Corporates 2010

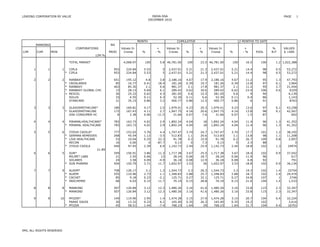

- 1. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 1 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% TOTAL MARKET 4,068.97 100 5.8 46,781.00 100 23.5 46,781.00 100 16.5 100 1.2 1,022,388 1 1 1 CIPLA 953 224.84 5.53 5 2,437.01 5.21 21.3 2,437.01 5.21 14.4 98 0.5 53,272 * CIPLA 953 224.84 5.53 5 2,437.01 5.21 21.3 2,437.01 5.21 14.4 98 0.5 53,272 2 2 2 RANBAXY* 651 195.12 4.8 3.8 2,186.16 4.67 17.9 2,186.16 4.67 11.2 95 1.3 47,793 * CROSLANDS 85 16.77 0.41 18.4 181.26 0.39 19.7 181.26 0.39 12.8 97 0.1 3,964 * RANBAXY 463 85.30 2.1 0.6 981.37 2.1 17.8 981.37 2.1 11.2 95 2.7 21,454 * RANBAXY GLOBAL CHC 13 28.13 0.69 6.1 289.42 0.62 30.6 289.42 0.62 23.4 106 0.6 6329 + REXCEL 26 25.22 0.62 4.3 281.05 0.6 15.5 281.05 0.6 9 94 6,139 SOLUS 33 4.55 0.11 6.3 52.30 0.11 6.6 52.30 0.11 0.4 86 1,143 STANCARE 31 35.15 0.86 3.2 400.77 0.86 12.5 400.77 0.86 6 91 8763 3 3 3 GLAXOSMITHKLINE* 180 169.81 4.17 2.5 1,979.41 4.23 20.3 1,979.41 4.23 13.6 97 0.1 43,258 * GLAXOSMITHKLINE 172 167.43 4.11 2.7 1,947.75 4.16 20.6 1,947.75 4.16 13.8 98 0.1 42,567 GSK CONSUMER HC 8 2.38 0.06 -11.5 31.66 0.07 7.6 31.66 0.07 1.5 87 692 4 4 4 PIRAMALHEALTHCARE* 783 163.73 4.02 2.9 1,892.24 4.04 18 1,892.24 4.04 11.4 96 1.3 41,352 * PIRAMAL HEALTHCARE 783 163.73 4.02 2.9 1,892.24 4.04 18 1,892.24 4.04 11.4 96 1.3 41,352 5 5 6 ZYDUS CADILA* 777 153.02 3.76 4.4 1,747.47 3.74 24.7 1,747.47 3.74 17.7 101 1.2 38,192 * GERMAN REMEDIES 268 45.54 1.12 -3.5 512.83 1.1 20.6 512.83 1.1 13.8 98 1.1 11,208 * LIVA HEALTHCARE 53 10.04 0.25 22.3 91.78 0.2 33.9 91.78 0.2 26.7 109 0.8 2,007 RECON 16 0.00 0 -87.7 0.13 0 7.3 0.13 0 2.3 88 3 * ZYDUS CADILA 440 97.45 2.39 6.9 1,142.73 2.44 25.9 1,142.73 2.44 18.8 102 1.3 24974 21.89 6 6 5 SUN* 549 156.91 3.86 11.3 1,717.38 3.67 25.5 1,717.38 3.67 18.4 102 0.9 37,542 MILMET LABS 21 2.55 0.06 13 28.24 0.06 18.7 28.24 0.06 11.9 96 617 SOLARES 24 3.58 0.09 -4.9 36.18 0.08 12.9 36.18 0.08 6.8 92 791 * SUN PHARMA 504 150.79 3.71 11.7 1,652.97 3.53 26 1,652.97 3.53 18.8 102 0.9 36,134 7 7 9 ALKEM* 708 126.17 3.1 1.3 1,544.73 3.3 26.3 1,544.73 3.3 19.3 102 1.4 33754 * ALKEM 555 110.96 2.73 1.1 1,348.83 2.88 25.7 1,348.83 2.88 18.7 102 1.4 29,474 * CACHET 85 9.18 0.23 -2.1 125.71 0.27 32.1 125.71 0.27 24.8 107 1 2746 * INDCHEMIE 68 6.03 0.15 11.7 70.19 0.15 28.8 70.19 0.15 21.6 104 1.4 1,533 8 8 8 MANKIND 507 126.84 3.12 12.3 1,480.26 3.16 41.6 1,480.26 3.16 33.8 115 2.3 32,347 * MANKIND 507 126.84 3.12 12.3 1,480.26 3.16 41.6 1,480.26 3.16 33.8 115 2.3 32,347 9 9 10 PFIZER* 149 119.90 2.95 1.4 1,474.28 3.15 27.9 1,474.28 3.15 20.7 104 0.4 32,224 PARKE DAVIS 30 13.32 0.33 6.1 165.40 0.35 26.3 165.40 0.35 19.2 102 3,614 * PFIZER 45 58.51 1.44 -7.4 768.23 1.64 29 768.23 1.64 21.7 104 0.4 16791 IMS, ALL RIGHTS RESERVED

- 2. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 2 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% PHARMACIA 25 8.01 0.2 -3.1 98.82 0.21 26.2 98.82 0.21 19.2 102 2,160 PHARMACIA HEALTH 13 6.08 0.15 11.8 62.10 0.13 28.3 62.10 0.13 21.2 104 1357 * WYETH LIMITED 36 33.99 0.84 17.8 379.73 0.81 26.7 379.73 0.81 19.4 103 0.8 8301 10 10 7 ABBOTT* 140 127.96 3.14 20.3 1,387.98 2.97 33.4 1,387.98 2.97 25.8 108 1 30,345 * ABBOTT 113 105.89 2.6 19.2 1,145.91 2.45 33 1,145.91 2.45 25.5 108 1.2 25,054 * SOLVAY PHARMA 27 22.07 0.54 25.9 242.07 0.52 34.9 242.07 0.52 27.2 109 0.1 5,291 38.15 11 11 11 LUPIN LIMITED 603 113.63 2.79 7.1 1,272.88 2.72 22.8 1,272.88 2.72 15.9 99 2.2 27818 * LUPIN LIMITED 603 113.63 2.79 7.1 1,272.88 2.72 22.8 1,272.88 2.72 15.9 99 2.2 27,818 12 12 15 ARISTO PHARMA* 253 88.74 2.18 -3.8 1,122.65 2.4 23.1 1,122.65 2.4 16.2 100 0.9 24,530 * ARISTO PHARMA 154 73.96 1.82 -4.1 940.08 2.01 23.8 940.08 2.01 16.9 100 0.8 20541 * GENETICA 99 14.77 0.36 -2.3 182.57 0.39 19.3 182.57 0.39 12.5 97 1.4 3,989 13 13 12 INTAS PHARMA* 773 96.64 2.38 25.3 1,022.38 2.19 39 1,022.38 2.19 31.2 113 1.6 22,350 ANDRE LABS 17 0.93 0.02 -2.3 10.94 0.02 8.2 10.94 0.02 2 88 239 * INTAS 756 95.71 2.35 25.6 1,011.44 2.16 39.5 1,011.44 2.16 31.7 113 1.6 22,111 14 14 13 DR REDDYS LABS 264 89.89 2.21 1.9 1,013.77 2.17 18.9 1,013.77 2.17 12.2 96 1 22149 * DR REDDYS LABS 264 89.89 2.21 1.9 1,013.77 2.17 18.9 1,013.77 2.17 12.2 96 1 22,149 15 15 16 SANOFI AVENTIS* 128 88.51 2.18 6.5 1,008.92 2.16 27.6 1,008.92 2.16 20.4 103 1.1 22053 * SANOFI AVENTIS 94 85.05 2.09 9.2 967.86 2.07 29.5 967.86 2.07 22.2 105 1.2 21,156 + SANOFI PASTEUR 18 3.27 0.08 -24 36.36 0.08 0.4 36.36 0.08 -5.2 81 795 + SHANTHA BIOTECH 16 0.18 0 -79.1 4.70 0.01 -34.4 4.70 0.01 -37.8 53 102 49.78 16 16 19 EMCURE* 437 81.58 2 13.9 952.02 2.04 26.2 952.02 2.04 19 102 1.8 20,805 * EMCURE 295 51.49 1.27 21 592.41 1.27 27.3 592.41 1.27 20 103 1.6 12,948 * ZUVENTUS PHARMA 142 30.08 0.74 3.4 359.61 0.77 24.3 359.61 0.77 17.4 101 2.3 7,857 17 17 14 MACLEODS PHARMA 282 88.86 2.18 31.7 941.05 2.01 47.6 941.05 2.01 39.4 120 3.1 20,574 * MACLEODS PHARMA 282 88.86 2.18 31.7 941.05 2.01 47.6 941.05 2.01 39.4 120 3.1 20574 18 18 18 TORRENT PHARMA 378 83.67 2.06 12.7 933.62 2 23 933.62 2 15.9 99 1.6 20,410 * TORRENT PHARMA 378 83.67 2.06 12.7 933.62 2 23 933.62 2 15.9 99 1.6 20410 19 19 17 WOCKHARDT-MERIND* 480 84.25 2.07 11.5 922.44 1.97 20.4 922.44 1.97 13.5 97 0.7 20,162 DUMEX 23 1.81 0.04 -12.4 25.93 0.06 51.9 25.93 0.06 43.7 123 567 + MERIND 72 15.24 0.37 -6.2 185.57 0.4 12.4 185.57 0.4 6 91 4056 * WOCKHARDT 385 67.20 1.65 17.4 710.94 1.52 21.7 710.94 1.52 14.7 98 0.9 15,540 20 20 20 ALEMBIC 356 75.09 1.85 -2.4 843.42 1.8 15.2 843.42 1.8 8.8 93 0.8 18430 IMS, ALL RIGHTS RESERVED

