16 February Daily market report

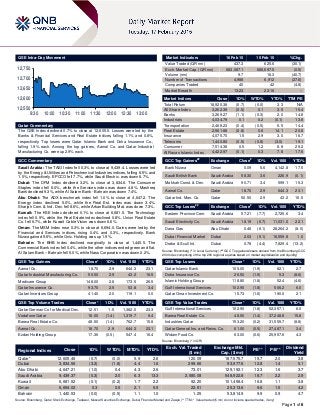

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.7% to close at 12,605.5. Losses were led by the Banks & Financial Services and Real Estate indices, falling 1.1% and 0.8%, respectively. Top losers were Qatar Islamic Bank and Doha Insurance Co., falling 1.9% each. Among the top gainers, Aamal Co. and Qatar Industrial Manufacturing Co. were up 2.9% each. GCC Commentary Saudi Arabia: The TASI Index fell 0.3% to close at 9,439.4. Losses were led by the Energy & Utilities and Petrochemical Industries indices, falling 6.5% and 1.0%, respectively. EPCCO fell 7.7%, while Saudi Electric. was down 6.7%. Dubai: The DFM Index declined 3.2% to close at 3,834.6. The Consumer Staples index fell 6.0%, while the Services index was down 4.8%. Mashreq Bank declined 9.3%, while Al Salam Bank - Bahrain was down 7.4%. Abu Dhabi: The ADX benchmark index fell 1.0% to close at 4,647.2. The Energy index declined 5.0%, while the Real Est. index was down 3.4%. Sharjah Cem. & Ind. Dev. fell 8.6%, while Arkan Building Mat. was down 7.3%. Kuwait: The KSE Index declined 0.1% to close at 6,681.5. The Technology index fell 0.9%, while the Real Estate index declined 0.8%. Union Real Estate Co. fell 6.7%, while Kuwait Cable Vision was down 6.6%. Oman: The MSM Index rose 0.3% to close at 6,694.0. Gains were led by the Financial and Services indices, rising 0.4% and 0.3%, respectively. Bank Nizwa gained 5.6%, while Onic. Holding was up 1.9%. Bahrain: The BHB Index declined marginally to close at 1,440.5. The Commercial Bank index fell 0.4%, while the other indices ended green and flat. Al Salam Bank – Bahrain fell 5.0%, while Nass Corporation was down 2.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Aamal Co. 18.70 2.9 644.3 23.1 Qatar Industrial Manufacturing Co. 50.50 2.9 43.2 16.5 Medicare Group 148.00 2.8 173.5 26.5 Qatar Insurance Co. 93.70 2.5 53.8 3.4 Qatari Investors Group 41.40 2.0 119.1 0.0 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar German Co for Medical Dev. 12.51 1.5 1,382.0 23.3 Vodafone Qatar 18.00 (1.4) 1,319.7 9.4 Barwa Real Estate Co. 48.50 (1.4) 762.7 15.8 Aamal Co. 18.70 2.9 644.3 23.1 Ezdan Holding Group 17.36 (0.5) 547.4 16.4 Market Indicators 16 Feb 15 15 Feb 15 %Chg. Value Traded (QR mn) 437.3 625.6 (30.1) Exch. Market Cap. (QR mn) 683,087.1 686,697.5 (0.5) Volume (mn) 9.7 16.3 (40.7) Number of Transactions 4,988 6,912 (27.8) Companies Traded 40 42 (4.8) Market Breadth 13:23 22:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,920.38 (0.7) (0.0) 3.3 N/A All Share Index 3,262.39 (0.5) 0.1 3.5 15.4 Banks 3,269.27 (1.1) (0.3) 2.0 14.8 Industrials 4,034.79 0.1 0.2 (0.1) 13.8 Transportation 2,468.23 (0.4) (0.5) 6.5 14.4 Real Estate 2,561.88 (0.8) 0.6 14.1 20.8 Insurance 4,075.70 1.5 2.9 3.0 16.7 Telecoms 1,440.80 (0.5) (0.8) (3.0) 19.1 Consumer 7,514.38 0.5 1.2 8.8 29.2 Al Rayan Islamic Index 4,422.97 (0.1) 0.3 7.8 17.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Bank Nizwa Oman 0.09 5.6 4,142.8 17.5 Saudi British Bank Saudi Arabia 58.30 3.6 226.9 (0.1) Makkah Const. & Dev. Saudi Arabia 90.71 3.4 599.1 15.3 Aamal Co. Qatar 18.70 2.9 644.3 23.1 Qatar Ind. Man. Co. Qatar 50.50 2.9 43.2 16.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Eastern Province Cem. Saudi Arabia 57.21 (7.7) 2,725.6 3.4 Saudi Electricity Co. Saudi Arabia 18.19 (6.7) 11,031.0 22.1 Dana Gas Abu Dhabi 0.46 (6.1) 28,264.2 (8.0) Dubai Financial Market Dubai 2.03 (5.1) 16,559.8 1.0 Drake & Scull Int. Dubai 0.78 (4.4) 7,829.4 (13.2) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar Islamic Bank 105.00 (1.9) 82.1 2.7 Doha Insurance Co. 26.50 (1.9) 5.3 (8.6) Islamic Holding Group 118.80 (1.8) 52.4 (4.6) Gulf International Services 102.90 (1.8) 506.2 6.0 Qatar Oman Investment Co. 15.73 (1.6) 190.0 2.1 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 102.90 (1.8) 52,357.1 6.0 Barwa Real Estate Co. 48.50 (1.4) 37,248.8 15.8 Industries Qatar 153.20 (0.2) 31,555.7 (8.8) Qatar General Ins. and Reins. Co. 61.00 (0.5) 27,487.1 3.4 Widam Food Co. 63.00 (0.6) 25,957.6 4.