1. PROPRIETARY RESEARCH

DIRECTOR'S REPORT

May 8, 2015

THE DIRECTOR'S REPORT

The Director's Report is the most comprehensive and up to the minute compilation of aggregated earnings growth and

market intelligence covering the companies included in the S&P 500 Index.

This report combines Thomson Reuters unrivaled historical earnings database, in depth coverage of Wall Street analysts'

bottom-up corporate earnings estimates, and the analytic capabilities of Thomson Reuters Proprietary Research Group

and desk-top solutions.

For inquiries on this and other proprietary financial market analysis and reports please contact your Thomson Reuters

relationship manager or e-mail TRPropResearch@thomsonreuters.com.

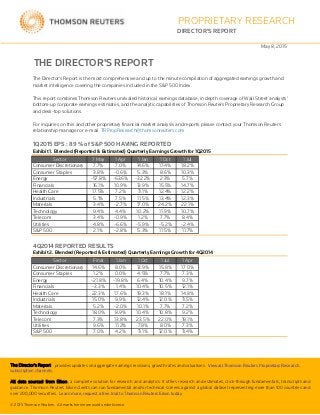

1Q2015 EPS : 89 % of S&P 500 HAVING REPORTED

Exhibit 1. Blended (Reported & Estimated) Quarterly Earnings Growth for 1Q2015

Sector 7 May 1 Apr 1 Jan 1 Oct 1 Jul

Consumer Discretionary 7.7% 7.0% 14.6% 17.4% 18.2%

Consumer Staples 3.8% -0.6% 5.3% 8.6% 10.3%

Energy -57.8% -63.6% -32.2% 2.3% 5.7%

Financials 16.1% 10.9% 13.9% 15.5% 14.7%

Health Care 17.5% 7.2% 11.1% 12.4% 12.2%

Industrials 5.1% 7.5% 11.5% 13.4% 12.3%

Materials 3.4% -2.7% 17.0% 24.2% 22.1%

Technology 9.4% 4.4% 10.2% 11.9% 10.7%

Telecom 3.4% -0.9% 1.2% 7.7% 8.4%

Utilities 4.8% -6.6% -5.9% -5.2% -2.4%

S&P 500 2.1% -2.8% 5.3% 11.5% 11.7%

4Q2014 REPORTED RESULTS

Exhibit 2. Blended (Reported & Estimated) Quarterly Earnings Growth for 4Q2014

Sector Final 1 Jan 1 Oct 1 Jul 1 Apr

Consumer Discretionary 14.6% 8.0% 13.9% 15.8% 17.0%

Consumer Staples 1.2% 0.0% 4.5% 7.7% 7.3%

Energy -21.8% -19.8% 6.4% 10.4% 9.7%

Financials -3.3% 1.4% 10.4% 10.5% 12.1%

Health Care 22.3% 17.6% 19.3% 18.1% 14.8%

Industrials 15.0% 9.9% 12.4% 12.0% 11.5%

Materials 5.2% -2.0% 10.1% 7.7% 7.2%

Technology 18.0% 8.9% 10.4% 10.8% 9.2%

Telecom 7.3% 13.8% 23.5% 22.0% 19.1%

Utilities 9.6% 11.2% 7.8% 8.0% 7.3%

S&P 500 7.0% 4.2% 11.1% 12.0% 11.4%

The Director's Report provides updates on aggregate earnings revisions, growth rates and valuations. View all Thomson Reuters Proprietary Research

subscription channels.

All data sourced from Eikon, a complete solution for research and analytics. It offers research and estimates, click-through fundamentals, transcripts and

guidance. Thomson Reuters Eikon clients can run fundamental and/or technical screens against a global dataset representing more than 100 countries and

over 200,000 securities. Learn more, request a free trial to Thomson Reuters Eikon today.over 200,000 securities. Learn more, request a free trial to Thomson Reuters Eikon today.

© 2015 Thomson Reuters. All marks herein are used under licence.