- 3. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 3 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% * ALEMBIC 356 75.09 1.85 -2.4 843.42 1.8 15.2 843.42 1.8 8.8 93 0.8 18,430 59.6 21 21 23 MICRO LABS* 654 72.63 1.78 4.5 817.39 1.75 18.4 817.39 1.75 11.8 96 1.3 17861 * BAL PHARMA 86 2.30 0.06 -17.5 27.54 0.06 -9.5 27.54 0.06 -14.6 73 0.3 602 * MICRO LABS 568 70.33 1.73 5.4 789.85 1.69 19.7 789.85 1.69 13 97 1.3 17,259 22 22 21 NOVARTIS INTL.* 202 74.09 1.82 6.6 806.42 1.72 24.8 806.42 1.72 17.7 101 0.2 17628 * NOVARTIS 103 65.80 1.62 8.3 708.84 1.52 27 708.84 1.52 19.8 103 0.2 15,496 * SANDOZ 99 8.29 0.2 -5.4 97.58 0.21 10.5 97.58 0.21 4.2 89 0.2 2,133 23 23 22 USV 171 73.17 1.8 17.2 787.81 1.68 29.4 787.81 1.68 22.1 105 0.7 17,220 * USV 171 73.17 1.8 17.2 787.81 1.68 29.4 787.81 1.68 22.1 105 0.7 17,220 24 24 26 FDC 213 58.36 1.43 -11.4 775.60 1.66 22.6 775.60 1.66 15.7 99 0.9 16949 * FDC 213 58.36 1.43 -11.4 775.60 1.66 22.6 775.60 1.66 15.7 99 0.9 16,949 25 25 24 GLENMARK PHARMA 240 68.22 1.68 15.5 718.92 1.54 31.4 718.92 1.54 24 106 2.3 15712 * GLENMARK PHARMA 240 68.22 1.68 15.5 718.92 1.54 31.4 718.92 1.54 24 106 2.3 15,712 67.95 26 26 25 UNICHEM* 275 60.82 1.49 6.9 702.75 1.5 23.3 702.75 1.5 16.3 100 0.9 15357 * UNICHEM 247 39.33 0.97 6.9 455.96 0.97 24.8 455.96 0.97 17.8 101 1.2 9,963 * UNISEARCH 28 21.48 0.53 7 246.80 0.53 20.5 246.80 0.53 13.6 97 0.3 5,394 27 27 27 IPCA LABS 211 50.92 1.25 1.7 675.53 1.44 29.6 675.53 1.44 22.4 105 1 14,757 * IPCA LABS 211 50.92 1.25 1.7 675.53 1.44 29.6 675.53 1.44 22.4 105 1 14,757 28 28 28 ELDER PHARMA 303 44.25 1.09 13.4 498.33 1.07 36.7 498.33 1.07 29.2 111 4.4 10,892 * ELDER PHARMA 303 44.25 1.09 13.4 498.33 1.07 36.7 498.33 1.07 29.2 111 4.4 10,892 29 29 29 FRANCO INDIAN 84 37.47 0.92 3.7 419.21 0.9 17.5 419.21 0.9 11 95 1.7 9,159 * FRANCO INDIAN 84 37.47 0.92 3.7 419.21 0.9 17.5 419.21 0.9 11 95 1.7 9,159 30 30 30 MERCK LIMITED 112 34.38 0.84 10 415.08 0.89 27.2 415.08 0.89 20 103 0.9 9,068 * MERCK LIMITED 112 34.38 0.84 10 415.08 0.89 27.2 415.08 0.89 20 103 0.9 9,068 73.74 31 31 33 CADILA PHARMA 398 31.63 0.78 -3.4 408.16 0.87 18.2 408.16 0.87 11.4 96 0.4 8,922 * CADILA PHARMA 398 31.63 0.78 -3.4 408.16 0.87 18.2 408.16 0.87 11.4 96 0.4 8,922 32 32 32 MSD PHARMACEUTICAL 80 32.86 0.81 -7.4 405.89 0.87 16.4 405.89 0.87 9.9 94 0.4 8,869 + FULFORD INDIA 30 10.92 0.27 -13.9 138.74 0.3 4.4 138.74 0.3 -1.5 85 3,031 * MSD PHARMACEUTICAL 10 10.24 0.25 7.3 123.36 0.26 68.5 123.36 0.26 59.8 137 1.5 2,696 + ORGANON 40 11.69 0.29 -11.9 143.79 0.31 0.8 143.79 0.31 -4.9 82 3142 IMS, ALL RIGHTS RESERVED