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,605.46 (0.7) (0.0) 5.9 2.6 120.09 187,575.7 15.7 2.0 3.8 Dubai 3,834.56 (3.2) (1.8) 4.4 1.6 299.66 93,977.6 12.8 1.4 5.1 Abu Dhabi 4,647.21 (1.0) 0.4 4.3 2.6 73.01 129,192.1 12.3 1.6 3.7 Saudi Arabia 9,439.37 (0.3) 2.0 6.3 13.3 2,580.08 548,922.8 18.7 2.2 2.9 Kuwait 6,681.52 (0.1) (0.2) 1.7 2.2 92.20 101,458.4 16.8 1.1 3.8 Oman 6,694.02 0.3 0.5 2.1 5.5 22.81 25,313.6 9.6 1.5 4.2 Bahrain 1,440.53 (0.0) (0.5) 1.1 1.0 1.25 53,814.9 9.9 0.9 4.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,550 12,600 12,650 12,700 12,750 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.7% to close at 12,605.5 The Banks & Financial Services and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from non-Qatari shareholders. Qatar Islamic Bank and Doha Insurance Co. were the top losers, falling 1.9% each. Among the top gainers, Aamal Co. and Qatar Industrial Manufacturing Co. were up 2.9% each. Volume of shares traded on Monday fell by 40.7% to 9.7mn from 16.3mn on Sunday. Further, as compared to the 30-day moving average of 15.0mn, volume for the day was 35.3% lower. Qatar German Co for Medical Devices and Vodafone Qatar were the most active stocks, contributing 14.3% and 13.6% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings and Global Economic Data Earnings Releases Company Market Currency Revenue (mn) 4Q2014 % Change YoY Operating Profit (mn) 4Q2014 % Change YoY Net Profit (mn) 4Q2014 % Change YoY National Agriculture Development Co. (NADEC)* Saudi Arabia SR – – 147.8 13.5% 107.2 7.0% Eastern Province Cement Co. (EPC)* Saudi Arabia SR – – 294.0 -1.3% 374.0 21.0% Dubai Financial Market (DFM)* Dubai AED 889.0 119.5% – – 759.3 166.8% United Foods Co. (UFC)* Dubai AED 418.2 13.0% – – 16.1 12.0% United Kaipara Dairies Co. (Unikai)* Dubai AED 310.4 0.1% -67.6 NA -66.1 NA Al Ain Ahila Insurance Co.* Abu Dhabi AED 209.8 2.2% 69.7 16.6% 65.0 54.0% Securities & Investment Co. (SICO)* Bahrain BHD 12.4 16.4% – – 5.4 11.3% Bahrain Telecommunications Co. (Batelco)* Bahrain BHD 389.7 5.2% – – 57.4 11.5% BMMI* Bahrain BHD 106.1 8.0% – – 11.3 11.7% Source: Company data, DFM, ADX, MSM (*FY2014 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/16 EU Eurostat Trade Balance SA December 23.3B 19.0B 21.6B 02/16 EU Eurostat Trade Balance NSA December 24.3B 20.0B 21.2B 02/16 UK Rightmove Rightmove House Prices MoM February 2.10% – 1.40% 02/16 UK Rightmove Rightmove House Prices YoY February 6.60% – 8.20% 02/16 China National Bureau of Stat. Foreign Direct Investment YoY January 29.40% – 10.30% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar GWCS begins tendering LVQ 5th phase expansion, approves dividend distribution – Gulf Warehousing Company’s (GWCS) Chairman Sheikh Abdulla bin Fahad bin Jassem bin Jabor al-Thani said that the company has begun the process of tendering the fifth phase of expansion of its Logistics Village Qatar (LVQ) project. In 2014, GWCS completed LVQ Phase 4 and expanded warehousing facilities at Ras Laffan Industrial City site. Meanwhile, the General Assembly approved the cash DPS of QR1.50. The assembly also confirmed the previous board members for another period of three years from 2015 and elected Ali Abdulatif al-Misnad as an independent board member under the supervision of the representatives from the Ministry of Economy & Commerce. We have already incorporated LVQ Phase 5 (25,000 square meters) in our model. Our 12-month price target remains at QR64.00 and we recommend a Market Perform rating on the stock. (QNBFS Research, Gulf-Times.com) Al-Sada: MPHC well-positioned to withstand challenging economic times ahead – Mesaieed Petrochemical Holding Company’s (MPHC) Chairman and Energy Minister HE Dr. Mohamed bin Saleh al-Sada said that MPHC is