More Related Content

Similar to Unconventional Ogm

Similar to Unconventional Ogm (18)

Unconventional Ogm

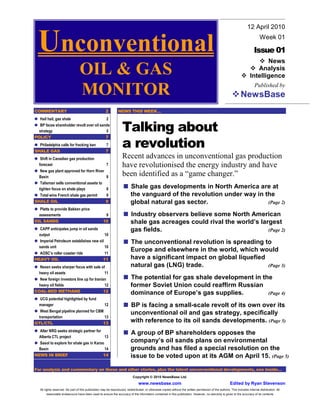

- 1. 12 April 2010

Unconventional Week 01

Issue 01

News

OIL & GAS Analysis

Intelligence

MONITOR NewsBase

Published by

COMMENTARY 2 NEWS THIS WEEK…

Hail hail, gas shale 2

BP faces shareholder revolt over oil sands

strategy 5 Talking about

POLICY 7

Philadelphia calls for fracking ban

SHALE GAS

7

7

a revolution

Shift in Canadian gas production Recent advances in unconventional gas production

forecast 7 have revolutionised the energy industry and have

New gas plant approved for Horn River

Basin 8

been identified as a “game changer.”

Talisman sells conventional assets to

tighten focus on shale plays 8 Shale gas developments in North America are at

Total wins French shale gas permit 9 the vanguard of the revolution under way in the

SHALE OIL 9 global natural gas sector. (Page 2)

Platts to provide Bakken price

assessments 9 Industry observers believe some North American

OIL SANDS 10 shale gas acreages could rival the world’s largest

CAPP anticipates jump in oil sands gas fields. (Page 2)

output 10

Imperial Petroleum establishes new oil The unconventional revolution is spreading to

sands unit 10

AOSC’s roller coaster ride 11

Europe and elsewhere in the world, which would

HEAVY OIL 11 have a significant impact on global liquefied

Nexen seeks sharper focus with sale of natural gas (LNG) trade. (Page 3)

heavy oil assets 11

New foreign investors line up for Iranian The potential for gas shale development in the

heavy oil fields 12 former Soviet Union could reaffirm Russian

COAL-BED METHANE 12 dominance of Europe’s gas supplies. (Page 4)

UCG potential highlighted by fund

manager 12 BP is facing a small-scale revolt of its own over its

West Bengal pipeline planned for CBM

unconventional oil and gas strategy, specifically

transportation 13

GTL/CTL 13

with reference to its oil sands developments. (Page 5)

Alter NRG seeks strategic partner for

A group of BP shareholders opposes the

Alberta CTL project 13

Sasol to explore for shale gas in Karoo company’s oil sands plans on environmental

Basin 14 grounds and has filed a special resolution on the

NEWS IN BRIEF 14 issue to be voted upon at its AGM on April 15. (Page 5)

For analysis and commentary on these and other stories, plus the latest unconventional developments, see inside…

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 2. Unconventional OGM 12 April 2010, Week 01 page 2

COMMENTARY

Hail hail, gas shale

North America is an established stomping ground for shale gas, which has revolutionised

the global gas industry. Excitement is now mounting about shale developments in Europe

By Ed Reed

Shale has only really been explored in North America and even this is a recent development

First movers are snapping up acreage around Europe, hoping to replicate the successes

Development in Europe poses its own set of problems and these will dominate the industry

Shale opportunities may be best pursued beyond Europe, although this will take time to emerge

Recent advances in unconventional gas unconventional gas resources, Scott “significantly around the world in the

production have revolutionised the Reeves, told UOGM. coming decades.”

energy industry and represent an Shale gas, tight gas and CBM share a

opportunity for companies to expand number of common traits – notably the North America

reserves and output – no mean feat when amount of work that has to be done to This new resource only came to

oil is increasingly concentrated in the create and maintain producing reservoirs prominence in 2007, but it has already

hands of a few state-owned national oil – Reeves said. had a dramatic impact on the world’s

companies (NOCs). The UK-based gas company is supply profile. Before the “shale gale”

However, the North American gas glut interested in these resources in order to broke, the expectation had been that

– in tandem with the global recession – “deepen [BG’s] supply presence” in its traditional producers – primarily in the

has depressed gas prices and threatens existing markets and break into new Middle East and Russia – would exert

further growth in this market, which has areas. The three types are spread out increasing dominance on supply chains

driven the technological advances needed across the world and, in some cases, can via LNG shipments.

to exploit unconventional resources. be exploited at an attractively low cost. North America’s shale gas undercut

The unconventional tag covers a Reeves defended the company’s this, removing a substantial amount of

multitude of areas – coal-bed methane combination of LNG and unconventional predicted LNG demand and concern can

(CBM), tight gas, gas hydrates – but the gas assets, describing them as now be detected when talking to

most important is shale gas. This complementary. Although its conventional gas producers. Qatar, for

resource has diverted the US from its regasification terminals in the US have instance, built up its LNG industry in the

expected path of increasing reliance on suffered from the rising tide of domestic belief that the US would become a

liquefied natural gas (LNG) imports and shale production, its CBM interests in substantial importer. This has been

rewritten expectations for gas producers Australia provide it with liquefaction thwarted and, while Qatar has redirected

around the world. The amount of shale in feedstock. cargoes towards Asia, the sense of shock

the world is immense but development The US’ National Petroleum Council is almost palpable.

outside North America is only in its (NPC) in a report in 2007 put the world’s Shale gas is now seen as a silver bullet

infancy. total unconventional gas resources at that could transform any and every