- 4. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 4 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 33 33 31 INDOCO* 309 33.56 0.82 -4.4 404.63 0.86 19 404.63 0.86 12.5 97 0.9 8,838 * INDOCO 264 27.19 0.67 -7.1 332.24 0.71 18.4 332.24 0.71 11.9 96 1 7,256 * WARREN 45 6.37 0.16 9 72.39 0.15 21.9 72.39 0.15 14.9 99 0.1 1582 34 34 34 HIMALAYA DRUG 108 31.10 0.76 6.4 366.92 0.78 21 366.92 0.78 14.1 98 0.3 8,020 * HIMALAYA DRUG 108 31.10 0.76 6.4 366.92 0.78 21 366.92 0.78 14.1 98 0.3 8020 35 35 35 ASTRAZENECA 57 26.58 0.65 8.6 273.49 0.58 20.8 273.49 0.58 14 98 0.9 5,979 * ASTRAZENECA 57 26.58 0.65 8.6 273.49 0.58 20.8 273.49 0.58 14 98 0.9 5979 77.72 36 36 36 BLUE CROSS 144 23.76 0.58 9.4 262.14 0.56 26 262.14 0.56 19.1 102 1.4 5,727 * BLUE CROSS 144 23.76 0.58 9.4 262.14 0.56 26 262.14 0.56 19.1 102 1.4 5727 37 37 37 UNIQUE PHARM 126 20.41 0.5 6.8 246.75 0.53 23.4 246.75 0.53 16.4 100 0.4 5,392 * UNIQUE PHARM 126 20.41 0.5 6.8 246.75 0.53 23.4 246.75 0.53 16.4 100 0.4 5392 38 38 39 BIOCHEM 293 19.02 0.47 0.8 231.38 0.49 28.2 231.38 0.49 21 104 0.4 5,058 * BIOCHEM 293 19.02 0.47 0.8 231.38 0.49 28.2 231.38 0.49 21 104 0.4 5058 39 39 41 MEDLEY PHARMA 246 17.11 0.42 -1.3 228.78 0.49 29.6 228.78 0.49 22.4 105 0.5 4,998 * MEDLEY PHARMA 246 17.11 0.42 -1.3 228.78 0.49 29.6 228.78 0.49 22.4 105 0.5 4998 40 40 38 WIN MEDICARE 59 19.49 0.48 9.7 220.54 0.47 32.9 220.54 0.47 25.5 108 0.1 4,819 * WIN MEDICARE 59 19.49 0.48 9.7 220.54 0.47 32.9 220.54 0.47 25.5 108 0.1 4819 80.26 41 41 42 RAPTAKOS BRETT 62 16.82 0.41 4.2 218.03 0.47 18.8 218.03 0.47 12 96 4,764 RAPTAKOS BRETT 62 16.82 0.41 4.2 218.03 0.47 18.8 218.03 0.47 12 96 4764 42 42 40 WALLACE 104 17.70 0.44 11.7 210.69 0.45 29 210.69 0.45 21.6 104 1.4 4,604 * WALLACE 104 17.70 0.44 11.7 210.69 0.45 29 210.69 0.45 21.6 104 1.4 4604 43 43 45 SHREYA LIFE SCIENC 222 15.22 0.37 -10.3 197.40 0.42 6 197.40 0.42 0 86 0.4 4,312 * PLETHICO 128 7.33 0.18 -17.3 95.95 0.21 3.9 95.95 0.21 -1.8 84 0.7 2096 * SHREYA LIFESCIENCE 94 7.89 0.19 -2.7 101.45 0.22 8 101.45 0.22 1.8 87 0 2,217 44 44 43 JANSSEN-CILAG 40 16.41 0.4 10.3 190.12 0.41 25.4 190.12 0.41 18.3 102 1.6 4,155 * JANSSEN-CILAG 40 16.41 0.4 10.3 190.12 0.41 25.4 190.12 0.41 18.3 102 1.6 4155 45 45 52 WANBURY 82 12.76 0.31 -20.1 186.39 0.4 19.5 186.39 0.4 12.9 97 3.9 4,072 * WANBURY 82 12.76 0.31 -20.1 186.39 0.4 19.5 186.39 0.4 12.9 97 3.9 4072 82.4 46 46 50 MANEESH PHARMA* 202 13.62 0.33 -4.4 175.60 0.38 13 175.60 0.38 6.7 92 0.3 3,836 + MANEESH HEALTHCARE 72 2.91 0.07 -13.7 37.07 0.08 3.3 37.07 0.08 -2.5 84 810 IMS, ALL RIGHTS RESERVED

- 5. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 5 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% SMYLE 2 0.06 0 -40.5 1.11 0 -6.4 1.11 0 -11.5 76 24 * SVIZERA HEALTHCARE 128 10.65 0.26 -1.1 137.42 0.29 16.2 137.42 0.29 9.7 94 0.4 3,002 47 47 46 PANACEA BIOTEC 146 15.06 0.37 1.7 173.94 0.37 14.6 173.94 0.37 8.1 93 1.3 3,801 * PANACEA BIOTEC 146 15.06 0.37 1.7 173.94 0.37 14.6 173.94 0.37 8.1 93 1.3 3,801 48 48 44 HETERO HEALTHCARE* 118 15.96 0.39 12.9 173.39 0.37 23.5 173.39 0.37 16.7 100 4 3,788 * GENIX 48 6.41 0.16 31.1 65.79 0.14 40.9 65.79 0.14 33.1 114 2.4 1437 * HETERO HEALTHCARE 70 9.56 0.23 3.2 107.60 0.23 14.8 107.60 0.23 8.5 93 5.1 2,350 49 49 47 MEYER ORGANICS 110 14.54 0.36 15.8 167.82 0.36 33.1 167.82 0.36 25.7 108 1.6 3,667 * MEYER ORGANICS 110 14.54 0.36 15.8 167.82 0.36 33.1 167.82 0.36 25.7 108 1.6 3,667 50 50 49 APEX 72 13.78 0.34 5.7 163.53 0.35 21.1 163.53 0.35 14.4 98 0 3,573 * APEX 72 13.78 0.34 5.7 163.53 0.35 21.1 163.53 0.35 14.4 98 0 3573 84.23 51 51 54 ALBERT DAVID 72 12.39 0.3 14.8 156.19 0.33 21.6 156.19 0.33 14.6 98 0.6 3,414 * ALBERT DAVID 72 12.39 0.3 14.8 156.19 0.33 21.6 156.19 0.33 14.6 98 0.6 3414 52 52 51 SYSTOPIC 104 13.01 0.32 15.9 147.51 0.32 32.8 147.51 0.32 25.2 107 1.2 3,224 * SYSTOPIC 104 13.01 0.32 15.9 147.51 0.32 32.8 147.51 0.32 25.2 107 1.2 3,224 53 53 48 CENTAUR 114 13.85 0.34 -2.1 144.16 0.31 17.6 144.16 0.31 11.2 95 0.7 3149 * CENTAUR 114 13.85 0.34 -2.1 144.16 0.31 17.6 144.16 0.31 11.2 95 0.7 3,149 54 54 60 GENO 56 11.21 0.28 2.6 141.80 0.3 38.4 141.80 0.3 30.7 112 1 3098 * GENO 56 11.21 0.28 2.6 141.80 0.3 38.4 141.80 0.3 30.7 112 1 3,098 55 55 55 DABUR 372 12.25 0.3 -19.5 141.13 0.3 -11.5 141.13 0.3 -16.6 72 0.1 3085 * DABUR 372 12.25 0.3 -19.5 141.13 0.3 -11.5 141.13 0.3 -16.6 72 0.1 3,085 85.79 56 56 53 FOURTS INDIA 122 12.56 0.31 13.1 140.43 0.3 22.5 140.43 0.3 15.5 99 1.4 3069 * FOURTS INDIA 122 12.56 0.31 13.1 140.43 0.3 22.5 140.43 0.3 15.5 99 1.4 3,069 57 57 61 IND-SWIFT 453 10.83 0.27 -17.4 138.94 0.3 4.9 138.94 0.3 -1 85 0.9 3036 * IND-SWIFT 453 10.83 0.27 -17.4 138.94 0.3 4.9 138.94 0.3 -1 85 0.9 3,036 58 58 64 BESTOCHEM 147 9.99 0.25 -2.9 134.46 0.29 22.8 134.46 0.29 15.9 99 2.3 2937 * BESTOCHEM 147 9.99 0.25 -2.9 134.46 0.29 22.8 134.46 0.29 15.9 99 2.3 2,937 59 59 57 ELI LILLY 22 11.76 0.29 8.4 129.38 0.28 23.7 129.38 0.28 16.7 100 0 2828 * ELI LILLY 22 11.76 0.29 8.4 129.38 0.28 23.7 129.38 0.28 16.7 100 0 2,828 IMS, ALL RIGHTS RESERVED