well-positioned to withstand the challenging economic times ahead. The board of directors is confident that the group can build on its “unique advantages” by maximizing shareholder value by capitalizing on QChem, QChem-II and Qatar Vinyl Company’s numerous competitive strengths. MPHC has expressed confidence that the group can continue its growth story, despite falling oil prices affecting its activities indirectly. He pointed out that the entire industrial spectrum was paying increased attention to the role of technology in enhancing highly reliable, more economic and safer operations. (Gulf-Times.com) Overall Activity Buy %* Sell %* Net (QR) Qatari 63.53% 70.99% (32,628,310.55) Non-Qatari 36.47% 29.00% 32,628,310.55

- 3. Page 3 of 6 DOHI CEO: Insurance sector benefits from robust Qatari economy – Doha Insurance (DOHI) Chief Executive Officer Bassam Hussein said that Qatar’s insurance sector has not felt any major impact due to the decline in oil prices and continues to benefit from an economy, which is robust and presents incredible opportunities. He said DOHI and the local market have gained from the big-ticket projects such as Q-Rail, preparations for 2022 FIFA World Cup and the infrastructure upgrade by the Public Works Authority (Ashghal). Meanwhile, he said that the company expects approval to set up a wholly- owned reinsurance business — MENA Re Underwriters Limited at the Dubai International Financial Centre (DIFC) within a few months. MENA Re Underwriters basically will carry out the reinsurance business. It will be 100% owned by DOHI. (Gulf- Times.com) QSE suspends trading of QATI shares on February 17 – The Qatar Stock Exchange (QSE) has announced the trading suspension of Qatar Insurance Company’s (QATI) shares on February 17, 2015 due to its AGM and EGM being held on that day. (QSE) QSE suspends trading of QEWS shares on February 17 – The Qatar Stock Exchange (QSE) has announced the trading suspension of Qatar Electricity and Water Company’s (QEWS) shares on February 17, 2015 due to its AGM being held on that day. Meanwhile, QEWS has announced the agenda for its AGM which includes discussing and approving balance sheet and profit & loss account as well as approving board’s proposal to distribute cash dividend. (QSE) International Eurozone December trade surplus higher than expected – The European Union's statistics office Eurostat said that the Eurozone had a bigger than expected unadjusted trade surplus in December as exports surged 8% YoY and imports edged just 1% higher. As per Eurostat data, the trade surplus of the Eurozone was €24.3bn in 2014, almost double that of €13.6bn recorded in December 2013 and well above the market expectations of €20.5bn. For the whole of 2014, exports rose 2% YoY while imports were flat, bringing the overall trade surplus for the whole year to €194.8bn from €152.3bn in 2013. Eurostat said that the energy trade deficit fell to €256.7bn in the first 11 months of 2014 from €292.5bn in the same period of 2013. Adjusted for seasonal swings, the Eurozone's trade surplus was only minimally smaller at €23.3bn in December. (Reuters) Greece defies creditors, seeking credit but no bailout – Talks between Greece and Eurozone finance ministers over the country's debt crisis broke down when Athens rejected a proposal to request a six-month extension of its international bailout package as unacceptable. The unexpectedly rapid collapse raised doubts about Greece's future in the Eurozone after a new leftist-led government vowed to scrap the €240bn bailout, reverse austerity policies and end cooperation with EU/IMF inspectors. Dutch Finance Minister Jeroen Dijsselbloem, who chaired the meeting, said Athens had to request for an extension, otherwise the bailout would expire at the end of the month. The Greek state and its banks would then face a looming cash crunch. How long Greece can keep itself afloat without foreign support is uncertain. The