Industry observers have said some of 32.6 quadrillion cubic feet (923.2 tcm) country’s gas balance. But scepticism is

the North American areas could rival the with around one third of this – 233 tcm – prudent.

world’s largest gas fields. Ross Smith in North America. Of this figure, shale A number of international oil

Energy Group, in an overview of the gas accounts for 16.1 qcf (455 tcm). companies (IOCs) have struck deals to

plays, picked out the Marcellus shale as The NPC reported, though, that carry out North American shale work

containing the most gas in the region, assuming lessons learned in the US can with local independents. BG has signed

with a recoverable resource of 199 be replicated, this figure should increase up with EXCO Resources; Statoil, BP,

trillion cubic feet (5.64 trillion cubic Total have formed joint ventures with

metres), which, if accurate, would make Chesapeake Energy, while Japan’s

The amount of

it the second largest field in the world. Mitsui & Co. recently struck a deal with

unconventional gas outside Anadarko Petroleum. The most

Overview significant move in the shale gas arena,

The amount of unconventional gas

North America is though, was ExxonMobil’s agreement to

outside North America is “probably “probably vastly acquire XTO Energy for US$41

vastly understated,” BG’s head of billion.

understated”

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 3. Unconventional OGM 12 April 2010, Week 01 page 3

COMMENTARY

Work on the resource in the US and “seemed to make business sense,” with North African gas and LNG. It is,

Canada has gained worldwide interest. In BG forming its joint venture to work on though, complementary,” Realm

the US, the key areas are known as the the Haynesville. Much of the enthusiasm Energy’s CEO, James Elston, told

“Big Four” and are the Haynesville, from IOCs for North America’s shale UOGM.

Fayetteville, Marcellus and Barnett opportunities is based on hopes to take Pricing is a key concern when

shales. The most information is available the lessons learned here and deploy them considering investments and the apparent

on the Barnett, where there are more than elsewhere. breakdown of the gas-to-oil link has led

10,000 wells, although development has However, shale development faces some to worry.

only been going on since 2003. In obstacles in other parts of the world as While gas demand has fallen by 7%

Canada, the two most important shales different rules apply. over the last 18 months in Europe, Elston

are the Montney and Horn River. “It’s an open question as to whether said, and LNG cargoes have been

As can be seen from activity on the shale developments can be pursued to the dumped on the market, in the medium

Barnett, an important factor in exploiting same extent outside North America,” term these wrinkles should resolve

shale gas is the drilling of numerous said Reeves. themselves. “I think that excess will

wells. Reeves described this method as unwind itself over the next four years;

“more like farming” than drilling Supplies and challenges from 2014 and onwards we should see a

conventional wells; others have Europe, in particular, would seem to be return of the full linkage between gas and

described it as a “statistical” or at the forefront of locations that would oil prices in Europe.”

“manufacturing” approach. benefit from a new, additional source of The appeal of investing in Europe’s

The reason shale gas has taken so long gas. The continent is increasingly reliant shale gas is apparent, but time is running

to exploit is because the resource has low on gas imports from Russia and North out. Some industry observers have said

permeability and low porosity. In order Africa. Although the recession of 2009 that many of the best opportunities have

to exploit it, companies are forced to cut into industrial demand, recovery is already gone. For instance, Elston said

create artificial reservoirs in a “brute likely to see a return to these suppliers. licensing in Poland “is now over, in my

force” process, blasting the rock in order The European Union is not altogether opinion.”

to make it flow. happy with its import reliance, As in any frontier area, most of the

Initial production from wells is high, particularly on Russian supplies, prime movers are minnows, which are

but the decline rates are severe. Barclays following a number of mid-winter able to move quickly to secure acreage.

Capital has estimated the decline rate in stoppages caused by pricing disputes These may carry out some exploration,

the Haynesville during the first year to be with transit states. Shale gas, therefore, but the model, for Realm at least, is to

around 80% and although this is the most has been hyped as solving this reliance, offload semi-developed licences onto

dramatic, the other shales also suffer providing Europe with a route to energy newcomers.

from the same problem to varying independence. Elston was guarded about where his

degrees. “Shale gas is not a total, viable company was looking, explaining the

Reeves said shale production in the US alternative to imports of Russian gas, deals were still being worked out.

BNK Petroleum’s vice president for

exploration, Jim Hill, was more willing

to share, with the company having signed

deals recently in Poland. BNK has an

array of assets in North America, but the

company is bullish on European

prospects.

“The European market ... [has a] good

stable pipeline system, a tremendous

market and a tremendous need for gas.

The cost of entry into European markets

is a lot lower than many of the plays in

the US. Our Polish acreage we picked up

for US$0.55 per acre [US$137.5 per

square km], whereas average costs in the

US are US$250 per acre [US$62,500 per

square km] and can go as high as

US$25,000 per acre [US$6.25 million

per square km],” Hill said.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 4. Unconventional OGM 12 April 2010, Week 01 page 4

COMMENTARY

The BNK representative told UOGM Opposition do not stand to benefit from drilling and

the company’s strategy was to farm There are likely to be specific problems so are more likely to oppose it.

down its acreage. “It only makes sense to in Europe that slow shale development. Elston claimed this would not be a

share the risk,” he said. Most notably, the much higher problem for Realm, owing to the

population density than that in North company’s policy of proving up licences

Execution America will make all stages of the and selling them on, but in the grander

However, not all such operations are operation more complicated. scheme of things this would slow

successful. ExxonMobil and MOL As an example, Szabo compared development and commercialisation.

announced their intentions in February to Falcon’s seismic work around the world. Another reason opposition to drilling

pull out of a project with Falcon Oil and “When we were doing our seismic may arise are the environmental concerns