- 6. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 6 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 60 60 63 ALLERGAN 43 10.35 0.25 15.7 123.49 0.26 37.1 123.49 0.26 29.3 111 4.7 2700 * ALLERGAN 43 10.35 0.25 15.7 123.49 0.26 37.1 123.49 0.26 29.3 111 4.7 2,700 87.22 61 61 56 HEGDE & HEGDE 46 11.88 0.29 19.4 122.92 0.26 35.8 122.92 0.26 28.4 110 2687 HEGDE & HEGDE 46 11.88 0.29 19.4 122.92 0.26 35.8 122.92 0.26 28.4 110 2,687 62 62 58 AJANTA PHARMA 147 11.51 0.28 13.3 122.74 0.26 19.2 122.74 0.26 12.3 96 2.9 2684 * AJANTA PHARMA 147 11.51 0.28 13.3 122.74 0.26 19.2 122.74 0.26 12.3 96 2.9 2,684 63 63 67 CFL 98 9.52 0.23 -5.9 121.28 0.26 5.1 121.28 0.26 -1 85 0.4 2650 * CFL 98 9.52 0.23 -5.9 121.28 0.26 5.1 121.28 0.26 -1 85 0.4 2,650 64 64 65 CHARAK PHARMA 60 9.93 0.24 -0.1 121.00 0.26 15.6 121.00 0.26 9.1 94 0 2643 * CHARAK PHARMA 60 9.93 0.24 -0.1 121.00 0.26 15.6 121.00 0.26 9.1 94 0 2,643 65 65 59 ORCHID CHEM&PHARM* 172 11.29 0.28 9.5 120.76 0.26 17.7 120.76 0.26 11 95 1.2 2639 * ORCHID CHEM&PHARMA 172 11.29 0.28 9.5 120.76 0.26 17.7 120.76 0.26 11 95 1.2 2,639 88.52 66 66 66 MODI MUNDIPHARMA 31 9.84 0.24 -11.8 116.37 0.25 10.8 116.37 0.25 4.5 90 0.1 2543 * MODI MUNDIPHARMA 31 9.84 0.24 -11.8 116.37 0.25 10.8 116.37 0.25 4.5 90 0.1 2,543 67 67 73 EAST INDIA 34 7.69 0.19 0 105.85 0.23 27.7 105.85 0.23 20.4 103 0 2313 * EAST INDIA 34 7.69 0.19 0 105.85 0.23 27.7 105.85 0.23 20.4 103 0 2,313 68 68 69 JAGSON PAL 88 8.51 0.21 -7.4 103.52 0.22 17 103.52 0.22 10.3 95 2262 + JAGSON PAL 88 8.51 0.21 -7.4 103.52 0.22 17 103.52 0.22 10.3 95 2,262 69 69 62 BAIDYANATH 333 10.37 0.25 3.7 102.81 0.22 23.9 102.81 0.22 17.2 101 0 2248 * BAIDYANATH 333 10.37 0.25 3.7 102.81 0.22 23.9 102.81 0.22 17.2 101 0 2,248 70 70 70 SERDIA 11 8.36 0.21 9.9 97.76 0.21 31.6 97.76 0.21 24.1 107 2136 + SERDIA 11 8.36 0.21 9.9 97.76 0.21 31.6 97.76 0.21 24.1 107 2,136 89.64 71 71 68 UNIVERSAL 56 8.74 0.21 8.7 96.47 0.21 14.8 96.47 0.21 8.2 93 0.3 2108 * UNIVERSAL 56 8.74 0.21 8.7 96.47 0.21 14.8 96.47 0.21 8.2 93 0.3 2,108 72 72 72 BIOLOGICAL E 65 7.75 0.19 -11.9 95.34 0.2 6.9 95.34 0.2 0.9 87 0.5 2083 * BIOLOGICAL E 65 7.75 0.19 -11.9 95.34 0.2 6.9 95.34 0.2 0.9 87 0.5 2,083 73 73 71 UCB PHARMA 19 7.95 0.2 10.6 83.16 0.18 22.4 83.16 0.18 15.6 99 4 1818 * UCB PHARMA 19 7.95 0.2 10.6 83.16 0.18 22.4 83.16 0.18 15.6 99 4 1,818 74 74 74 BIOCON 50 7.53 0.18 19.5 82.74 0.18 25.2 82.74 0.18 18 101 3.6 1808 IMS, ALL RIGHTS RESERVED

- 7. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 7 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% * BIOCON 50 7.53 0.18 19.5 82.74 0.18 25.2 82.74 0.18 18 101 3.6 1,808 75 75 90 DEY S 46 5.29 0.13 -8.9 80.64 0.17 12.6 80.64 0.17 6.2 91 0.7 1762 * DEY S 46 5.29 0.13 -8.9 80.64 0.17 12.6 80.64 0.17 6.2 91 0.7 1,762 90.58 76 76 79 TABLETS INDIA 84 6.62 0.16 -6 77.61 0.17 24.1 77.61 0.17 17.3 101 0.4 1696 * TABLETS INDIA 84 6.62 0.16 -6 77.61 0.17 24.1 77.61 0.17 17.3 101 0.4 1,696 77 77 76 SERUM INSTITUTE 66 7.01 0.17 19.5 77.03 0.16 18.7 77.03 0.16 12 96 2 1683 * SERUM INSTITUTE 66 7.01 0.17 19.5 77.03 0.16 18.7 77.03 0.16 12 96 2 1,683 78 78 83 JOHNSON & JOHNSON 48 6.08 0.15 -18.5 75.90 0.16 5.4 75.90 0.16 -0.5 85 1659 + JOHNSON & JOHNSON 48 6.08 0.15 -18.5 75.90 0.16 5.4 75.90 0.16 -0.5 85 1,659 79 79 78 TTK HEALTHCARE LTD 81 6.67 0.16 10.3 74.77 0.16 24.3 74.77 0.16 17.2 101 1.8 1634 * TTK HEALTHCARE LTD 81 6.67 0.16 10.3 74.77 0.16 24.3 74.77 0.16 17.2 101 1.8 1,634 80 80 77 PHARMED 68 6.81 0.17 28.9 74.73 0.16 34 74.73 0.16 26.4 108 4.5 1633 * PHARMED 68 6.81 0.17 28.9 74.73 0.16 34 74.73 0.16 26.4 108 4.5 1,633 91.39 81 81 75 PARAS PHARMA 27 7.13 0.18 0.5 74.62 0.16 3.2 74.62 0.16 -2.5 84 0.1 1630 * PARAS PHARMA 27 7.13 0.18 0.5 74.62 0.16 3.2 74.62 0.16 -2.5 84 0.1 1,630 82 82 82 TROIKAA PHARMA 144 6.37 0.16 8.4 74.52 0.16 40 74.52 0.16 32.3 114 5.2 1628 * TROIKAA PHARMA 144 6.37 0.16 8.4 74.52 0.16 40 74.52 0.16 32.3 114 5.2 1,628 83 83 88 WALTER BUSHNELL 22 5.52 0.14 -0.4 71.98 0.15 16.4 71.98 0.15 9.8 94 1573 WALTER BUSHNELL 22 5.52 0.14 -0.4 71.98 0.15 16.4 71.98 0.15 9.8 94 1,573 84 84 87 ANGLO FRENCH DRUGS 91 5.63 0.14 -14.9 71.89 0.15 9.6 71.89 0.15 3.4 89 0.5 1571 * ANGLO FRENCH DRUGS 91 5.63 0.14 -14.9 71.89 0.15 9.6 71.89 0.15 3.4 89 0.5 1,571 85 85 80 RPG LIFE SCIENCES 186 6.58 0.16 31.4 70.64 0.15 21.5 70.64 0.15 14.4 98 2.2 1544 * RPG LIFE SCIENCES 186 6.58 0.16 31.4 70.64 0.15 21.5 70.64 0.15 14.4 98 2.2 1,544 92.17 86 86 86 BAYER PHARMA LTD. 23 5.86 0.14 -11.3 68.57 0.15 -0.4 68.57 0.15 -6 81 0.9 1498 * BAYER PHARMA LTD. 23 5.86 0.14 -11.3 68.57 0.15 -0.4 68.57 0.15 -6 81 0.9 1,498 87 87 81 NATCO PHARMA 117 6.57 0.16 2.4 66.09 0.14 7 66.09 0.14 0.8 86 3.4 1447 * NATCO PHARMA 117 6.57 0.16 2.4 66.09 0.14 7 66.09 0.14 0.8 86 3.4 1,447 88 88 84 BRITISH BIOLOGICAL 17 6.04 0.15 19.9 66.03 0.14 26 66.03 0.14 18.8 102 0.2 1443 * BRITISH BIOLOGICAL 17 6.04 0.15 19.9 66.03 0.14 26 66.03 0.14 18.8 102 0.2 1,443 IMS, ALL RIGHTS RESERVED

