Qingdao Port Market | Port Investor by InduStreams

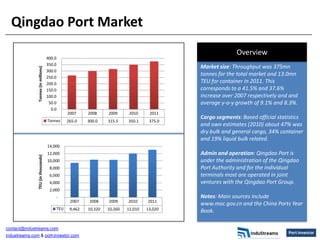

- 1. Qingdao Port Market Overview 400.0 350.0 Market size: Throughput was 375mn Tonnes (in millions) 300.0 250.0 tonnes for the total market and 13.0mn 200.0 TEU for container in 2011. This 150.0 corresponds to a 41.5% and 37.6% 100.0 increase over 2007 respectively and and 50.0 average y-o-y growth of 9.1% and 8.3%. 0.0 2007 2008 2009 2010 2011 Cargo segments: Based official statistics Tonnes 265.0 300.0 315.5 350.1 375.0 and own estimates (2010) about 47% was dry bulk and general cargo, 34% container and 19% liquid bulk related. 14,000 12,000 Admin and operation: Qingdao Port is TEU (in thousands) 10,000 under the administration of the Qingdao 8,000 Port Authority and for the individual 6,000 terminals most are operated in joint 4,000 ventures with the Qingdao Port Group. 2,000 - Notes: Main sources include 2007 2008 2009 2010 2011 www.moc.gov.cn and the China Ports Year TEU 9,462 10,320 10,260 12,010 13,020 Book. contact@industreams.com industreams.com & port-investor.com