Gas in Hungary, following disappointing campaign in Australia we had to related to fracking. The US

results. negotiate with three individuals, in the Environmental Protection Agency (EPA)

Falcon’s chairman, Gyorgy Szabo, US, maybe 300 people. In Hungary – and recently began a study on the impact of

seemed undaunted by this lack of similarly in other European countries – this technique and scrutiny in New York

confidence, telling UOGM that the we had to deal with 30,000 people for a is substantial, with concerns that fluids

company would “definitely” bring in dozen square km,” he said. used will transfer to the water table.

another partner, although “we have learnt The acquisition of seismic can be Realm’s CEO predicted a positive

lessons.” He stressed that gas was present complicated, although Szabo noted outcome. “Frac water can be sensibly

in the Mako trough; the only question Falcon’s success in this case. However, disposed of – be it in safe deep

was: “how we drain these systems and moving from exploration into formations or, after extensive treatment,

how efficiently this can be done.” development is also likely to run into into above-ground water systems” and it

BNK’s Hill made similar points on problems, primarily because of the will be shown to have a “minimal to non-

sticking with development. “You cannot “statistical” approach to drilling. existent impact on the water table,”

be discouraged by disappointing results,” Shale requires numerous wells for its Elston said.

he said. “We’ve drilled good wells, exploitation and this has been successful

we’ve drilled bad wells [in North in the US and Canada, with reports that Politics

America]: everything is applicable in some shales can be developed with well Shale gas will be developed in Europe

Europe. The shales are all different, you spacing of as little as 400 feet (120 and there is increasing evidence of

have to have the experience level and the metres). Such development seems interest in this area, for instance, Total

tenacity to work your way through it ... extremely unlikely in Europe given the signed up to explore an area in France

but you can bring the experience and the population density. recently. (See: Total wins French shale

databases from the US into these Companies from North America have gas permit, page 9)

[European] shale plays and you’ll be able hailed the lack of royalties in Europe, However, there are also noticeable

to make a lot more rapid progress.” noting this will act to reduce costs and obstacles to this development. Politicians

Hill summed it up, saying: improve returns. “Resources are owned will face competing interests. Concerns

“Exploration is easy, completions are the by sovereign governments in Europe, so are growing within the EU over reliance

problem.” The BNK official went on to we’re not having to pay landowners on foreign energy, particularly from

say that service costs would be fairly direct, unlike in North America,” Russia. However, it remains open to

high in the near term, but would fall as Realm’s Elston said. question whether this long-term strategic

demand for their work picked up. However, the flip side of this royalty- goal can trump short-term opposition and

free environment is that local landowners environmental worries.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 5. Unconventional OGM 12 April 2010, Week 01 page 5

COMMENTARY

Falcon’s Szabo was confident that the Australia may well be a key production might offer contract flexibility to attract

EU would back shale work. “It is clear point, either converting the feedstock investors.

the EU would like more [domestically into LNG or consuming it domestically The largest source of shale gas outside

produced] gas and this must include for power, as the country’s reliance on North America, though, is likely to be the

unconventional,” he said. coal leads to high levels of greenhouse former Soviet Union (FSU).

The industry will grow in Europe but gas (GHG) emissions. Development here would allow Gazprom

not to the same extent as seen in North Furthermore, officials from the to retain its role as the world’s top gas

America. Looking further ahead, one Egyptian General Petroleum Corporation company. Ultimately, shale gas could

might consider South America as a (EGPC) told UOGM that the North reinforce the old ties of gas dependence

potential destination, where Total is African country was considering for Europe, rather than sever them.

reportedly considering Argentina. pursuing shale gas development and

BP faces shareholder revolt

over oil sands strategy

BP’s plans to step up activity in the oil sands has drawn criticism from a group of the

company’s shareholders

By Kevin Godier

A group of BP shareholders oppose the company’s oil sands strategy on environmental grounds

The group has filed a special resolution on the issue to be voted upon at the company’s AGM on April 15

Fellow European super-major Shell is facing a similar resolution at its AGM in May

UK super-major BP is stepping up its reality that has earned Canada near- reserves held more cost-effective growth

activity in the oil sands sector, where it is pariah status among green groups and potential. The company has subsequently

something of a late entrant. The ride is pockets of the scientific community. reversed that decision, on the grounds

not without its bumps, however, as that higher oil prices and the difficulty in

demonstrated by recent action taken by a Big problems? replacing conventional reserves have

group of over 100 shareholders who are The dissident BP shareholder grouping, made the oil sands an essential play.

concerned that the company is which includes Britain’s public-sector In 2008, a US$5 billion asset swap

underestimating the sectoral risks, workers union, Unison, and Boston with Husky Energy gave BP 50% of the

especially the potential cost of expected Common Asset Management, has filed a Sunrise oil sands project, a US$2.4

regulations on greenhouse gas (GHG) special resolution to be voted upon at the billion development whose first oil

emissions. company’s April 15 annual general production from a 200,000 barrel per day

The oil sands industry was hit hard by meeting. The resolution demands that the development facility is expected in 2014.

the global economic meltdown and a firm publish a full report next year about In March, BP then paid an undisclosed

drop in oil prices, with a glut of project the financial, environmental, social and amount for a majority stake in Value

cancellations or decisions to mothball reputational risks associated with its Creation’s undeveloped Terre de Grace

schemes evidence of the recession’s planned Alberta oil sands investments. oil sands project in the Athabasca region

impact. However, higher oil prices and BP formed an oil sands study group in of Northern Alberta.

