Euro Area Lending Update (Grant Toch 5 30 2015)

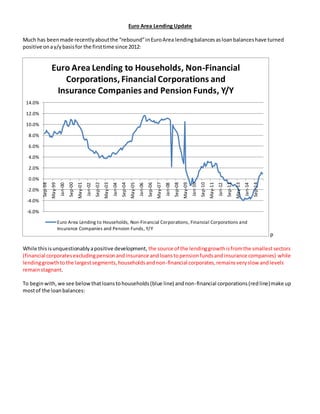

- 1. Euro Area Lending Update Much has beenmade recentlyaboutthe “rebound”inEuroArea lendingbalancesasloanbalanceshave turned positive onay/ybasisfor the firsttime since 2012: p While thisisunquestionablyapositive development, the source of the lendinggrowthisfromthe smallestsectors (financial corporatesexcludingpensionandinsurance andloanstopensionfundsandinsurance companies) while lendinggrowthtothe largestsegments,householdsandnon-financial corporates,remainsveryslow andlevels remainstagnant. To beginwith, we see below thatloanstohouseholds(blue line) andnon-financial corporations(redline)make up mostof the loanbalances: -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Sep-98 May-99 Jan-00 Sep-00 May-01 Jan-02 Sep-02 May-03 Jan-04 Sep-04 May-05 Jan-06 Sep-06 May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 Jan-14 Sep-14 Euro Area Lending to Households, Non-Financial Corporations, Financial Corporations and Insurance Companies and Pension Funds, Y/Y Euro Area Lending to Households, Non-Financial Corporations, Financial Corporations and Insurance Companies and Pension Funds, Y/Y

- 2. 1. To Households Loans to households,the largestsector,remainnegative y/y: 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% Sep-97 May-98 Jan-99 Sep-99 May-00 Jan-01 Sep-01 May-02 Jan-03 Sep-03 May-04 Jan-05 Sep-05 May-06 Jan-07 Sep-07 May-08 Jan-09 Sep-09 May-10 Jan-11 Sep-11 May-12 Jan-13 Sep-13 May-14 Jan-15 Euro Area Lending to Each Sector, By Percentage To Households To Non-Financial Corporates To Financial Corporates, Excluding Insurance and Pension To Insurance Corporations and Pension Funds

- 3. From a level perspective,loanstothe householdsectorhave beenflattishforalongtime because,aswe will see later,growthGermanyhouseholdlendingisoffsettingcontinuedcontractioninthe periphery: 2. To Non-Financial Corporations -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% Sep-98 May-99 Jan-00 Sep-00 May-01 Jan-02 Sep-02 May-03 Jan-04 Sep-04 May-05 Jan-06 Sep-06 May-07 Jan-08 Sep-08 May-09 Jan-10 Sep-10 May-11 Jan-12 Sep-12 May-13 Jan-14 Sep-14 Euro Area Lending to Households, Y/Y Euro Area Lending to Households, Y/Y 2000000 2500000 3000000 3500000 4000000 4500000 5000000 5500000 Sep-97 Jun-98 Mar-99 Dec-99 Sep-00 Jun-01 Mar-02 Dec-02 Sep-03 Jun-04 Mar-05 Dec-05 Sep-06 Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 Mar-11 Dec-11 Sep-12 Jun-13 Mar-14 Dec-14 Euro Area Lending to Households, Level Data Lending to Households, Level Data

- 4. Loans to non-financial corporationsare still declining: From a level perspective,balanceshave stabilizedattheirlow levels: -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% Sep-98 Apr-99 Nov-99 Jun-00 Jan-01 Aug-01 Mar-02 Oct-02 May-03 Dec-03 Jul-04 Feb-05 Sep-05 Apr-06 Nov-06 Jun-07 Jan-08 Aug-08 Mar-09 Oct-09 May-10 Dec-10 Jul-11 Feb-12 Sep-12 Apr-13 Nov-13 Jun-14 Jan-15 Euro Area Lending to Non-Financial Corporations, Y/Y Euro Area Lending to Non-Financial Corporations, Y/Y 2000000 2500000 3000000 3500000 4000000 4500000 5000000 5500000 Sep-97 May-98 Jan-99 Sep-99 May-00 Jan-01 Sep-01 May-02 Jan-03 Sep-03 May-04 Jan-05 Sep-05 May-06 Jan-07 Sep-07 May-08 Jan-09 Sep-09 May-10 Jan-11 Sep-11 May-12 Jan-13 Sep-13 May-14 Jan-15 Euro Area Lending to Non-Financial Corporations, Level Data Euro Area Lending to Non-Financial Corporations, Level Data