European Central Bank will decide whether to maintain emergency lending to Greek banks that are bleeding deposits at an estimated rate of €2bn a week. The state faces some heavy loan repayments in March 2015. Meanwhile, the International Monetary Fund (IMF) head Christine Lagarde said that the fund will not disburse more funds to Greece if Athens does not make progress with its reforms. (Reuters) Abe hopes BoJ keeps stimulus to meet inflation goal, upbeat on economy – Japanese Prime Minister Shinzo Abe is hopeful about the central bank continuing with its bold monetary easing campaign to achieve its 2% inflation target. Abe praised the Bank of Japan’s (BoJ) aggressive stimulus program for helping revive the economy and wipe out the public's "sticky deflationary mindset." Abe sidestepped a question from an opposition lawmaker on whether the government is concerned about the demerits of excessive monetary easing, saying only that specific monetary policy measures were up to the BoJ to decide. The BoJ has kept the monetary policy steady since expanding its quantitative easing program in October 2014 to prevent slumping oil prices and a subsequent slowdown in inflation, from delaying achievement of its 2% price goal. (Reuters) S.Korea, Japan agree to let $10bn forex swap deal expire – South Korea's central bank said it has agreed with Japan to let the existing currency swap line between the two countries worth $10bn expire on February 23 as both economies are seen as financially stable. A Bank of Korea official said the agreement had been made as the situation in financial markets in both countries was "good" and that political tensions between South Korea and Japan were not included in the discussions to end the currency swap agreement. The official also said that the two countries could decide to make a new swap agreement if the situation arises. (Reuters) Modernizing China's agriculture key to tackling slower economy; $40bn Silk Road fund starts work along PE lines – Chinese Premier Li Keqiang said modernizing Chinese agriculture will help in countering slower economic growth by driving investment in rural infrastructure and boosting consumption. The Chinese economy grew at its slowest pace in 24 years in 2014 as property prices cooled, hitting demand for a wide range of commodities. Li said infrastructure investment in rural areas could help digest some of the excess capacity in China's steel and cement industries, as well as create new jobs. Li further added that overhauling farming models and improving efficiency in distribution systems could also boost rural incomes. Meanwhile, Governor of the People's Bank of China (PBoC), Zhou Xiaochuan said the country’s $40bn Silk Road infrastructure fund has started work along the lines of a long- term private equity (PE) venture to boost businesses in countries and regions along the road. The fund is partially financed by China's foreign exchange reserves, with investors including China Investment Corp, the country's sovereign fund. The PBoC said other investors were China's Development Bank and The Export-Import Bank of China, two leading Chinese policy banks, which lend in line with government instructions. (Reuters) Regional Zawya Projects: Sustainability to drive $2.87tn construction projects in GCC – GCC countries are increasingly seeking sustainable and environmentally responsible developments, as the region’s construction sector booms on the back of social infrastructure spending. According to Zawya Projects data, as much as $2.87tn worth of projects are in the design, bid or construction stages in the GCC region up to 2025, with $1.53tn worth of real estate projects under construction. Further, according to a report by Ventures Middle East, GCC governments have acted swiftly over the past three years to embrace sustainable construction through awareness and legislation, which has created demand for green development.