2. THOMSON REUTERS PROPRIETARY RESEARCH MAY 8, 2015

DIRECTOR'S REPORT

THE QUARTERLY OUTLOOK FOR THE S&P 500 EARNINGS

Exhibit 3. Estimated Earnings Growth for 2Q2015

Sector 7 May 1 Apr 1 Jan 1 Oct 1 Jul

Consumer Discretionary 8.2% 11.4% 16.6% 17.9% 19.9%

Consumer Staples -1.9% -0.1% 4.0% 7.4% 9.2%

Energy -65.2% -64.8% -31.6% 2.8% 10.5%

Financials 15.2% 16.0% 18.0% 20.0% 13.6%

Health Care 5.2% 5.2% 6.3% 7.8% 14.1%

Industrials 1.6% 7.1% 7.5% 9.6% 11.5%

Materials 1.8% 7.4% 14.6% 20.1% 25.9%

Technology 3.6% 6.0% 11.3% 13.2% 13.5%

Telecom 6.1% 3.4% 4.3% 8.3% 6.1%

Utilities 1.7% 4.8% 6.7% 6.3% 3.9%

S&P 500 -2.4% -0.5% 5.9% 11.8% 13.3%

Exhibit 4. Estimated Earnings Growth for 3Q2015

Sector 7 May 1 Apr 1 Jan 1 Oct

Consumer Discretionary 12.6% 13.4% 17.6% 20.2%

Consumer Staples 0.9% 2.1% 6.0% 10.0%

Energy -60.4% -58.7% -26.4% 13.0%

Financials 14.7% 16.0% 17.8% 23.1%

Health Care 6.6% 8.4% 10.3% 14.8%

Industrials 4.4% 11.0% 8.7% 12.2%

Materials -0.5% -1.0% 6.4% 17.0%

Technology 8.1% 9.4% 12.1% 15.9%

Telecom 8.1% 5.5% 5.6% 7.3%

Utilities 2.1% 3.8% 5.2% 4.0%

S&P 500 0.4% 2.2% 7.4% 15.4%

Exhibit 5. Estimated Earnings Growth for 4Q2015

Sector 7 May 1 Apr 1 Jan

Consumer Discretionary 14.1% 13.2% 18.2%

Consumer Staples 4.3% 5.0% 9.2%

Energy -40.3% -37.1% -1.8%

Financials 21.6% 22.9% 21.2%

Health Care 7.9% 9.2% 14.2%

Industrials 2.8% 7.7% 11.2%

Materials 3.8% 4.1% 19.7%

Technology 3.0% 4.2% 11.1%

Telecom 15.5% 12.9% 13.8%

Utilities 2.1% 4.6% 6.6%

S&P 500 5.0% 6.4% 12.9%

2© 2015 Thomson Reuters. All marks herein are used under licence. TRPR_82201_20150508