- 8. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 8 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 89 89 93 OZONE 78 4.89 0.12 -6.4 60.40 0.13 10.8 60.40 0.13 4.5 90 1320 + OZONE 78 4.89 0.12 -6.4 60.40 0.13 10.8 60.40 0.13 4.5 90 1,320 90 90 92 BHARAT SERUM 44 5.02 0.12 -7.4 58.51 0.13 8.9 58.51 0.13 2.6 88 1.4 1279 * BHARAT SERUM 44 5.02 0.12 -7.4 58.51 0.13 8.9 58.51 0.13 2.6 88 1.4 1,279 92.85 91 91 94 VERITAZ HEALTHCARE 87 4.77 0.12 11.8 55.38 0.12 33 55.38 0.12 25.8 108 4.4 1209 * VERITAZ HEALTHCARE 87 4.77 0.12 11.8 55.38 0.12 33 55.38 0.12 25.8 108 4.4 1,209 92 92 97 COMED CHEMICALS 93 4.38 0.11 -7.7 54.81 0.12 12 54.81 0.12 5.6 91 1197 + COMED CHEMICALS 93 4.38 0.11 -7.7 54.81 0.12 12 54.81 0.12 5.6 91 1,197 93 93 95 MAPRA LABS 61 4.68 0.12 2.8 54.59 0.12 5.6 54.59 0.12 -0.6 85 1193 + MAPRA LABS 61 4.68 0.12 2.8 54.59 0.12 5.6 54.59 0.12 -0.6 85 1,193 94 94 89 GALDERMA 14 5.31 0.13 11.2 51.71 0.11 29.4 51.71 0.11 22.2 105 1130 + GALDERMA 14 5.31 0.13 11.2 51.71 0.11 29.4 51.71 0.11 22.2 105 1,130 95 95 96 OVERSEAS 63 4.40 0.11 4.5 51.52 0.11 54.8 51.52 0.11 46.7 126 3 1126 * OVERSEAS 63 4.40 0.11 4.5 51.52 0.11 54.8 51.52 0.11 46.7 126 3 1,126 93.42 96 96 109 LABORATE PHARMA 140 3.48 0.09 -22.5 51.38 0.11 5.5 51.38 0.11 -0.5 85 3.1 1122 * LABORATE PHARMA 140 3.48 0.09 -22.5 51.38 0.11 5.5 51.38 0.11 -0.5 85 3.1 1,122 97 97 100 JENBURKT 57 4.15 0.1 -9 51.35 0.11 14.8 51.35 0.11 8.4 93 1122 + JENBURKT 57 4.15 0.1 -9 51.35 0.11 14.8 51.35 0.11 8.4 93 1,122 98 98 105 KHANDELWAL 141 3.88 0.1 -17.7 51.27 0.11 2.2 51.27 0.11 -3.5 83 0.4 1120 * KHANDELWAL 141 3.88 0.1 -17.7 51.27 0.11 2.2 51.27 0.11 -3.5 83 0.4 1,120 99 99 102 JUGGAT PHARMA 33 3.97 0.1 7.6 50.88 0.11 17.5 50.88 0.11 10.8 95 1112 + JUGGAT PHARMA 33 3.97 0.1 7.6 50.88 0.11 17.5 50.88 0.11 10.8 95 1,112 100 100 91 GRANDIX 126 5.29 0.13 -1.3 50.70 0.11 -5.5 50.70 0.11 -10.8 77 1108 + GRANDIX 126 5.29 0.13 -1.3 50.70 0.11 -5.5 50.70 0.11 -10.8 77 1,108 93.97 101 101 111 AGLOWMED 60 3.42 0.08 -15.1 48.94 0.1 0.5 48.94 0.1 -5.1 81 1069 + AGLOWMED 60 3.42 0.08 -15.1 48.94 0.1 0.5 48.94 0.1 -5.1 81 1,069 102 102 101 THEMIS MEDICARE 77 4.08 0.1 -3.1 48.07 0.1 18.6 48.07 0.1 12 96 0.2 1051 * THEMIS MEDICARE 77 4.08 0.1 -3.1 48.07 0.1 18.6 48.07 0.1 12 96 0.2 1,051 IMS, ALL RIGHTS RESERVED

- 9. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 9 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 103 103 107 DWD PHARMACEUTICAL 72 3.76 0.09 -13 47.27 0.1 3.4 47.27 0.1 -2.3 84 2.9 1032 * DWD PHARMACEUTICAL 72 3.76 0.09 -13 47.27 0.1 3.4 47.27 0.1 -2.3 84 2.9 1,032 104 104 120 CLARIS LIFESCIENCE 66 2.89 0.07 4.4 46.88 0.1 16 46.88 0.1 9.4 94 0.5 1024 * CLARIS LIFESCIENCE 66 2.89 0.07 4.4 46.88 0.1 16 46.88 0.1 9.4 94 0.5 1,024 105 105 85 ERIS LIFE SCIENCES 55 6.01 0.15 165 46.64 0.1 301 46.64 0.1 285.4 331 12.1 1020 * ERIS LIFE SCIENCES 55 6.01 0.15 165 46.64 0.1 301 46.64 0.1 285.4 331 12.1 1,020 94.48 106 106 99 ALCON 15 4.21 0.1 29.7 45.91 0.1 45.3 45.91 0.1 37.1 118 1003 + ALCON 15 4.21 0.1 29.7 45.91 0.1 45.3 45.91 0.1 37.1 118 1,003 107 107 104 ICPA HEALTH 24 3.91 0.1 0.6 45.88 0.1 16.9 45.88 0.1 10.3 95 1003 ICPA HEALTH 24 3.91 0.1 0.6 45.88 0.1 16.9 45.88 0.1 10.3 95 1,003 108 108 98 ZANDU PHARMA 135 4.34 0.11 -10.6 45.37 0.1 -4 45.37 0.1 -9.3 78 991 ZANDU PHARMA 135 4.34 0.11 -10.6 45.37 0.1 -4 45.37 0.1 -9.3 78 991 109 109 119 HEINZ 5 2.90 0.07 9.2 44.59 0.1 21.3 44.59 0.1 13.8 98 975 HEINZ 5 2.90 0.07 9.2 44.59 0.1 21.3 44.59 0.1 13.8 98 975 110 110 110 TORQUE PHARMA 93 3.48 0.09 -27.2 43.40 0.09 8.6 43.40 0.09 2.6 88 0.3 949 * TORQUE PHARMA 93 3.48 0.09 -27.2 43.40 0.09 8.6 43.40 0.09 2.6 88 0.3 949 94.96 111 111 103 UNISON PHARMA 41 3.91 0.1 25.9 41.56 0.09 47.3 41.56 0.09 39.2 120 0.2 908 * UNISON PHARMA 41 3.91 0.1 25.9 41.56 0.09 47.3 41.56 0.09 39.2 120 0.2 908 112 112 108 NEON LABS 77 3.49 0.09 -2.1 41.22 0.09 30.5 41.22 0.09 23.4 106 0.4 900 * NEON LABS 77 3.49 0.09 -2.1 41.22 0.09 30.5 41.22 0.09 23.4 106 0.4 900 113 113 114 UNIMARCK PHARMA 89 3.33 0.08 -4.2 39.67 0.08 18.8 39.67 0.08 12 96 1 867 * UNIMARCK PHARMA 89 3.33 0.08 -4.2 39.67 0.08 18.8 39.67 0.08 12 96 1 867 114 114 113 AIMIL 23 3.41 0.08 5.3 39.43 0.08 27.6 39.43 0.08 20.4 103 862 AIMIL 23 3.41 0.08 5.3 39.43 0.08 27.6 39.43 0.08 20.4 103 862 115 115 106 PALSON DRUG 75 3.76 0.09 11.7 38.81 0.08 19.8 38.81 0.08 13.1 97 1.4 848 * PALSON DRUG 75 3.76 0.09 11.7 38.81 0.08 19.8 38.81 0.08 13.1 97 1.4 848 95.39 116 116 122 UNI SANKYO 49 2.83 0.07 7.5 38.53 0.08 31.2 38.53 0.08 23.6 106 0.4 841 * UNI SANKYO 49 2.83 0.07 7.5 38.53 0.08 31.2 38.53 0.08 23.6 106 0.4 841 117 117 112 PSYCHOTROPICS 202 3.41 0.08 5.2 37.33 0.08 10.4 37.33 0.08 4 89 0.8 816 IMS, ALL RIGHTS RESERVED