tentative signs of economic revival have the late 1970s, which concluded that

triggered renewed investor interest. technology costs were too high and that Interrupted momentum

Despite the potential influx of fresh much of the most promising properties The call for a special report by the

capital, the environmental concerns that for “in situ” (below ground) oil recovery dissident investors will cast a minor pall

hang over the sector refuse to go away. had already been taken by rivals Shell over the growing momentum behind oil

Oil sands production is one of the and Exxon. It acquired some oil sands sands at the world’s third largest publicly

world’s largest single sources of man- properties, but then sold them in 1999, traded oil company.

made GHG emissions, an environmental after concluding that conventional oil

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 6. Unconventional OGM 12 April 2010, Week 01 page 6

COMMENTARY

The group’s holdings in BP are valued But Exley said he was encouraged that motion.

at about GBP150 million (US$230 BP had made public statements about the A similar resolution is being tabled

million), according to an April 6 report in resolution. Via written declarations, BP against Shell at its AGM on May 18.

the Globe and Mail, representing just a has replied to the dissident shareholders Shell’s board has responded to this by

tiny fraction of BP’s GBP118 billion by saying it is well aware of the risks of publishing a report on its oil sands

London Stock Exchange value. the oil sands, including “the potential activities a full year earlier than

Nevertheless, FairPensions, the British impact of carbon pricing on investment expected.

consulting group that lobbies pension viability.” At a wider level, environmental groups

funds to make morally responsible It also pledged to use the latest are intensifying global campaigns to

investments, hopes the resolution, which technology to ensure the Alberta hammer home their message to the

has already received considerable media operations would emit the lowest public and lawmakers that oil sands are

attention in the UK, will “raise awareness possible amounts of carbon dioxide, and among the world’s most damaging

and prompt investors who are not really said it would consider equipping the energy sources.

engaged to get engaged” on the risks of Sunrise project with carbon capture and

the oil sands investments, said Duncan storage (CCS) technology. However this Enhanced activity

Exley, FairPensions’ campaigns director. technology is highly expensive and has On the other hand, the oil sands industry

The FairPensions campaign is being so far been resisted by oil and power has seen some significant movement in

backed by several celebrities and generation companies. recent months. Devon Energy recently

politicians in the UK, including Liberal BP also maintains that oil sands paid US$500 million to buy a 50%

Democrat MP Simon Hughes. In a developments are required to meet global interest in BP’s Kirby oil sands property,

statement, Hughes said the “tar sands are energy demand, which it expects to rise while French super-major Total

a very risky investment, financially, by 40% by 2030, with fossil fuels announced it would proceed with

environmentally and socially ... supplying most of the increase. development at its Joslyn Creek project,

Governments should lead by example despite experiencing major setbacks with

and be a responsible investor; for this Campaigners progress the property.

reason, it is essential that the MPs’ Some analysts believe that the anti-oil In another sign of renewed

pension fund supports these resolutions.” sands campaigners have made significant commitment to oil sands, Total and its

Fair Pensions has predicted that the progress, whatever fate befalls the partner ConocoPhillips agreed in January

resolution is nonetheless likely to to ramp up the production target for

fail, given that some prominent their jointly owned Surmont project

pension funds have already said they to 110,000 bpd from an early target

intend to vote against it. of 27,000 bpd by 2015.

The UK Local Authority Pension In late 2009, Chinese oil major

Fund Forum said in a March 30 PetroChina paid US$1.8 billion to

statement that it had advised its acquire a 60% stake in Athabasca

members to oppose the resolution, Oil Sands Corporation’s MacKay

arguing that BP had already River and Dover oil sands projects.

provided sufficient evidence that its This all seems to indicate that a lot

approach to oil sands was well of big players are now willing to bet

grounded. major dollars that the oil price will

“No evidence was found to move significantly higher in the

indicate BP had adopted a position years ahead, even as the oil sands

that was not supported by technical industry struggles to convince

and economic research. The forum governments outside Canada that it

also does not believe BP or their is doing all it can to minimise the

partner have failed to meet the wide impact of development and

range of local requirements set by production on the environment.

government to protect the While BP cannot yet boast any oil

environment and local sands production, it seems to have

communities,” it said in a statement. come to terms with any internal

Separately, RiskMetrics, which anxieties that oil sands

makes voting recommendations to developments may cause excessive

institutional investors, confirmed environmental damage and might

that it would also advise BP require too high an oil price to be

shareholders to reject the proposal. economically sound.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 7. Unconventional OGM 12 April 2010, Week 01 page 7

POLICY

Philadelphia calls for fracking ban

Officials for the city of Philadelphia have At issue specifically is that the the US,” he said. Moreover, Stone

asked a state agency to ban hydraulic company must receive a permit before it Energy is complying with all local, state

fracturing because of fears about the takes water from a tributary of the and federal regulations governing gas

contamination of drinking water. The Delaware River so that it can frack, a development, he said. Other municipal

controversy is starting to mirror events in process that is usually highly water- areas are expected to investigate fracking

New York State, where the dispute over intensive. A Philadelphia City on the heels of the news that the US

the safety of the gas drilling method is councilwoman, Blondell Reynolds Environmental Protection Agency (EPA)

liveliest. New York City is seeking a ban Brown, who introduced the resolution, will conduct a comprehensive US$1.9

on fracking in its vast watershed. said of fracking, “Long-term impacts can million research study into the practice.