- 5. 3. To Financial CorporationsExcluding Insurance Companiesand PensionFunds Loans to financial corporationsexcluding insurance companiesandpensionfundshave surgedrecently,perhapsin response toQE: 4. To Insurance Companiesand PensionFunds Loans to insurance companiesandpensionfundshave surgedevenmore,perhapsinresponsetoQE: 0 200000 400000 600000 800000 1000000 1200000 1400000 Sep-97 Jun-98 Mar-99 Dec-99 Sep-00 Jun-01 Mar-02 Dec-02 Sep-03 Jun-04 Mar-05 Dec-05 Sep-06 Jun-07 Mar-08 Dec-08 Sep-09 Jun-10 Mar-11 Dec-11 Sep-12 Jun-13 Mar-14 Dec-14 Euro Area Lending to Financial Corporations Excluding Insurance and Pension Funds, Level Data Euro Area Lending to Financial Corporations Excluding Insurance and Pension Funds, Level Data

- 6. From a country specificperspective,we see that loansto the householdsector continue to contract in Spain and Ireland,while Italy is seeingmodestgrowth and Germanyis seeinga surge: 0 20000 40000 60000 80000 100000 120000 140000 160000 Sep-97 May-98 Jan-99 Sep-99 May-00 Jan-01 Sep-01 May-02 Jan-03 Sep-03 May-04 Jan-05 Sep-05 May-06 Jan-07 Sep-07 May-08 Jan-09 Sep-09 May-10 Jan-11 Sep-11 May-12 Jan-13 Sep-13 May-14 Jan-15 Euro Area Lending to Insurance Companies and Pension Funds, Level Data Euro Area Lending to Insurance Companies and Pension Funds, Level Data

- 7. 200000 300000 400000 500000 600000 700000 800000 900000 1000000 Jan-03 Aug-03 Mar-04 Oct-04 May-05 Dec-05 Jul-06 Feb-07 Sep-07 Apr-08 Nov-08 Jun-09 Jan-10 Aug-10 Mar-11 Oct-11 May-12 Dec-12 Jul-13 Feb-14 Sep-14 Apr-15 Spain: Lending to Households, Level Data Spain: Lending to Households, Level Data 50000 70000 90000 110000 130000 150000 170000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Ireland: Lending to Households, Level Data Ireland: Lending to Households, Level Data

- 8. In the non-financial corporate sector we see continuedcontraction across all these countries 250000 300000 350000 400000 450000 500000 550000 600000 650000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Italy: Lending to Households, Level Data Italy: Lending to Households, Level Data 1400000 1410000 1420000 1430000 1440000 1450000 1460000 1470000 1480000 1490000 1500000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Germany: Lending to Households, Level Data Germany: Lending to Households, Level Data

- 9. 300000 400000 500000 600000 700000 800000 900000 1000000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Spain: Lending to Non-Financial Corporations, Level Data Spain: Lending to Non-Financial Corporations, Level Data 50000 70000 90000 110000 130000 150000 170000 190000 210000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Ireland: Lending to Non-Financial Corporations, Level Data Ireland: Lending to Non-Financial Corporations, Level Data

- 10. 450000 550000 650000 750000 850000 950000 1050000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Italy: Lending to Non-Financial Corporations, Level Data Italy: Lending to Non-Financial Corporations, Level Data 750000 800000 850000 900000 950000 1000000 Jan-03 Jul-03 Jan-04 Jul-04 Jan-05 Jul-05 Jan-06 Jul-06 Jan-07 Jul-07 Jan-08 Jul-08 Jan-09 Jul-09 Jan-10 Jul-10 Jan-11 Jul-11 Jan-12 Jul-12 Jan-13 Jul-13 Jan-14 Jul-14 Jan-15 Germany: Lending to Non-Financial Corporations, Level Data Germany: Lending to Non-Financial Corporations, Level Data