3. THOMSON REUTERS PROPRIETARY RESEARCH MAY 8, 2015

DIRECTOR'S REPORT

Exhibit 6. Estimated Earnings Growth for 1Q2016

Sector 7 May 1 Apr

Consumer Discretionary 18.7% 19.8%

Consumer Staples 7.3% 10.3%

Energy 18.3% 45.8%

Financials 6.0% 11.0%

Health Care 4.4% 17.1%

Industrials 9.8% 12.8%

Materials 14.1% 25.8%

Technology 8.3% 14.0%

Telecom 3.2% 4.8%

Utilities -4.5% 3.4%

S&P 500 8.5% 15.1%

THE CALENDAR YEAR OUTLOOK FOR S&P 500 EARNINGS

Exhibit 7. Estimated Earnings Growth for CY2015

Sector 7 May 1 Apr 1 Jan 1 Oct 1 Jul

Consumer Discretionary 10.3% 11.1% 16.9% 18.0% 18.0%

Consumer Staples 1.7% 1.9% 6.6% 9.1% 8.9%

Energy -56.4% -56.6% -23.3% 7.0% 6.5%

Financials 16.5% 16.1% 17.8% 16.7% 12.5%

Health Care 9.7% 7.7% 10.5% 11.6% 11.9%

Industrials 4.7% 9.8% 9.7% 11.6% 11.8%

Materials 3.2% 2.3% 14.7% 19.1% 20.2%

Technology 5.9% 6.0% 11.3% 12.5% 11.3%

Telecom 7.5% 4.6% 4.9% 6.5% 6.5%

Utilities 1.3% 0.9% 2.5% 2.9% 3.5%

S&P 500 1.5% 1.7% 8.1% 12.4% 11.5%

Exhibit 8. Estimated Earnings Growth for CY2016

Sector 7 May 1 Apr

Consumer Discretionary 15.9% 15.0%

Consumer Staples 9.1% 9.0%

Energy 37.9% 46.1%

Financials 9.9% 10.5%

Health Care 11.1% 12.8%

Industrials 9.5% 8.6%

Materials 19.3% 20.3%

Technology 11.0% 11.9%

Telecom 3.6% 5.0%

Utilities 3.4% 4.1%

S&P 500 12.0% 12.8%

3© 2015 Thomson Reuters. All marks herein are used under licence. TRPR_82201_20150508

4. THOMSON REUTERS PROPRIETARY RESEARCH MAY 8, 2015

DIRECTOR'S REPORT

HISTORICAL/CURRENT/FUTURE EARNINGS GROWTH RATES

Exhibit 9.

Sector 1Q2014 2Q2014 3Q2014 4Q2014 1Q2015 2Q2015 3Q2015 4Q2015 1Q2016

Consumer Discretionary 8.8% 7.5% -1.7% 14.6% 7.7% 8.2% 12.6% 14.1% 18.7%

Consumer Staples 3.3% 7.8% 5.7% 1.2% 3.8% -1.9% 0.9% 4.3% 7.3%

Energy -0.1% 17.0% 10.3% -21.8% -57.8% -65.2% -60.4% -40.3% 18.3%

Financials -0.6% -6.6% 16.3% -3.3% 16.1% 15.2% 14.7% 21.6% 6.0%

Health Care 11.8% 18.5% 16.3% 22.3% 17.5% 5.2% 6.6% 7.9% 4.4%

Industrials 3.9% 11.4% 13.1% 15.0% 5.1% 1.6% 4.4% 2.8% 9.8%

Materials 0.0% 12.2% 20.7% 5.2% 3.4% 1.8% -0.5% 3.8% 14.1%

Technology 10.0% 15.3% 10.3% 18.0% 9.4% 3.6% 8.1% 3.0% 8.3%

Telecom 14.0% 6.8% 6.4% 7.3% 3.4% 6.1% 8.1% 15.5% 3.2%

Utilities 22.6% -0.1% 2.1% 9.6% 4.8% 1.7% 2.1% 2.1% -4.5%

S&P 500 5.6% 8.6% 10.3% 7.0% 2.1% -2.4% 0.4% 5.0% 8.5%

LATEST REPORTED QUARTER EARNINGS STATISTICS

Exhibit 10. 1Q2015 Actuals vs. Mean

Above Match Below Surprise Reported Index

Sector % % % Factor Total # Total #

Consumer Discretionary 65% 8% 27% 2.2% 63 84

Consumer Staples 75% 9% 16% 6.9% 32 38

Energy 68% 5% 27% 22.8% 41 41

Financials 61% 15% 24% 4.8% 85 87

Health Care 82% 8% 10% 10.3% 49 55Health Care 82% 8% 10% 10.3% 49 55

Industrials 62% 10% 28% -0.7% 61 65

Materials 63% 4% 33% 7.2% 27 29

Technology 65% 11% 24% 5.9% 55 66

Telecom 80% 0% 20% 5.0% 5 5

Utilities 78% 4% 19% 8.5% 27 30

S&P 500 68% 9% 23% 6.3% 445 500

MAJOR INDEX VALUATION METRICS

Exhibit 11.

Last Trailing Trailing Forward Forward

Index Close Total P/E Total P/E

S&P500 2088 119.22 17.5 122.17 17.1

S&P400 1505.2 77.50 19.4 79.90 18.8

S&P600 706.18 33.48 21.1 36.32 19.4

Russell 2K 1225.5 42.67 28.7 51.15 24.0

4© 2015 Thomson Reuters. All marks herein are used under licence. TRPR_82201_20150508

5. THOMSON REUTERS PROPRIETARY RESEARCH MAY 8, 2015

DIRECTOR'S REPORT

QUARTERLY REPORTED RESULTS AND FUTURE EXPECTATIONS

Exhibit 12. Industry Analyst Estimates - S&P 500 Bottom Up ($/share)