Philadelphia has specifically asked the take years or decades to develop, and we The country-wide study, which will

Delaware River Basin Commission to have too many examples of that. Long- not be completed until 2012, will probe

deny a drilling permit to Louisiana’s term impacts can be devastating.” the “potential adverse impact” that

Stone Energy and any other company A spokesman for Stone Energy, Tim fracking may have on water quality and

that wants to use hydro fracking in its O’Leary, told Reuters that fracking was public health, said the agency in March.

watershed. Officials with the council harmless to the water supply. “Stone “There are concerns that hydraulic

contend that Stone Energy, which is now Energy believes that hydraulic fracturing fracturing may impact ground water and

seeking two drilling permits, began work technologies are a safe and proven surface water quality,” the EPA noted.

in part of the river basin without the method of accessing ample domestic

necessary approval, reported Reuters. sources of clean natural gas needed by

SHALE GAS

Shift in Canadian gas

production forecast

Canada’s National Energy Board (NEB) The move would primarily be driven “Natural gas is shifting not only in

has released a short-term report on by activity in the tight and location but also in type, which can

natural gas drilling that foresees a shift in unconventional gas plays throughout translate into opportunities for many in

production from Alberta to British northeastern BC in the Montney and the industry,” noted NEB’s chairman,

Columbia (BC) over the next two years. Horn River areas. Gaétan Caron. More than 210 wells

could be drilled in Montney and 70 wells

in Horn River in 2010 alone, said the

report, called: “Short-term Canadian

Natural Gas Deliverability 2010-2012.”

Meanwhile, Alberta’s gas production is

expected to decline over the next few

years from 12.7 billion cubic feet (360

million cubic metres) per day to 8.5 bcf

(241 mcm) per day.

Neighbouring BC will see an increase

from 2.7 bcf (76.5 mcm) per day to 3.7

bcf (105 mcm) per day.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 8. Unconventional OGM 12 April 2010, Week 01 page 8

SHALE GAS

Even so, Canada’s overall natural gas Capital spending on natural gas gas right now, the board noted, and some

production is expected to drop from 2010 projects will stabilise and then increase of the new technology that was designed

to 2012 as drilling activity slows down. over the projected time period, predicted to extract shale gas is being used for oil

In 2012, gas “deliverability” could be the board. The number of “drilling days” extraction in parts of Alberta and

down to 13 bcf (368 mcm) per day, down will increase about 11% from 45,659 Saskatchewan. Capital investment in oil

from 15.1 bcf (428 mcm) per day as days in 2010 to 50,512 days in 2012. production is drawing some investment

recently as 2009. Drilling for oil is more profitable than away from gas, it said.

New gas plant approved

for Horn River Basin

Canada’s National Energy Board last report of greenhouse gas (GHG) accommodate up to 830 mcf (23.5 mcm)

week approved a C$1 billion (US$995 emissions and on possible ways of per day of incremental gas from the

million) new gas plant to serve increased reducing and capturing carbon from the seven producers.

shale gas production from the Horn River shale gas processing. The company’s Earlier this year EnCana Corp., also of

Basin in British Columbia. existing Fort Nelson gas plant can Calgary, had secured a certificate for

Spectra Energy Transmission will process 1 bcf (28 mcm) per day of gas. environmental assessment for its Cabin

build the Fort Nelson North gas- In March 2009, Spectra announced it Gas Plant Project, to be located near Fort

processing facility – and a small pipeline had received firm customer commitments Nelson. The plant will process as much

loop – to serve the increasingly busy east – and subsequently contracts –for 760 as 800 mcf (22.7 mcm) per day and will

side of the Horn River area. The plant mcf (21.5 mcm) per day in gathering and cost between C$800 million (US$796

will be able to process around 250 processing capacity from seven million) and C$1 billion. The plant will

million cubic feet (7 million cubic producers operating in the basin. As a be built ‘capture ready’ to address the

metres) per day of gas. result of several upgrades, to be issue of GHG emissions and must

One of the conditions is that Spectra, completed in 2012 and including explore carbon capture and storage

through its Vancouver-based subsidiary construction of the Fort Nelson North (CCS).

Westcoast, will have to submit an annual plant, Spectra hopes to be able to

Talisman sells conventional assets

to tighten focus on shale plays

Talisman Energy is sharpening its focus being sold were “excellent,” it could not 40,000 boepd as it focused on freeing up

on booming North American shale gas “effectively compete for capital within capital for more investment in

plays by selling some conventional oil [its] emerging strategic asset mix. These unconventional shale gas production.

and gas assets for C$1.9 billion (US$1.89 sales are value-accretive and will help Many other large Canadian producers

billion). [it] focus on, finance and build [its] are also selling their conventional assets

The sales, announced on April 7, growing, low-cost North American shale to prepare for new investments in the

consist of five separate transactions with gas business.” growing Canadian shale gas industry,

mostly unnamed parties, covering assets The acreage being sold is located in the including EnCana Corp., Suncor Energy

producing about 42,500 barrels of oil greater Peace River Arch, central Alberta and Nexen. The rationale among these

equivalent per day, 90% of which is Foothills and greater Hinton areas in companies is that conventional gas is

natural gas production. Talisman said the Alberta, and in Ontario. unable to compete with the productivity

sales would be finalised by the end of Talisman said in January that it was and economies of scale of shale gas.

