating agencies is a testimony to the strength of its economy, its financial position and prudent policies adopted by the government. He said that Qatar will continue to move ahead with key development plans in health, education, and major development projects, including those related to hosting the 2022 FIFA World Cup. He further added that the country will continue to seek further efficiency across the public sector and achieve value for money in the implementation of public sector projects and initiatives. (Bloomberg, Peninsula Qatar) QCB to issue T-bills worth QR4bn on Sept 1 – The Qatar Central Bank (QCB) will issue new three month treasury bills (T-bills) worth Q2bn, along with six and nine month T-bills worth QR1bn each on September 1, 2015. (QCB) MDPS: Qatar trade balance down 1.4% MoM in July 2015 – According to a recent report by the Ministry of Development, Planning and Statistics (MDPS), Qatar’s trade balance achieved a surplus of QR14.3bn in July 2015, down 1.4% MoM and down 55.6% YoY. The exports for July were worth QR23.5bn, down 41.7% YoY and 1.1% MoM. Imports were up 13.5% MoM to QR9.2mn. Petrol & Hydrocarbon exports were down by 40.5% to QR15.6bn. Japan was the top exporter to Qatar, exporting products worth QR4.3bn, while South Korea stood at the second place with QR4bn. The two countries jointly represent 37.1% of Qatar’s total imports. Cars, air planes and helicopters were Qatar’s biggest imports. (Peninsula Qatar) QTA: Qatar’s hospitality sector continues to grow – The Qatar Tourism Authority (QTA) in its 2015 mid-year tourism performance summary showed that the country’s tourism accommodation sector continued to develop and expand with the opening of 11 new hotels at the start of 2015. According to the QTA, these hotels (five 5-stars, one 4-star, and five 3-stars) added around 1,400 new rooms to the hospitality sector, including high- end resorts such as Marsa Malaz Kempinski and Banana Island Resort by Anantara. As per the report, additional 13 properties with around 2,500 rooms are expected to come online before the end of 2015. Meanwhile, Marsa Malaz Kempinski GM Wissam Suleiman said room rates at hotels and hotel apartments in Qatar are likely to be lower due to the rising competition in the hospitality industry. (Gulf-Times.com) QSE signs MoU with Borsa Istanbul – Borsa Istanbul and Qatar Stock Exchange (QSE) have signed a MoU to improve their capital markets through exchange of information on operations of bourses and markets, and organize promotional events. (Bloomberg) Kahramaa updates electronic database to issue certificates – Qatar General Water & Electricity Corporation (Kahramaa) has upgraded and updated its electronic database for water & electricity supplies to ease the process of issuing subscribers, “To whom it may concern” certificates electronically. Such certificates mostly specify the location of the consumer’s accommodation according to their Kahramaa connection number. Accordingly, the subscribers, both locals and expatriates, could log on to the Kahramaa website at km.qa or open the Kahramaa application on their smartphones for the certificate. (Gulf-Times.com) ORDS’ new broadband gateway set to offer superior experience – Ooredoo (ORDS) has launched two new services designed to enhance Fiber customer’s online experience. For new Fiber customers, ORDS is launching the SuperNet Fiber Wi-Fi Broadband Gateway, a new device that uses the best-in-class Wi-Fi performance to deliver better coverage, faster speeds and offer the best Wi-Fi performance of any fixed carrier in Qatar. The new Broadband Gateway supports over 40 simultaneous connections, to satisfy even the most demanding of homes and employs the latest 802.11ac Wi-Fi specifications. All new Fiber connections will automatically be provided with the new device, which replaces ORDS’s existing gateway device. ORDS will begin offering the new Wi-Fi Broadband Gateways for new Fiber broadband and Mozaic TV subscribers in coming weeks. (Gulf-Times.com) QA to reinstate Nagpur service from Dec 1 – Qatar Airways (QA) will operate an A320 daily on the route between Doha and Nagpur from December 1, 2015. The reinstated service will take the airline’s total weekly passenger flights from 95 to 102 across 13 key cities in India. QA had previously served Nagpur from September 2007 to May 2009. This highlights the importance of QA’s ongoing expansion and commitment to the Indian market. (Gulf-Times.com) International US economy growth revised sharply higher in 2Q2015 – The US economy grew faster than initially thought in 2Q2015 on solid domestic demand, showing fairly strong momentum that could