- 10. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 10 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% * PSYCHOTROPICS 202 3.41 0.08 5.2 37.33 0.08 10.4 37.33 0.08 4 89 0.8 816 118 118 115 ORDAIN HEALTHCARE 73 3.19 0.08 12.1 36.06 0.08 41.2 36.06 0.08 33.4 114 2.4 788 * ORDAIN HEALTHCARE 73 3.19 0.08 12.1 36.06 0.08 41.2 36.06 0.08 33.4 114 2.4 788 119 119 121 SHINE PHARMA 92 2.89 0.07 5.1 35.26 0.08 30 35.26 0.08 22.7 105 0.2 770 * SHINE PHARMA 92 2.89 0.07 5.1 35.26 0.08 30 35.26 0.08 22.7 105 0.2 770 120 120 117 INDI PHARMA 35 2.96 0.07 1.1 34.38 0.07 10.3 34.38 0.07 4.3 89 0 751 * INDI PHARMA 35 2.96 0.07 1.1 34.38 0.07 10.3 34.38 0.07 4.3 89 0 751 95.78 121 121 116 GROUP 54 3.09 0.08 4 34.33 0.07 18.1 34.33 0.07 11.5 96 0.2 750 * GROUP 54 3.09 0.08 4 34.33 0.07 18.1 34.33 0.07 11.5 96 0.2 750 122 122 118 OBSURGE BIOTECH 69 2.96 0.07 10.2 34.09 0.07 10.5 34.09 0.07 4 89 4.6 745 * OBSURGE BIOTECH 69 2.96 0.07 10.2 34.09 0.07 10.5 34.09 0.07 4 89 4.6 745 123 123 124 RELIANCE 101 2.73 0.07 49 31.51 0.07 130.6 31.51 0.07 119.3 188 4.3 689 * RELIANCE 101 2.73 0.07 49 31.51 0.07 130.6 31.51 0.07 119.3 188 4.3 689 124 124 136 RECKITT BENCKISER 12 2.26 0.06 -11.7 31.19 0.07 -7.1 31.19 0.07 -12.5 75 681 RECKITT BENCKISER 12 2.26 0.06 -11.7 31.19 0.07 -7.1 31.19 0.07 -12.5 75 681 125 125 126 GALPHA LABS 96 2.67 0.07 10.7 30.86 0.07 14.5 30.86 0.07 8 93 0.9 675 * GALPHA LABS 96 2.67 0.07 10.7 30.86 0.07 14.5 30.86 0.07 8 93 0.9 675 96.12 126 126 127 LUNDBECK 6 2.65 0.07 9.2 30.59 0.07 9.7 30.59 0.07 3.3 89 669 + LUNDBECK 6 2.65 0.07 9.2 30.59 0.07 9.7 30.59 0.07 3.3 89 669 127 127 123 TALENT 92 2.79 0.07 10.1 30.25 0.06 15 30.25 0.06 8.3 93 4 661 * TALENT 92 2.79 0.07 10.1 30.25 0.06 15 30.25 0.06 8.3 93 4 661 128 128 125 SHALAKS PHARMA 100 2.67 0.07 3 30.21 0.06 9.9 30.21 0.06 3.5 89 1.8 660 * SHALAKS PHARMA 100 2.67 0.07 3 30.21 0.06 9.9 30.21 0.06 3.5 89 1.8 660 129 129 131 CONCEPT PHARMA 95 2.41 0.06 -5.9 29.73 0.06 16.6 29.73 0.06 10.2 95 0.1 649 * CONCEPT PHARMA 95 2.41 0.06 -5.9 29.73 0.06 16.6 29.73 0.06 10.2 95 0.1 649 130 130 134 VHB LIFESCIENCES 100 2.35 0.06 -16.9 29.59 0.06 13.7 29.59 0.06 7.4 92 1.2 646 * VHB LIFESCIENCES 100 2.35 0.06 -16.9 29.59 0.06 13.7 29.59 0.06 7.4 92 1.2 646 96.45 131 131 139 ELAN PHARMA 32 2.19 0.05 -3.6 28.32 0.06 18.3 28.32 0.06 11.7 96 0.6 619 * ELAN PHARMA 32 2.19 0.05 -3.6 28.32 0.06 18.3 28.32 0.06 11.7 96 0.6 619 IMS, ALL RIGHTS RESERVED

- 11. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 11 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 132 132 135 SUNWAYS 88 2.33 0.06 -9.2 27.65 0.06 11.2 27.65 0.06 4.8 90 2.7 604 * SUNWAYS 88 2.33 0.06 -9.2 27.65 0.06 11.2 27.65 0.06 4.8 90 2.7 604 133 133 140 KARNATAKA ANTIBIOT 62 2.14 0.05 -3.8 27.61 0.06 31.4 27.61 0.06 24.2 107 603 + KARNATAKA ANTIBIOT 62 2.14 0.05 -3.8 27.61 0.06 31.4 27.61 0.06 24.2 107 603 134 134 133 YASH PHARMA 65 2.40 0.06 4.8 27.56 0.06 32 27.56 0.06 24.8 107 602 + YASH PHARMA 65 2.40 0.06 4.8 27.56 0.06 32 27.56 0.06 24.8 107 602 135 135 143 LINCOLN PHARMA 198 2.02 0.05 -8.3 27.32 0.06 12.2 27.32 0.06 6 91 4.8 597 * LINCOLN PHARMA 198 2.02 0.05 -8.3 27.32 0.06 12.2 27.32 0.06 6 91 4.8 597 96.74 136 136 129 MOLEKULE INDIA 52 2.47 0.06 14.5 26.96 0.06 54.5 26.96 0.06 46.5 126 0.8 589 * MOLEKULE INDIA 52 2.47 0.06 14.5 26.96 0.06 54.5 26.96 0.06 46.5 126 0.8 589 137 137 132 WINGS PHARMA 47 2.40 0.06 21.9 26.84 0.06 29.8 26.84 0.06 22.5 105 587 WINGS PHARMA 47 2.40 0.06 21.9 26.84 0.06 29.8 26.84 0.06 22.5 105 587 138 138 130 STRESSENBURG 17 2.42 0.06 24.9 26.21 0.06 25.1 26.21 0.06 18.2 101 0.8 573 * STRESSENBURG 17 2.42 0.06 24.9 26.21 0.06 25.1 26.21 0.06 18.2 101 0.8 573 139 139 142 BAXTER 20 2.07 0.05 -4.4 25.69 0.05 -8.3 25.69 0.05 -13.7 74 561 + BAXTER 20 2.07 0.05 -4.4 25.69 0.05 -8.3 25.69 0.05 -13.7 74 561 140 140 141 BENNET PHARMA 21 2.09 0.05 15.8 25.65 0.05 27.9 25.65 0.05 20.7 104 561 + BENNET PHARMA 21 2.09 0.05 15.8 25.65 0.05 27.9 25.65 0.05 20.7 104 561 97.02 141 141 137 EISAI PHARMA 8 2.25 0.06 14.3 25.16 0.05 26.9 25.16 0.05 19.8 103 7.5 550 * EISAI PHARMA 8 2.25 0.06 14.3 25.16 0.05 26.9 25.16 0.05 19.8 103 7.5 550 142 142 147 PARENTERAL DRUGS 84 1.87 0.05 -6.5 25.15 0.05 13.2 25.15 0.05 6.8 92 0.7 549 * PARENTERAL DRUGS 84 1.87 0.05 -6.5 25.15 0.05 13.2 25.15 0.05 6.8 92 0.7 549 143 143 128 SAMARTH PHARMA 80 2.63 0.06 57.6 24.35 0.05 73.3 24.35 0.05 63.7 141 2.3 532 * SAMARTH PHARMA 80 2.63 0.06 57.6 24.35 0.05 73.3 24.35 0.05 63.7 141 2.3 532 144 144 146 MEDO PHARMA 49 1.91 0.05 2.9 22.60 0.05 36.4 22.60 0.05 29.3 111 493 + MEDO PHARMA 49 1.91 0.05 2.9 22.60 0.05 36.4 22.60 0.05 29.3 111 493 145 145 155 SEAGULL LABS 211 1.59 0.04 -35.5 22.34 0.05 23.4 22.34 0.05 17 100 5.9 488 * SEAGULL LABS 211 1.59 0.04 -35.5 22.34 0.05 23.4 22.34 0.05 17 100 5.9 488 97.28 IMS, ALL RIGHTS RESERVED