Year 1Q 2Q 3Q 4Q CY

2004 15.87 16.74 16.59 17.83 67.10

2005 17.95 19.11 18.86 20.19 76.28

2006 20.73 22.31 22.60 22.44 88.18

2007 22.71 24.40 21.31 16.14 85.12

2008 18.96 19.78 17.49 5.62 65.47

2009 12.83 16.03 16.36 16.80 60.80

2010 19.71 21.48 21.75 22.55 85.28

2011 23.50 24.14 25.65 24.55 97.82

2012 25.60 25.84 26.00 26.32 103.80

2013 26.74 27.40 27.63 28.62 109.68

2014 28.18 30.07 30.04 30.54 118.78

2015 28.58 28.88 30.26 31.95 119.30

2016 31.09 32.93 34.45 36.23 134.02

2017 149.29

THE LATEST AVAILABLE CORPORATE PRE-ANNOUNCEMENTS

Exhibit 13. Pre-Announcements

2Q2015 2Q2015 2Q2014 2Q2014 1Q2015 1Q2015

Type Total # Total % Total # Total % Total # Total %

Positive 17 24.6% 22 23.4% 10 13.7%

In-Line 2 2.9% 10 10.6% 3 4.1%In Line 2 2.9% 10 10.6% 3 4.1%

Negative 50 72.5% 62 66.0% 60 82.2%

Total 69 94 73

N/P Ratio 2.9 2.8 6

5© 2015 Thomson Reuters. All marks herein are used under licence. TRPR_82201_20150508

6. THOMSON REUTERS PROPRIETARY RESEARCH MAY 8, 2015

DIRECTOR'S REPORT

ABOUT THOMSON REUTERS

IMPORTANT NOTICE

By accessing these materials, you hereby agree to the following:

These research reports and the information contained therein is for your internal use only and redistribution of this

information is expressly prohibited. These reports including the information and analysis, any opinion or recommendation

is not intended for investment purposes and does not constitute investment advice or an offer, or an invitation to make an

offer, to buy or sell any securities or any derivatives related to such securities.

Thomson Reuters does not warrant the accuracy of the reports for any particular purpose and expressly disclaims any

warranties of merchantability or fitness for a particular purpose; nor does Thomson Reuters guarantee the accuracy,

validity, timeliness or completeness of any information or data included in these reports for any particular purpose.

Thomson Reuters is under no obligation to provide you with any current or corrected information. Neither Thomson

Reuters nor any of its affiliates directors officers or employees will be liable or have any responsibility of any kind for any

Thomson Reuters is the world's leading source of intelligent information for businesses and professionals. We combine

industry expertise with innovative technology to deliver critical information to leading decision makers in the financial,

legal, tax and accounting, scientific, healthcare and media markets, powered by the world's most trusted news

organization. With headquarters in New York and major operations in London and Eagan, Minnesota, Thomson Reuters

employs more than 50,000 people in 93 countries. Thomson Reuters shares are listed on the New York Stock Exchange

(NYSE: TRI) and Toronto Stock Exchange (TSX: TRI). For more information, go to www.thomsonreuters.com.

This disclaimer is in addition to and not in replacement of any disclaimer of warranties and liabilities set forth in a written

agreement between Thomson Reuters and you or the party authorizing your access to the Service ("Contract

Disclaimer"). In the event of a conflict or inconsistency between this disclaimer and the Contract Disclaimer the terms of

the Contract Disclaimer shall control.

Reuters nor any of its affiliates, directors, officers or employees, will be liable or have any responsibility of any kind for any

loss or damage (whether direct, indirect, consequential, or any other damages of any kind even if Thomson Reuters was

advised of the possibility thereof) that you incur in connection with, relating to or arising out of these materials or the

analysis, views, recommendations, opinions or information contained therein, or from any other cause relating to your

access to, inability to access, or use of these materials, whether or not the circumstances giving rise to such cause may

have been within the control of Thomson Reuters.

The information provided in these materials is not intended for distribution to, or use by, any person or entity in any

jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject

Thomson Reuters or its affiliates to any registration requirement within such jurisdiction or country.

6© 2015 Thomson Reuters. All marks herein are used under licence. TRPR_82201_20150508