- 4. Page 4 of 7 still allow the Federal Reserve to hike interest rates this year. The Commerce Department said the GDP expanded at a 3.7% annual pace instead of the 2.3% rate reported in July. Underscoring the solid economic fundamentals, a measure of private domestic demand that excludes trade, inventories and government expenditures rose at a 3.3% rate in 2Q2015, instead of the previously reported 2.5%. Consumer spending, which accounts for more than two-thirds of US economic activity, grew at a 3.1% rate, rather than the 2.9% pace reported in July. A strong labor market, cheaper gasoline and relatively higher house prices are boosting household wealth, helping to support consumer spending. Meanwhile, US consumer confidence declined in August to a three- month low as recent stock-market turbulence weighed on Americans’ outlook for the US economy in the coming year. The University of Michigan final consumer sentiment index had dropped to 91.9 from 93.1 in July. A measure of prospects for the economy over the next 12 months was the weakest since November. (Reuters, Bloomberg) Moody’s slashes 2016 global growth forecasts – Credit rating firm Moody’s cut its 2016 global economic growth forecasts on August 28, with China and the US both trimmed and Russia and Brazil seen staying in recession. It was a surprise move from the firm, coming just 10 days since its last forecasts. It put average growth in the top-20 world economies at 2.8% on an average, versus the 3% it had forecasted previously. Moody’s lowered 2016 US growth forecast to 2.6% from 2.8% saying the negative impact of the stronger dollar seems more pronounced than assumed previously. The rating agency kept its Eurozone forecast unchanged despite the recent turbulence in Greece, at 1 and 2% in 2015 and 2016, respectively. Moody’s said Brazil’s output would shrink as much as 1% in 2016 and Russia’s as much as 1.5%. China, Japan and Korea’s growth also saw downgrades partly due to expectations of more muted exports. Emerging markets Turkey and South Africa had their forecasts reduced too. (Reuters) Eurozone economic confidence unexpectedly gains in August – Eurozone economic confidence unexpectedly rose in August, defying a slowdown in China and renewed political uncertainty in Greece. The European Commission said an index of executive and consumer confidence increased to 104.2 in August from 104 in July. Sentiment among consumers improved to minus 6.9 from minus 7.2, whereas confidence in the services sector increased to 10.2 from 8.9. However, the industrial confidence in the region weakened to minus 3.7 from minus 2.9. A business-climate indicator dropped to 0.21 in August from a revised 0.41 in July. The report follows a roller-coaster week for global markets on concerns that China’s slowdown is deepening. While Chinese authorities have taken steps to stimulate the economy, cutting interest rates five times in 10 months and devaluing the yuan, questions remain over whether China is heading for a hard landing after decades of surging growth. (Bloomberg) UK exports drive economic growth in 2Q2015 – According to a report released by the Office for National Statistics (ONS), UK exports picked up in 2Q2015, helping trade contribute to the economic expansion by the most in four years. Exports rose 3.9% from 1Q2015, while imports gained just 0.6%. The GDP increased 0.7% during the same period, including a 1 percentage-point addition from net trade. The report also showed that consumer spending growth eased slightly to 0.7% and the pace of government expenditure held at 0.9%. Business investment increased 2.9% QoQ, the most in a year, and was up 5% YoY. Overall UK growth continues to be led by services, the largest part of the economy, which expanded 0.7%, the same as the ONS’s previous estimate. The production growth was revised down to 0.7% from 1%. Britain’s strengthening economy and accelerating wage growth are pushing the Bank of England policy makers closer to their first interest-rate increase from the current record low. (Bloomberg) Japan inflation stalls, household spending slides in July – Japan’s consumer inflation ground to a halt for the first time in more than two years and household spending unexpectedly fell in July, heightening pressure on policy makers to offer fresh fiscal and monetary support to underpin a fragile recovery. The core consumer price index (CPI), which includes oil products but excludes volatile fresh food prices, was unchanged YoY in July. That was the slowest pace of growth since May 2013, with sharp declines in oil offsetting price rises for a growing number of items like hotel rooms and television sets. Further, household