June. looking to sell non-core conventional

Talisman said that although the assets assets in North America producing about

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 9. Unconventional OGM 12 April 2010, Week 01 page 9

SHALE GAS

As of the end of 2009, Talisman had the company on key assets, including unit of Toronto asset-management firm

sold assets producing 38,000 boepd for North American unconventional shale Dundee Corp., as one of the buyers, but

C$3.2 billion (US$3.19 billion) after gas plays. would not identify the other

president and CEO, John Manzoni, Talisman spokeswoman Phoebe purchasers.

announced a strategy in 2008 to refocus Buckland confirmed Eurogas Corp., a

Total wins French shale gas permit

French oil major Total has been awarded Total also operates the Lacq and The Montelimar permit will boost the

the Montelimar shale gas permit in the Meillon gas fields in the southwest of company’s bid to boost production from

south of France for a period of five years. France, in which it has a 100% interest. unconventional resources, including

Total will have a 100% stake in shale gas.

the 4,327-square km exploration Total is also seeking permits to

permit following its acquisition of explore for unconventional gas in

the French affiliate of the US Devon Argentina and earlier this year it

Energy, which was jointly allocated agreed to buy a stake in Chesapeake

the permit. Energy’s US gas assets for US$2.25

In a statement, Yves-Louis billion.

Darricarrère, president of Shale gas’ potential is said to be

exploration and production, said: exciting in Europe. Analysts believe

“Total has committed to a there are substantial amounts of shale

programme of work that is aimed at gas to be found in Sweden, Poland,

confirming the presence of shale gas Germany, France and Austria.

in the region and [at] appraising the Furthermore, unlike in the US, a

possibility of economical significant chunk of Europe’s

development of these resources. prospective shale gas resource lies

Should the first geological activities under rural land, thereby lessening the

be promising, exploration wells will fears of urban groundwater

be drilled in order to evaluate this contamination.

potential.”

SHALE OIL

Platts to provide Bakken

price assessments

Platts is to provide the world’s first price “This new high-quality crude oil stream runs down from Canada and into North

assessments to value crude oil produced is expected to help meet Midwest Dakota and Montana. The first oil flowed

from the Bakken shale field in the central refining demand and potentially that of from the Bakken shale in 1951; however,

US. the US Gulf Coast. Because of its up until recently it has been difficult to

“Thanks to favourable economics and importance, the industry needs a means extract.

advances in technology, production from of placing a value on this crude. Our new Times have now changed and

this unconventional crude oil source has price assessments address this need by horizontal drilling and fracturing

risen dramatically in recent years,” said providing a transparent price discovery techniques have been applied to drilling

Esa Ramasamy, director of Americas process and daily pricing information.” for oil in shale formations.

market reporting at Platts in a statement. The formation of the Bakken shale

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 10. Unconventional OGM 12 April 2010, Week 01 page 10

SHALE OIL

Platts has reported current US Bakken The Bakken shale fields are currently using the company’s Market-on-Close

crude output at 200,000 barrels per day the largest oil reserve in the US, with (MOC) methodology, which, said Platts,

and the North Dakota Pipeline Authority estimated recoverable reserves of 4 “Identifies bid, offer and transaction data

estimates that the Bakken field’s yield billion barrels. by company of origin and results in a

could rise to between 400,000 bpd to Platts’ Bakken blend assessments of time-sensitive end-of-trading-day daily

500,000 bpd over the next 10 years Bakken Blend ex-Clearbrook and price assessment.”

before dropping back. Bakken Blend ex-Guernsey will be made

OIL SANDS

CAPP anticipates jump

in oil sands output

Industry watchdog Canadian Association in Calgary on April 7 to reignite business permanent a 5% front-end incentive on

of Petroleum Producers (CAPP) has competitiveness in the province and the drilling of new natural gas and

projected oil sands output from Alberta attract new investments. conventional oil wells; a 14% reduction

will be 1.55 million barrels per day in “Alberta’s advantage has always been of maximum royalty rate to 36% for both

2010 and will increase to 1.66 million its ability to build investor confidence unconventional and conventional natural

bpd in 2011. In 2009, production was and compete successfully for global gas output, and a reduction to 40-50%

1.34 million bpd. capital dollars. Contrary to the ‘gambler’ earlier – for crude oil production. The

“Momentum is picking up once again stereotype of the oil and gas industry, reductions will be capped off at

in the province, with [the] oil price global capital is not the kind of money maximum natural gas and crude oil

stabilising at US$80 per barrel and that goes to the race track or to a casino prices of US$9 per million British

demand increasing,” said CAPP’s looking for good luck. Rather, it looks thermal unit and US$82 per barrel

president, David Collyer. “In the current for stability and long-term return on respectively.

year, total investment in Canada’s oil and investment and does not like uncertainty “We are certainly encouraged by the

gas sector is estimated to be C$40 billion or frequent changes in policy and new fiscal measures. But, there is a great

[US$39.75 billio], compared to C$35 regulation,” Collyer said. deal more work to be done. Royalty

billion [US$34.78 billion] in 2009. Last Providing regulatory stability in the curves and other fiscal details need to be

year, investments in Alberta alone were province is very much on the agenda of firmed up by end May,” Collyer said. He

C$24 billion [US$23.85 billion], with a the Tory government in Edmonton, added: “The regulatory part of the

vast majority being in the oil sands which in early March announced changes competitiveness review is just now

sector.” to the existing royalty structure issued in getting under way and has ambitious

Collyer’s statement was made on the late 2007. Offerings under the new targets to deliver substantive process

sidelines of a major campaign launched competitiveness review include: making improvements by year-end.”