- 4. Page 4 of 6 Increased spending on social infrastructure to improve living standards and using outdoor space more effectively are also driving the construction market and boosting outdoor projects. (GulfBase.com) Fitch Ratings appoints Global Head of Islamic Finance – Fitch Ratings announced the appointment of Bashar Al Natoor as the Global Head of Islamic Finance to be based in Dubai. (Reuters) D&B BOI: KSA non-hydrocarbon sector maintains optimism in 1Q2015 – According to Dun & Bradstreet’s (D&B) Business Optimism Index (BOI) survey for Saudi Arabia, the Kingdom’s non-hydrocarbon sector maintains its optimism level with its composite BOI standing at 48 in 1Q2015 vis-à-vis 47 in 4Q2014 and 1Q2014. Firms have cited new projects from existing and new clients, rising demand and increasing investment as reasons for their strong outlook. However, the hydrocarbon sector’s composite BOI is weighed down sharply by weaker expectations for prices and profitability. The composite BOI has declined from 50 in 1Q2014 and 34 in 4Q2014 to 16 in 1Q2015. (GulfBase.com) Al Alamiya’s accumulated losses decreases to 31.51% of its capital – Al Alamiya for Cooperative Insurance Company announced that its accumulated losses have decreased to SR126mn, representing 31.51% of its capital. The reason for steady decline in the loss as a percentage of capital is due to the increase in the company’s capital to SR400mn through a rights issue. (Tadawul) NADEC BoD recommends SR35mn dividend for 2014; SR70mn capital increase – National Agriculture Development Company’s (NADEC) board of directors has recommended the distribution of 5% dividend (SR0.5 per share), amounting to SR35mn for 2014. Meanwhile, the BoD has recommended increasing the company's capital from SR700mn to SR770mn through bonus shares, offering one bonus shares for every ten shares owned. The raise will be done through capitalization of SR70mn from NADEC’s retained earnings, and is aimed at supporting the company’s investment plan. Those shareholders who are registered with Tadawul at the close of trading on the extraordinary general assembly day (to be determined later) will be eligible for the dividend and bonus shares. (Tadawul) DAAR repays SR1.7bn Sukuk IV – Dar Al-Arkan Real-Estate Development Company (DAAR) announced that it has completed the repayment of its SR1.7bn Sukuk IV, due on February 18, 2015. DAAR transferred the total principal sum to Deutsche Bank (the principal paying agent), and its Sukuk holders will receive the funds on February 18, 2015. This fourth Sukuk issue was part of the company’s Islamic structured debt program initiated in 2007. The program aims to provide long- term external financing to complement the company’s robust internal cash flow and to match the development lifecycle of its real estate projects. During the last seven years, DAAR has successfully repaid four Sukuk issues, totaling SR8.4bn. The developer has supplied the Saudi real estate market with more than 15,000 residential units and 10mn square meters of developed land. (Tadawul) Al-Woustah to start operations in 2Q2015 – Abdullah Al Othaim Markets Company (Al Othaim), with reference to its previous announcement about signing a non-binding MoU with AGAD United Company for Investment, announced that the establishment of the new company has been attested by the Ministry of Commerce & Industry. The new Jeddah-based entity, named ‘Al-Woustah Company for Food Services’ will operate with a share capital of SR100mn. Al Othaim owns 25% of the share capital, while AGAD owns 75%, which is a sister company of ALBAIK Food Systems. Al-Woustah is expected to start its operations in 2Q2015. (Tadawul) POSCO to sell stake in Posco E&C to PIF for $1.36bn – POSCO, a South Korea-based steelmaker has signed a deal to sell a 38% stake plus new shares of its construction unit, Posco Engineering & Construction (Posco E&C) to Saudi Arabia's Public Investment Fund (PIF) for about $1.36bn. Posco owns almost 90% stake in Posco E&C. Posco plans to use some of the proceeds to build a joint construction firm with PIF for tapping into the gas & oil plant market in Saudi Arabia. Merrill Lynch and JP Morgan managed this deal. (GulfBase.com) Alkhabeer Capital acquires majority stake in Eed Group – Alkhabeer Capital announced that its fund ‘Alkhabeer Healthcare Private Equity Fund I’ has acquired a majority stake in Eed Group, an integrated healthcare provider in Saudi Arabia. (GulfBase.com) S&P: UAE banks' profit growth to dip on weaker economy, asset quality – According to a report by Standard & Poor's (S&P), profit growth at banks in the UAE is expected to slip to 5- 6% in 2015 as macroeconomic challenges and minimal improvements in asset quality reduce lenders' earnings. In 4Q2014, the top eight UAE banks by assets reported a YoY net profit growth of between 13% and 82%, building on the successive quarters of strong growth earlier in the year. S&P expects lower oil prices to feed through into reduced economic growth in the Gulf Arab state in 2015, which will reduce the demand for new lending from companies and in some cases, will increase default levels on existing debts. (Reuters) Deyaar to showcase projects at Dubai Property Show in London – Deyaar Development announced that it will participate in the inaugural edition of the Dubai Property Show in London, between February 27 and March 1, 2015. The expo will allow Deyaar to showcase several of its prominent projects in Dubai, including Montrose in Al Barsha South at the extension of Umm Suqeim road. The company will also put a spotlight its premium project ‘The Atria’, a 1.25mn square feet luxury twin towers complex of residential and hotel serviced apartments located in the Business Bay district. (DFM) Etisalat’s Egypt unit signs $120mn loan – Emirates Telecommunications Corporation’s (Etisalat) Egyptian subsidiary, Etisalat Misr has signed a $120mn three-year loan with HSBC and the National Bank of Abu Dhabi. The two banks will provide $60mn each. The company will use these funds to increase its competitiveness. (Reuters) NMC Health secures $825mn loan – NMC Health, the London- listed UAE healthcare provider, has secured a five-year $825mn loan from a group of six banks that will be used to pay existing debt and fund acquisitions. The facility is divided into two tranches, with both priced in a mix of US dollars and the UAE dirhams, and will save up to $3.75mn a year in interest payments. The first tranche for $350mn is an amortizing loan and will be used to refinance existing debts of NMC and its subsidiaries and for general corporate purposes. The second tranche of $475mn is for acquisitions. Abu Dhabi Commercial Bank, Commercial Bank of Dubai, Goldman Sachs, HSBC, Standard Chartered and Union National Bank have underwritten the facility. (Reuters) Bank Sohar’s BoD approves rights issue price – Bank Sohar’s board of directors has approved a rights issue price of 175 baizas per share, divided into rights issue price of 173 baizas per share plus issue costs of 2 baizas per share. The shareholders will be entitled to one share by way of rights for every five shares held by them as on a record date to be