- 12. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 12 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 146 146 145 HELIOS 88 1.96 0.05 12.2 20.81 0.04 36 20.81 0.04 28.6 110 3.1 454 * HELIOS 88 1.96 0.05 12.2 20.81 0.04 36 20.81 0.04 28.6 110 3.1 454 147 147 150 MOREPEN LABS 97 1.82 0.04 -0.2 20.55 0.04 13.9 20.55 0.04 7.6 92 1.5 449 * MOREPEN LABS 97 1.82 0.04 -0.2 20.55 0.04 13.9 20.55 0.04 7.6 92 1.5 449 148 148 138 AMRUTANJAN 10 2.19 0.05 -4.9 20.54 0.04 -6.3 20.54 0.04 -11.6 76 449 AMRUTANJAN 10 2.19 0.05 -4.9 20.54 0.04 -6.3 20.54 0.04 -11.6 76 449 149 149 158 STADMED PRIVATE 49 1.49 0.04 6.8 20.08 0.04 14.3 20.08 0.04 7.9 93 439 + STADMED PRIVATE 49 1.49 0.04 6.8 20.08 0.04 14.3 20.08 0.04 7.9 93 439 150 150 148 LEBEN LABS 41 1.86 0.05 59.2 19.69 0.04 37.3 19.69 0.04 29.8 111 430 LEBEN LABS 41 1.86 0.05 59.2 19.69 0.04 37.3 19.69 0.04 29.8 111 430 97.49 151 151 149 SH PHARMA 31 1.83 0.04 -4.3 19.64 0.04 12.1 19.64 0.04 6 91 5 429 * SH PHARMA 31 1.83 0.04 -4.3 19.64 0.04 12.1 19.64 0.04 6 91 5 429 152 152 165 ESKAG PHARMA 24 1.34 0.03 -23.3 19.38 0.04 20.9 19.38 0.04 14.3 98 423 + ESKAG PHARMA 24 1.34 0.03 -23.3 19.38 0.04 20.9 19.38 0.04 14.3 98 423 153 153 159 FRESENIUS KABI 27 1.47 0.04 7 19.13 0.04 1.1 19.13 0.04 -4.8 82 0.3 418 * FRESENIUS KABI 27 1.47 0.04 7 19.13 0.04 1.1 19.13 0.04 -4.8 82 0.3 418 154 154 156 VANGUARD 35 1.56 0.04 -2.5 18.60 0.04 4.9 18.60 0.04 -0.9 85 406 VANGUARD 35 1.56 0.04 -2.5 18.60 0.04 4.9 18.60 0.04 -0.9 85 406 155 155 153 GUFIC 63 1.72 0.04 36.3 18.54 0.04 32.2 18.54 0.04 24.6 107 3.1 405 * GUFIC 63 1.72 0.04 36.3 18.54 0.04 32.2 18.54 0.04 24.6 107 3.1 405 97.7 156 156 152 NOEL PHARMA 91 1.77 0.04 30.7 18.40 0.04 19.7 18.40 0.04 13 97 2.9 402 * NOEL PHARMA 91 1.77 0.04 30.7 18.40 0.04 19.7 18.40 0.04 13 97 2.9 402 157 157 166 MERCURY LABS 41 1.29 0.03 -12.3 17.55 0.04 17.8 17.55 0.04 11.1 95 0.1 383 * MERCURY LABS 41 1.29 0.03 -12.3 17.55 0.04 17.8 17.55 0.04 11.1 95 0.1 383 158 158 154 A.N.PHARMACIA 34 1.70 0.04 55.8 17.30 0.04 37.2 17.30 0.04 28.9 111 0.7 378 * A.N.PHARMACIA 34 1.70 0.04 55.8 17.30 0.04 37.2 17.30 0.04 28.9 111 0.7 378 159 159 164 ADONIS 18 1.37 0.03 -14.1 17.25 0.04 14.8 17.25 0.04 8.7 93 377 ADONIS 18 1.37 0.03 -14.1 17.25 0.04 14.8 17.25 0.04 8.7 93 377 160 160 161 JAWA 48 1.46 0.04 4.5 17.20 0.04 18.9 17.20 0.04 12 96 1.8 376 IMS, ALL RIGHTS RESERVED

- 13. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 13 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% * JAWA 48 1.46 0.04 4.5 17.20 0.04 18.9 17.20 0.04 12 96 1.8 376 97.89 161 161 151 BAN LABS. 36 1.78 0.04 14.2 16.97 0.04 43.9 16.97 0.04 36.2 117 371 BAN LABS. 36 1.78 0.04 14.2 16.97 0.04 43.9 16.97 0.04 36.2 117 371 162 162 157 GLAND PHARMA 30 1.50 0.04 32.1 16.54 0.04 37.8 16.54 0.04 30.1 112 4.4 361 * GLAND PHARMA 30 1.50 0.04 32.1 16.54 0.04 37.8 16.54 0.04 30.1 112 4.4 361 163 163 163 SYNCOM 111 1.37 0.03 -10.5 15.63 0.03 9.2 15.63 0.03 3.3 89 341 + SYNCOM 111 1.37 0.03 -10.5 15.63 0.03 9.2 15.63 0.03 3.3 89 341 164 164 162 FEM CARE PHARMA 42 1.38 0.03 0.1 15.36 0.03 1.9 15.36 0.03 -3.9 83 1.4 336 * FEM CARE PHARMA 42 1.38 0.03 0.1 15.36 0.03 1.9 15.36 0.03 -3.9 83 1.4 336 165 165 171 KEE PHARMA 35 1.14 0.03 -19.1 15.08 0.03 0.8 15.08 0.03 -4.9 82 329 KEE PHARMA 35 1.14 0.03 -19.1 15.08 0.03 0.8 15.08 0.03 -4.9 82 329 98.06 166 166 167 ALARSIN 14 1.26 0.03 3.5 14.71 0.03 12.1 14.71 0.03 5.6 91 321 ALARSIN 14 1.26 0.03 3.5 14.71 0.03 12.1 14.71 0.03 5.6 91 321 167 167 177 KLAR SEHEN 46 1.03 0.03 -0.2 14.65 0.03 20.9 14.65 0.03 13.9 98 320 KLAR SEHEN 46 1.03 0.03 -0.2 14.65 0.03 20.9 14.65 0.03 13.9 98 320 168 168 160 KON TEST CHEMICALS 36 1.47 0.04 43.7 14.07 0.03 -4.2 14.07 0.03 -9.8 77 307 KON TEST CHEMICALS 36 1.47 0.04 43.7 14.07 0.03 -4.2 14.07 0.03 -9.8 77 307 169 169 173 ACRON 31 1.13 0.03 -6.5 14.05 0.03 5.3 14.05 0.03 -1.3 85 0 307 * ACRON 31 1.13 0.03 -6.5 14.05 0.03 5.3 14.05 0.03 -1.3 85 0 307 170 170 170 STEDMAN 49 1.16 0.03 1 13.25 0.03 16.8 13.25 0.03 10.4 95 21.2 289 * STEDMAN 49 1.16 0.03 1 13.25 0.03 16.8 13.25 0.03 10.4 95 21.2 289 98.21 171 171 187 FLAMINGO PHARMA 23 0.93 0.02 -21.5 13.23 0.03 8.5 13.23 0.03 2.4 88 3 289 * FLAMINGO PHARMA 23 0.93 0.02 -21.5 13.23 0.03 8.5 13.23 0.03 2.4 88 3 289 172 172 168 MPI 20 1.25 0.03 13.2 13.21 0.03 21.6 13.21 0.03 14.6 98 289 MPI 20 1.25 0.03 13.2 13.21 0.03 21.6 13.21 0.03 14.6 98 289 173 173 179 MENARINI RAUNAQ 17 1.00 0.02 0.5 13.19 0.03 41.6 13.19 0.03 33.9 115 288 + MENARINI RAUNAQ 17 1.00 0.02 0.5 13.19 0.03 41.6 13.19 0.03 33.9 115 288 174 174 183 GUJARAT TERCE 78 0.97 0.02 -35 13.03 0.03 -5.3 13.03 0.03 -10.7 77 285 GUJARAT TERCE 78 0.97 0.02 -35 13.03 0.03 -5.3 13.03 0.03 -10.7 77 285 IMS, ALL RIGHTS RESERVED