Imperial Petroleum establishes

new oil sands unit

Imperial Petroleum has formed a new Imperial said it owned a 33.3% interest processing outside of Canada, using a

company, Arrakis Oil Recovery, to in Arrakis with two other partners, non-thermal, mechanical and chemical

develop a new process to recover including the technology provider, and closed-loop process to recover the

bitumen or heavy oil from tar and oil would manage the new company. It said bitumen. The chemical employed in the

sands. that Arrakis had been granted a licence to process is not a solvent and is both non-

The Evansville, Indiana-headquartered the new technology for oil sand toxic and biodegradable.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 11. Unconventional OGM 12 April 2010, Week 01 page 11

OIL SANDS

In connection with Arrakis, Imperial Jeffrey T Wilson, Imperial’s president. research and development facility owned

also signed an engagement agreement Wilson expanded on the practice: “The by the technology provider on oil sands

with Hyde Park Capital Group and process operates without hot water or from Oklahoma, Texas and Utah. The

Charlotte Capital Partners to raise steam and without any solvents, either initial installation will process some

US$6.1 million for the initial facility hydrocarbon or otherwise, so there are no 2,400 tonnes per day of oil sands

installation planned for late summer emissions issues. The process produces a containing an average of 8% bitumen and

2010. clean sand residue while separating the should generate approximately US$20

“We believe that the technology bitumen in an eco-friendly manner. million annual cash flow. The first

developed and licensed to Arrakis is the Operating costs are significantly less than facility will be located at a site on which

most advanced, cost-effective and conventional processes because the several million tonnes of the material

environmentally friendly processing chemical medium is re-cycled and re- have already been mined.”

technology available for recovering used. The process has been pilot tested

bitumen from tar and oil sands,” said on several tonnes of material at the

AOSC’s roller coaster ride

Athabasca Oil Sands Corp. (AOSC) estimates that it will not achieve barrels of probable reserves, 26 million

raised almost C$1.35 billion (US$1.34 commercial production from Canada’s barrels of possible reserves and 7.1

billion) through its recent initial public oil sands before 2015. It will use a billion barrels of contingent reserves. It

offering (IPO), the richest Canadian technology that is unproven in carbonate recently formed a C$1.9 billion (US$1.88

share floatation since 1999. However, the reserves – steam-assisted gravity billion) partnership with state-owned

Calgary-based company’s shares quickly drainage rather than mining – to recover PetroChina for a 60% share in two oil

lost C$440 million (US$437.3 million) bitumen from oil sands deposits. AOSC sands projects in northeastern Alberta,

during its first day of trading on April 8. described its technology as having a MacKay and Dover.

At the close of the first day of trading smaller surface footprint, using less The correction in stock price was not

on the Toronto Stock Exchange, its water and not requiring tailings ponds. unexpected given the complexities of

shares were C$16.90 (US$16.79), down “The shares were simply overpriced producing from the oil sands. “Oil sands

6.1% or C$1.10 (US$1.09). The 75 compared to other early stage oil sands are a really, really labour-intensive, cost-

million shares, priced at C$18 players, given that the technology is intensive investment proposition,”

(US$17.89) each, represented a 19% unproven for 25% of the company’s Steven Conville, who helps manage

stake in the company. On April 9, the reserves, and because of the estimated about C$8 billion (US$7.95 billion) at

second day of trading, the stock fell 7.1% timing of production,” an unnamed Macquarie Private Wealth, told

to close at C$15.70 (US$15.60). analyst told the Calgary Herald. Oil Bloomberg. “I’m not sure people are

The money raised in the company’s prices had also weakened. really into the sizzle at this point in time.

IPO had startled observers. AOSC According to AOSC, it has 114 million People want steak.”

HEAVY OIL

Nexen seeks sharper focus

with sale of heavy oil assets

Calgary-based Nexen is planning to sell sell its assets. Proposals to Scotia barrels of oil equivalent per day of

some heavy oil properties around the Waterous are due by May 3, 2010. natural gas. Additionally, the area has the

Alberta and Saskatchewan border, near The bank has said Nexen’s properties – potential for enhanced oil recovery

Lloydminster. amounting to approximately 225,000 net (EOR) and large original-oil-in-place

According to Scotia Waterous, the acres (910 square km) of land – to be (OOIP) fields that could work well with

investment banking arm of Scotia Bank, sold include established production of thermal or chemical methods of

Nexen has engaged the bank’s services to 15,000 barrels per day of oil and 2,000 extraction.

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 12. Unconventional OGM 12 April 2010, Week 01 page 12

HEAVY OIL

Add in the infrastructure of pipelines, A Nexen spokesperson, Carla Yuill, focus on its international operations, oil

batteries and a working field office and told reporters that the sale “is because we sands operations and shale gas. Nexen’s

this sale could well be one of the largest, want to streamline our core strategies … Lloydminster sale is estimated to fetch

if not the largest, Canadian property We do think we can get good prices, C$600-800 million (US$600-800

deals of 2010. given low differentials.” million).

The legacy of Nexen’s properties dates The property sale fits in with a It is possible the proceeds could

back to the 1970s and 1990s, when they statement from Nexen’s CEO, Marvin significantly reduce Nexen’s debt but

belonged to Occidental Petroleum and Romanow, in December 2009, when he analysts have been reported as saying

Wascana Energy. Nexen started out as said the company would be disposing of this is more of a strategic shift and that

Occidental in 1971 and acquired approximately C$1 billion (US$1 billion) the money will probably be reinvested in

Wascana in 1997. worth of assets over the next two years to the company’s core businesses.

New foreign investors line up

for Iranian heavy oil fields

Iranian media have reported a deal is Ordibehesht, which begins April 21, and dispatched envoys to visit the companies

close between the National Iranian Oil named the consortium as the Iranian– and evaluate their financial capabilities.