spending fell 0.2% in the year to July, confounding forecasts for a 1.3% rise and reinforcing concerns on the strength of Japan’s recovery. The gloomy data, coupled with soft exports blamed on China’s slowdown, reinforces the dominant market view that any rebound in growth from a contraction in April-June will be modest. (Reuters) China increases margin requirements on stock-index futures– China increased the margin requirements on stock-index futures contracts to 30% and narrowed the number of contracts that traders can open before they are considered “abnormal trading.” According to the website of China’s Financial Futures Exchange, the nation’s margin requirements on stock-index futures currently stand at 20%. Zhang Xiaojun, a spokesman for the China Securities Regulatory Commission, said opening more than 100 contracts on a single index-futures product on the CSI 300, SSE 50 and CSI 500 indexes will be defined as “abnormal trading” from August 31. Previously, opening more than 600 new contracts met that designation. The increase is the latest effort by the government to crack down on suspected market manipulation after a recent equity rout wiped out $5tn. Last week, the securities regulator said it will penalize major shareholders at publicly traded companies for violating rules that limit stake sales. (Bloomberg) Brazil’s economy shrinks more than forecasts in 2Q2015 – Brazil’s economy contracted more than analysts forecast in 2Q2015, as tighter monetary policy and faster inflation torpedoed confidence and caused activity to nosedive. According to the national statistics agency, the GDP contracted 1.9% QoQ in 2Q2015, the biggest contraction in more than six years, and worse than the median estimate of a 1.7% fall. Family spending dropped 2.1% QoQ, while investment tumbled 8.1% – the eighth straight quarter of contraction. On the economy’s supply side, the industry contracted 4.3% and services declined 0.7%. On a YoY basis, the GDP fell 2.6%. Latin America’s largest economy is suffering from multiple woes: borrowing costs at their highest since 2006, inflation at more than double the target, rising unemployment, a crumbling currency and a corruption scandal that could unseat President Dilma Rousseff. (Bloomberg) Regional IFC to meet investors on Sukuk issue – The World Bank unit, International Finance Corp. (IFC), is planning to meet fixed income investors ahead of a potential issue of US dollar-denominated Sukuk. IFC has picked Dubai Islamic Bank, HSBC, National Bank of Abu Dhabi and Standard Chartered Bank to arrange investor meetings, which will be held in the Middle East, with a possible Sukuk issue to follow subject to market conditions. The Sukuk will be listed on Nasdaq Dubai and an application will also be made for a subsequent listing on the London Stock Exchange. (Reuters) Jarir Marketing opens new showroom in Abu Dhabi – Jarir Bookstore, a retail chain operated by Jarir Marketing Company, has opened a new showroom in Abu Dhabi, taking the number of its showrooms to two in Abu Dhabi and 39 in Saudi Arabia and GCC countries. The new showroom is located on Corniche Road at

- 5. Page 5 of 7 Nation Galleria Mall, the total area of 3,600 sqm, and it contains all of the known products for Jarir Bookstore. Investing in this location had cost over SR15mn, and it is expected to increase sales & profits of the company, which will affect the financial state of 3Q2015. (Tadawul) SAMA: Saudi foreign reserves fall slows in July 2015 after bond sale – According to the Saudi Arabian Monetary Agency (SAMA), the fall in Saudi Arabia’s foreign reserves slowed in July 2015 after the government began issuing domestic debt to cover part of a budget deficit created by low oil prices. Saudi Arabia has been drawing down its reserves to cover the deficit. Net foreign assets at SAMA, which acts as the Kingdom’s sovereign wealth fund, have been sliding since they reached a $737bn peak in August 2014. As per the report, net foreign assets shrank only 0.5% to SR2.48tn in July 2015 as compared to June 2015, their lowest level since early 2013. They had dropped 1.2% MoM in June 2015 and at faster rates earlier in 2015. In July 2015, the government began selling bonds for the first time since 2007, placing SR15bn of debt with quasi-sovereign funds, while in August it sold SR20bn of bonds to banks. The domestic debt sales appear to have reduced the need for the government to cover its deficit by drawing down foreign assets. Securities shrank 3.6% MoM in July 2015, while deposits expanded 9.6% to their highest level in 2015. (Reuters) RAK FTZ targets new markets to increase investments – RAK Free Trade Zone (RAK FTZ) is