- 5. Page 5 of 6 announced later, in consultation with the Capital Market Authority and Muscat Securities Market. (MSM) OIFC receives license from CBO for Wasel Exchange’s Head Office – Oman Investment & Finance Company (OIFC) has received the final approval and license for the Head Office of the Wasel Exchange from the Central Bank of Oman (CBO). The operations of Wasel Exchange, a wholly-owned subsidiary of OIFC, are expected to commence soon. (MSM) Batelco’s BoD recommends BHD41.58mn dividend – Bahrain Telecommunications Company’s (Batelco) board of directors has recommended cash dividends of BHD41.58mn for 2014, equivalent to 25 fils per share. Out of this, 10 fils per share has already been paid during 3Q2014 and the remaining 15 fils per share will be paid in cash following the AGM in March 2015. (Bahrain Bourse) BMMI’s BoD recommends cash dividends, bonus shares – BMMI has recommended the distribution of cash dividend at 50% of the issued share capital (50 fils per share), excluding treasury shares and bonus shares at the rate of one bonus share for ten existing shares. Out of this, 20 fils per share has already been distributed as interim dividend during 2014. Those shareholders who are registered in the company’s records on the day of the general assembly will be eligible for the dividend and bonus shares. (Bahrain Bourse) Al Baraka Bank plans Sukuk for Jordanian unit – Bahrain- based Al Baraka Banking Group’s CEO, Adnan Ahmed Yousif said the bank is planning to issue a 10-year local currency Sukuk for its Jordanian unit, Jordan Islamic Bank, later in 2015. He said that Al Baraka is also planning a Sukuk for its South African unit in 2015. (Reuters)

- 6. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on 16 February 2015) Source: Bloomberg (*$ adjusted returns; # Market closed on 16 February 2015) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 QSE Index S&P Pan Arab S&P GCC (0.3%) (0.7%) (0.1%) (0.0%) 0.3% (1.0%) (3.2%) (4.0%) (3.2%) (2.4%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,231.50 0.2 0.2 3.9 MSCI World Index 1,752.91 0.0 0.0 2.5 Silver/Ounce 17.28 (0.5) (0.5) 10.0 DJ Industrial# 18,019.35 0.0 0.0 1.1 Crude Oil (Brent)/Barrel (FM Future) 61.40 (0.2) (0.2) 7.1 S&P 500# 2,096.99 0.0 0.0 1.9 Crude Oil (WTI)/Barrel (FM Future)# 52.78 0.0 0.0 (0.9) NASDAQ 100# 4,893.84 0.0 0.0 3.3 Natural Gas (Henry Hub)/MMBtu# 2.73 0.0 0.0 (8.9) STOXX 600 376.55 (0.6) (0.6) 3.2 LPG Propane (Arab Gulf)/Ton# 59.50 0.0 0.0 21.4 DAX 10,923.23 (0.8) (0.8) 4.1 LPG Butane (Arab Gulf)/Ton# 71.75 0.0 0.0 9.5 FTSE 100 6,857.05 (0.5) (0.5) 2.9 Euro 1.14 (0.3) (0.3) (6.1) CAC 40 4,751.95 (0.6) (0.6) 4.4 Yen 118.48 (0.2) (0.2) (1.1) Nikkei 18,004.77 0.8 0.8 4.1 GBP 1.54 (0.2) (0.2) (1.4) MSCI EM 984.09 (0.3) (0.3) 2.9 CHF 1.07 0.0 0.0 6.7 SHANGHAI SE Composite 3,222.36 0.4 0.4 (1.1) AUD 0.78 0.1 0.1 (4.9) HANG SENG 24,726.53 0.1 0.1 4.7 USD Index 94.20 0.0 0.0 4.4 BSE SENSEX 29,135.88 0.1 0.1 7.9 RUB 63.20 (0.4) (0.4) 4.1 Bovespa# 50,635.92 0.0 0.0 (5.4) BRL# 0.35 0.0 0.0 (6.5) RTS 897.35 (1.8) (1.8) 13.5 181.1 142.3 129.8