- 14. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 14 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 175 175 176 PHARMA-TECH INDIA 39 1.04 0.03 9.4 13.00 0.03 32.4 13.00 0.03 24.7 107 284 PHARMA-TECH INDIA 39 1.04 0.03 9.4 13.00 0.03 32.4 13.00 0.03 24.7 107 284 98.35 176 176 180 ENTOD 62 0.99 0.02 2.3 12.78 0.03 33.1 12.78 0.03 25.7 108 0.9 279 * ENTOD 62 0.99 0.02 2.3 12.78 0.03 33.1 12.78 0.03 25.7 108 0.9 279 177 177 169 MERIDIAN LAB 51 1.25 0.03 31.7 12.60 0.03 35.1 12.60 0.03 27.4 109 0.1 275 * MERIDIAN LAB 51 1.25 0.03 31.7 12.60 0.03 35.1 12.60 0.03 27.4 109 0.1 275 178 178 172 FERRING PHARMA 19 1.13 0.03 4.2 12.59 0.03 22.4 12.59 0.03 15.5 99 275 FERRING PHARMA 19 1.13 0.03 4.2 12.59 0.03 22.4 12.59 0.03 15.5 99 275 179 179 178 SKYMAX LABS 24 1.01 0.02 25.2 12.31 0.03 -12.5 12.31 0.03 -17.5 71 18.2 269 * SKYMAX LABS 24 1.01 0.02 25.2 12.31 0.03 -12.5 12.31 0.03 -17.5 71 18.2 269 180 180 175 NULIFE 36 1.04 0.03 -0.5 11.86 0.03 9.2 11.86 0.03 3 88 259 + NULIFE 36 1.04 0.03 -0.5 11.86 0.03 9.2 11.86 0.03 3 88 259 98.48 181 181 191 LEO PHARMA 39 0.87 0.02 28.6 11.79 0.03 30.8 11.79 0.03 23.7 106 258 LEO PHARMA 39 0.87 0.02 28.6 11.79 0.03 30.8 11.79 0.03 23.7 106 258 182 182 199 THEMIS PHARMA 14 0.79 0.02 -27.9 11.59 0.02 2.7 11.59 0.02 -3 83 253 + THEMIS PHARMA 14 0.79 0.02 -27.9 11.59 0.02 2.7 11.59 0.02 -3 83 253 183 183 181 INGA 38 0.98 0.02 -1.9 11.07 0.02 13.7 11.07 0.02 7.3 92 0.4 242 * INGA 38 0.98 0.02 -1.9 11.07 0.02 13.7 11.07 0.02 7.3 92 0.4 242 184 184 182 AR EX 25 0.97 0.02 -3 11.04 0.02 15.6 11.04 0.02 9.1 94 5.3 241 * AR EX 25 0.97 0.02 -3 11.04 0.02 15.6 11.04 0.02 9.1 94 5.3 241 185 185 189 JUPITER 29 0.89 0.02 9.2 11.00 0.02 17.7 11.00 0.02 11.1 95 0.9 240 * JUPITER 29 0.89 0.02 9.2 11.00 0.02 17.7 11.00 0.02 11.1 95 0.9 240 98.6 186 186 185 PULSE PHARMA 43 0.96 0.02 1.5 10.97 0.02 11.9 10.97 0.02 5.4 90 240 + PULSE PHARMA 43 0.96 0.02 1.5 10.97 0.02 11.9 10.97 0.02 5.4 90 240 187 187 174 OPTHO REMEDIES 52 1.08 0.03 40.3 10.89 0.02 19.6 10.89 0.02 12.5 97 238 + OPTHO REMEDIES 52 1.08 0.03 40.3 10.89 0.02 19.6 10.89 0.02 12.5 97 238 188 188 195 LI TAKA PHARMA 42 0.84 0.02 3.7 10.72 0.02 -4.6 10.72 0.02 -10 77 234 LI TAKA PHARMA 42 0.84 0.02 3.7 10.72 0.02 -4.6 10.72 0.02 -10 77 234 IMS, ALL RIGHTS RESERVED

- 15. LEADING CORPORATION BY VALUE INDIA-SSA PAGE 15 DECEMBER 2010 MONTH CUMULATIVE 12 MONTHS TO DATE RANKINGS NO CORPORATIONS Values In + Values In + Values In + % VALUES 12M CUM MON PROD Crores % -% Crores % -% Crores % -% EVOL N.P $ +000 12M.% 189 189 184 UNI LABS 12 0.96 0.02 -1.6 10.66 0.02 12.6 10.66 0.02 6.2 91 233 UNI LABS 12 0.96 0.02 -1.6 10.66 0.02 12.6 10.66 0.02 6.2 91 233 190 190 193 LA PHARMA 56 0.86 0.02 -6.5 10.32 0.02 25.3 10.32 0.02 18.5 102 226 + LA PHARMA 56 0.86 0.02 -6.5 10.32 0.02 25.3 10.32 0.02 18.5 102 226 98.72 191 191 200 REKVINA 41 0.78 0.02 -11.6 10.14 0.02 9.2 10.14 0.02 3 88 1.6 221 * REKVINA 41 0.78 0.02 -11.6 10.14 0.02 9.2 10.14 0.02 3 88 1.6 221 192 192 190 BDF 13 0.87 0.02 -21.1 10.07 0.02 -6.4 10.07 0.02 -11.6 76 220 BDF 13 0.87 0.02 -21.1 10.07 0.02 -6.4 10.07 0.02 -11.6 76 220 193 193 212 HINDUSTAN ANTIBIOT 31 0.64 0.02 -17.6 9.90 0.02 23.5 9.90 0.02 16.6 100 216 HINDUSTAN ANTIBIOT 31 0.64 0.02 -17.6 9.90 0.02 23.5 9.90 0.02 16.6 100 216 194 194 192 STERKEM 42 0.86 0.02 22.6 9.85 0.02 59.8 9.85 0.02 51.1 130 215 STERKEM 42 0.86 0.02 22.6 9.85 0.02 59.8 9.85 0.02 51.1 130 215 195 195 202 MARTIN HARRIS 5 0.75 0.02 -8.8 9.76 0.02 18.6 9.76 0.02 11.9 96 213 MARTIN HARRIS 5 0.75 0.02 -8.8 9.76 0.02 18.6 9.76 0.02 11.9 96 213 98.82 196 196 194 RESILIENT COSME 30 0.85 0.02 5.1 9.74 0.02 12.5 9.74 0.02 5.9 91 4.8 213 * RESILIENT COSME 30 0.85 0.02 5.1 9.74 0.02 12.5 9.74 0.02 5.9 91 4.8 213 197 197 196 TWILIGHT MARCANTIL 38 0.82 0.02 -3.6 9.73 0.02 -4.3 9.73 0.02 -9.6 78 4.5 212 * TWILIGHT MARCANTIL 38 0.82 0.02 -3.6 9.73 0.02 -4.3 9.73 0.02 -9.6 78 4.5 212 198 198 211 TIDAL LABS 32 0.64 0.02 -33.1 9.57 0.02 -7.4 9.57 0.02 -12.6 75 209 + TIDAL LABS 32 0.64 0.02 -33.1 9.57 0.02 -7.4 9.57 0.02 -12.6 75 209 199 199 204 EISEN PHARMA 19 0.74 0.02 -7.4 9.39 0.02 19 9.39 0.02 12.3 96 205 EISEN PHARMA 19 0.74 0.02 -7.4 9.39 0.02 19 9.39 0.02 12.3 96 205 200 200 216 LARK LABS 102 0.63 0.02 -37.2 9.24 0.02 -19.3 9.24 0.02 -24.1 65 202 LARK LABS 102 0.63 0.02 -37.2 9.24 0.02 -19.3 9.24 0.02 -24.1 65 202 98.92 201 201 206 NAVIL 36 0.70 0.02 -8.3 9.20 0.02 14.2 9.20 0.02 8.1 93 201 + NAVIL 36 0.70 0.02 -8.3 9.20 0.02 14.2 9.20 0.02 8.1 93 201 202 202 186 STIEFEL 23 0.93 0.02 721.1 8.97 0.02 18.5 8.97 0.02 10.7 95 196 STIEFEL 23 0.93 0.02 721.1 8.97 0.02 18.5 8.97 0.02 10.7 95 196 203 203 207 OZONE AYURVEDICS 8 0.68 0.02 -36.9 8.87 0.02 -9 8.87 0.02 -14.1 74 194 IMS, ALL RIGHTS RESERVED