planning to attract more investment, especially from Europe, Asia, America and Australia. The FTZ announced a rise in the number of registered companies to 8,000 in 2015 as compared to 7,500 companies in 2014. RAK FTZ Executive Director Ramy Jallad said the authority has focused on attracting foreign investment from the Middle East, Europe, and South Asia. (GulfBase.com) UAE cuts Sept 2015 petrol prices as global oil falls – The UAE cut petrol and diesel prices between 8% and 9% for September 2015. The decline in retail gasoline partially rolled back an increase in August 2015, the first month in which the government eliminated subsidies and allowed pump prices to fluctuate according to global markets. The UAE is the first among Gulf countries to eliminate fuel subsidies as falling oil prices erode government income. According to data posted on the energy ministry website, motorists will pay 8.4% less for 95-octane gasoline in September 2015 than they did August 2015. The six-nation GCC has discussed efforts to align fuel prices, though none of the other members has yet moved to allow fuel prices to follow the market. (Gulftimes.com) OSN signs $400mn five-year loan – According to sources, Dubai- based pay-TV company OSN has signed a $400mn five-year loan. The facility is split into two parts – a $255mn term loan and a $145mn revolving credit facility. The term loan has an amortizing structure, which means the principal of the facility is paid down during its lifetime, as opposed to the borrower only servicing the interest payments and paying the full amount off at the end. OSN will use the cash for general business purposes and to refinance existing debt. The amortizing starts on March 31, 2016. The banks backing the transaction are Barclays, Mashreq, BNP Paribas, Citigroup, HSBC, National Bank of Kuwait, Societe Generale, First Gulf Bank, Commercial Bank of Dubai, Credit Suisse and JPMorgan. (Reuters) ADIB offers rights issue through internet, mobile banking – Abu Dhabi Islamic Bank (ADIB) has started offering rights holders, who are also its customers, the ability to subscribe to its rights issue through the ADIB internet banking portal and the ADIB mobile banking smartphone application. The subscription period will run until September 10, 2015, during which all holders of rights, as at the end of the rights trading period on September 3, 2015, will be able to subscribe to new and additional shares at a price of AED3 per share. The holders of rights will also have the option to subscribe to additional shares in excess of the number of rights that they hold, which will be allocated in the event that unsubscribed shares remain at the end of the subscription period. The rights, for ADIB’s AED504mn rights issue, will continue to be traded on the Abu Dhabi Securities Exchange until September 3, 2015. (GulfBase.com) ADIA handled 2.1mn passengers in July 2015 – The Abu Dhabi International Airport (ADIA) set a new record by handling 2.1mn passengers in July 2015, reflecting an increase of 23.3% YoY, taking the average daily number of passengers to over 60,000. Within these numbers, 1.11mn passengers departed from ADIA in July, the first time this has happened in a single month. Aircraft movements reached 15,059, representing a 14.2% increase over the 13,188 reported in July 2014. Cargo activity was also on the rise in July 2015, recording 68,888 metric tons handled, indicating a 2.1% YoY increase. Etihad cargo, which represents 91.5% of the airport total cargo, grew by 3%. (Bloomberg) Saipem bags two contracts for Al-Zour NRP – Saipem has received award notification by the Kuwait National Petroleum Corporation (KNPC) for Package 4 and Package 5 of the Al-Zour New Refinery Project (NRP) for a total amount of around $1.3bn. Al-Zour NRP is located 90 km south of Kuwait City and will be one of the largest oil-refining plants in the world, with a refining output capacity of 615,000 barrels per day (bpd). The NRP has been divided into five major EPC packages. Package 4, for which Saipem has received award notification in joint venture (JV) with Essar Projects Limited, consists of engineering, procurement, construction, pre- commissioning and assistance during commissioning/start- up/performance testing for the tankages, related road works, buildings, pipe racks, pipelines, water systems and control systems for the Al-Zour refinery. Package 4 will be completed by the beginning of 2019. Package 5, for which Saipem has received award notification in JV with Hyundai Engineering & Construction and SK Engineering & Construction, consists of the offshore maritime export facilities for the Al-Zour NRP. (Bloomberg) ACWA, Mitsui