Company (NIOC) and an Iranian- Australian KIPC joint venture. Iran has struggled for years to find the

Australian consortium backed by Samimi said the development plan for cash and the technology to develop its

Chinese financing, for the development the three fields was signed in 2009. “The energy sector, as sanctions and political

of three heavy crude oilfields in the KIPC consortium has submitted the pressure have kept foreign firms away.

southern part of the country. master development plan on Western companies in particular are

The Iranian Oil Ministry’s SHANA Kouhmound, Kaki and Boushgan and the increasingly wary of investing in the

website reported on April 5 that Bahman plan has been approved by the ... board country because of an international

Samimi, in charge of the development of of directors of the National Iranian Oil dispute over Tehran’s nuclear ambitions.

heavy oilfield projects at NIOC, said the Company,” Samimi said, in an exclusive On March 10, Shell announced it had

contract concerned the development of interview. stopped supplying refined petroleum to

the onshore Kouhmond, Kaki, and The KIPC has introduced a number of Iran. The government has shifted to

Boushgan oilfields in Bushehr province companies as financiers, mostly Chinese, energy-hungry Asian countries such as

in southern Iran. No financial details of SHANA said, adding that buyback China, India and Malaysia for

the deal were available. contracts would be signed after the NIOC hydrocarbon investments.

SHANA said the contract was to be approved the proposed financing

signed during the Iranian month of companies. He said the NIOC had

COAL-BED METHANE

UCG potential highlighted

by fund manager

An Australian fund manager has although CBM has become one of the do share similarities … those who have

highlighted that underground coal biggest stories in the resources sector in come across underground coal

gasification (UCG) can be considered as the past three years, highly efficient UCG gasification often say, ‘We have seen

the often overlooked younger brother to techniques are starting to emerge from its some pilot plants work; conceptually it

coal-bed methane (CBM). shadow. looks good, but there are still some

According to LimeStreet Capital On April 6, the Sydney Morning question marks hanging over its head

resources fund manager Stephen Bartrop, Herald quoted Bartrop as saying: “They until it is commercialised.’”

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents

- 13. Unconventional OGM 12 April 2010, Week 01 page 13

COAL-BED METHANE

“However, given that for one cubic director, Len Walker, one of the UCG In March, Cougar announced ignition

metre of coal you get 20 times the pioneers in Australia, said that rising of its flagship Kingaroy project in

amount of energy out of a coal seam energy demand had put the technology in southeast Queensland and the successful

through UCG than through CBM play. production of synthetic gas. Cougar will

technology, it really is just a matter of “Apart from Linc Energy, Carbon soon undertake a series of trials,

time before it comes into its own.” He Energy and ourselves, which are the big underground and on the surface, which

stressed that this would have “huge three in the space, I have counted six or will be used for a pre-feasibility study

implications for Australia’s vast seven other listed companies that have and a subsequent bankable feasibility for

coalfields.” recently popped up and which are all a planned 400-MW power station.

UCG technology was developed in the promoting UCG in different ways,” he

19th century. Cougar Energy’s managing said in the newspaper report.

West Bengal pipeline planned

for CBM transportation

India’s Essar Oil plans to lay a 160-km from its Raniganj block in West Bengal of 4 million cubic metres per day, given

pipeline from Durgapur to Kolkata in in the first quarter of 2010. Initial output the PNGRB’s requirement of having

West Bengal to transport gas from its is expected to be 9,000-10,000 cubic 33% excess capacity for leasing out to

coal-bed methane (CBM) blocks to metres of gas per day, with peak third parties.

consumers in the state. production of 3.5 million cubic metres The Raniganj block holds 4.6 trillion

The company said the natural gas per day envisaged in mid-2013. cubic feet (130 billion cubic metres) in

pipeline would help ease some of the A special purpose vehicle would be set place and recoverable resources of

environmental concerns stemming from up for executing the project, Essar said. around 1 tcf (28.3 bcm).

the abundance of steel and coal plants in Besides Raniganj, the pipeline may also In the Rajmahal Block, where Essar

the region, the Press Trust of India be used to transport gas from Essar’s was declared the provisional winner in a

reported on April 7. Rajmahal CBM block in neighbouring recently concluded auction of CBM

Essar Oil has applied to the sector’s Jharkhand. Shishir Agrawal, head of areas, an in-place resource of 9.5 tcf (269

regulator, the Petroleum and Natural Gas Essar Exploration Production Division, bcm) has been estimated with

Regulatory Board (PNGRB), for said in the application that 15 test wells recoverable resources of 4.7 tcf (133

permission to lay a 24-inch pipeline, had already been drilled in Raniganj and bcm).

according to the company’s application. 500 more were planned.

Essar is likely to start producing CBM Essar has suggested a pipeline capacity

GTL/CTL

Alter NRG seeks strategic partner

for Alberta CTL project

A final investment decision (FID) is erupted in late 2008 damaged its identified, told UOGM. “We are aiming

awaited at Alter NRG for its proposed prospects. for three categories of companies – with

40,000 barrel per day coal-to-liquids “We are on the look-out for a strategic mining and extraction experience, oil

(CTL) project in northern Alberta. company to partner on the project. We companies based in Alberta and project

For the past two years, the Calgary- have huge coal reserves and the project is engineering and construction firms. The

based firm has been seeking finances to feasible, but no particular time frame has successful partner will be offered a 60%

move ahead with the project. However, been set to break ground,” an Alter NRG stake.”

the global economic downturn that official, who did not wish to be

Copyright © 2010 NewsBase Ltd.

www.newsbase.com Edited by Ryan Stevenson

All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All

reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its contents