group secures $630mn financing for Oman power plant – A consortium, including ACWA Power and Japan-based Mitsui & Company, has secured financing for the $630mn Salalah 2 power scheme in Oman. The pair, along with Dhofar International Development and Investment Holding Company (DIDI), won the contract in March 2015 to construct a 445 megawatts (MW) gas- fired power plant at Raysut in the southwest of Oman. Under the proposal, the consortium will also acquire Dhofar Generating Company, which owns and operates an existing 273 MW gas-fired plant. Banks supporting the loan were Standard Chartered, Sumitomo Mitsui Trust Bank, KfW IPEX-Bank, Sumitomo Mitsui Banking Corp, Mizuho, Bank Muscat and Bank Dhofar. ACWA and Mitsui will each take a 45% stake in the project, while DIDI will hold the remaining 10%. The consortium will sell electricity to Oman under a 15-year agreement. The new plant is due to be operational in January 2018. (Reuters) Bank Nizwa remains open to M&A options – Bank Nizwa CEO Jamil Al Jaroudi has said that the bank is open to potential mergers or acquisitions, despite withdrawing from a proposed tie-up with United Finance Company. Several financial services companies are in talks about possible merger and acquisition in Oman, encouraged by a financial regulator keen to limit the number of lenders in a country, where around 18 banks serve a population of 4mn. (Reuters) Oman committed to currency peg despite cheap oil – Central Bank of Oman (CBO) Executive President Hamood Sangour Al Zadjali has said that Oman is committed to maintaining the peg of its

- 6. Page 6 of 7 currency against the US dollar despite the drop in oil prices. Devaluing the Omani Riyal could aid state finances by increasing the local currency value of oil exports. However, it would also raise the cost of many imports, on which Oman depends, and could shake investor confidence, so economists do not think the authorities will abandon the peg. (Reuters) Orpic Sohar refinery project achieves safety milestone – Oman Oil Refineries & Petroleum Industries Company (Orpic) has achieved 15mn man-hours without lost time due to injury at its Sohar refinery improvement project, with over 6,500 people on site, working to a 2016 completion date. (GulfBase.com) DNO International exits Oman Blocks 30 and 31 – DNO International, a Norwegian oil & gas operator, has confirmed that it has pulled out of two oil and gas blocks in Oman. DNO, in its 2Q2015 earnings report, said that it had withdrawn from Block 30 and Block 31 in northwestern part of Oman. With its departure from the two concessions, DNO has seen its portfolio of Omani hydrocarbon assets shrink to two blocks: Block 8 offshore Oman, and Block 36 onshore Oman. (GulfBase.com) OTTCO launches floating storage facility in Oman – Oman Tank Terminal Company (OTTCO), a subsidiary of Oman Oil Company (OOC), has launched a new floating storage facility with a 2.1mn barrel capacity at Mina Al Fahal for global customers of Oman Export Blend. China Oil, Glencore and Oman Trading International (OTI) have won bids for access to the facility on board a very large crude carrier (VLCC), which will be provided and operated by Oman Shipping Company (OSC). The facility has been developed in partnership with OSC, Petroleum Development Oman (PDO) and the Dubai Mercantile Exchange (DME). (TimesofOman)

- 7. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Aug-11 Aug-12 Aug-13 Aug-14 Aug-15 QSE Index S&P Pan Arab S&P GCC 3.0% 3.1% 1.1% (0.1%) 0.6% 3.0% 4.0% (2.0%) 0.0% 2.0% 4.0% 6.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,133.55 0.8 (2.4) (4.3) MSCI World Index 1,658.07 0.5 0.4 (3.0) Silver/Ounce 14.60 0.8 (4.7) (7.0) DJ Industrial 16,643.01 (0.1) 1.1 (6.6) Crude Oil (Brent)/Barrel (FM Future) 50.05 5.2 10.1 (12.7) S&P 500 1,988.87 0.1 0.9 (3.4) Crude Oil (WTI)/Barrel (FM Future) 45.22 6.3 11.8 (15.1) NASDAQ 100 4,828.33 0.3 2.6 1.9 Natural Gas (Henry Hub)/MMBtu 2.66 (1.0) (1.5) (11.3) STOXX 600 363.28 (0.2) (1.0) (2.0) LPG Propane (Arab Gulf)/Ton 40.75 11.6 10.1 (16.8) DAX 10,298.53 (0.6) 0.1 (3.4) LPG Butane (Arab Gulf)/Ton 51.00 6.3 4.3 (22.1) FTSE 100 6,247.94 0.8 (1.1) (6.0) Euro 1.12 (0.5) (1.8) (7.5) CAC 40 4,675.13 (0.1) (0.6) 1.1 Yen 121.71 0.6 (0.3) 1.6 Nikkei 19,136.32 2.9 (1.2) 7.9 GBP 1.54 (0.1) (1.9) (1.2) MSCI EM 820.25 0.9 1.0 (14.2) CHF 1.04 0.4 (1.7) 3.3 SHANGHAI SE Composite 3,232.35 5.1 (7.9) (2.9) AUD 0.72 0.1 (2.0) (12.3) HANG SENG 21,612.39 (1.0) (3.5) (8.4) USD Index 96.11 0.5 1.2 6.5 BSE SENSEX 26,392.38 0.3 (3.6) (8.4) RUB 65.21 (1.0) (5.7) 7.4 Bovespa 47,153.87 (2.3) 0.6 (30.4) BRL 0.28 (0.7) (2.2) (26.0) RTS 829.95 3.1 8.9 5.0 135.1 108.7 104.4